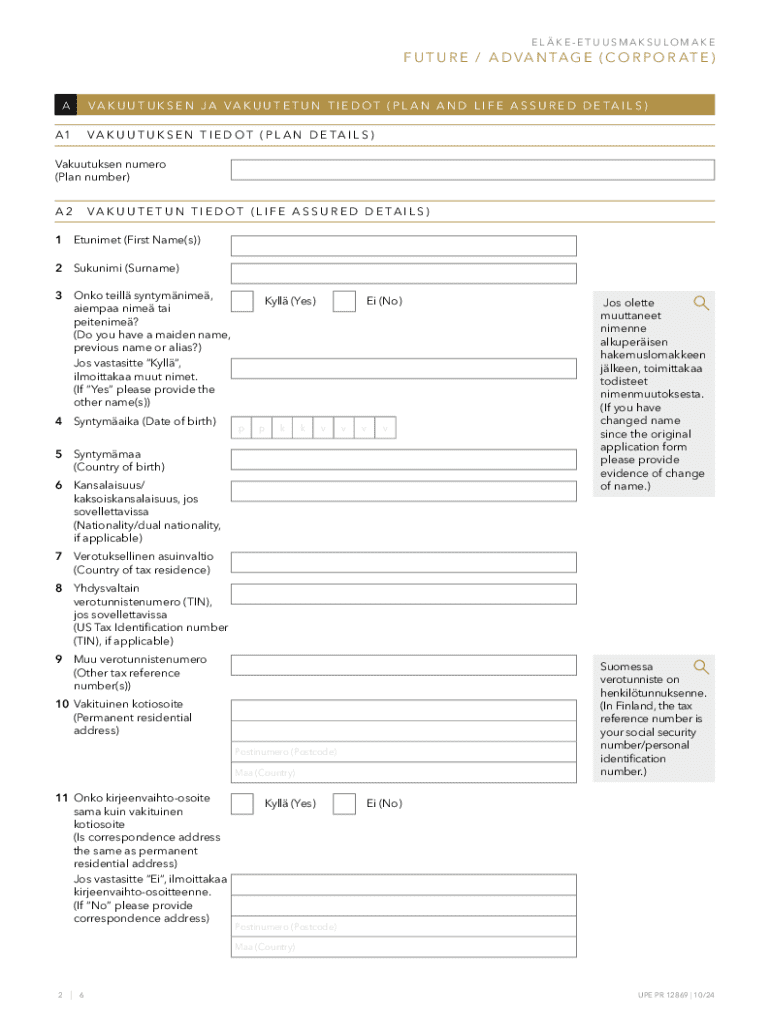

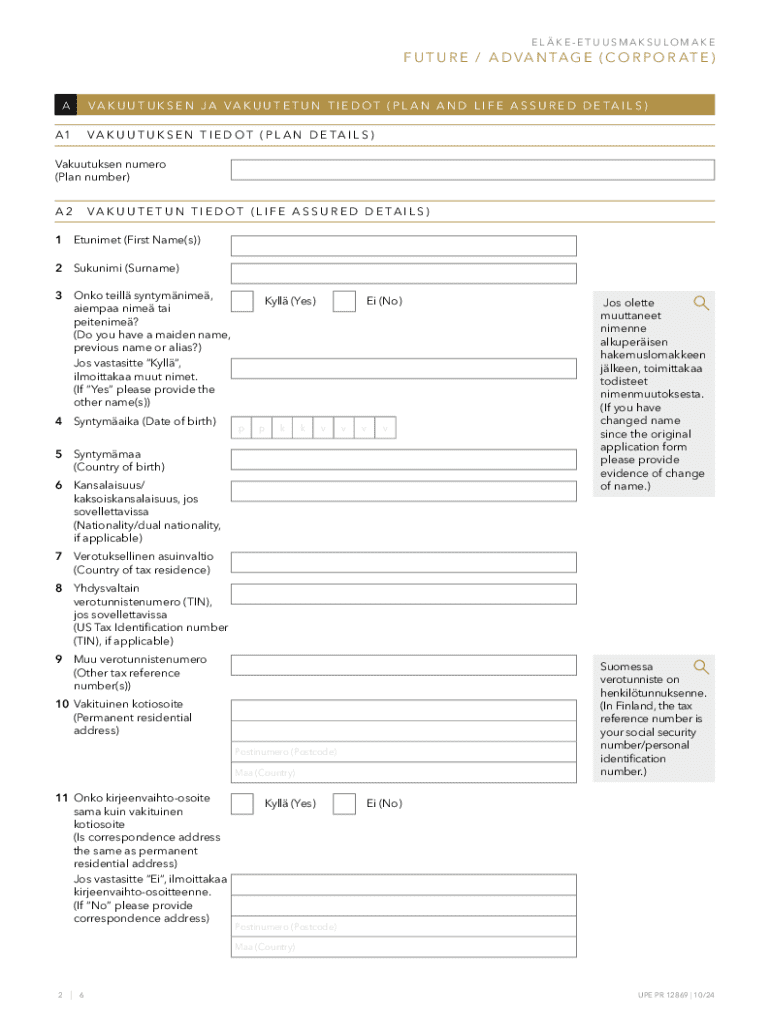

Get the free FUTURE/ADVANTAGE (CORPORATE)

Get, Create, Make and Sign futureadvantage corporate

Editing futureadvantage corporate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out futureadvantage corporate

How to fill out futureadvantage corporate

Who needs futureadvantage corporate?

Understanding the Future Advantage Corporate Form

Defining future advantage corporate form

A corporate form, fundamentally, is the structure that a business adopts to operate legally. This structure can greatly influence a company’s ability to manage its operations, attract investors, and mitigate risks. As businesses evolve, selecting the right corporate form is crucial for maximizing future success and adaptability. The concept of the 'future advantage corporate form' arises from the need for innovative business structures that allow flexibility and scalability, responding to rapid technological changes and market demands.

New forms of business, such as benefit corporations and flexible purpose corporations, are emerging to help organizations not only achieve financial success but also social and environmental impact. These innovations are gathering momentum as they address stakeholder expectations that extend beyond profit maximization.

Key characteristics of future advantage corporate forms

One defining feature of future advantage corporate forms is their flexibility in ownership structure. Unlike traditional structures like C corporations or S corporations, these modern forms accommodate diverse ownership models that include various stakeholders, such as employees and social investors. This diversity fosters a sense of community and shared purpose, driving commitment and innovation within the organization.

Another vital characteristic is enhanced scalability, enabling organizations to adapt quickly to changing market conditions. These corporate forms encourage agile decision-making processes, allowing teams to pivot and implement new strategies without the bureaucratic hurdles typical of older corporate structures. This responsiveness is essential in a business landscape where adaptability is a survival skill.

