Get the free Mortgage Assistance

Get, Create, Make and Sign mortgage assistance

Editing mortgage assistance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage assistance

How to fill out mortgage assistance

Who needs mortgage assistance?

Mortgage Assistance Form: How-to Guide

Understanding Mortgage Assistance

Mortgage assistance is a vital resource designed to support homeowners facing financial difficulties, enabling them to manage their obligations more effectively. This can include federal assistance programs, state initiatives, and options from private lenders. The importance of mortgage assistance lies in its ability to reduce the burden of loan payments during tough times, making homeownership feasible for many.

Who qualifies for mortgage assistance often depends on factors such as income level, employment status, and the specifics of the hardship faced. Common eligibility criteria include having a temporary financial issue such as unemployment, medical expenses, or other situations that temporarily impact one's ability to pay the mortgage. Understanding these requirements is crucial for homeowners seeking assistance.

The Mortgage Assistance Form: An Overview

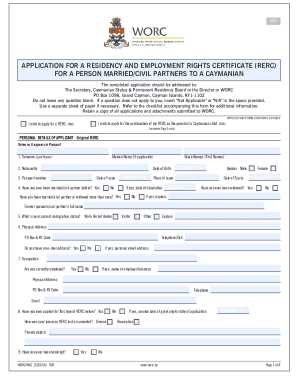

The mortgage assistance form serves as a formal request for help, providing lenders with the necessary information to determine eligibility for assistance programs. Typically, this form requires details about the applicant’s personal information, financial situation, and specifics about the property in question. By standardizing this information, lenders can efficiently assess the applicant’s needs.

Obtaining the mortgage assistance form can be done through various sources including lender websites, government agencies, and non-profit organizations. Each source offers distinct benefits. For example, government sites may provide comprehensive state-specific programs, while lenders may have tailored options based on their services.

Step-by-step guide to filling out the mortgage assistance form

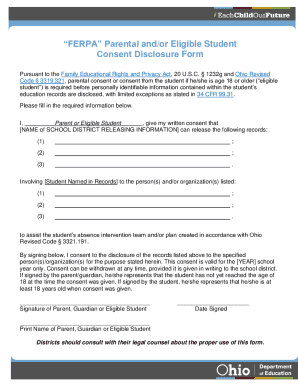

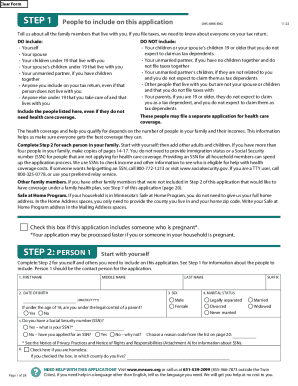

Filling out the mortgage assistance form accurately is crucial for your application to be processed without delays. First, gather all necessary personal and financial information. This will include your recent pay stubs, tax returns, bank statements, and any additional documents that illustrate your financial status. Having this information readily available can streamline the filling process.

After filling out the form, take the time to review your entries carefully. Look for common pitfalls such as typos in your financial information or missing signatures. Ensure that all dates are current, as this can affect the validity of your application.

Interactive tools and resources for completing the form

Leveraging tools like pdfFiller can vastly enhance your experience when filling out the mortgage assistance form. Features such as editing, eSigning, and sharing options make it a versatile resource for managing documents. The cloud-based platform allows users to create, edit, and store forms securely from anywhere, which is beneficial in sensitive cases like mortgage assistance.

Collaborating with others using pdfFiller can enhance the accuracy and completeness of your submission. Inviting team members or partners to review your entries in real-time ensures all perspectives are taken into account, adding to the strength of your application.

Common mistakes to avoid

Filling out the mortgage assistance form can be daunting, and common errors can hinder the approval process. One frequent mistake is misunderstanding the questions or particular fields, leading to incomplete or incorrect submissions. For instance, misreporting your income or neglecting to include certain expenses can result in miscalculations that affect your eligibility.

Employing best practices based on user feedback can significantly ease the application process. Utilizing pdfFiller to check your document can help enhance accuracy, ensuring you submit a well-prepared application.

After submission: What to expect

Once your mortgage assistance form has been submitted, knowing how to track your application status can be crucial for alleviating anxiety. Most lenders will provide a method for applicants to check their status online or through direct communication.

In the event your application is approved or denied, understanding the next steps is essential. If approved, your lender will outline the terms and any further actions you’re required to take. Conversely, should your application be denied, don’t hesitate to reach out for alternatives or options available for addressing your financial situation.

FAQs regarding the mortgage assistance form

Many questions arise around the mortgage assistance form, particularly regarding the submission process and timelines. One common inquiry is whether the form can be submitted online, which typically is the case through most lenders' portals.

Following the submission, maintaining effective communication with lenders is pivotal. Establishing a clear line of communication can ease uncertainties and facilitate a smoother resolution process.

Additional tips for effective mortgage management

Once your mortgage assistance request is in progress, maintaining communication with your lender should remain a priority. Regularly updating your lender about any changes in your financial situation can create opportunities for additional support. Keeping them informed shows responsibility, which can play a crucial role in securing further assistance if needed.

Long-term strategies for managing mortgage payments can help sustain financial health and set you on a path toward eventual stability. Engaging with resources that offer budgeting support can amplify these efforts.

Accessibility and support

Utilizing platforms like pdfFiller provides additional advantages when managing documentation related to the mortgage assistance form. Tools such as live support offer real-time guidance, while extensive learning resources help users familiarize themselves with the document management process. This dual-access approach enables a thorough understanding of how to navigate forms effectively.

Embracing these resources significantly enhances your chances of a successful application and a smoother overall experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mortgage assistance to be eSigned by others?

Can I create an eSignature for the mortgage assistance in Gmail?

How do I complete mortgage assistance on an Android device?

What is mortgage assistance?

Who is required to file mortgage assistance?

How to fill out mortgage assistance?

What is the purpose of mortgage assistance?

What information must be reported on mortgage assistance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.