Get the free Tax Transparency - Hardeman County, Texas

Get, Create, Make and Sign tax transparency - hardeman

Editing tax transparency - hardeman online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax transparency - hardeman

How to fill out tax transparency - hardeman

Who needs tax transparency - hardeman?

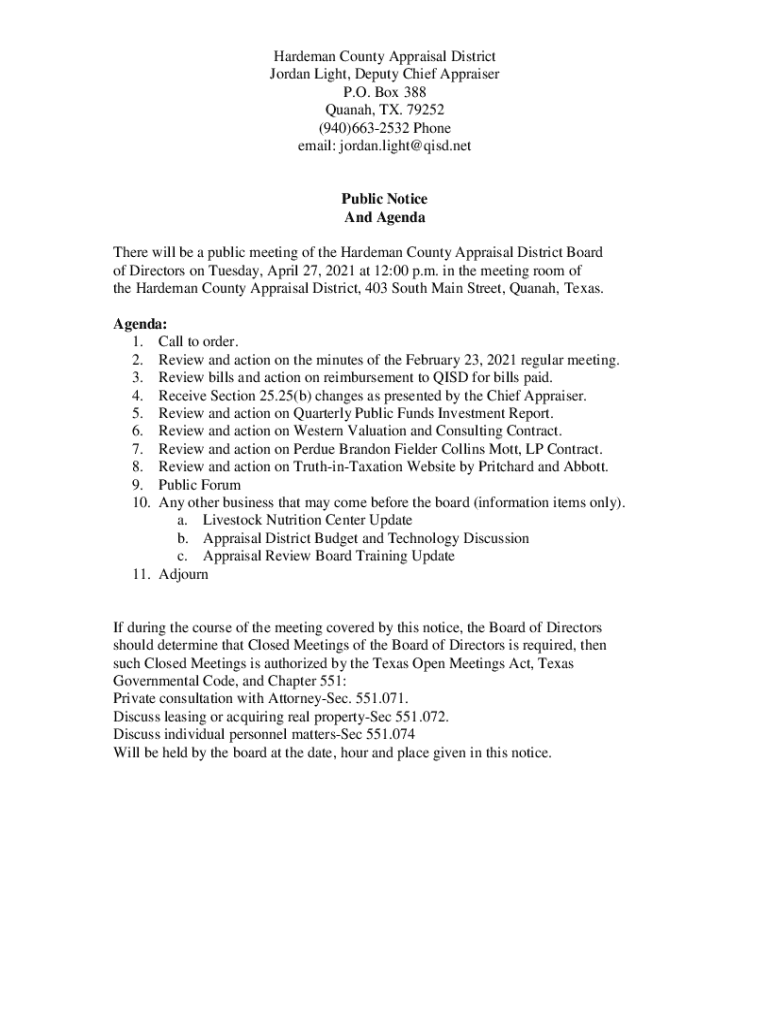

Tax Transparency - Hardeman Form: A Comprehensive Guide

Understanding tax transparency

Tax transparency refers to the clear disclosure of financial information regarding tax obligations and payments. This concept is becoming increasingly important as governments worldwide seek to reduce tax evasion and improve compliance. By promoting tax transparency, authorities enable individuals and businesses to understand their tax liabilities better, thereby encouraging ethical behavior and enhancing trust within the tax system.

For individuals and businesses alike, tax transparency can have a significant impact. A transparent tax system ensures that everyone pays their fair share, leveling the playing field and fostering an environment of accountability. It also aids in informed financial planning, as taxpayers can effectively strategize their income and deductions based on reliable information.