Ownership structure of future advantage corporate forms

Ownership structures can vary significantly among future advantage corporate forms, featuring a blend of shareholders and stakeholders. Shareholders typically hold equity and seek financial returns, while stakeholders may include employees and community members invested in the company's mission and social responsibilities. This multi-faceted ownership can create enhanced loyalty and motivation among individuals involved in the business.

The implications of diverse ownership structures are profound. For example, companies like Patagonia and Ben & Jerry's have successfully incorporated stakeholder interests into their business models, enabling them to align nonprofit objectives with profit margins. Their unique structures have paved the way for sustainable practices while still maintaining financial growth.

Liability implications in future advantage corporate forms

Understanding the liability implications of different corporate forms is vital for business owners. Corporations typically offer limited liability, ensuring that the personal assets of owners are protected from business debts. However, in certain structures, like partnerships, liability may be shared among owners, potentially exposing personal assets in case of business failures.

Establishing robust legal protection practices is crucial. Entrepreneurs can mitigate risks associated with various corporate forms by conducting thorough legal reviews of their structures, securing adequate insurance, and maintaining compliance with state and federal regulations. The right corporate form should provide not only an opportunity for growth but also sustainable protections against unforeseen liabilities.

Tax considerations for future advantage corporate forms

Tax obligations can greatly vary based on corporate structure. For instance, an S corporation may benefit from pass-through taxation, while a C corporation may be subject to double taxation. It’s essential for business owners to understand the tax landscape associated with their chosen corporate form to optimize their financial strategies.

