Get the free E dividends form copy new

Get, Create, Make and Sign e dividends form copy

How to edit e dividends form copy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out e dividends form copy

How to fill out e dividends form copy

Who needs e dividends form copy?

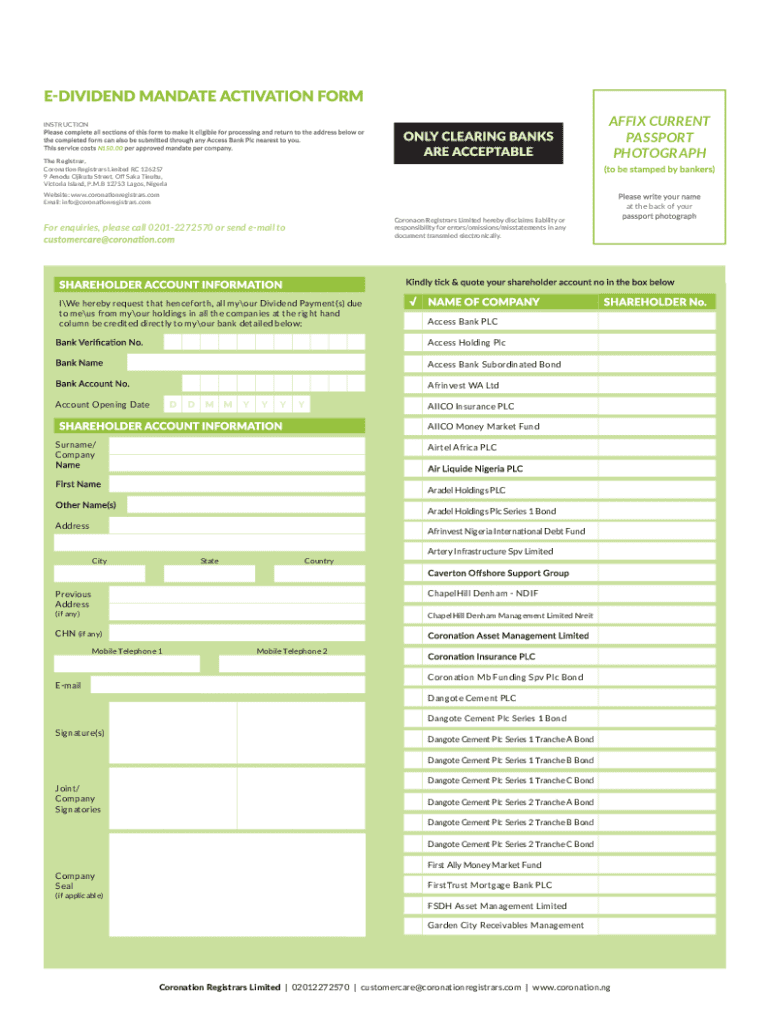

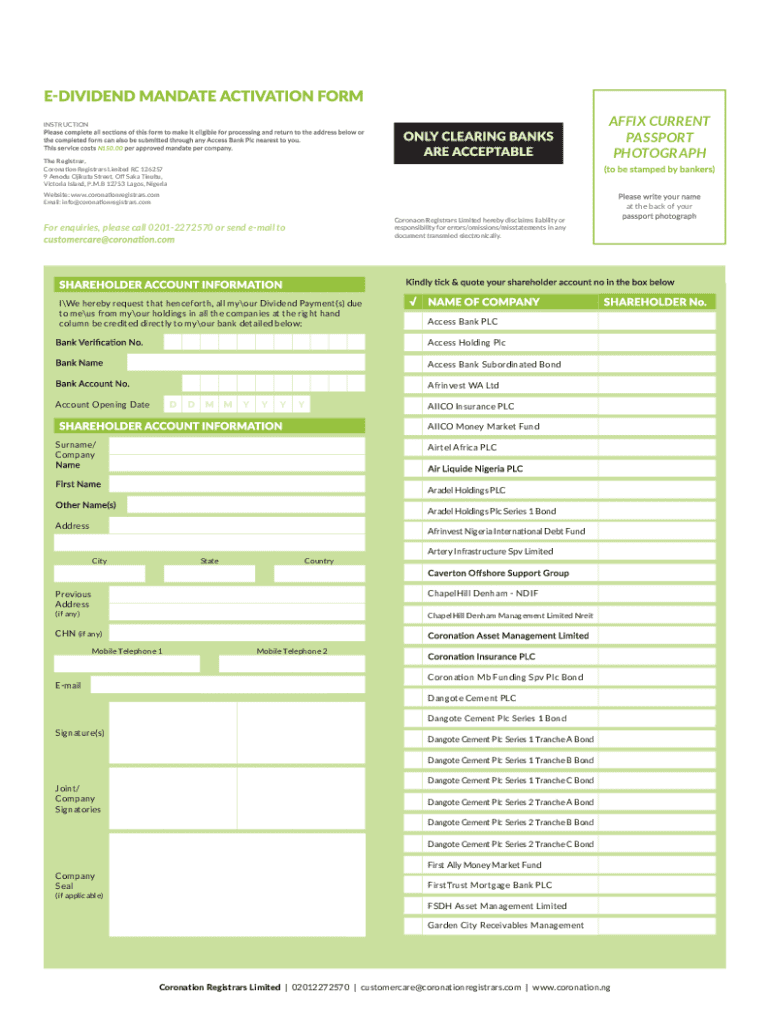

Understanding and Managing Your e-Dividends Form Copy Form

Understanding e-Dividends

e-Dividends refer to electronic dividend payments that allow individuals and teams to receive dividends directly into their bank accounts, rather than receiving physical checks. This modern approach not only streamlines the payment process but also enhances security, reducing the risks associated with lost or stolen checks. e-Dividends are becoming increasingly important in today's fast-paced financial environment, ensuring timely payments and ease of access.

The significance of e-Dividends extends beyond just functionality; they empower users to manage their investments more effectively. By switching to e-Dividends, investors can reap various advantages that align with their financial goals. Moreover, organizations benefit from decreased administrative costs and increased efficiency.

The importance of properly completing the e-Dividends form

Completing the e-Dividends form accurately is crucial for several reasons. Common errors, whether in personal details or bank account information, can lead to delays or even the non-receipt of dividends. Therefore, understanding the implications of mistakes can save time and prevent financial setbacks.

Investors must pay attention to the information they provide. Not only must details be accurate, but the required supporting documents must also be attached for successful processing. Many users overlook these requirements, which can result in unnecessary follow-ups.

Step-by-step guide to filling out the e-Dividends form

Filling out your e-Dividends form can seem daunting, but by following these steps, you can simplify the process.

Collaborating and managing e-Dividends forms

