Get the free Vendor financing application process flow

Get, Create, Make and Sign vendor financing application process

Editing vendor financing application process online

Uncompromising security for your PDF editing and eSignature needs

How to fill out vendor financing application process

How to fill out vendor financing application process

Who needs vendor financing application process?

Comprehensive Guide to the Vendor Financing Application Process Form

Understanding vendor financing: What it is and why it matters

Vendor financing is a strategic agreement where suppliers provide credit to their customers, allowing them to purchase goods or services while deferring payment. This financial arrangement enhances business liquidity and fosters stronger supplier-customer relationships. For businesses, especially those in industries with fluctuating cash flow, vendor financing offers crucial benefits, including immediate access to necessary materials without the burden of upfront costs.

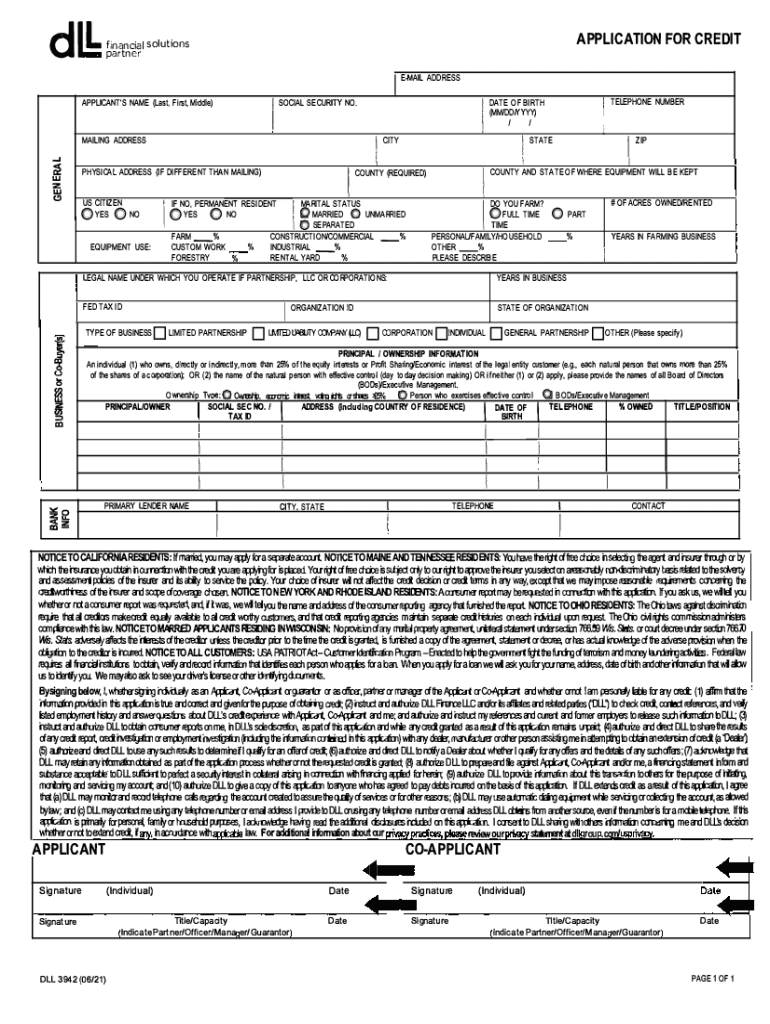

A comprehensive vendor financing application is essential since it establishes the groundwork for securing favorable credit terms. Careful articulation of financial health, operational viability, and compliance with regulatory requirements through the application process can significantly influence funding outcomes. Thus, the vendor financing application process form plays a pivotal role in assessing a business’s eligibility for vendor support.

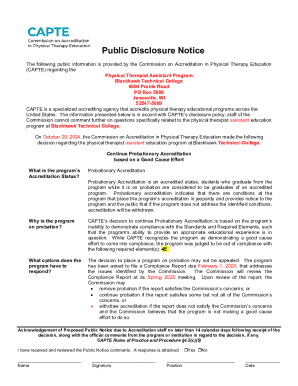

Overview of the vendor financing application process

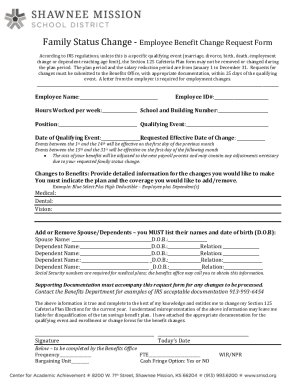

Navigating the vendor financing application process begins with understanding its core steps. Initially, the prospective vendor gathers substantial documentation, including financial statements and business history. This phase is followed by the completion of the vendor financing application process form, where accuracy and attention to detail play crucial roles in your submission’s acceptance. Finally, the application undergoes a thorough review, where financial health and compliance with lending criteria are crucial evaluation elements.