Future advantage corporate forms often come with innovative tax benefits. These may arise from their ability to incorporate social goals, allowing for the possibility of special tax credits and deductions. Forward-thinking owners should plan for future tax implications when selecting a structure, as the right choice can contribute positively to the bottom line.

Steps to establishing a future advantage corporate form

Establishing a future advantage corporate form involves a multi-step process that centers around clarity and strategy. The initial step is to accurately assess your business needs and future goals. Considerations should include what you intend to achieve and how flexible you need your structure to be as the business evolves.

Next, conduct in-depth research on the various corporate forms available to determine which aligns with your vision. Consulting with legal and financial advisors is crucial; they can provide insights tailored to your specific situation. Once the suitable corporate structure is chosen, completing the necessary documentation is streamlined using tools like pdfFiller, allowing users to fill out, sign, and manage important files efficiently.

Leveraging pdfFiller for document management

When starting a future advantage corporate form, managing the relevant documentation efficiently saves time and ensures compliance. With pdfFiller, creating and editing corporate formation documents becomes a seamless process. Users can upload existing files or create new documents from scratch using customizable templates.

Additionally, the platform allows for digital signing, which speeds up the process of getting necessary approvals. Teams can collaborate in real-time, making contributions to drafts, leaving comments, and keeping all documents organized in a cloud-based space accessible from anywhere.

Interactive tools for future business planning

To assist individuals and teams in mapping out their corporate structures, pdfFiller provides interactive templates that can simplify planning. These tools are customizable, enabling users to generate financial forecasts, business plans, and project outlines catering to specific needs.

Real-time collaboration features enhance the document creation process, allowing stakeholders to review changes and contribute ideas simultaneously. This interaction leads to improved clarity and commitment toward shared goals, ultimately setting up the business for future success.

FAQs about future advantage corporate forms

Individuals and teams often have pressing questions when considering future advantage corporate forms. Common inquiries include: What corporate structure is most suitable for my business model? How do I ensure legal compliance? What are the potential tax implications of my choice? Lawyers and financial advisors can provide tailored responses, but tools like pdfFiller also offer resources and documentation to streamline the learning process and help users address their concerns effectively.

Real-world examples of successful future advantage corporate forms

Organizations like Warby Parker and TOMS Shoes exemplify the power of innovative corporate structures. Both companies not only prioritize profit but also strive to address social issues, such as access to vision care and providing shoes to those in need. By adopting models that integrate social missions, these businesses have thrived, setting a precedent for future entrepreneurs.

The lessons learned from such examples include the necessity of aligning business goals with stakeholder interests. New entrepreneurs venturing into future advantage corporate forms should prioritize not just the financial aspects but also the broader impact of their business decisions.

Navigating compliance and legal frameworks

Each corporate form comes with its own legal frameworks that must be navigated to maintain compliance. Entrepreneurs must understand the specifics of their chosen structure, including reporting requirements, state registration, and governance rules. Regular reviews of compliance standards are vital as businesses evolve and regulatory environments change.

Using pdfFiller can assist in ensuring that all legal documentation stays up-to-date and securely stored. Entrepreneurs can set reminders for renewal dates or legal updates, ensuring the business remains compliant while focusing on growth.

Future trends in corporate forms and their implications

As the business world evolves, corporate forms are expected to continue their transformation. One trend is the integration of technology into corporate structures, allowing for increased transparency and efficiency. For instance, blockchain and smart contracts could significantly reshape the landscape of ownership and legal compliance, ensuring that stakeholding is both secure and easily accessible.

Additionally, regulatory changes may emerge as governments adapt to new business models, making it imperative for entrepreneurs to stay well-informed. Preparing for future shifts by regularly consulting industry resources and tools like pdfFiller can provide businesses with a solid foundation and flexibility to embrace upcoming challenges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send futureadvantage corporate to be eSigned by others?

How do I make changes in futureadvantage corporate?

How do I edit futureadvantage corporate in Chrome?

What is futureadvantage corporate?

Who is required to file futureadvantage corporate?

How to fill out futureadvantage corporate?

What is the purpose of futureadvantage corporate?

What information must be reported on futureadvantage corporate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.