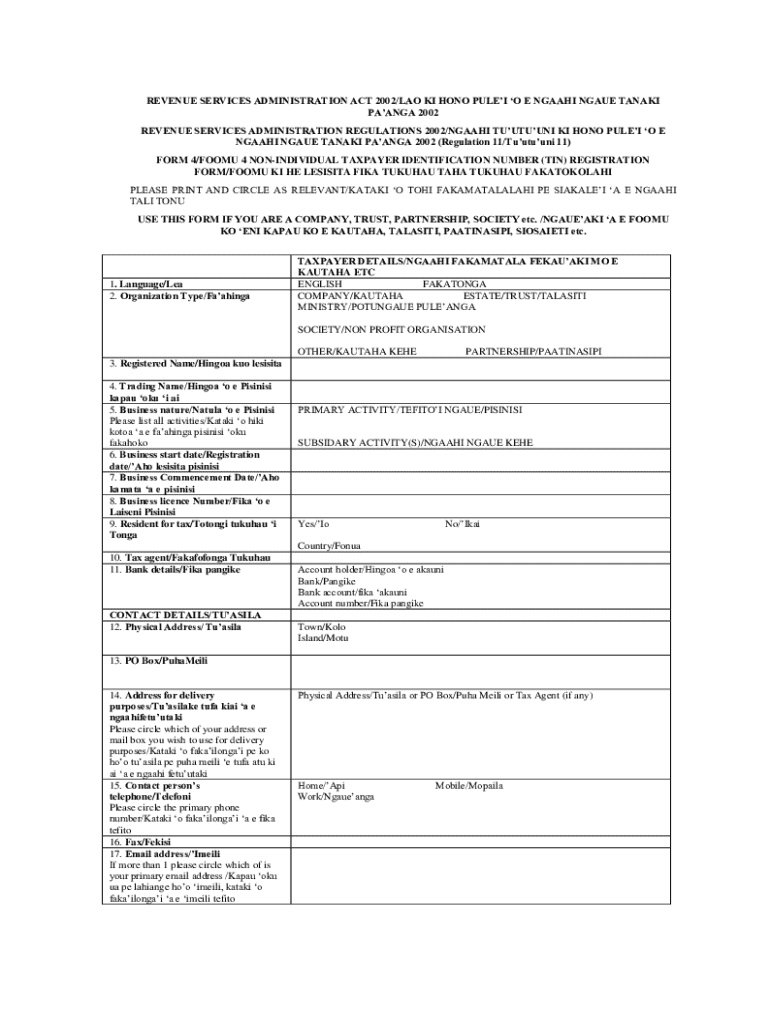

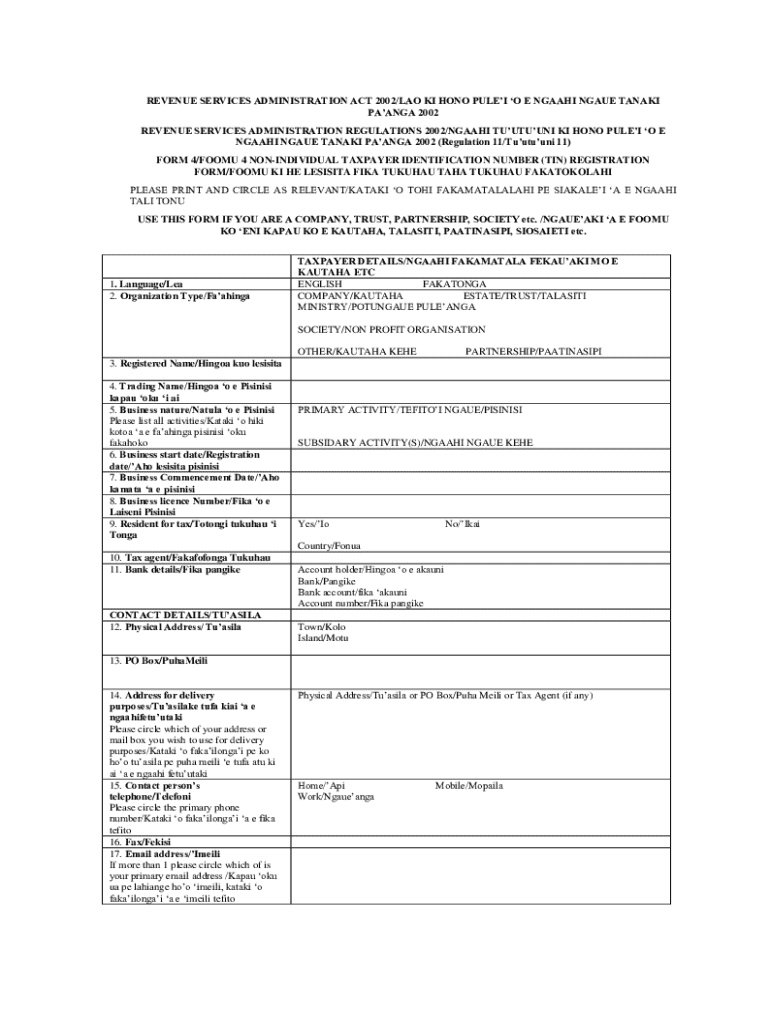

Get the free Non-individual Taxpayer Identification Number (tin) Registration Form

Get, Create, Make and Sign non-individual taxpayer identification number

How to edit non-individual taxpayer identification number online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-individual taxpayer identification number

How to fill out non-individual taxpayer identification number

Who needs non-individual taxpayer identification number?

