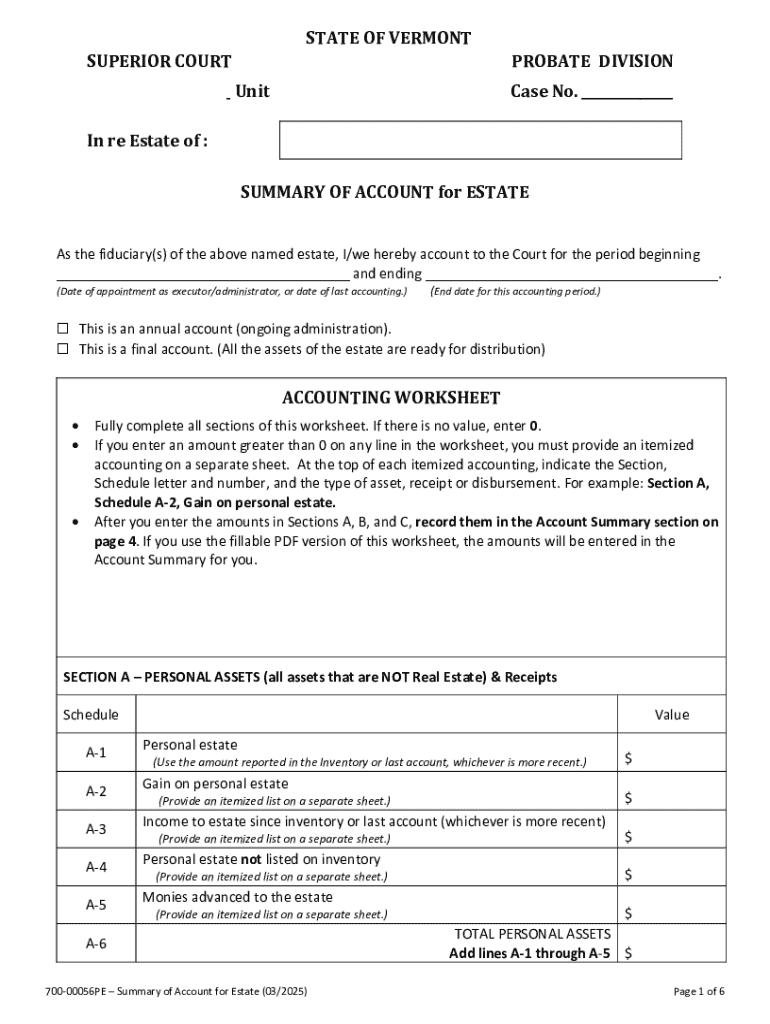

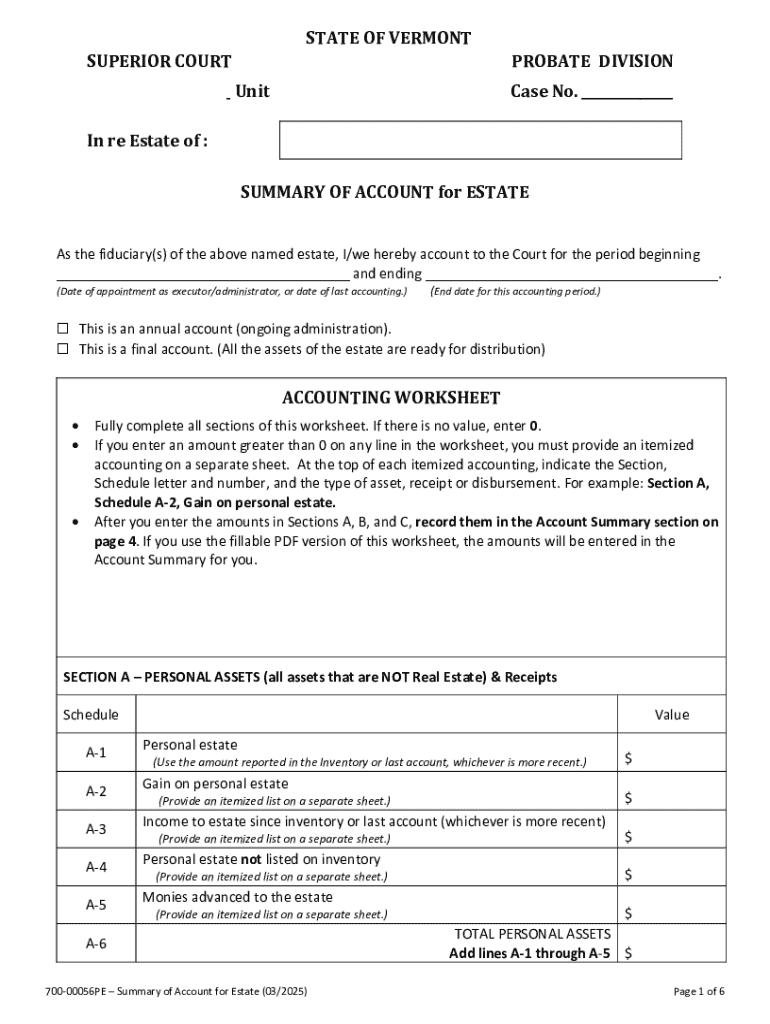

Get the free SUMMARY OF ACCOUNT ACCOUNTING WORKSHEET

Get, Create, Make and Sign summary of account accounting

How to edit summary of account accounting online

Uncompromising security for your PDF editing and eSignature needs

How to fill out summary of account accounting

How to fill out summary of account accounting

Who needs summary of account accounting?

