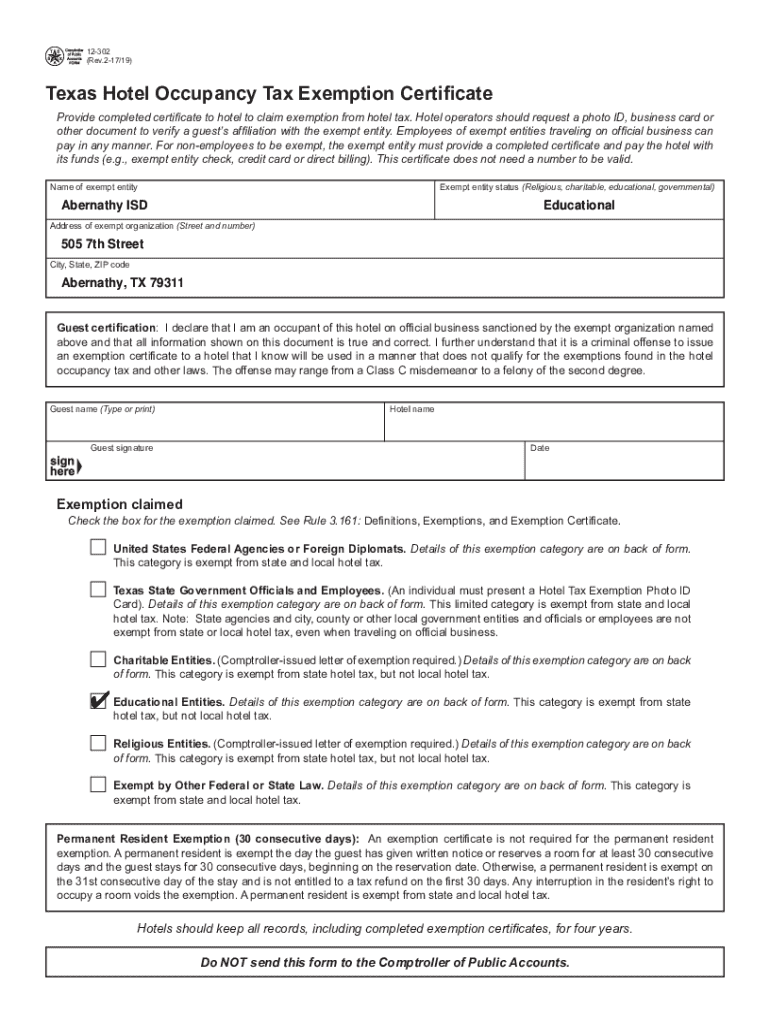

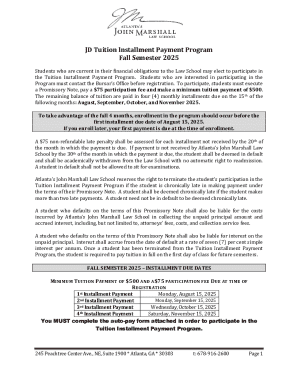

Get the free 2017-2025 Form TX Comptroller 12-302 Fill Online, Printable ...

Get, Create, Make and Sign 2017-2025 form tx comptroller

Editing 2017-2025 form tx comptroller online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2017-2025 form tx comptroller

How to fill out 2017-2025 form tx comptroller

Who needs 2017-2025 form tx comptroller?

Comprehensive Guide to the 2 TX Comptroller Form

Understanding the 2 TX Comptroller Form

The 2 TX Comptroller Form serves as a crucial document for individuals and organizations in Texas, facilitating the accurate reporting of income and deductions. This form ensures compliance with the Texas Administration Code, helping taxpayers fulfill their responsibilities while also maximizing available credits and deductions. Understanding the purpose of the form is essential as it helps taxpayers avoid common mistakes that could lead to penalties or missed opportunities for refunds.

Since its implementation, this form has seen various updates designed to simplify the completion process while enhancing accuracy in reporting. These changes reflect the state’s commitment to improving taxpayer interaction while ensuring the collection of necessary revenue. Knowing the key updates to the form, especially between 2017 and 2025, can provide valuable insights into compliance requirements that taxpayers must meet.

Eligibility to fill out the form typically includes individuals earning wages, investors reporting financial gains, and organizations needing to declare financial performance. Recognizing who must complete this form not only aligns with legal requirements but also contributes to an organized financial record.

Detailed breakdown of the form sections

The TX Comptroller Form is divided into specific sections that allow for the structured and systematic filing of important tax information. Each section has its designated purpose, with details crucial for accurate reporting and compliance.

Section 1: Personal Information

This section requires essential personal details such as your name, address, and contact information. Providing accurate details is vital; errors here can cause delays in processing your form. The integrity of your personal information directly impacts your tax records and correspondence from the Texas Comptroller’s office.

To complete this section accurately, make sure to double-check the spelling of your name and ensure that your address matches what is on file with the IRS and local jurisdictions.

Section 2: Income Reporting

Here, taxpayers report various types of income, including wages from employment, income from investments, and any other income sources relevant to Texas state tax. It’s crucial to be thorough, as failing to report income accurately can lead to penalties and interest on unpaid taxes.

When calculating your total income, consider keeping a detailed record of W-2 forms, 1099s, and any pertinent documentation that can substantiate your income claims. Ensuring accuracy here prevents future issues with tax authorities.

