Get the free Form ADV Part 2A. Disclosure Brochure Steward ...

Get, Create, Make and Sign form adv part 2a

Editing form adv part 2a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form adv part 2a

How to fill out form adv part 2a

Who needs form adv part 2a?

Form ADV Part 2A: Your Comprehensive How-To Guide

Understanding Form ADV Part 2A

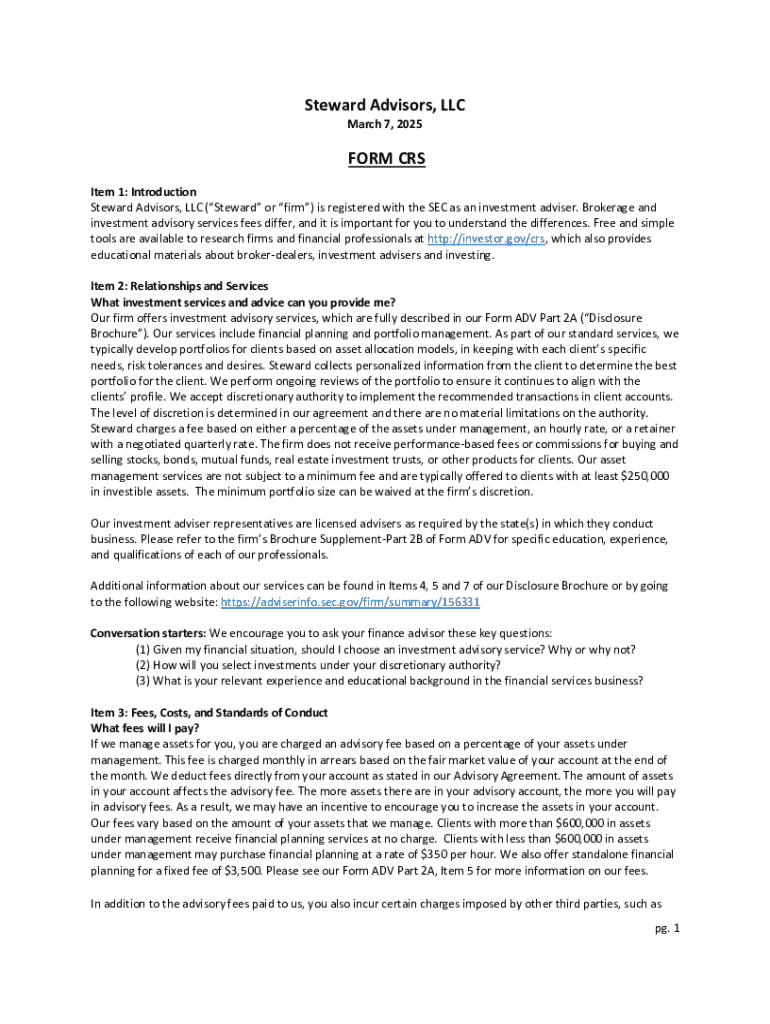

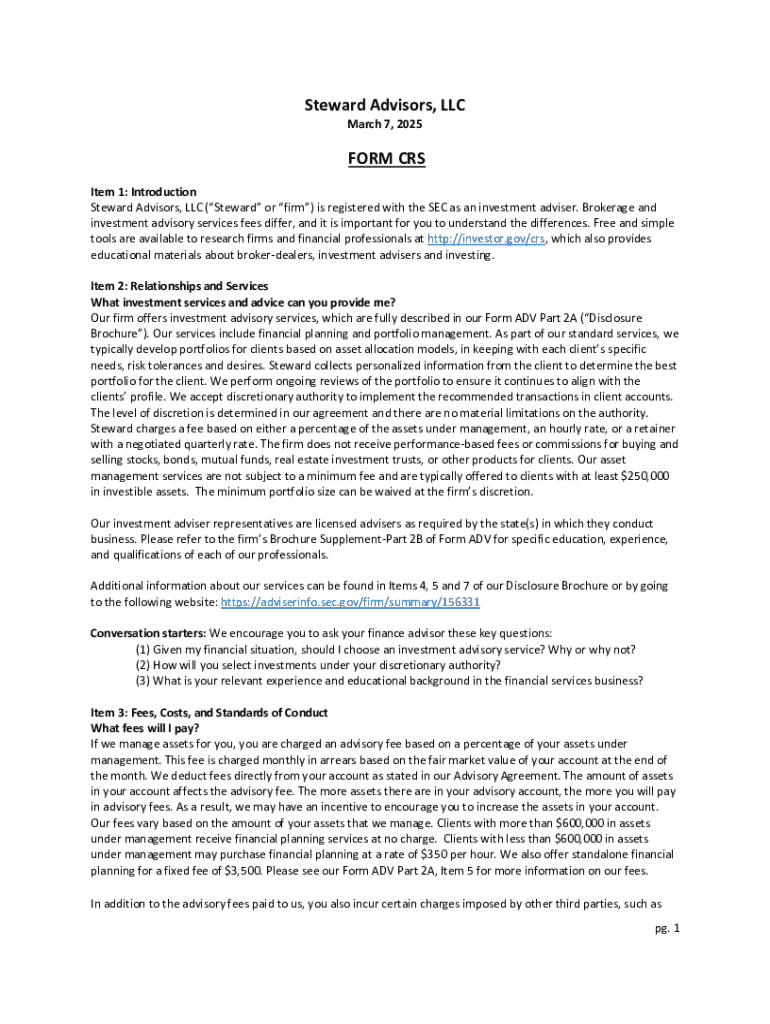

Form ADV Part 2A serves as the principal disclosure document for registered investment advisors, aimed at providing clients with clear and essential information regarding the advisor's services. Its pivotal role is to facilitate informed decision-making, thereby enhancing transparency in the advisor-client relationship.

This form not only details the nature of the advisory services offered, but it also encompasses fee structures, potential conflicts of interest, and disciplinary history. By understanding and utilizing Form ADV Part 2A, advisors ensure compliance while instilling trust and confidence in their client base.

Key requirements for compliance

Understanding which entities must file Form ADV Part 2A is essential. Essentially, any investment advisor registered with either the SEC or state authorities must complete this form. Each state may have its nuances; therefore, staying informed on both federal and state regulations is critical for compliance.

The regulatory framework governs the advisor's operations, and failure to comply can lead to sanctions or loss of license. It's crucial to highlight that new advisors must file Form ADV upon application for registration and subsequently update it annually or whenever significant changes occur.

Components of Form ADV Part 2A

Form ADV Part 2A is divided into several key sections that provide comprehensive details about the advisor's business. Each section has specific requirements and offers insight into different facets of the advisory practice.

Starting with the Cover Page, advisors include their name, contact information, and the effective date of the document. The Material Changes section is crucial for transparency, allowing advisors to highlight any updates since the last filing. A well-organized Table of Contents also aids clients in quickly finding relevant information.

How to fill out Form ADV Part 2A

Filling out Form ADV Part 2A can seem daunting, but a systematic approach makes the process manageable. Start by gathering all necessary documents, including previous versions of your ADV, client lists, and any relevant performance data.

Next, complete the Cover Page accurately—double-check each entry. Address the Material Changes section carefully; anything significant since your last filing should be reported. Clearly articulate advisory business activities in Items 4-7; transparency is vital.

