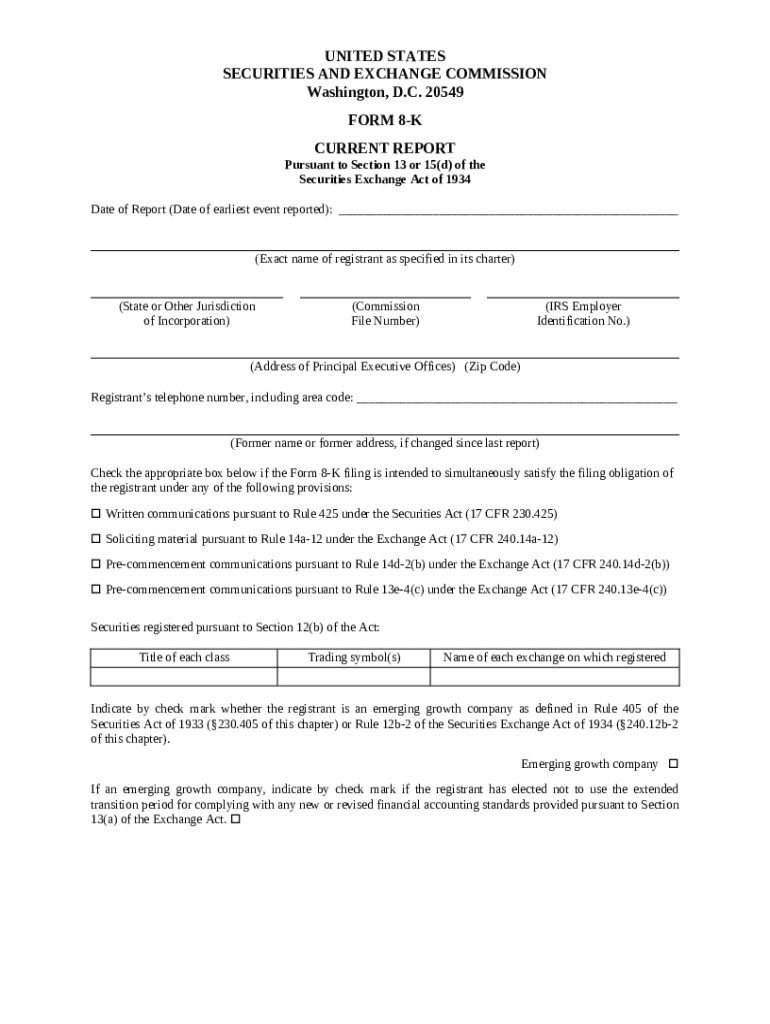

Understanding the 8-K Current Report Filing Form

Overview of the 8-K filing

An 8-K filing is a crucial document that publicly traded companies must file with the Securities and Exchange Commission (SEC) whenever a significant event occurs that might be of interest to investors. This form plays a vital role in corporate governance by ensuring transparency about major corporate events.

The 8-K filing is used to report a wide variety of events ranging from mergers and acquisitions to changes in executive leadership. Companies must file an 8-K to inform investors and ensure that the market has access to relevant information.

Major corporate events, such as mergers, acquisitions, or bankruptcies.

Changes in management, including the appointment or resignation of key executives.

Key components of an 8-K report

The 8-K report is organized into specific items that detail different types of events. This structure aids in clarity and ease of access for users looking for specific information.

For example, Item 1.01 addresses the entry into a material definitive agreement, reporting significant commitments by the company. Similarly, Item 2.01 covers the completion of an acquisition or asset disposition, which is vital for understanding a company’s strategic direction.

Item 1.01: Entry into a Material Definitive Agreement.

Item 2.01: Completion of Acquisition or Disposition of Assets.

Item 3.01: Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard.

Understanding the precise language used in 8-K filings is important, as it reflects the seriousness of the reported events and alerts investors to changes that might affect their decisions.

Who needs to file an 8-K?

Generally, companies that are publicly traded on major stock exchanges such as the NYSE or NASDAQ are required to file 8-K reports. This requirement ensures that all investors have equal access to important information that could influence their investment decisions.

