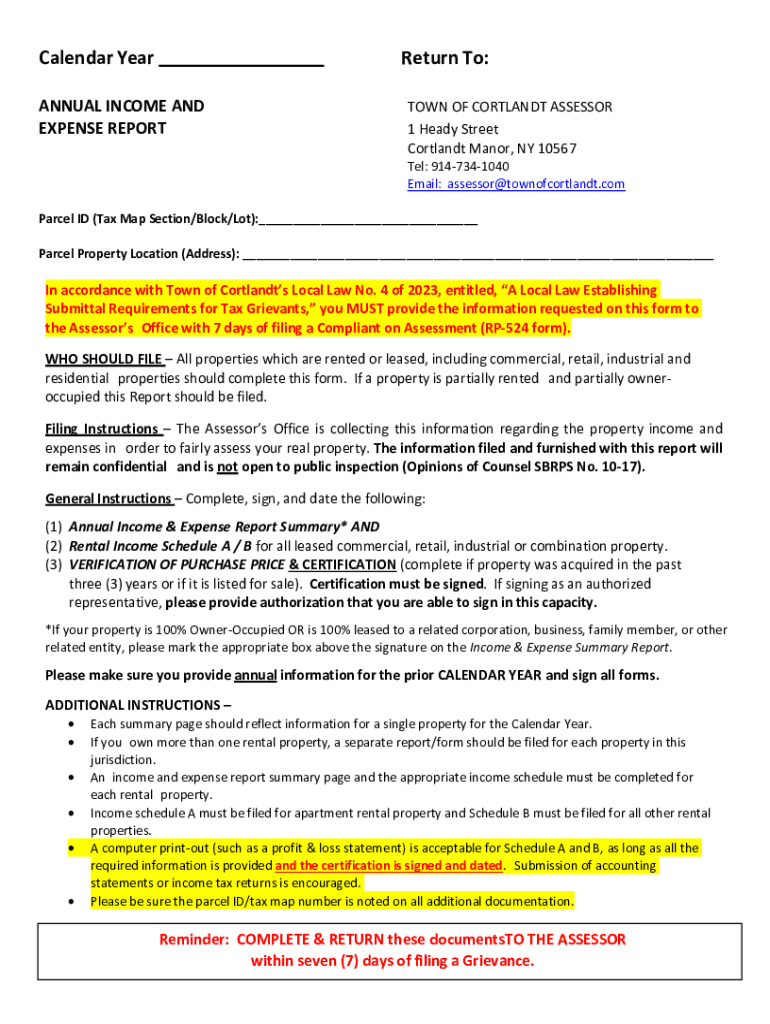

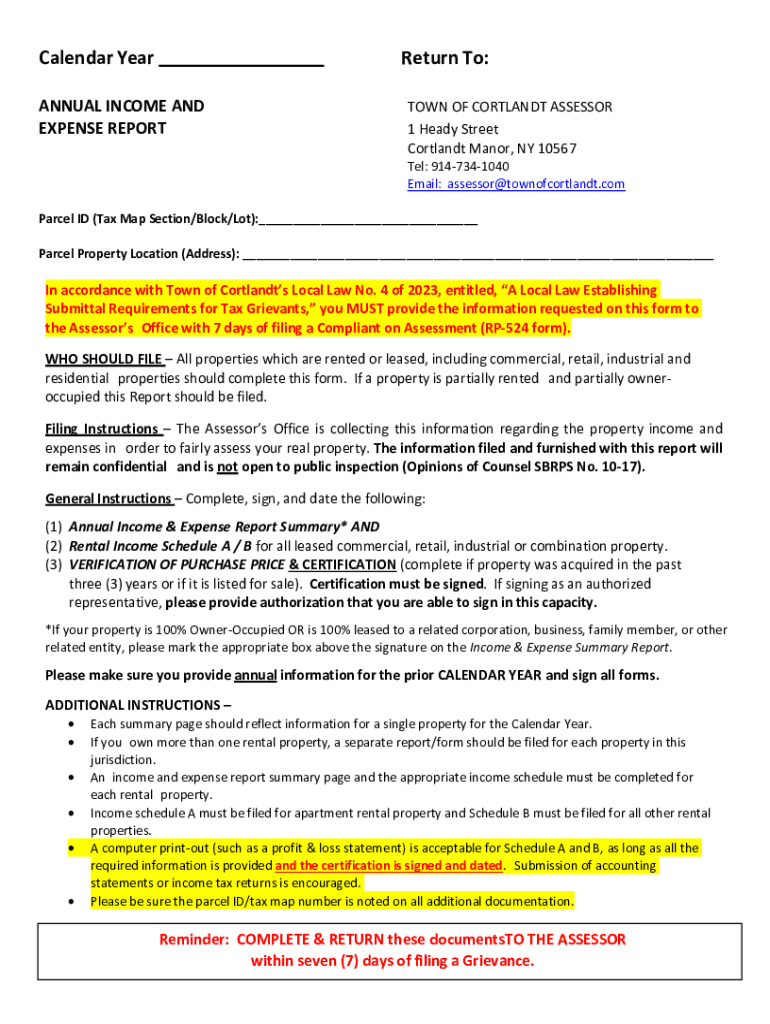

Get the free Calendar Year Return To: - ANNUAL INCOME AND

Get, Create, Make and Sign calendar year return to

How to edit calendar year return to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out calendar year return to

How to fill out calendar year return to

Who needs calendar year return to?

Your comprehensive guide to winning with a calendar year return to form

Understanding the calendar year return

A calendar year return is defined as the tax return filed for the period beginning January 1 and ending December 31 of the same year. This type of return is essential for individuals and entities as it aligns the tax calendar with the calendar year, making it easier to track financial data while maximizing deductions. For many, it simplifies record-keeping as all income and deductible expenses from January to December can be considered in one comprehensive review.

Individuals looking to file for a calendar year return generally include employees receiving W-2 forms, freelancers or consultants reporting 1099 income, and retirees managing pensions or social security income. It’s crucial to understand the implications of filing this type of return—it can influence tax rates based on your total annual income as well as eligibility for various credits and deductions.

Key components of the calendar year return

To successfully file a calendar year return, gathering the necessary documentation is paramount. Required documents typically include income statements such as W-2s for employees and 1099s for independent contractors, along with receipts for deductible expenses throughout the year. It's advisable to maintain an organized system for these documents to expedite the filing process.

In the U.S., the most common tax forms include IRS Form 1040, 1040A, and 1040EZ. Each serves different needs: Form 1040 is standard for most taxpayers, whereas 1040A is designed for those with simpler tax situations. Form 1040EZ is the quickest option for individuals with no dependents and limited income—ideal for first-time filers or younger taxpayers with straightforward finances.

Step-by-step guide to completing your calendar year return

Filing your calendar year return doesn’t need to be complicated. Here’s a step-by-step guide to navigate the process seamlessly:

Using pdfFiller for your calendar year return

pdfFiller offers a powerful cloud-based document creation solution that significantly simplifies the process of preparing your calendar year return. With its ease of access, you can edit forms from anywhere, making tax preparation even simpler, especially if you need to work collaboratively.