For teams, managing e-Dividends forms collaboratively can enhance productivity. pdfFiller provides various tools that facilitate sharing the e-Dividends form with team members seamlessly. Collaboration is crucial as information often requires inputs from multiple stakeholders.

Additionally, the platform equips users with the functionality to obtain signatures electronically. The eSign feature simplifies finalizing documents, ensuring all parties can provide consent regardless of their location.

Troubleshooting common issues

Even with a well-prepared form, users can encounter issues during submission. It's vital to know common submission errors and how to resolve them quickly. Typically, issues arise due to incomplete fields or mismatched information.

For those needing additional help, pdfFiller offers customer support services to assist with navigating the e-Dividends form process. Having accessible resources, including a dedicated FAQ section, can enhance your experience.

Conclusion: Empowering your document management with pdfFiller

Utilizing pdfFiller for your e-Dividends forms can simplify your financial tasks, enhancing both convenience and efficiency. Not only does the platform provide tools to manage your forms effectively, but it also ensures that your submissions are accurate and secure.

The comprehensive suite of features available on pdfFiller empowers users to navigate the complexities associated with documentation and form management. By taking advantage of these resources, individuals and teams can streamline their processes, leading to better financial outcomes.

Frequently Asked Questions (FAQs) About e-Dividends

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit e dividends form copy in Chrome?

How do I fill out the e dividends form copy form on my smartphone?

How do I edit e dividends form copy on an Android device?

What is e dividends form copy?

Who is required to file e dividends form copy?

How to fill out e dividends form copy?

What is the purpose of e dividends form copy?

What information must be reported on e dividends form copy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.