Get the free Sec24

Get, Create, Make and Sign sec24

Editing sec24 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec24

How to fill out sec24

Who needs sec24?

A Comprehensive Guide to the Sec24 Form: Everything You Need to Know

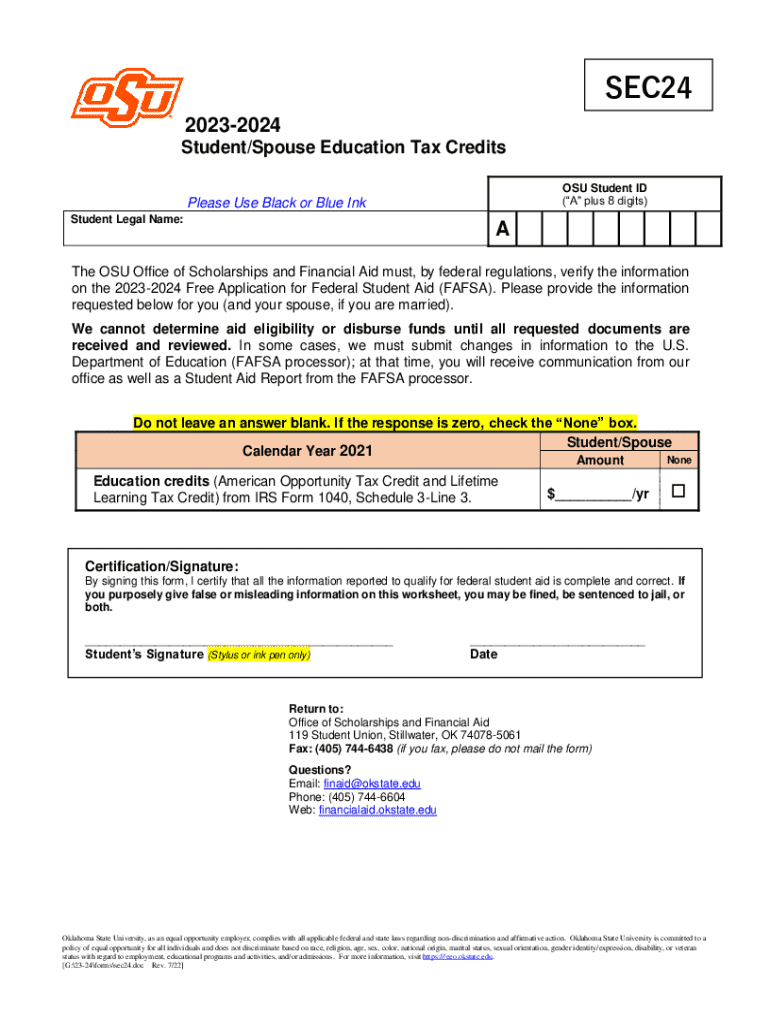

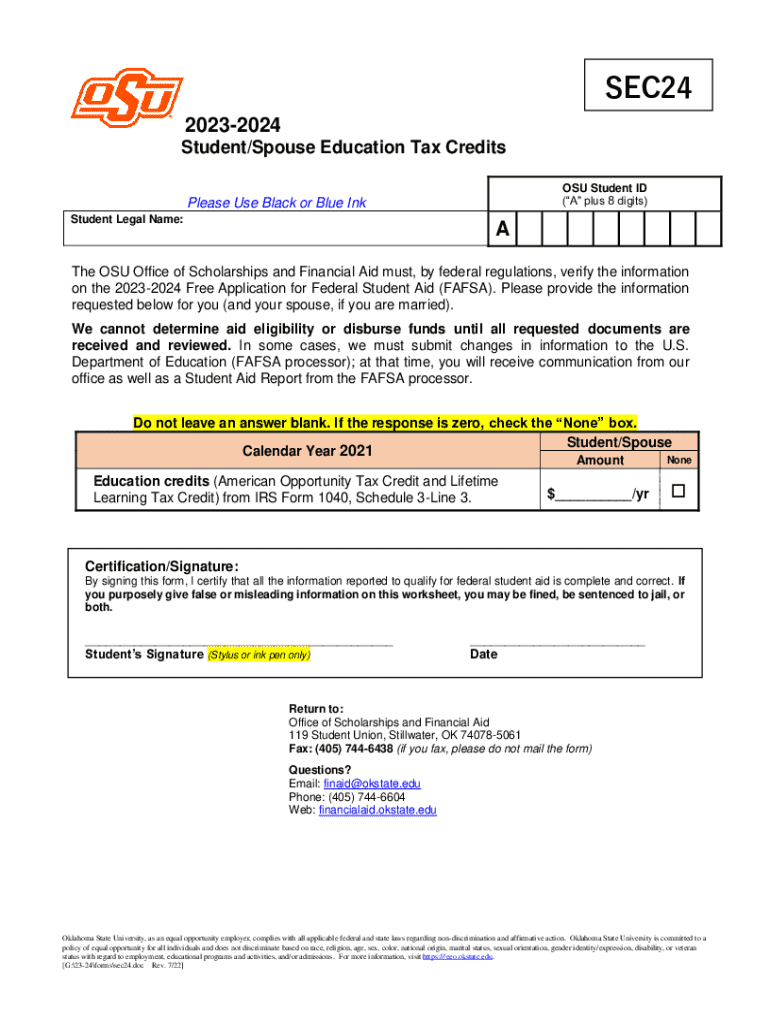

Understanding the Sec24 form

The Sec24 form serves as an essential document vital in various legal and tax-related processes. Derived from the Internal Revenue Service guidelines, this form is utilized primarily to report specific financial information that aids regulatory compliance. Whether you are an individual preparing your annual tax returns or a business owner filing compliance reports, the Sec24 form is integral for maintaining transparency and accuracy in financial disclosures.

The importance of the Sec24 form cannot be understated. It not only serves as a tracking vessel for income and tax obligations but also guarantees that the financial data provided to the government is correct and complete. Missing or incorrect information can lead to penalties, misunderstandings, and ultimately, legal complications.

Key features of the Sec24 form

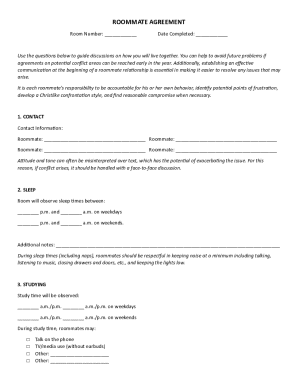

The Sec24 form consists of several comprehensive fields that are essential for reporting various financial particulars. Typically, it includes sections for personal identification, income details, deductions, and certifications. Each of these sections requires specific data points that collect a complete picture of an individual's or business's financial situations.

Common scenarios that necessitate the use of the Sec24 form include filing annual income taxes, applying for loans, or reporting earnings for governmental programs. Understanding these use cases is critical for ensuring this form is timely and accurately submitted.

Who needs to fill out the Sec24 form

The target audience for the Sec24 form encompasses a wide range of individuals and entities. Individuals who earn income from various sources, including freelance work or salary, will need to fill out this form during tax season. Additionally, business owners—especially those operating as sole proprietors—will also find the form pertinent for reporting their earnings and expenses.

Furthermore, specific professions, such as accountants and financial advisors, frequently assist clients in preparing the form. Understanding the specific requirements related to each target group can significantly facilitate the process of completing and submitting the Sec24 form correctly.

Preparing to fill out the Sec24 form

Before filling out the Sec24 form, it is vital to gather all the necessary information and documentation to ensure accuracy. Essential details include your name, contact information, Social Security number, financial statements, and any prior tax forms that may assist in providing a comprehensive overview of your financial status.

The documentation needed for this form typically comprises previous tax returns, identification numbers, W-2s (if applicable), and any additional statements that reflect income or deductions. Having all of these documents ready before you begin filling out the form will streamline the process and reduce errors.

Tips for ensuring accuracy

Accuracy is paramount when filling out the Sec24 form to avoid potential repercussions. A few strategies for double-checking your information include thoroughly reviewing each section before submission, using a checklist of required fields, and cross-referencing financial figures against official documents.