Section 3: Deductions and Credits

The deductions section is where you can lower your taxable income significantly. Taxpayers should be aware of common deductions such as mortgage interest, student loan interest, and charitable contributions. Utilizing this section wisely can substantially reduce your overall tax burden.

To maximize your credits, it’s beneficial to consult a tax professional or use resources available through platforms like pdfFiller that can help you navigate the process effectively.

Section 4: Payment and Submission Details

In this last section, taxpayers decide how they wish to remit any owed taxes. Options include online payments, mailing a check, or making in-person payments at designated locations. Understanding these payment modalities ensures that you meet your obligations without unnecessary complications.

Submission deadlines are critical elements to remember; missing them can result in penalties. Therefore, keep key dates in mind, such as the initial filing deadlines and extensions.

Step-by-step instructions for filling out the form

Before beginning to fill out the 2 form TX Comptroller Form, it’s essential to prepare adequately. Having the necessary tools and resources at your disposal will streamline the process significantly.

Preparing to fill out the form: Tools and resources to use

1. Gather all relevant documents such as W-2 forms, investment statements, and proof of deductions. This preparation will greatly assist in ensuring that you do not overlook any income sources or eligible deductions.

Step 1: Gathering necessary documents

Your first step is to collect all documents related to your income and deductions. Ensure that you have not just personal copies of these documents, but also organized records that can be easily referenced when completing the form.

Step 2: Completing each section: A detailed walkthrough

As you move through each section, focus on the accuracy of the information you provide. Use available online resources, like those at pdfFiller, which enable you to fill out the form electronically and reduce the chance of mistakes.

Step 3: Review and finalize: Ensuring accuracy and compliance

After completing the form, take the time to review all sections carefully. A peer review can also be helpful; another set of eyes might catch errors or omissions that you missed. Compliance with the Texas Administrative Code is paramount.

Step 4: Submission: Best practices for timely submission

Submit your form using your preferred method, but make sure you retain a copy for your records. If submitting online, ensure you get confirmation of your submission; if mailing, consider using certified mail for tracking purposes.

Interactive tools and resources

To enhance your form-filling experience, utilizing interactive tools can prove invaluable. For instance, pdfFiller provides an interactive PDF editor that simplifies the process of filling out tax forms and documents.

Form completion checklist: Ensuring you don’t miss any steps

Using a form completion checklist ensures that you address all necessary sections. This can help mitigate common mistakes and provide peace of mind. Checklists can include:

Interactive PDF editor: How to use pdfFiller for your form

The pdfFiller platform comes equipped with a variety of features that enable you to edit and manage documents efficiently. You can collaborate with team members on a shared document, ensuring a seamless completion process.

Features of pdfFiller for editing and managing documents

Some key features include:

Addressing common questions and concerns

Completing the 2 TX Comptroller Form may lead to various questions. Addressing these concerns early can alleviate anxiety and prevent unnecessary errors.

Frequently asked questions about the TX Comptroller Form

In case of errors, it is essential to act quickly, as the Texas Comptroller allows amendments. If you realize an error post-submission, utilize the amendment process to correct your return before it creates complications, ensuring that your compliance with the state tax laws remains intact.

Troubleshooting: Common submission issues and solutions

Common submission issues could involve incorrect information or technical difficulties with online submission; however, thorough reviews can often catch these mistakes ahead of time. Should you encounter persistent issues, reaching out to customer support or utilizing online forums can provide solutions.

Tips for efficient document management

As part of the form-filling process, efficient document management is crucial. Securely storing completed forms not only keeps your information safe but also allows for easy retrieval in future years.

Storing your completed forms securely online

Utilizing cloud-based solutions such as pdfFiller aids in secure storage and management of your documents. Ensure that your forms are backed up and organized methodically for efficient access.

Using pdfFiller for future tax forms: Streamline your process

Incorporating cloud-based document management systems like pdfFiller not only streamlines your current form process but also prepares you for future submissions. This proactive approach allows you to maintain compliance while saving time on successive tax filings.

Benefits of a cloud-based solution for document management

Best practices for future form submissions

Staying informed about changes in tax laws is crucial for accurate and timely submissions. Regularly review updates from the Texas Comptroller’s office and adapt your processes as necessary.

Planning ahead: Annual review of submission requirements

Set a schedule to review submission requirements yearly, or even bi-annually. This can involve subscribing to newsletters, following regulatory updates, and engaging with community resources for tax preparation. Such diligence will keep you ahead of compliance needs while optimizing your submission process.

Conclusion

Accurate submission of the 2 form TX Comptroller Form is paramount for all Texas taxpayers. Ensuring that you follow procedures diligently not only helps in meeting legal obligations but also maximizes potential financial benefits.

Furthermore, embracing efficient document management practices through tools like pdfFiller not only simplifies the form-filling process but also empowers taxpayers to handle future submissions with confidence and ease.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2017-2025 form tx comptroller in Chrome?

Can I sign the 2017-2025 form tx comptroller electronically in Chrome?

How do I edit 2017-2025 form tx comptroller on an iOS device?

What is form tx comptroller?

Who is required to file form tx comptroller?

How to fill out form tx comptroller?

What is the purpose of form tx comptroller?

What information must be reported on form tx comptroller?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.