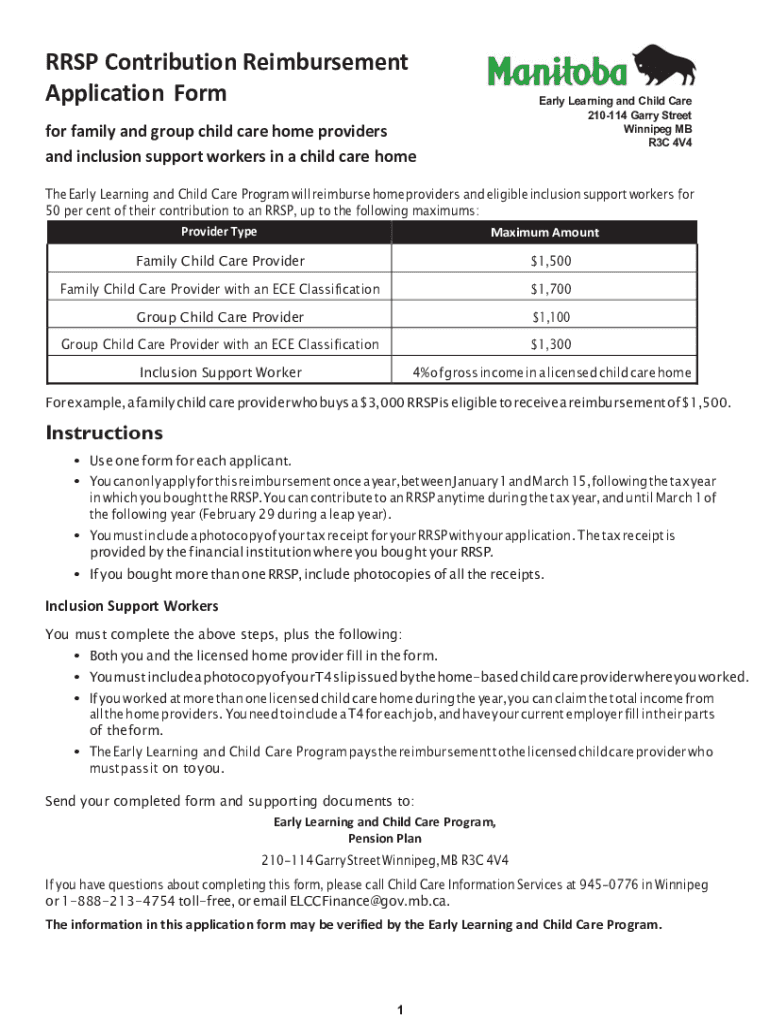

Get the free RRSP Contribution Reimbursement Application Form for family and ...

Get, Create, Make and Sign rrsp contribution reimbursement application

How to edit rrsp contribution reimbursement application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out rrsp contribution reimbursement application

How to fill out rrsp contribution reimbursement application

Who needs rrsp contribution reimbursement application?

Guide to the RRSP Contribution Reimbursement Application Form

Understanding RRSP contributions

A Registered Retirement Savings Plan (RRSP) plays a pivotal role in retirement planning for Canadians, providing tax advantages that help individuals save for the future. Contributions to an RRSP are essentially deposits made into this account, allowing the funds to grow tax-deferred until withdrawal during retirement. This growth typically leverages the power of compound interest, allowing for more substantial savings over time.

The importance of RRSP contributions cannot be overstated; they not only contribute to future financial security but can also result in immediate tax deductions for the contributor, effectively lowering their taxable income in the year they make the contribution. Furthermore, understanding which expenses are eligible for reimbursement under this structure is crucial. Eligible expenses may include professional fees, specific investment costs, or contributions made if your employer offers a matching RRSP program.

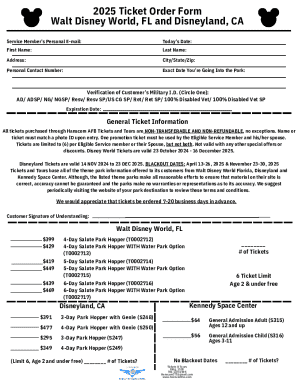

Overview of the RRSP contribution reimbursement application form

The RRSP Contribution Reimbursement Application Form is designed to streamline the process through which contributors request reimbursement for eligible RRSP contributions they've made. This form acts as a formal request to recover funds that may have initially been expended from the contributor’s own pocket under their employer's RRSP plan.

Typically, this form should be filed by anyone who has participated in an RRSP plan and is seeking reimbursement. Understanding the key sections of the application—the personal information, contribution details, and supporting documentation—is essential for a successful submission. Each part of the form plays a significant role in the consideration of your request.

