Get the free Should vendors pay booth fee if they don't attend due to ...

Get, Create, Make and Sign should vendors pay booth

How to edit should vendors pay booth online

Uncompromising security for your PDF editing and eSignature needs

How to fill out should vendors pay booth

How to fill out should vendors pay booth

Who needs should vendors pay booth?

Should vendors pay booth form?

Understanding the booth fee structure

Booth fees refer to the charges that vendors must pay to secure a space at various events like craft fairs, farmers markets, and music festivals. These fees can cover aspects such as venue costs, utilities, advertising, and administrative expenses. Understanding the specific booth fee structure is crucial for vendors to ensure they budget accurately and maximize their participation in events. Fees can significantly vary depending on the event's scale, location, and target audience.

Event organizers often adjust fees based on demand and the overall budget to host the event. For example, a well-known music festival in a metropolitan area may demand much higher fees than a local craft fair in a smaller town. However, paying booth fees can provide vendors with several benefits, including exposure to a larger audience, sales opportunities, and networking with other vendors and businesses in the industry.

When is the booth fee required?

Booth fees are typically required at various types of events, each having its unique fee structure. The most common events that require vendors to pay booth fees include:

In some cases, booth fees may be waived, particularly for non-profit organizations or through sponsorship agreements. Non-profit events often aim to promote community engagement and may not impose fees on vendors, while sponsorship agreements might provide benefits to vendors in exchange for marketing opportunities, thus reducing or eliminating their booth fees.

How to determine your booth fee

Determining your booth fee can be a detailed process. Start by researching the costs associated with specific events you are interested in. Each event will have its own unique fees based on various factors, including:

By taking these factors into account, vendors can make informed decisions that align with their business goals and budget constraints.

Vendors' responsibilities regarding booth fees

Understanding your role as a vendor goes beyond just selling products. Vendors need to be diligent about the financial aspects, specifically concerning booth fees. One of the primary responsibilities includes reviewing the application and payment process thoroughly before the event. Vendors should also be aware of the payment deadlines to ensure smooth participation.

Moreover, keeping receipts and records of booth payments is vital. This documentation is not only essential for personal accounting but also for any potential disputes with event organizers or for tax purposes. Failing to maintain accurate records can lead vendors to face challenges when substantiating their participation and expenses during tax season.

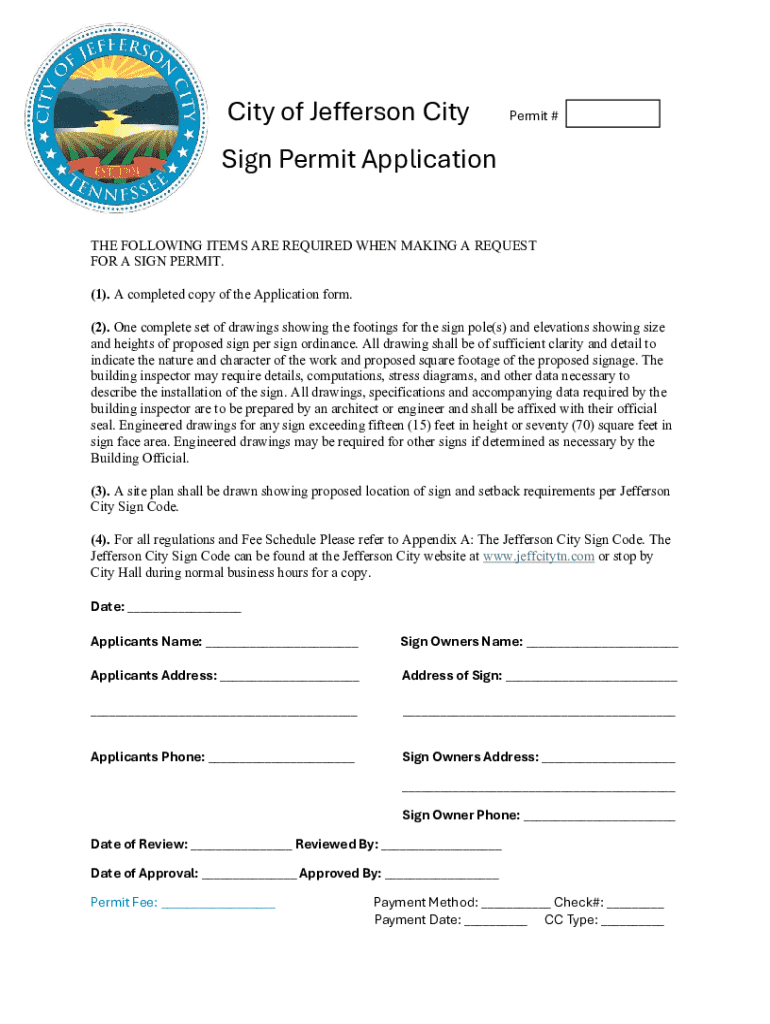

The process of paying booth fees

When it comes to paying booth fees, vendors have various options available for payment, including:

Regardless of which payment method is chosen, it’s important to follow a step-by-step process when filling out the payment form. Vendors should be ready to provide necessary information, such as their name, business name, contact information, and payment amount. Additionally, common mistakes to avoid include incorrect amounts, missing signatures, or failing to provide necessary additional documentation, which can delay registration.

Understanding tax implications of booth fees

Understanding how booth fees impact sales tax obligations is crucial for vendors. In most cases, booth fees themselves are not taxed. However, they may influence the overall business expenses that vendors report on their tax returns. It’s essential for vendors to track their income and expenses diligently, including booth fees, to maintain clear records for IRS reporting.

Vendors should also be aware that state-specific sales tax guidelines can vary. Some regions may have unique regulations regarding how vendors are taxed based on event type or location. Engaging with local tax authorities or consulting with law firms specializing in small business laws can further clarify any uncertainties. Keeping accurate documents will facilitate easier tracking and reporting for tax purposes, ultimately leading to a smoother filing experience.

Frequently asked questions (FAQs)

When vendors have questions or concerns about booth fees, several common queries arise, including:

Best practices for vendors managing booth fees

Effective management of booth fees is essential for any vendor aiming for success at events. One key tip is to create a budget that includes booth fees, setup costs, and other associated expenses to avoid overspending. Additionally, vendors should keep meticulous records of all fees associated with multiple events to ensure they remain on track financially.

Utilizing tools like pdfFiller can be invaluable for document management. Vendors can easily fill out, edit, sign, and manage forms related to booth fees, ensuring that all necessary paperwork is organized and accessible from anywhere. This not only streamlines the payment process but also allows for a clear view of all financial obligations when participating in various events.

Conclusion: Making informed decisions on booth fees

Deciding whether vendors should pay booth fees remains a significant consideration for any business looking to showcase their products. Emphasizing the importance of research and planning cannot be overstated, as it plays a crucial role in budget management and event selection. Informed decisions lead to more productive engagements at events, fostering growth and customer connections.

Leveraging efficient tools like pdfFiller will aid vendors in streamlining their document management processes, supporting their efforts in handling booth fees smoothly. Ultimately, understanding the nuances of vendor obligations around booth fees can enhance the event experience and contribute to overall business success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my should vendors pay booth in Gmail?

Can I create an electronic signature for signing my should vendors pay booth in Gmail?

How do I complete should vendors pay booth on an iOS device?

What is should vendors pay booth?

Who is required to file should vendors pay booth?

How to fill out should vendors pay booth?

What is the purpose of should vendors pay booth?

What information must be reported on should vendors pay booth?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.