Several reportable events trigger the obligative filing of an 8-K. These typically include major financial decisions, legal proceedings, changes in financial condition, and significant shareholder actions.

Companies listed on major stock exchanges.

Events such as mergers, acquisitions, or bankruptcy.

Actions taken by shareholders or significant management changes.

Timeliness is crucial; 8-K filings must generally be submitted within four business days after the event occurs to maintain compliance with SEC regulations.

How to prepare an 8-K filing

Preparing an 8-K filing involves several critical steps to ensure the document is accurate and compliant with SEC requirements. Adhering to these steps can help mitigate any potential issues or penalties associated with late or inaccurate filings.

Identify the event prompting the report.

Gather relevant information and documentation related to the event.

Draft the report using appropriate language to maintain professionalism and clarity.

Review and revise the document for compliance and accuracy before submission.

Effective communication is key. The information should be presented clearly, and any financial impacts should be explicitly stated, enabling stakeholders to grasp the implications quickly.

Filing process for the 8-K

Once the 8-K is drafted, the next step is submitting it through the SEC's EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system. This digital filing process allows for easier public access to documents.

Understanding key deadlines is essential; if a company fails to file on time, it may face penalties or increased scrutiny from the SEC. Thus, it’s beneficial to establish a robust internal timeline for preparing and submitting these documents.

Use the SEC's EDGAR system for filings.

Keep track of submission deadlines closely.

Ensure compliance with SEC regulations to avoid pitfalls.

Common pitfalls that companies should avoid include submitting documents that lack necessary disclosures or filing after deadlines. Ensuring that the report adheres to regulatory standards is not just a compliance issue but a matter of corporate integrity.

Interactive tools for 8-K filing management

Utilizing technology can significantly streamline the 8-K filing process. Platforms like pdfFiller provide tools for editing and managing documents efficiently. Users can take advantage of features such as eSigning and collaboration tools to enhance team efficiency.

By leveraging a cloud-based platform, teams can track and manage filings cohesively. For example, pdfFiller allows users to create a repository of past filings, making it easier to reference previous disclosures when needed.

Use pdfFiller for seamless document editing.

Utilize eSigning and collaboration features for effective teamwork.

Manage and track filings within a cloud-based platform for accessibility.

Best practices for handling 8-K filings

To maintain a good standing with regulators and stakeholders, companies should ensure that their filing processes are timely and accurate. Establishing a consistent filing schedule helps organizations keep track of potential disclosures.

Businesses should also develop legal considerations and risk management strategies to limit their exposure during the filing process. This proactive approach safeguards against potential litigation or market backlash.

Ensure timely reporting of significant events.

Maintain a detailed filing schedule for organizational transparency.

Implement legal and risk management strategies to mitigate potential issues.

Case studies: 8-K filings in action

Examining specific cases can provide insight into the practical application of the 8-K filing process. Companies like Tesla and Apple have utilized the 8-K to communicate significant business decisions to their investors.

For instance, a recent acquisition by Tesla prompted a detailed 8-K filing, which impacted the company’s stock price positively, reflecting investor confidence. Understanding these real-world implications can illustrate the importance of maintaining diligent filing practices.

Example of Tesla's strategic acquisition impacting stock prices.

Analysis of Apple's executive changes and corresponding market reactions.

Lessons learned from high-profile disclosures.

Resources and tools for staying updated

Keeping abreast of developments and changes in 8-K filings is essential for compliance. Subscribing to news alerts or updates from the SEC can provide relevant insights into recent regulations.

Additionally, using tools for document management can enhance the efficiency of maintaining filing practices.

Follow SEC updates for regulatory changes.

Use document management tools for effective filing practices.

Subscribe to alerts on new filings to remain informed.

Frequently asked questions about 8-K filings

Various inquiries arise around the 8-K filing process. Many individuals and teams often ask about the specific types of events that require an 8-K or how to draft their filings accurately.

Common concerns also revolve around understanding the language used in filings and the potential consequences of late submissions. Regular education and awareness can enhance understanding of SEC regulations.

What constitutes a reportable event for an 8-K?

How can one ensure compliance during filing?

What are the risks associated with late 8-K filings?