Get the free Non-retirement Asset Transfer

Get, Create, Make and Sign non-retirement asset transfer

Editing non-retirement asset transfer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-retirement asset transfer

How to fill out non-retirement asset transfer

Who needs non-retirement asset transfer?

Non-retirement asset transfer form: A How-to Guide

Understanding non-retirement asset transfer forms

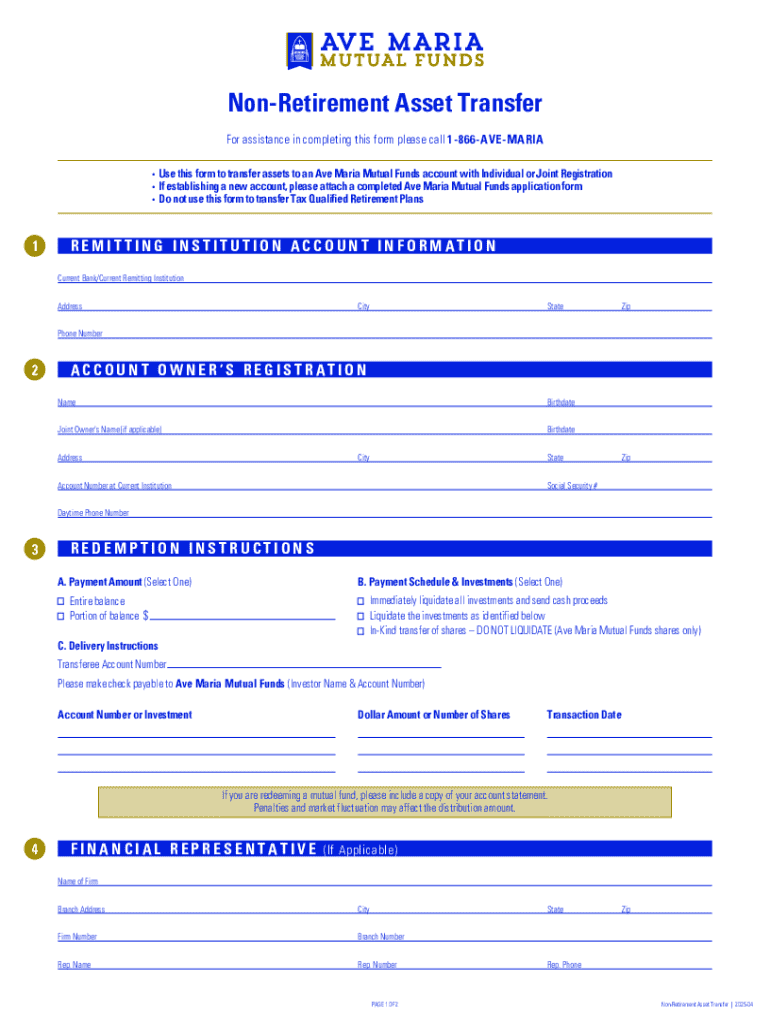

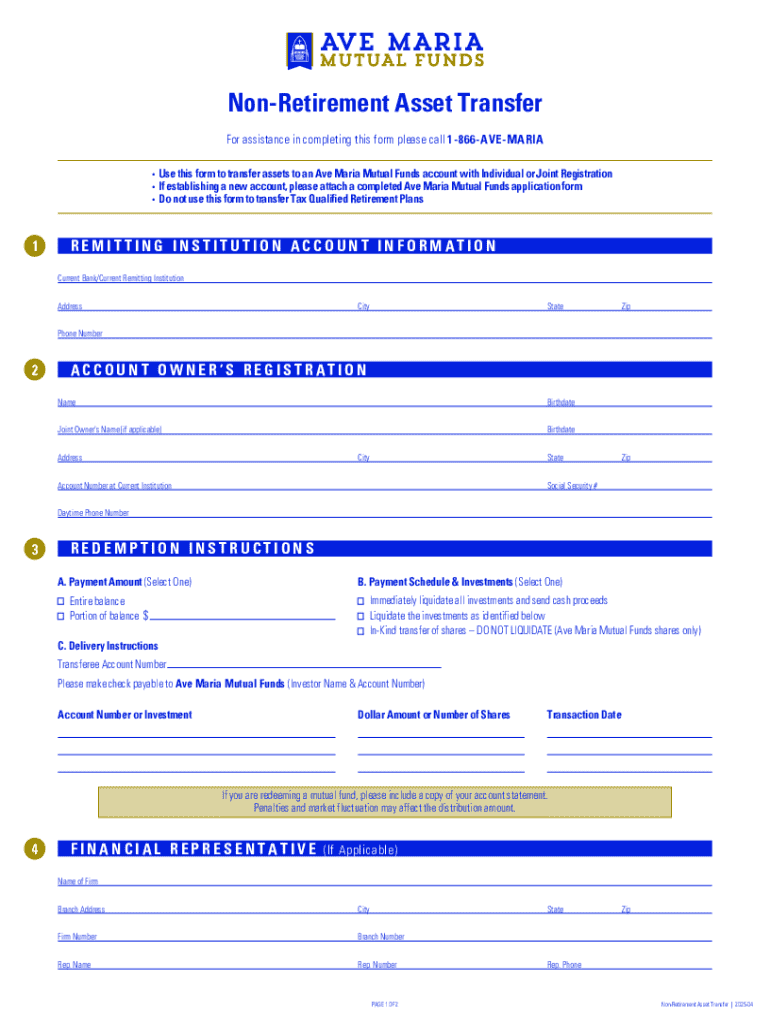

A non-retirement asset transfer form is a vital document used to facilitate the transfer of ownership of various assets that do not fall under retirement accounts, such as real estate, investment accounts, and personal property. The purpose of this form is to officially record the change of ownership to ensure all parties involved legally acknowledge the transfer.