Step-by-step guide to completing the Sec24 form

Accessing the Sec24 form has been made simple via pdfFiller. To retrieve the form, visit the pdfFiller website and navigate to the section dedicated to tax forms or document templates. Here, you will find the Sec24 form available for download or direct completion online.

Upon accessing the form, users can take advantage of pre-filled options and templates that can help speed up the completion process. These templates ensure users are on the right track by providing guidance on essential fields.

Detailed walkthrough of each section

1. **Personal Information Section**: Filling out personal and contact details involves entering your full name, address, phone number, and date of birth. Ensuring these details are accurate will prevent any future complications.

2. **Financial Details Section**: This is arguably the most critical part of the Sec24 form. Here, you will report total income for the year, detailing different sources — wages, interests, and dividends, alongside any deductions and credits. Ensure that all entries correspond with your official financial statements.

3. **Certifications and Signatures**: Once everything is filled in correctly, you will finalize the document using the e-signing feature within pdfFiller. Adhering to regulations regarding electronic signatures is crucial, and pdfFiller simplifies this process with clear prompts.

Common mistakes to avoid

Users frequently make several mistakes while filling out the Sec24 form, such as transposing numbers or leaving sections blank. Mistakes like these can lead to rejections or audits. Therefore, utilizing the digital completion features of pdfFiller can significantly reduce such errors that are often made when filling out paper forms. Using digital tools not only expedites the process but also enhances accuracy.

Editing and revising the Sec24 form

After completing the Sec24 form, utilizing pdfFiller’s editing tools is essential for ensuring the accuracy of your submission. If you notice errors or require additional information, pdfFiller offers features that allow for easy corrections and updates to the document. Users can modify any text, adjust numerical values, or add any required annotations quickly.

The platform's collaborative tools also enable team members to provide input and review changes in real time. This is particularly beneficial for business owners or individuals working with financial advisors who want to ensure a thorough review process.

Version control and document management

Version control is crucial while managing the Sec24 form, especially if several iterations are created. pdfFiller’s cloud storage offers an organized way to retain all versions of the form, allowing users to track changes efficiently. This prevents confusion and keeps detailed historical data of the form filing, which can be invaluable in future audits or reviews.

Submitting the Sec24 form

Understanding how to submit the Sec24 form correctly is as important as completing it accurately. There are various submission methods available, including online submissions through designated tax portals, mailing the form to local tax offices, or delivering it in person. Each method has specific deadlines, and being aware of these will help avoid penalties.

For online submission, ensure that you familiarize yourself with the portal's requirements, while submissions by mail require sufficient time for delivery. Knowing the deadline is crucial because late submissions can incur fines or penalties.

Following up after submission

Once the Sec24 form is submitted, knowing how to confirm that it has been processed becomes essential. Most online submission platforms provide confirmation receipts. For mail submissions, tracking can often be achieved through postal services. In case of issues post-submission, keep detailed records of your submission, and ensure you have documentation ready for follow-up.

Additional features of pdfFiller for Sec24 form users

pdfFiller enhances the experience of users filling out the Sec24 form by offering tools for real-time collaboration. Team members can assist in filling out the form simultaneously, which fosters better accuracy and input security. This collaborative aspect allows everyone involved to provide insights, ask questions, and minimize the likelihood of mistakes.

In addition to collaborative features, pdfFiller provides an array of support resources for users who might need assistance while completing the Sec24 form. Users can access tutorials, guides, and customer support at any time, allowing for a comprehensive understanding of what is required when submitting this important document.

Frequently asked questions about the Sec24 form

As you engage in completing the Sec24 form, you may encounter common questions that others have found useful. These may involve queries about specific sections of the form, such as what to do if your income changes or how to report unique financial situations. Addressing these concerns before you start filling out the form can save considerable time and effort.

Troubleshooting is another aspect that often arises during the completion process. Users may face challenges with accessing the form, technical issues during e-signing, or retrieving previously filled forms. Exploring pdfFiller's resources can provide solutions to these issues efficiently, ensuring you stay on track.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute sec24 online?

How do I make changes in sec24?

How do I complete sec24 on an Android device?

What is sec24?

Who is required to file sec24?

How to fill out sec24?

What is the purpose of sec24?

What information must be reported on sec24?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.