Get the free New EPFO directive requires Form 5A display at workplace

Get, Create, Make and Sign new epfo directive requires

Editing new epfo directive requires online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new epfo directive requires

How to fill out new epfo directive requires

Who needs new epfo directive requires?

New EPFO directive requires form: What you need to know

Understanding the new EPFO directive

The Employees' Provident Fund Organisation (EPFO) is pivotal in managing retirement savings for millions of employees in India. Established under the Employees' Provident Funds and Miscellaneous Provisions Act, 1952, its primary aim is to provide financial security post-retirement. As part of its statutory compliance efforts, EPFO issues directives that help streamline processes related to employee benefits. This latest compliance update mandates the submission of specific forms by employers and employees, underscoring the importance of meeting these requirements to avoid any potential penalties.

What is the new directive and its purpose?

The new EPFO directive aims to simplify and standardize the information that employers must provide. The directive outlines specific forms that must be completed, ensuring that data related to workforce retirement benefits is accurately captured. Changes introduced include a clearer definition of documentation requirements and a stricter enforcement timeline for compliance. The objectives behind this implementation are twofold: to enhance the accuracy of member records and to ensure that employees receive their rightful dues without delay due to bureaucratic inefficiencies.

Essential forms under the new directive

To comply with the new EPFO directive, organizations must familiarize themselves with several key forms. The most critical among these is Form 5A, which plays a central role in the documentation process. Proper understanding of this form, along with others like Form 11 and Form 2, is essential for effective compliance. Each form serves its own purpose, contributing to a comprehensive understanding of employee eligibility and contributions in the EPF scheme.

