Get the free Application for Insurance

Get, Create, Make and Sign application for insurance

How to edit application for insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for insurance

How to fill out application for insurance

Who needs application for insurance?

A comprehensive guide to the application for insurance form

Understanding the application for insurance form

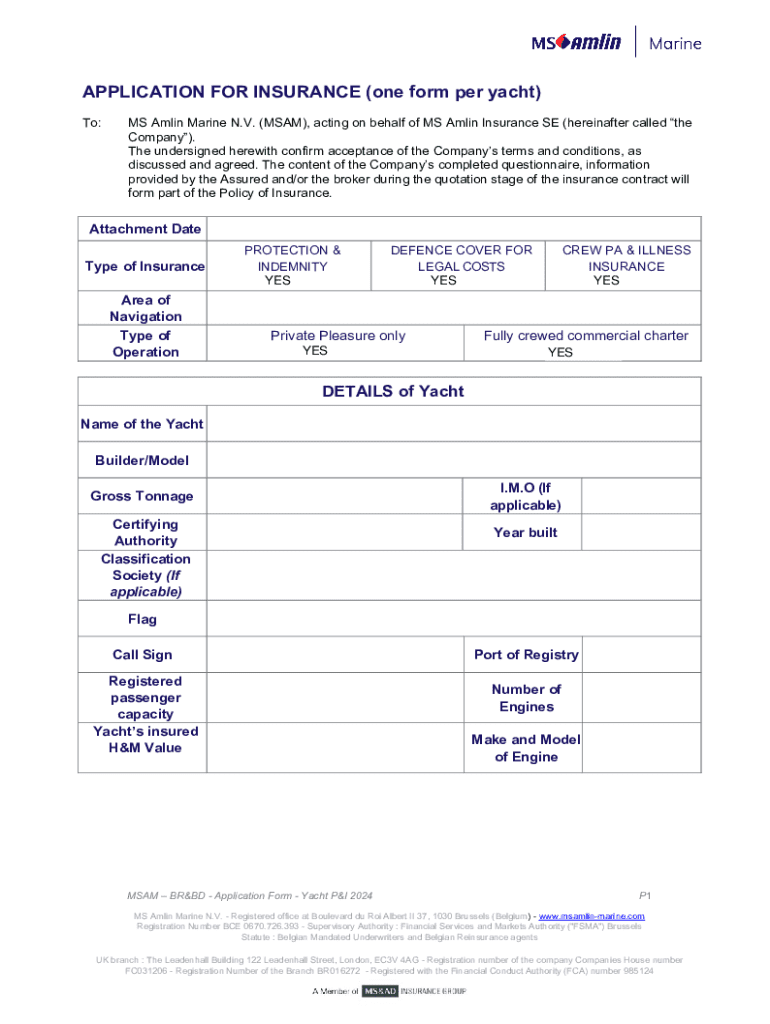

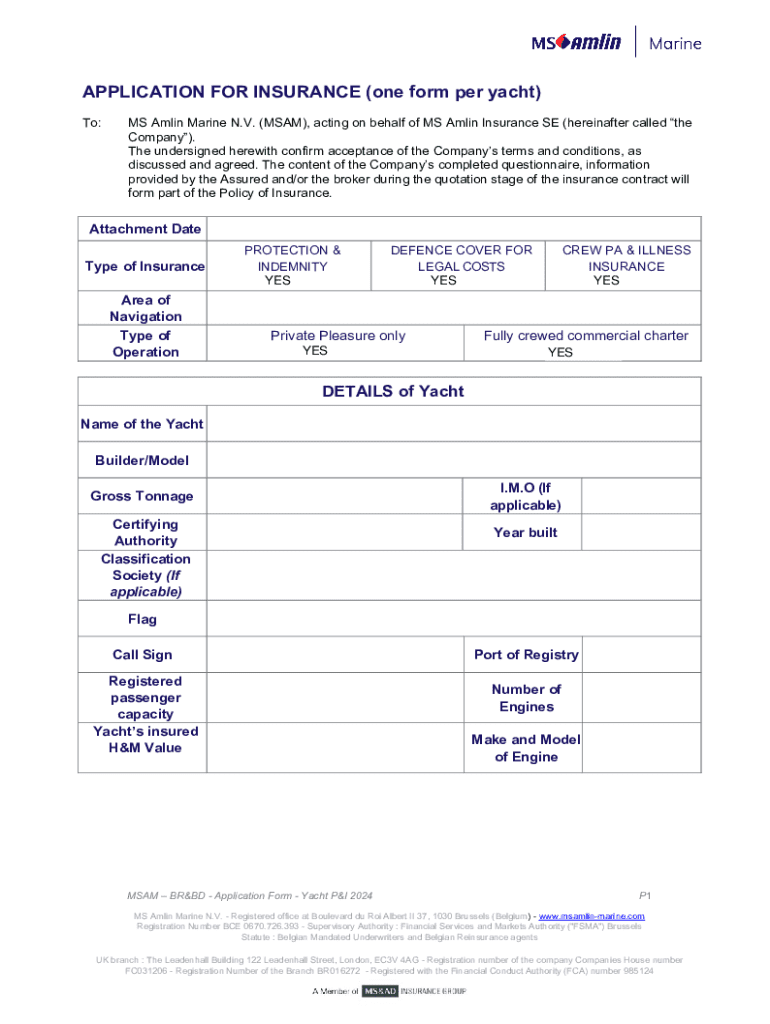

An application for insurance form is a crucial document that initiates the process of obtaining an insurance policy. It collects essential information about the applicant’s identity, background, and specific coverage needs. This standard form serves as a key tool for insurance companies to assess risk and determine eligibility for coverage tailored to individual circumstances.