Your Comprehensive Guide to the Non-Individual Taxpayer Identification Number Form

Understanding the Non-Individual Taxpayer Identification Number (TIN) Form

A Non-Individual Taxpayer Identification Number, or Non-Individual TIN, is essential for various entities like corporations, partnerships, and trusts that need to report taxes to the IRS. This identification number serves as a unique identifier for tax purposes, allowing businesses and organizations to comply with federal tax regulations.

Obtaining a Non-Individual TIN is crucial for any entity that engages in taxable activities. Without this number, businesses risk facing penalties during their tax reporting. Furthermore, a TIN allows these entities to conduct routine transactions such as filing tax returns, defining payroll responsibilities, and accessing certain tax benefits.

Preparing to fill out the Non-Individual TIN form

Before filling out the Non-Individual TIN, it's crucial to gather the necessary information, including your Employer Identification Number (EIN), business structure details, and other relevant documentation. Entities must understand their classification, whether as a C Corporation, S Corporation, or another structure, as this affects the way the form is filled out.

Common mistakes often arise from misreporting information. Ensure that your EIN is accurate and you clearly outline your entity type. Being meticulous in this process avoids future complications, such as discrepancies that result in your application being delayed or rejected.

Step-by-step guide to filling out the Non-Individual TIN form

Access the Non-Individual TIN Form on the IRS website, where both PDF and online fillable versions are available. Selecting the right format can enhance convenience and efficiency during the filling process. With the online version, you can save your progress and make edits easily.

When filling out each section, attention to detail is paramount. For Section 1—Entity Identification—include the complete legal name of the business, entity type, and address details. Be clear about the reason for applying for a TIN in Section 3, as this information is vital for the IRS to understand your request.

If you're a foreign entity, additional requirements may apply. Consult IRS guidelines for non-resident applicants, which outline specific documentation needed to avoid complications during processing.

Editing and signing the Non-Individual TIN form

Electronic signatures have become increasingly accepted across various platforms, streamlining the submission process. Using tools like pdfFiller, users can securely eSign documents, ensuring legal compliance and enhancing data security. This is crucial for maintaining the integrity of submitted forms and commitments.

To eSign using pdfFiller, simply upload your form and select the eSign option. You can add your eSignature using various authenticated methods, enhancing the convenience and speed of your document processing. Collaborative features allow multiple team members to contribute their signatures, ensuring a smoother workflow.

Submitting the Non-Individual TIN form

Submitting your Non-Individual TIN Form can be done electronically or via traditional mail. Each method has its benefits, but electronic submission is typically faster and allows you to receive confirmation almost immediately. Ensure your submission includes all required documentation, such as evidence of the entity’s registration.

After submission, processing times can vary. Generally, the IRS processes TIN requests promptly, but it may take several weeks. To check the status of your application, maintain your submission confirmation details and reach out to the IRS as needed.

Managing your Non-Individual TIN form after submission

Once you've successfully submitted the Non-Individual TIN Form, ensuring the safekeeping and management of your TIN and related documents is essential. Utilizing cloud-based solutions like pdfFiller to store and organize your forms offers easy future access and the ability to edit if your information changes.

Review your TIN regularly. Situations may arise where updates or amendments are necessary, such as changes in entity structure or compliance with different tax reporting requirements. Knowing when and how to make updates will facilitate smoother operations as your business evolves.

Frequently asked questions about Non-Individual TIN forms

Losing your Non-Individual TIN can lead to frustration during tax reporting. It's advisable to keep a secure record of this vital number. If misplaced, you can retrieve it through IRS resources or by contacting the IRS directly. Be proactive in managing your documents to prevent such occurrences.

Discrepancies can occur in TINs if incorrect information is reported. It’s vital to verify all inputs before finalizing the form, as IRS corrections can be cumbersome and time-consuming. Knowing how to navigate the complexities surrounding your Non-Individual TIN will prepare you for any hurdles during tax reporting.

Interactive tools and resources on pdfFiller

pdfFiller provides a variety of interactive tools that aid in creating custom Non-Individual TIN forms. Users have access to templates which can be tailored to suit their specific needs. By utilizing these resources, individuals and teams can efficiently manage their tax documentation without the hassle of paper forms.

The platform also facilitates collaboration among team members, allowing users to create and edit forms collectively, thus improving efficiency and ensuring everyone is on the same page when it comes to form submissions and document management.

Helpful guides and quick links

The IRS website offers an array of resources pertinent to Non-Individual TINs. Staying informed makes for seamless navigation through tax regulations and responsibilities. pdfFiller continually updates its inventory of tools and guides related to various forms, including the Non-Individual TIN, promoting an easier workflow for all your documentation needs.

When seeking quick access to related tax forms and guides, the pdfFiller support team can assist with any inquiries you may have regarding the Non-Individual TIN Form or any other documentation needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify non-individual taxpayer identification number without leaving Google Drive?

How do I edit non-individual taxpayer identification number in Chrome?

How do I fill out non-individual taxpayer identification number on an Android device?

What is non-individual taxpayer identification number?

Who is required to file non-individual taxpayer identification number?

How to fill out non-individual taxpayer identification number?

What is the purpose of non-individual taxpayer identification number?

What information must be reported on non-individual taxpayer identification number?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.