The platform also features interactive tools, such as templates specifically designed for calendar year forms. This can streamline the preparation process for individuals or families budgeting together, enhancing teamwork when managing financial documentation.

Frequently asked questions (FAQs)

Questions often arise during the process of filing calendar year returns. Here are some commonly asked queries along with their answers:

Advanced considerations

Choosing between a fiscal year and a calendar year return can have significant implications on your tax situation. While a calendar year aligns with the calendar, a fiscal year allows businesses to tailor their tax filing to their operational cycles, often benefiting seasonal businesses conversely.

Understanding state-specific filing requirements can complicate your return. Some states may have different deadlines or additional forms and documents, making it essential to conduct your research, ensuring compliance, and maximizing your overall tax efficiency.

Tips for future years

Organization throughout the year is crucial for a successful calendar year return. Following a few key practices can save time and stress:

Understanding your financial obligations after filing

After your calendar year return is accepted, it’s important to acknowledge the next steps regarding any refunds or taxes due. If you're set to receive a refund, tracking its status via the IRS website can provide peace of mind. Refunds usually direct deposit faster than paper checks.

In case you're facing a liability, remember that timely payments are essential to avoid penalties and interest. Establishing a payment plan with the IRS, should the amount be substantial, helps maintain compliance while easing your financial burden.

Interactive tools and features from pdfFiller

pdfFiller facilitates a seamless experience with its templates designed specifically for calendar year returns. Users can easily fill out any required forms, edit material as needed, and digitally sign documents—all in one place.

With eSignature features, collaborations on tax submissions become efficient, allowing you to involve trusted advisors or family members more freely in the tax preparation process. pdfFiller empowers users to manage this vital task with confidence and ease, setting the stage for fiscal success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify calendar year return to without leaving Google Drive?

How do I fill out the calendar year return to form on my smartphone?

How can I fill out calendar year return to on an iOS device?

What is calendar year return to?

Who is required to file calendar year return to?

How to fill out calendar year return to?

What is the purpose of calendar year return to?

What information must be reported on calendar year return to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.