Get the free Lending Club Agrees To Pay $2 Million Penalty To ...

Get, Create, Make and Sign lending club agrees to

How to edit lending club agrees to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out lending club agrees to

How to fill out lending club agrees to

Who needs lending club agrees to?

Lending Club agrees to form: A comprehensive guide to your agreement process

Understanding the Lending Club agreement

Lending Club operates as a pioneering peer-to-peer lending platform, allowing individual borrowers to connect with lenders seeking to invest in personal loans. This model democratizes access to credit, enabling members to bypass traditional banking hurdles. When engaging in such transactions, a legally binding agreement is vital, ensuring both parties understand their roles and responsibilities. This article delves into the intricacies involved in forming an agreement with Lending Club.

In peer-to-peer lending, agreements are critical. They outline terms, conditions, and obligations, reinforcing transparency and trust. A well-structured agreement secures the rights of both the borrower and the lender, detailing consequences in case of defaults or disputes. Hence, understanding the nuances of your Lending Club agreement is paramount.

The agreement formation process

Forming an agreement with Lending Club is a multi-step process designed to streamline the borrowing and lending experience. Here's a breakdown of the steps involved:

Key components of the Lending Club agreement

The Lending Club agreement comprises several key components that empower members to know their rights and obligations. It includes essential legal frameworks determining the agreement's enforceability and jurisdictions, ensuring that all parties are aware of governing laws applicable to peer-to-peer lending.

Borrowers and lenders should closely examine financial terms, including interest rates and any applicable fees. Various repayment schedule options may be provided, allowing borrowers flexibility in managing repayments. Additionally, the obligations of both parties are explicitly outlined. Borrowers must adhere to payment terms, while lenders enjoy protections that safeguard their investments and ensure compliance with the agreed repayment plans.

Customizing your Lending Club agreement

Customization is vital to tailoring the Lending Club agreement to suit your specific needs. By leveraging pdfFiller’s tools, users can edit and modify their agreements to better reflect personal agreements and financial circumstances. This includes ensuring that all definitions and terms align with their understanding.

eSigning your Lending Club agreement

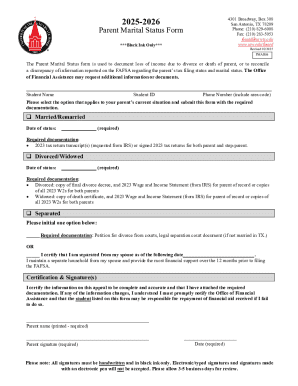

The advantages of electronic signatures extend to legal validity and convenience. By opting for eSigning, users can expedite the agreement process significantly. Here is a step-by-step guide to signing your Lending Club agreement using pdfFiller:

Managing your Lending Club documents

Effective management of Lending Club documents is essential for both tracking agreements and ensuring compliance. pdfFiller offers robust storage and organizational features to keep your agreements secure and accessible. Users can categorize their documents for easy retrieval and ensure timely access to their loan or borrower agreements.

Legal considerations and compliance

Engaging in a Lending Club agreement necessitates understanding the legal implications involved. Both borrowers and lenders must ensure compliance with local and federal regulations, particularly in the state of Utah, where specific laws may apply to peer-to-peer lending transactions.

Resources for legal advice are readily available as users can find information through online legal platforms or consult directly with attorneys specializing in financial agreements. By staying informed of applicable laws, Lending Club members can protect their rights while also managing obligations effectively.

Troubleshooting common issues with Lending Club agreements

Issues may arise during the agreement process with Lending Club, often stemming from misunderstandings of terms or inadequate information on how to proceed. Frequently asked questions can clarify some common areas of confusion, helping users navigate the agreement process more smoothly.

Additional tools for successful peer-to-peer lending

Beyond agreements, pdfFiller offers a suite of tools designed to enhance the peer-to-peer lending experience. These resources can assist borrowers and lenders alike in making informed decisions regarding financial transactions.

Success stories: Real users’ experiences with Lending Club agreements

Numerous individuals have successfully navigated the Lending Club agreement process, offering insights that can inform new users. Testimonials reveal how flexible terms and straightforward processes led to satisfactory borrowing experiences, often emphasizing the importance of understanding agreement nuances.

Lessons learned typically include the value of proactive communication with lenders and the need to carefully read through agreements to avoid misunderstandings regarding rights and obligations. Such real-life experiences enrich the understanding of what it takes to successfully engage with Lending Club.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in lending club agrees to?

How do I fill out lending club agrees to using my mobile device?

How can I fill out lending club agrees to on an iOS device?

What is lending club agrees to?

Who is required to file lending club agrees to?

How to fill out lending club agrees to?

What is the purpose of lending club agrees to?

What information must be reported on lending club agrees to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.