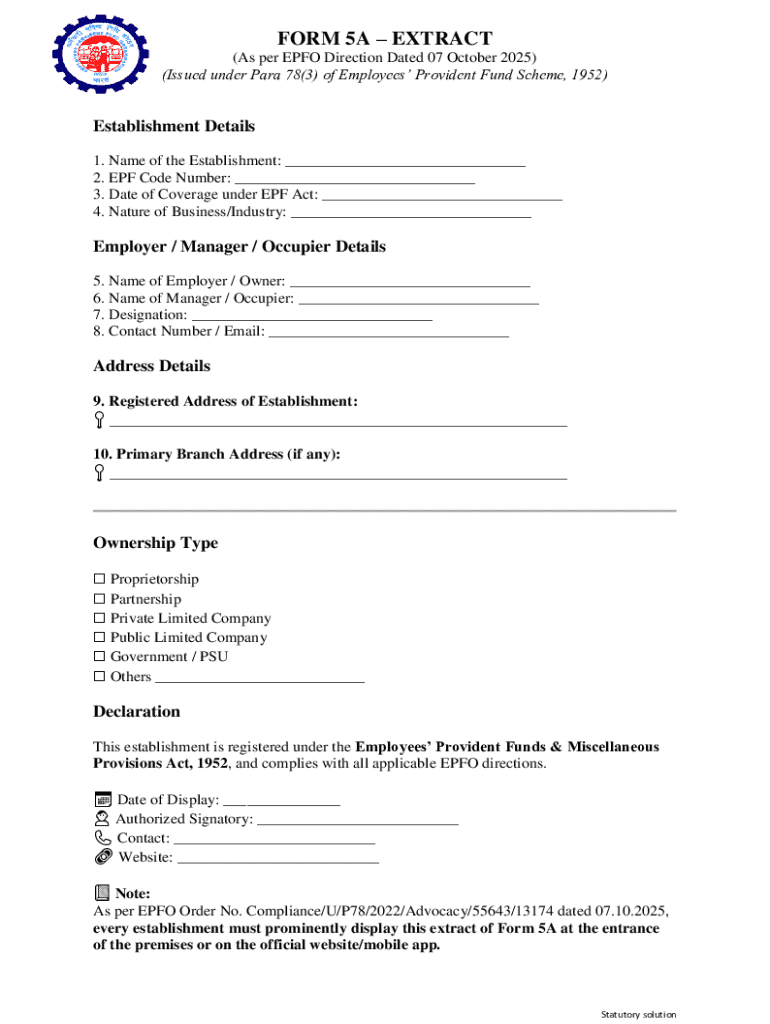

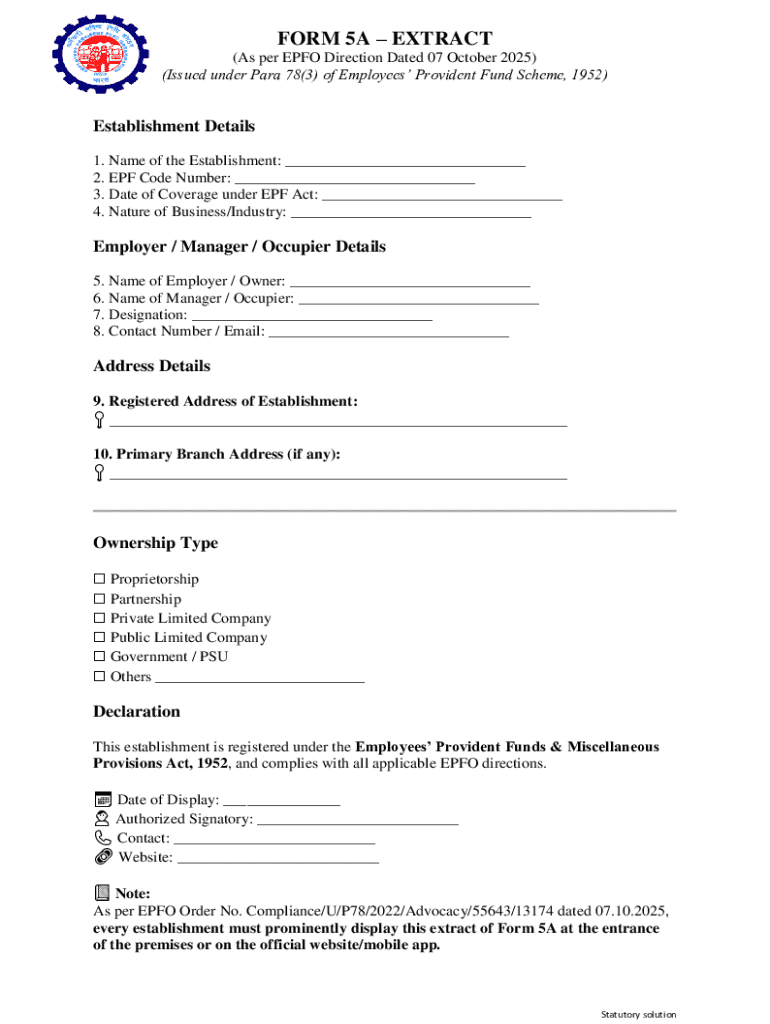

Form 5A: A comprehensive guide

Form 5A is designed for collecting specific details necessary for registering new employees under EPF. Its primary purpose is to facilitate the accurate gathering of personal and employment-related information. This includes employee’s name, age, gender, date of joining, and details of the establishment. The proper completion of this form ensures that employees are seamlessly integrated into the EPF system, thereby safeguarding their rights to pensions and other benefits.

Compliance requirements for organizations

Organizations need to adhere to certain compliance obligations stemming from the new EPFO directive. Firstly, all applicable forms must be submitted accurately within stipulated timelines to avoid penalties. Non-compliance can lead to significant financial implications and potentially damage the organization's reputation among employees. Employers should also maintain thorough documentation to demonstrate their commitment to compliance with EPFO regulations.

Detailed breakdown of Form 5A

Understanding the sections of Form 5A is crucial for compliance. Segmenting the form into manageable parts can streamline the data entry process. Key sections include employee details, establishment details, and declarations related to previous employment and EPF affiliations. It’s vital to fill each section meticulously, as inaccuracies might lead to rejection of submissions, requiring rework and delay in benefits provision.

How to access and download forms

Accessing the required forms, including Form 5A, is straightforward through the EPFO Employer Portal. Employers should log in with their credentials to navigate to the forms section, where all necessary documentation is available for downloading. It’s essential to ensure secure cloud storage of these documents to prevent data loss or unauthorized access.

Best practices for HR and compliance teams

HR and compliance teams play an integral role in adhering to the new EPFO directive. Developing a structured approach to compliance through regular training and updates is crucial. Allocating specific compliance roles within the team enhances accountability, ensuring that no detail slips through the cracks. Furthermore, using tools like pdfFiller can significantly improve documentation management by facilitating easy editing, eSigning, and collaboration among team members.

Understanding the implications of non-compliance

The consequences of non-compliance with the new EPFO directives can be dire. Organizations may face heavy financial penalties, which could strain cash flows and budgetary allocations. Moreover, failure to comply could lead to legal risks and potential lawsuits from employees claiming unpaid dues. Beyond financial impacts, non-compliance could also erode employee trust and compromise the company’s reputation, making it challenging to attract and retain top talent.

Strategies for effective communication and reporting

Establishing a robust internal communication plan is vital for keeping the workforce informed about compliance updates. Regular newsletters or bulletins can be employed to relay critical information regarding the EPFO directive. Moreover, organizations should have clear protocols in place for reporting completed submissions and updates to the EPFO, ensuring transparency and accountability within the compliance framework.

Leveraging technology for document management

Utilizing technologies like pdfFiller can streamline document management processes related to EPFO compliance. With features that enable access from anywhere, users can edit, eSign, and share forms instantly, thus accelerating turnaround times and improving collaboration between HR and finance teams. By integrating pdfFiller, organizations can move beyond traditional document management methods, allowing for efficient workflow and enhanced compliance tracking.

Preparing for future changes in compliance

As regulatory landscapes evolve, it is essential for organizations to prepare for future directives from EPFO. Keeping abreast of industry news and participating in discussion forums can provide valuable insights into upcoming changes. Furthermore, organizations should regularly review their compliance strategies and be adaptable to stay compliant with any new amendments or requirements laid down by EPFO.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my new epfo directive requires in Gmail?

How do I complete new epfo directive requires online?

How do I make edits in new epfo directive requires without leaving Chrome?

What is new epfo directive requires?

Who is required to file new epfo directive requires?

How to fill out new epfo directive requires?

What is the purpose of new epfo directive requires?

What information must be reported on new epfo directive requires?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.