Get the free Property Value Appeals Board Authorization to Represent ...

Get, Create, Make and Sign property value appeals board

Editing property value appeals board online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property value appeals board

How to fill out property value appeals board

Who needs property value appeals board?

Property Value Appeals Board Form: A Comprehensive How-to Guide

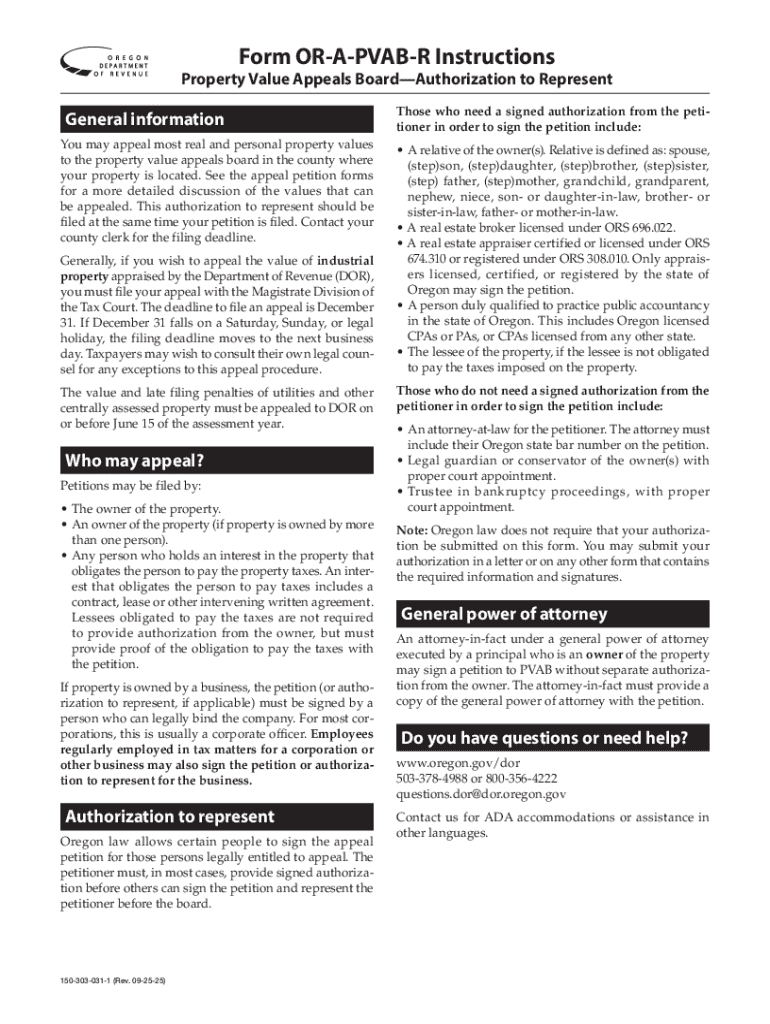

Understanding the Property Value Appeals Board

A Property Value Appeals Board is a local governing body tasked with addressing disputes concerning property valuations. Primarily, property owners may find themselves in disagreement with property tax assessments levied by local municipalities. The board serves an essential role in reviewing these cases, ensuring that property values are assessed fairly and equitably. By providing a structured process for appeals, the board facilitates a critical check against potential overvaluation that could unfairly burden homeowners.

The significance of the Property Value Appeals Board stems from its role in safeguarding the interests of property owners. As local economies fluctuate, fair property valuation is crucial for not only the individual accountable for taxes but also for the overarching health of the community.

Who can appeal?

Eligibility to appeal to the Property Value Appeals Board generally includes anyone who holds an interest in the property in question. This includes individual homeowners, business owners, or even lessees, provided they can demonstrate a vested interest in the property. Typically, the properties eligible for appeal range from residential homes to commercial buildings, indicating that all property types are considered under this appeal process.

Key dates for filing an appeal

Filing deadlines for property value appeals are critical. Typically, these dates are established annually by state or local taxation authorities. For instance, many Maryland counties require that appeals be submitted by a specific date that typically falls in the spring, following the receipt of the annual property assessment notice. Missing this deadline may result in the loss of the right to contest your property assessment for that tax year.

