Get the free Mississippi Personal Income Form 80-105

Get, Create, Make and Sign mississippi personal income form

Editing mississippi personal income form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mississippi personal income form

How to fill out mississippi personal income form

Who needs mississippi personal income form?

Understanding the Mississippi Personal Income Form: A Comprehensive Guide

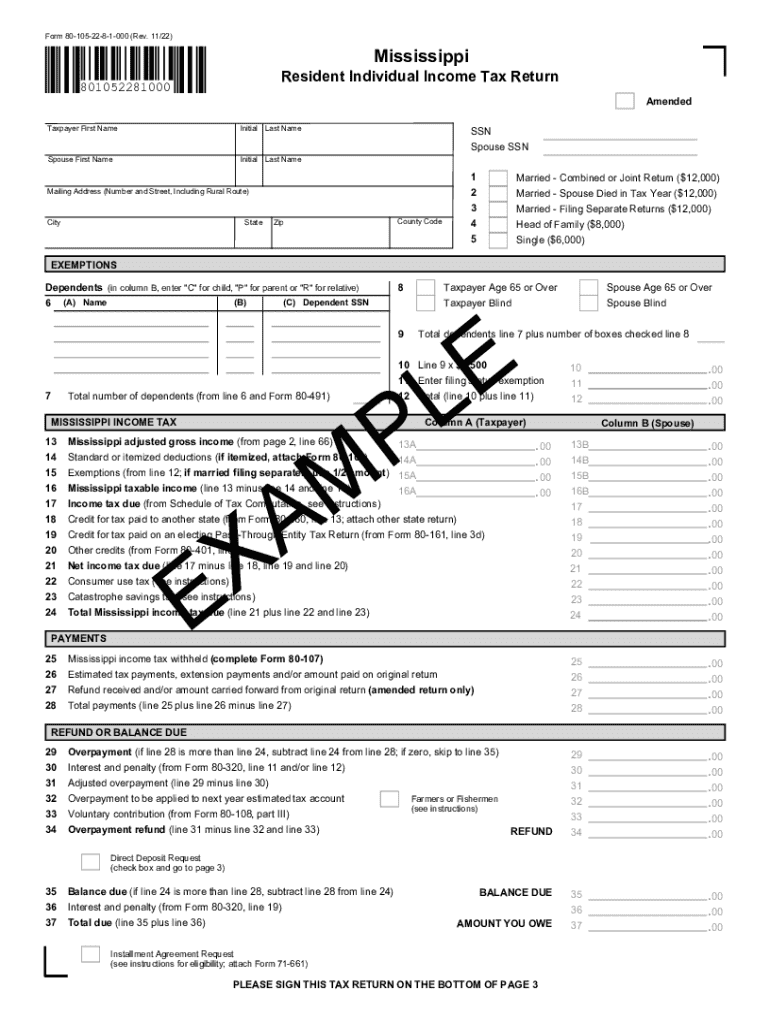

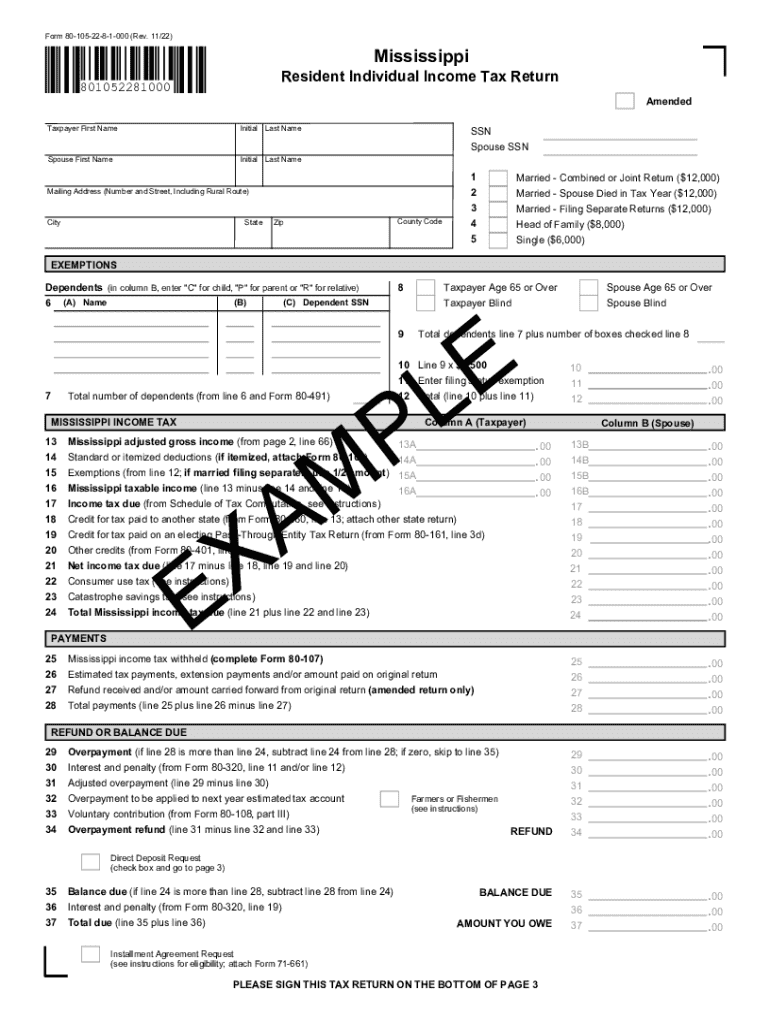

Overview of Mississippi Personal Income Form

The Mississippi Personal Income Form is a crucial document for individuals and families living in Mississippi, intended for reporting income to the state for tax purposes. This form serves not just as a means to fulfill tax obligations but also plays a vital role in financial planning and compliance with state regulations. By understanding its importance, taxpayers can better navigate their responsibilities and manage their finances.

Filing the Mississippi Personal Income Form is essential for accurately reporting income, claiming eligible deductions and credits, and ultimately calculating owed tax or refunds. Ensuring that this form is completed correctly is foundational for financial well-being and legal compliance.

Key features of the Mississippi Personal Income Form

Understanding the key features of the Mississippi Personal Income Form can significantly ease the tax filing process. The form consists of various sections designed to gather information about taxpayers' income sources, deductions, exemptions, and applicable tax credits. In this section, we will delve into these components.

Navigating the form effectively requires familiarity with these sections. Knowing what information is needed and how to fill it out correctly can streamline the process and minimize errors, ultimately making for a smoother filing experience.

Eligibility for filing the Mississippi Personal Income Form

Determining who needs to file the Mississippi Personal Income Form is essential. Generally, individuals and families with taxable income that meets or exceeds the state's income thresholds are required to complete this form. Additionally, self-employed individuals or those with income from various sources must be aware of their filing obligations.

Moreover, residency is a crucial factor for Mississippi tax filers. To file, one must be a resident or maintain a physical presence in the state during the tax year, ensuring that local taxes are appropriately managed.

Step-by-step instructions for completing the form

Completing the Mississippi Personal Income Form can be a straightforward process with the right preparation and understanding. Here, we'll break it down into manageable parts to facilitate your filing experience.

Gathering necessary documentation