Summary of Account Accounting Form: A Comprehensive Guide

Understanding the account accounting form

The account accounting form is a critical document in the landscape of financial reporting and management. Its primary purpose is to compile a comprehensive summary of an entity's financial activities over a specific period. This form aids in maintaining transparency, ensuring efficient tracking of financial data, and facilitating better decision-making for organizations, whether they are small businesses or large corporations.

Key components of the form include distinct sections dedicated to income, expenses, assets, and liabilities. Each section must be accurately filled to present a truthful picture of the financial status of the entity. Accurate data entry within these components holds heightened importance; any mistake can mislead stakeholders and may lead to unfavorable financial analysis during audits.

Different types of account accounting forms

Several variants of the account accounting form cater to different entities' needs. For instance, the standard account accounting form is widely used by businesses of varying sizes. It includes all necessary components for thorough financial documentation and reporting, making it ideal for larger organizations with complex financial transactions.

In contrast, the simplified account accounting form is designed for individuals and small businesses that require less detailed reporting. It streamlines the process, allowing users to track essential financial data without overwhelming detail. Choosing the appropriate form can markedly affect financial analysis and decision-making, as it dictates the depth of insight one can derive from the data presented.

Step-by-step guide to completing the account accounting form

To successfully fill out the account accounting form, begin by gathering all necessary information and documents. This includes transaction records, invoices, bank statements, and receipts. With this information at hand, you can ensure that all aspects of your finances are accurately recorded, contributing to a more reliable financial picture.

Filling out the form appropriately requires attention to detail in each section, which can be broken down as follows:

Additionally, employing multi-year comparisons when filling out the form can reveal significant trends, allowing businesses to strategize effectively for growth and financial health.

Common pitfalls and how to avoid them

Misclassification of income and expenses is a frequent error that can lead to distorted financial reporting. For instance, mixing personal expenses with business expenses can result in misleading profit/loss dynamics. It's essential to maintain clear boundaries and categories for all transactions.

Additionally, missing documentation such as receipts or invoices can create gaps in the financial picture, which could lead to inconsistencies in reporting. Keeping meticulous records of all transactions alongside the account accounting form is vital to facilitate accuracy.

Moreover, failing to account for necessary adjustments, such as asset depreciation, may lead to inflated asset values. Regularly updating the form to reflect these changes is crucial for providing a true representation of financial health.

Managing and storing your completed account accounting form

Once completed, choosing whether to store the account accounting form digitally or physically is essential. Digital storage offers accessibility and ease of retrieval, beneficial for timely decision-making and reviews. On the flip side, physical documents may be preferred by those who prioritize hard copies.

Utilizing a cloud-based platform like pdfFiller gives users a robust solution for managing their documents. It allows users to easily edit PDFs, eSign, and collaborate remotely, creating efficiencies in how teams handle financial documentation.

Collaboration tools within pdfFiller enhance teamwork by enabling collective input and review, ensuring that everyone involved has access to the most recent information and can share insights effectively.

Frequently asked questions about the account accounting form

Users often wonder about the flexibility of the account accounting form. Many can modify the structure of the form to better suit their specific business needs while still adhering to general accounting principles.

Mistakes may occur during the filling process. Users should know the steps to correct any inaccuracies, which might include adjusting figures or providing additional documentation to ensure clarity. Lastly, keeping compliance with local regulations is paramount; regular checks against relevant accounting standards can help you remain aligned with legal requirements.

Conclusion of best practices for account accounting form management

Regular review and updates to the account accounting form are necessary for accurate financial assessments. Establishing a schedule for revisiting the form, perhaps quarterly or bi-annually, ensures that recent transactions and changes are always captured.

Transparency is critical in financial reporting. Accessible records foster trust amongst stakeholders, contributing to a healthier relationship between employees, management, and external partners. By adhering to best practices, you can enhance your financial oversight and promote effective decision-making.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send summary of account accounting for eSignature?

How do I fill out the summary of account accounting form on my smartphone?

How do I edit summary of account accounting on an iOS device?

What is summary of account accounting?

Who is required to file summary of account accounting?

How to fill out summary of account accounting?

What is the purpose of summary of account accounting?

What information must be reported on summary of account accounting?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.