Utilizing a non-retirement asset transfer form is essential in financial planning, as it provides a clear path for asset allocation in scenarios like estate planning, inheritance, and asset management. By having a solid plan in place, individuals can minimize disputes and ensure a smooth transition of assets.

Common scenarios for use

There are various situations where a non-retirement asset transfer form becomes necessary. For instance, during inheritance and estate planning, it serves to distribute assets according to the deceased's wishes. Likewise, when changing ownership of real estate, the form provides legal proof of the new owner’s rights. Another scenario is when transferring investment accounts, where the form helps in maintaining accurate records for financial institutions.

Types of non-retirement assets

Non-retirement assets can be categorized into three primary types: real estate, investment accounts, and personal property. Understanding the specific requirements and processes for each of these types is crucial for effective asset management.

Real estate

Real property refers to land and anything permanently attached to it, such as buildings. There are different types of real estate transfers like sales, gifts, and intra-family transfers. Required documentation typically includes the title deed, a transfer agreement, and any pertinent warranties or disclosures to verify the transaction's legitimacy.

Investment accounts

Investment accounts encompass various financial instruments such as stocks, bonds, and mutual funds. The procedures for transferring ownership may vary between types of accounts and financial institutions. Most firms require a completed transfer form along with any applicable identification and account information to enact changes in ownership.

Personal property

Personal property can include vehicles, collectibles, and valuable artifacts. To formally document the transfer of such belongings, it's essential to create an agreement specifying the details of the items being transferred. This may include descriptions, serial numbers, and the parties involved, ensuring a clear legal record of ownership change.

Key elements of a non-retirement asset transfer form

A well-structured non-retirement asset transfer form includes several necessary elements to ensure its validity. Information collected from the current owner typically encompasses details such as their full name, address, and signature. On the other hand, the new owner must provide similar identification plus, in some cases, financial or tax information to facilitate asset registration.

Legal considerations are also crucial. Most forms require the signatures of both parties, and many jurisdictions mandate witness signatures or notarization. These elements confirm the identities of those involved and validate the document's authenticity, thus preventing potential disputes in the future.

Step-by-step guide to completing a non-retirement asset transfer form

Completing a non-retirement asset transfer form can seem daunting, but with a structured approach, the process can become manageable.

Gathering required information

Start by collecting all pertinent documents and details, including existing titles for property, investment account statements, and identity verification for both parties. Having everything in one place simplifies the process and minimizes errors.

Filling out your transfer form

When filling out the transfer form, follow the provided structure closely. Ensure that you enter accurate information in designated fields, such as the asset description, parties' identification details, and any other required declarations. It helps to read through the entire form first to avoid missing any crucial sections.

Review and verification

Before final submission, it’s essential to review the form thoroughly. Utilize a checklist to ensure every detail is accurate, that both parties have signed, and that all necessary documentation is attached. Any discrepancies could lead to delays or complications in the transfer process.

Finalizing the transfer

Once the form is complete and reviewed, you can submit it through the necessary channels, whether that be online, in-person, or by mail. Keeping a record of the submission and utilizing tracking options can provide reassurance as you await the transfer's completion.

Common mistakes to avoid

Even with the best intentions, missteps can occur during the asset transfer process. One common mistake is providing incomplete or incorrect information. For instance, missing signatures or failing to include required documents can cause delays or even render the form invalid.

Another critical error is neglecting to understand the tax implications associated with transferring assets. Certain transfers may trigger tax liabilities that need to be managed carefully to avoid penalties. Additionally, not keeping copies of the completed transfer form can lead to complications later, so it's vital to maintain proper records for future reference.

Tools and resources for managing transfers

There are numerous tools available to help facilitate the process of non-retirement asset transfers. Utilizing features from pdfFiller can greatly streamline the experience.

Utilizing pdfFiller features for forms

With pdfFiller, users can easily edit PDFs, ensuring the transfer form is tailored to their specific needs. The eSigning capabilities allow for secure, digital signatures, eliminating the need for physical meetings. Additionally, collaboration tools enable multiple parties to be involved seamlessly in the transfer process, enhancing efficiency.

Online resources for asset management

Various websites and tools are available that offer assistance in managing asset transfers. From legal templates to financial advice, these resources can provide guidance to ensure successful management and transfer of your assets.

Frequently asked questions (FAQs)

As you navigate the intricacies of asset transfer, questions may arise. For example, what happens if the current owner is deceased? In such cases, estate executors typically manage the title transfer through probate. Another frequently asked question pertains to the duration of the transfer process; this can vary significantly based on the asset type and jurisdiction.

Understanding whether you can transfer an asset without a formal document is essential as well. While informal agreements may hold significance, a formal document provides far greater legal protection. Lastly, losing a transfer form can be troublesome. If this occurs, promptly contacting the relevant financial institution or legal body can help expedite obtaining a duplicate.

Next steps after completing your transfer

Once you have successfully completed your non-retirement asset transfer, monitoring its completion becomes paramount. Ensure you have followed up with the institution or entity managing the transfer. This will help confirm that all necessary procedures have been undertaken and the transfer is now in effect.

Keeping your records updated is equally important. Verify that all financial records and account details reflect the recent changes, as this will facilitate easier future transactions. Lastly, it's wise to think ahead regarding any potential future asset transfers, especially in terms of your estate planning, to ensure everything remains in order.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find non-retirement asset transfer?

How do I make changes in non-retirement asset transfer?

Can I create an electronic signature for the non-retirement asset transfer in Chrome?

What is non-retirement asset transfer?

Who is required to file non-retirement asset transfer?

How to fill out non-retirement asset transfer?

What is the purpose of non-retirement asset transfer?

What information must be reported on non-retirement asset transfer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.