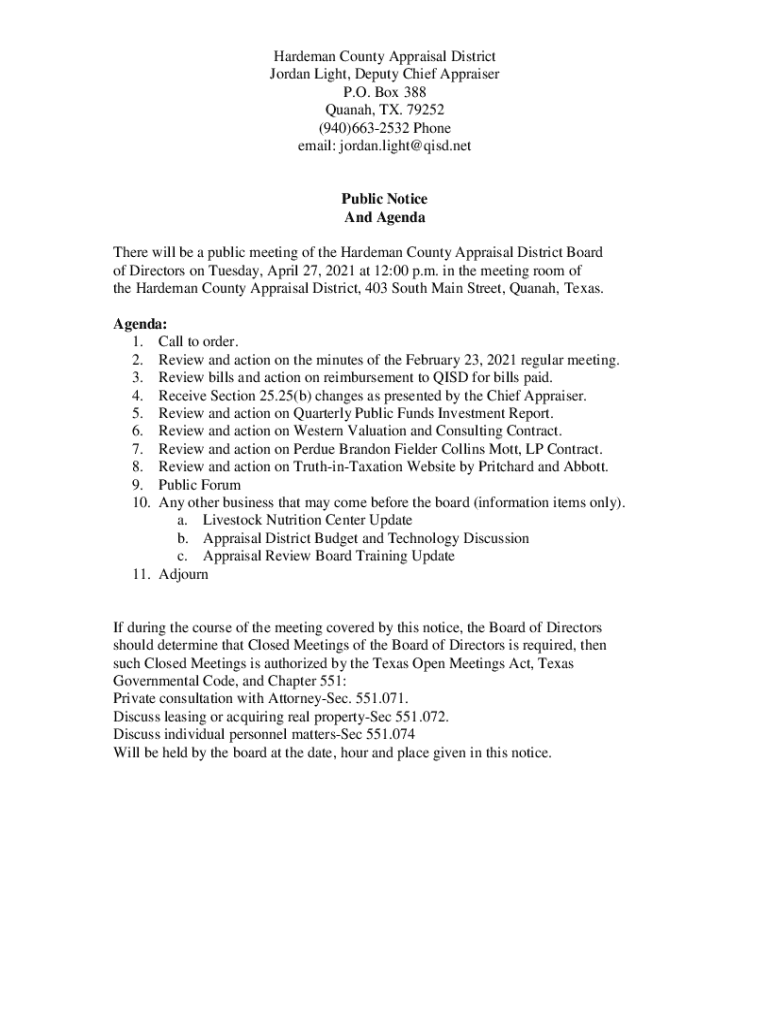

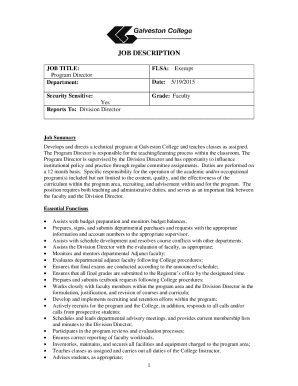

Overview of the Hardeman tax form

The Hardeman Tax Form serves as a critical tool designed to help property owners accurately report their taxes. Its primary purpose is to facilitate tax assessment processes by detailing property values and applicable tax rates. This ensures that not only is the assessment fair, but it also aligns with state and local tax regulations.

One of the key features of the Hardeman Form is its user-friendly layout, allowing property owners to easily navigate through the required sections. In comparison to other tax forms, the Hardeman Form is specifically tailored for property tax reporting, making it essential for those engaged in real estate. Its importance lies in its contributions to accurate property valuations, which directly affect the taxes owed.

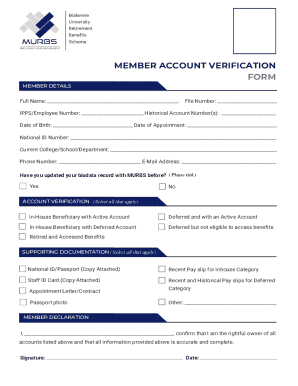

Accessing the Hardeman form

To access the Hardeman Form, taxpayers can conveniently find it online through various state and local government websites. These forms are typically located in the tax or property assessment sections of the respective websites. Moreover, an increasingly popular option is using pdfFiller, which provides a streamlined access point for filling, editing, and managing the Hardeman Form.

On pdfFiller, users can easily locate the Hardeman Form by typing 'Hardeman Form' into the search bar. This enables instant access to the required document, equipped with additional tools for editing and eSigning, making the process quick and efficient.

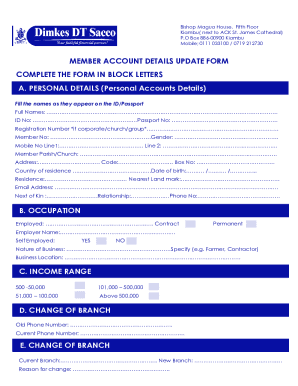

Completing the Hardeman form

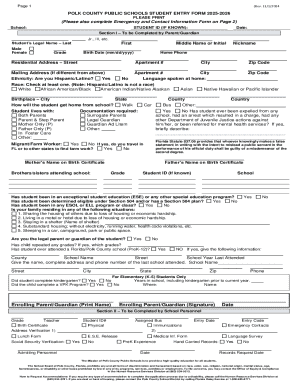

Filling out the Hardeman Form can be straightforward if approached systematically. Typically, the form includes sections requiring property identification, owner information, recent valuations, and applicable tax rates.