Before beginning your application, gather all your necessary documents, including W-2s, 1099s, and previous year returns. This documentation forms the backbone of your tax reporting influence.

Filling out the form

Once you have your documentation, start filling out the form. Be sure to follow instructions precisely, filling each section as applicable.

Common mistakes to avoid when completing the form

To avoid pitfalls that can delay processing or lead to errors, double-check each entry and pay careful attention to details.

Filing options for the Mississippi Personal Income Form

When it comes to filing the Mississippi Personal Income Form, there are two primary submission options: online and paper. Each method has its own benefits and considerations, allowing taxpayers to choose what works best for their circumstance.

Online submission

Online submission has gained popularity due to its convenience and efficiency. Taxpayers can quickly complete and submit their returns without the hassle of printing and mailing physical documents.

Paper submission

If you prefer a more traditional approach, paper submission is also accepted. However, proper preparation and adherence to deadlines are critical.

Managing your Mississippi Personal Income Form with pdfFiller

Managing your forms doesn't stop after filing; understanding how to utilize pdfFiller's tools can enhance your document handling experience.

Frequently asked questions (FAQs)

Clarifying common queries can alleviate concerns for taxpayers. Here’s a collection of frequently asked questions regarding the Mississippi Personal Income Form.

Tips for smooth document management post-filing

Maintaining organization following your filing can be equally as important as the filing itself. Here are tips to help keep track of essential documents and plan for future filings.

Additional tools for residents

Mississippi residents can also take advantage of various resources specifically available through pdfFiller for comprehensive tax management. This functionality enables a more organized approach to handling all federal and state tax forms effectively. A broader understanding of available forms helps taxpayers align their state filings with their federal requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the mississippi personal income form in Gmail?

How can I edit mississippi personal income form on a smartphone?

How do I fill out mississippi personal income form on an Android device?

What is Mississippi personal income form?

Who is required to file Mississippi personal income form?

How to fill out Mississippi personal income form?

What is the purpose of Mississippi personal income form?

What information must be reported on Mississippi personal income form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.