Key factors during the application stage include business structure, creditworthiness, and industry-specific compliance guidelines. It's imperative to submit a fully accurate and complete application, as missing information or inaccuracies can lead to delays or outright denials. Proactively ensuring all required elements are included can streamline the review process and significantly improve chances of approval.

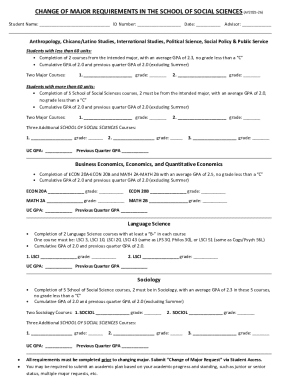

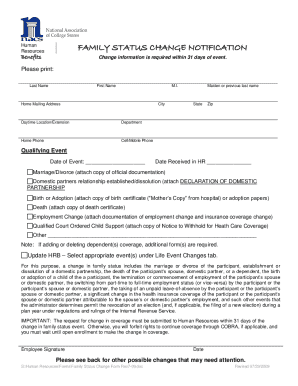

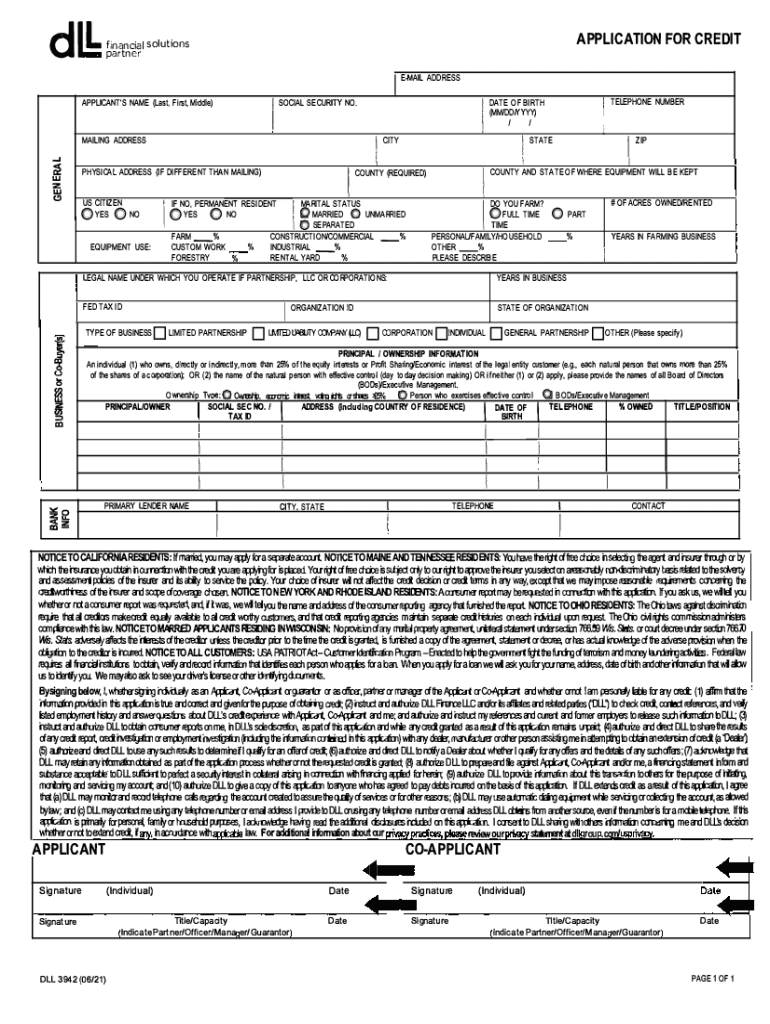

Essential components of the vendor financing application form

The vendor financing application form contains various essential components that provide vendors with a comprehensive snapshot of your business' suitability for financing. Understanding these components will help you prepare effectively and present your case convincingly.

Questions to include on your vendor financing application form

Including relevant questions in the vendor financing application form helps provide a comprehensive assessment of your business. Start with must-have questions that highlight your financial stability and operational credibility. These core questions should cover basic company details, contact information, and fundamental financial metrics.

In addition, optional questions can enrich the evaluation process. These may delve into aspects like growth plans, specific financial challenges faced, or unique operational metrics relevant to your industry. Customizing questions based on your business type ensures that the information collected aligns with your specific sector's requirements.