Accurate and complete information is paramount when filling out this application because any discrepancies can lead to coverage disputes down the line. Insurance underwriters analyze the details provided to formulate a policy that addresses both the coverage limits and potential risks associated with the insured items or individuals. The thoroughness of this process directly influences the premium and terms of the insurance granted.

These pivotal documents can cover various types of insurance, including property, casualty insurance, liability insurance, and health insurance. Each type will have a distinct application form reflecting the specific requirements relevant to its coverage.

Key components of an insurance application form

Every application for insurance form contains key components that serve to gather comprehensive details about the applicant and their specific coverage needs. The first section usually includes personal information requirements, which help insurance companies identify the individual applying for coverage.

Following personal details, the form typically requires specifics about the coverage sought. This includes the type of insurance needed and the value of insured items, which determines the coverage amount. For applicable insurances, health information may also be requested, especially in life and health insurance applications.

Furthermore, supporting documents like proof of income and identification are commonly required to substantiate the information provided in the application. These documents reassure the insurance company of the applicant’s stability and identity.

Step-by-step guide to filling out the insurance application form

Filling out an application for insurance form can be a straightforward process if approached methodically. The first step involves gathering required information and identifying necessary documents. Ensure you have everything from your identification to any financial statements that support your coverage needs.

Once you have all the required information, it's essential to start completing the form. Each section of the application requires careful attention; you should ensure you understand each question and provide accurate responses.

Reviewing your application is critical before submission. Pay special attention to fields commonly missed or filled incorrectly. Double-checking these items can save you from potential frustrations later.

Editing and enhancing your insurance application form

Utilizing tools like pdfFiller can significantly streamline the process of creating and editing your application for insurance form. This cloud-based solution provides easy access to various templates that enable users to customize forms as per their requirements.

In today's digital age, eSignatures are invaluable; they expedite the signing process significantly. Understanding how to incorporate them into your application process with pdfFiller ensures you meet legal requirements while maintaining security.

Moreover, if you are working within a team, pdfFiller allows for collaboration. You can invite others to edit, comment, and track changes, streamlining the form submission process and enhancing overall productivity.

Submitting your insurance application

After completing your application for insurance form, the next crucial step involves submission. Understanding the submission process thoroughly can make a significant difference. Depending on your choice, you may opt for either online submissions or hard copies, each having applicable benefits.

Once submitted, be proactive about following up on your application status. Most companies provide tracking options for applicants to check progress. Maintaining open lines of communication with your insurer is vital; it shows your investment in the process and can help clarify any outstanding requirements.

Common mistakes to avoid in insurance applications

Even a minor oversight can lead to denials or delays in the insurance application process, which is why recognizing common mistakes is essential. One frequent error is providing incomplete information. Ensure you answer all questions thoroughly, as missing answers can trigger automatic denials.

Another common pitfall is misunderstanding the terms and conditions. It's wise to read through the policy details clearly to ensure complete understanding before submission. If at any point you are unsure about something, don’t hesitate to seek assistance from your insurance agent.

Frequently asked questions about insurance application forms

Navigating the application for insurance form can generate a host of questions. Many applicants wonder what happens if their application is denied. It's critical to understand that you can often request an explanation for the denial and subsequently appeal the decision, assuming the reasons fall within a disputable range.

Advantages of completing your application with pdfFiller

Utilizing pdfFiller offers a multitude of advantages when completing your application for insurance form. Its cloud-based accessibility means you can work on your documents from anywhere, providing flexibility and convenience, especially for busy individuals and teams.

Wrap-up: Key takeaways for successful insurance applications

Completing an application for insurance form accurately and efficiently is imperative for securing the coverage you need. Recapping the essential steps, remember to gather your documents, fill out the form meticulously, and review it thoroughly before submission. Being aware of common mistakes to avoid ensures a smoother application process.

Ultimately, having a robust understanding of how to navigate the process using advanced tools like pdfFiller empowers you to manage documents confidently. Embrace these resources to enhance your application experience and secure the insurance that best meets your needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit application for insurance on a smartphone?

How do I fill out application for insurance using my mobile device?

How do I fill out application for insurance on an Android device?

What is application for insurance?

Who is required to file application for insurance?

How to fill out application for insurance?

What is the purpose of application for insurance?

What information must be reported on application for insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.