Detailed breakdown of the RRSP contribution reimbursement application form

Personal information section

Completing the personal information section accurately is paramount for ensuring your application is processed without unnecessary delays. Required fields typically include your full name, mailing address, Social Insurance Number (SIN), and contact information. Providing accurate details helps avoid any administrative errors that could delay reimbursement.

Contribution details section

The contribution details section requires you to specify the amounts of your contributions. It's essential to include contributions from the current tax year and any carry-forward amounts if applicable. Additionally, verifying contribution amounts through supporting documents, such as bank statements or pay stubs, enhances the reliability of your application.

Supporting documentation

Certain documents must accompany your application form to substantiate your reimbursement request. Required documents often include proof of your contributions, such as RRSP receipts or bank statements reflecting contributions made. To compile these documents efficiently, organize them in chronological order and ensure they are legible and clear, as clarity can speed up the review process.

Signature and submission section

To finalize your application submission, your signature is needed. If completing the form electronically, eSigning options are often available and can be handled smoothly through platforms like pdfFiller. Be aware of submission methods, as applications can usually be submitted via email or traditional mail. Additionally, familiarize yourself with any deadlines—missed deadlines could lead to the rejection of your application.

Common mistakes in completing the application

Awareness of common pitfalls in completing the RRSP Contribution Reimbursement Application Form can greatly enhance your chances of approval. Some frequent mistakes include overlooking necessary signatures, which can render your application invalid. It's also crucial to ensure that all personal information is complete; missing data can lead to significant delays.

Moreover, incorrectly reporting contribution amounts is a prevalent error that can either reduce your reimbursement or lead to outright rejection. Always double-check calculations and ensure they align with your submitted supporting documents.

Frequently asked questions (FAQs)

One of the top questions is about the timeline for reimbursement; typically, the process can take anywhere from several weeks to a few months depending on the administration’s workload and the accuracy of your submission. If you receive a rejection, promptly reviewing the provided reasons will help you amend any errors.

Another common query is whether applications can be amended post-submission—generally, while you can submit a corrected application, you cannot modify the original application after it is sent. For assistance with your application, it's advisable to contact your HR department or the plan administrator directly, as they can provide pertinent guidance.

Additional tools and resources

Several interactive tools can assist in calculating RRSP contributions, which can help clarify tax implications and potential refunds. Resources such as online calculators enable you to input specifics about your income and contributions, generating useful estimates to guide your financial planning.

For document management, pdfFiller offers tools that simplify compiling your RRSP documentation. With its easy-to-use interface, you can edit documents, fill in forms, and save your files securely, all while ensuring that you can access them from anywhere when needed.

Managing your RRSP documents effectively

Effective management of RRSP-related documents ensures you are prepared for tax season and can quickly locate necessary paperwork when submitting for reimbursement. Organizing your documents chronologically or thematically, based on your contributions, can save time when you need to reference them.

Using cloud storage solutions helps maintain accessibility to your RRSP files. Platforms like pdfFiller enable you to store files securely online, ensuring you can access important documents from any device. Collaborating with financial advisors through shared document access can also enhance your RRSP strategy, allowing for real-time adjustments based on your financial goals.

Leveraging pdfFiller for your documentation needs

pdfFiller offers a comprehensive suite of features tailored to document management, making it a vital tool for handling your RRSP Contribution Reimbursement Application Form. Through this platform, you can edit your PDFs, eSign documents, and collaborate with team members seamlessly, all from a centralized, cloud-based location.

The ability to integrate pdfFiller with other tools like cloud storage services enhances workflow, allowing for streamlined operations that aid in meticulous documentation management. Utilizing a cloud-based document creation solution can substantially reduce the hassle associated with paperwork while increasing your efficiency in handling reimbursement applications.

Updates and changes to RRSP regulations

Being aware of recent changes in RRSP contribution limits is vital, as these caps tend to adjust annually. Increases in contribution limits can provide broader opportunities for tax-deferred saving, making understanding current regulations a key part of financial planning.

Changes in tax regulations that affect contributions and reimbursements may arise due to shifts in government policy. Staying updated on these issues ensures that you maximize your contributions effectively and are well-prepared for posing any reimbursement requests.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete rrsp contribution reimbursement application online?

How do I edit rrsp contribution reimbursement application in Chrome?

How do I complete rrsp contribution reimbursement application on an iOS device?

What is rrsp contribution reimbursement application?

Who is required to file rrsp contribution reimbursement application?

How to fill out rrsp contribution reimbursement application?

What is the purpose of rrsp contribution reimbursement application?

What information must be reported on rrsp contribution reimbursement application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.