Additional information for enhanced evaluation

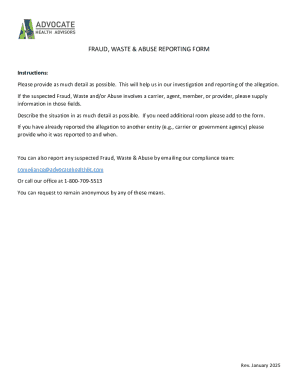

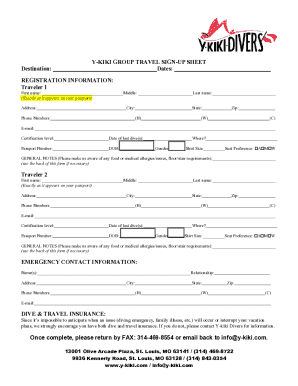

To facilitate a more thorough assessment, consider providing references that can vouch for your business’s credibility and operational competency. These references might include past vendors, clients, or business partners who can validate your reliability and payment history.

Furthermore, compiling supporting documents to supplement your application strengthens your case. Attach credit reports, bank statements, and any business plans or proposals that showcase your future direction and industry insights. Such documents not only enhance the review process but also demonstrate your commitment to transparency.

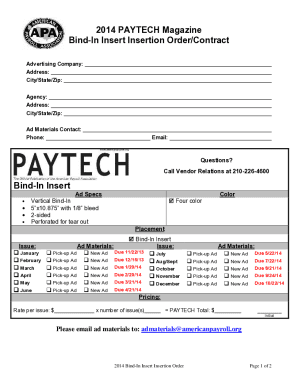

How to create your vendor financing application form using pdfFiller

Creating a vendor financing application form is streamlined using pdfFiller. First, access the template through the pdfFiller platform, which offers a variety of pre-made forms tailored for vendor financing needs. Once you have the template, customize and edit your application as necessary to include your specific business details and requirements.

Saving and managing your completed form can also be done effortlessly on the pdfFiller platform. Use the cloud-based functionality to store documents securely and access them from virtually anywhere. Implementing interactive tools available on pdfFiller can further enhance this process, allowing for easy collaboration with team members if necessary.

Common mistakes to avoid when filling out the vendor financing application

Understanding common pitfalls during the application process can save you time and frustration. Frequently, applicants might overlook crucial details or fail to provide complete information. Double-checking your application can prevent unnecessary delays and ensure a smoother review process.

Another prevalent mistake includes supplying inaccurate information that might misrepresent your financial standing. Ensure all figures and statements are up-to-date and truthful. Lastly, neglecting to include supporting documents might hinder your application’s credibility, so always attach relevant financial records and other supporting documentation.

Tips for submitting a successful vendor financing application

Submission best practices can significantly affect the outcome of your application. Ensure that all components are thoroughly filled, and double-check for any errors before submitting your vendor financing application process form. Clear communication with the vendors regarding any specific submission guidelines is also critical. Following their instructions allows you to present your application in the preferred format.

After you've submitted, stay proactive by following up with the lender to confirm receipt and inquire about the next steps. During the review process, expect potential queries or requests for additional documentation. Maintaining an open line of communication not only shows your engagement but also builds rapport with potential lenders.

Next steps after the application submission

Understanding the timeline following your application is essential. Most vendor financing applications take anywhere from a few days to several weeks to process, depending on the vendor's workload and your business’s complexity. Familiarize yourself with their review timeline to manage expectations effectively.

Should your application be approved, prepare to discuss the terms of financing and any next steps regarding payment schedules or purchase orders. Conversely, if denied, seek feedback on the decision so you can address any deficiencies for future applications. Establishing and maintaining good communication with lenders plays a vital role in building strong business relationships in the long run.

Using pdfFiller for ongoing document management

One of the primary advantages of using pdfFiller is its robust cloud-based document management system. With the ability to securely store vendor financing documentation alongside all other business documents, your team can easily access, edit, and collaborate without the chaos of physical papers.

Additionally, pdfFiller’s collaboration features allow teams to work on applications collectively, enhancing productivity and reducing errors. Organizing your vendor financing documents with the help of cloud technology not only improves compliance but ensures that all necessary files are available when required, facilitating smoother financial transactions and vendor relations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in vendor financing application process?

Can I create an electronic signature for the vendor financing application process in Chrome?

How do I edit vendor financing application process on an Android device?

What is vendor financing application process?

Who is required to file vendor financing application process?

How to fill out vendor financing application process?

What is the purpose of vendor financing application process?

What information must be reported on vendor financing application process?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.