Consequences of missing appeal deadlines can be significant. You may be forced to accept the property’s assessed value, which could lead to higher taxation and financial burden. Timely submissions are essential; thus, understanding the local deadlines specific to your region is paramount for ensuring a successful appeal.

Preparing your appeal

Successful appeals hinge on adequate preparation and documentation. Start gathering necessary information, which includes tax assessment notices, property details, and any relevant financial records. A well-prepared appeal is not simply about submitting forms but rather substantiating claims with clear evidence.

When evaluating your property’s value in comparison to market standards, investigating comparable sales data provides significant insights. This involves identifying properties similar to yours that have sold recently in your area. You may also opt to commission an appraisal, although this could incur additional costs. Every piece of evidence you gather can serve to bolster your case.

Filling out the property value appeals board form

Completing the property value appeals board form requires attention to detail. The first step involves providing your personal information, including your name and contact details. Follow this by filling in the property identification details. Ensure that each section is completed accurately; any errors here can complicate your submission.

Next, articulate your grounds for appeal clearly. This section is crucial, as it outlines the rationale behind contesting the valuation. Provide a well-structured reason, supported by the data and documents collected. Utilizing platforms like pdfFiller can simplify this process by offering interactive tools that help you easily fill out forms, making necessary adjustments as required.

Submitting your appeal

Once you have filled out the form, the next step is to submit your appeal. There typically are multiple methods available for submitting your petition, including in-person delivery, postal mail, or electronic submission where permitted. Utilizing certified mail provides an added layer of reassurance, allowing you to confirm that your appeal has been received by the appropriate authority.

Additionally, some jurisdictions may require payment of fees when submitting an appeal. Review the local requirements thoroughly to avoid complications during submission. The pdfFiller platform makes this process straightforward by offering payment options integrated directly within the platform for your convenience.

The hearing process

If your appeal progresses to a hearing, understanding what to expect is essential. Generally, Board members will convene to listen to your case, review evidence presented, and ask questions about your position. Preparation is key to presenting your case effectively. Consider practicing your presentation or gathering supporting witnesses who can provide testimony on your behalf.

Common challenges arise during hearings, including unexpected questions from Board members or difficulties in articulating your case. Having a clear outline of your submitted documents and evidence can mitigate these issues. Familiarize yourself with frequently asked questions, and ensure your presentation is organized.

Petition guidelines

When filing an appeal, adhering to established guidelines can significantly affect the outcome. The do’s and don’ts of filing are pivotal in ensuring your petition is taken seriously. For instance, make sure to be respectful during hearings and only present truthful information, as any discrepancies can jeopardize your appeal.

After the hearing concludes, understanding the decision-making timeline is essential. The Board will deliberate before issuing a final decision, and this may take several weeks. Should you disagree with the outcome, there may be subsequent steps you can take, though often these include further appeals to higher authorities.

Utilizing pdfFiller for document management

Leveraging the cloud-based capabilities of pdfFiller can transform how you manage the property value appeals board form. One of the standout benefits of using pdfFiller is its ability to edit PDF documents effortlessly. This allows users to make adjustments quickly, enhancing accuracy and efficiency.

Moreover, the platform supports secure electronic signatures and collaboration among team members. This capability is particularly beneficial in ensuring that everyone involved in the appeal process can review and provide input efficiently, which aids in refining the appeal before submission.

FAQs about the property value appeals process

Navigating the property value appeals process can lead to many queries. For instance, you might wonder how to access the forms or what documentation is necessary for your appeal. Additionally, you may be curious about the appellate rights if the Board denies your claim. This type of information is essential for all involved, especially in understanding the nuances of the process.

For any specific questions not covered here, refer to resources available on your local taxation authority's website or contact support for personalized assistance. Utilizing such avenues can provide clarity and aid your appeal's progress smoothly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in property value appeals board without leaving Chrome?

How do I fill out the property value appeals board form on my smartphone?

How do I fill out property value appeals board on an Android device?

What is property value appeals board?

Who is required to file property value appeals board?

How to fill out property value appeals board?

What is the purpose of property value appeals board?

What information must be reported on property value appeals board?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.