Common mistakes to avoid include failing to double-check property values or omitting relevant information, which can lead to an inaccurate assessment and potential penalties. To ensure compliance, always keep detailed records and consult with a tax professional if necessary.

Editing the Hardeman form

pdfFiller offers extensive editing capabilities for the Hardeman Form, allowing users to make necessary modifications without hassle. Whether adding new information or correcting existing entries, the platform provides intuitive tools that enhance the editing process.

Engaging with the editing tools on pdfFiller not only helps in maintaining accuracy but also allows for better communication with team members, especially in collaborative environments.

Signing the Hardeman form

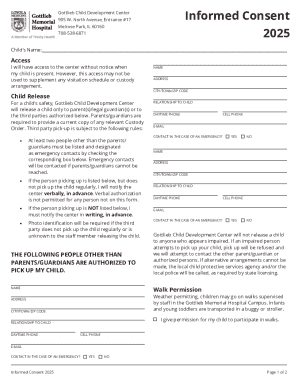

Once the Hardeman Form is complete, signing it is the next crucial step. pdfFiller supports electronic signatures, providing users with various options for adding these signatures securely and legally.

eSignatures on tax documents are legally recognized across most jurisdictions, allowing for a quick and convenient signing process. To add an eSignature using pdfFiller, users can follow these steps:

Collaborating with others

The ability to collaborate on the Hardeman Form is vital, especially when multiple parties are involved in property ownership or tax assessments. Using pdfFiller, users can share the form with team members, promoting transparency and accuracy in the completion process.

Real-time collaboration allows multiple users to view and edit the form simultaneously while tracking changes and comments, ensuring everyone is on the same page and mitigating errors.

Managing your tax documents

Proper management of tax documents is crucial for ensuring compliance and future referencing. pdfFiller simplifies document management by allowing users to organize and store completed forms efficiently.

Frequently asked questions (FAQs) about the Hardeman form

Many users have common queries regarding the Hardeman Form, which can lead to confusion if not addressed. Some frequently asked questions include:

For any troubleshooting needs, pdfFiller’s support resources can help guide users through specific issues related to the Hardeman Form.

Staying informed on tax compliance

Remaining informed about tax compliance is critical to avoid penalties and ensure adherence to regulatory changes. Timely filing of the Hardeman Form, as well as staying updated on local tax regulations, safeguards property owners against unwanted issues.

pdfFiller aids in this process by providing reminders, updates, and easy access to the latest forms, ensuring that users can swiftly adapt to any changes in tax laws.

User testimonials and success stories

The practicality of pdfFiller for managing the Hardeman Form is evident in user testimonials. Many have highlighted how the platform's features have empowered them to streamline their tax process, reducing the time spent on form completion.

Users frequently report significant reductions in errors and improved collaboration efficiency, which leads to timely submissions. The overall experience has been noted as a positive transformation in how individuals and teams manage their tax documentation.

Future developments in tax transparency

Looking ahead, tax transparency is evolving rapidly with changes in legislation and public expectations. Tax authorities are increasingly embracing technology to enhance transparency and compliance among taxpayers.

As these trends continue, pdfFiller remains at the forefront, working on innovations that simplify document management further, improving user experiences while maintaining necessary compliance with evolving regulations.

Contact support for assistance

If you encounter any difficulties with the Hardeman Form, pdfFiller’s support team is readily available for assistance. Users can reach out through the website, utilizing the live chat options or comprehensive FAQs.

In addition, external resources are available for further tax guidance, ensuring that users can find the help they need to navigate their tax responsibilities effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit tax transparency - hardeman on an iOS device?

How can I fill out tax transparency - hardeman on an iOS device?

How do I complete tax transparency - hardeman on an Android device?

What is tax transparency - hardeman?

Who is required to file tax transparency - hardeman?

How to fill out tax transparency - hardeman?

What is the purpose of tax transparency - hardeman?

What information must be reported on tax transparency - hardeman?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.