Common pitfalls in completing Form ADV Part 2A

Navigating the complexities of Form ADV Part 2A is not without challenges. Many advisors fall into common pitfalls that can jeopardize compliance. One frequent error is the failure to disclose essential information which can lead to legal ramifications.

Another stumbling block is the use of vague or incomplete descriptions. This not only affects compliance but also diminishes client trust. Understanding regulatory requirements is crucial; advisors must not overlook details that differentiate their services in a competitive market.

Tips for maintaining compliance after filing

Post-filing compliance is as crucial as the filing process itself. Regular reviews of Form ADV Part 2A are essential to ensure it reflects current practices, fee structures, and advisory strategies. Set a calendar reminder for annual updates, and whenever there are material changes in your business.

Moreover, staying informed about changes in financial regulations will equip advisors to make the necessary amendments on time. Accessing resources, participating in webinars, and joining advisory committees can enhance compliance knowledge significantly.

Utilizing pdfFiller for Form ADV Part 2A

pdfFiller provides a user-friendly platform to create, edit, and manage Form ADV Part 2A effortlessly. Its cloud-based solutions offer editing and storage options, which are instrumental for financial advisors who need to update their documents frequently. The ability to eSign documents enhances the process, promoting quicker turnaround times.

Using pdfFiller is straightforward. Simply upload your form, use intuitive editing tools to make necessary changes, then utilize the eSigning feature to finalize. Facilitating smooth document sharing and management promotes efficient workflows.

Enhancing your document creation with pdfFiller tools

Beyond basic editing, pdfFiller equips users with advanced interactive tools that simplify the form creation process. Advisors can access a variety of templates tailored for Form ADV Part 2A, making it easier to create compliant documents from scratch.

Moreover, the collaborative features in pdfFiller allow teams to give feedback directly on the document. This functionality is particularly valuable when multiple advisors or compliance staff contribute to form completion, ensuring thoroughness and upholding compliance.

Additional considerations for investment advisors

Investment advisors operate within a rigorous regulatory framework that demands compliance and high standards of transparency. Using Form ADV Part 2A not only fulfills legal obligations but is also a tool for enhancing client relationships. Clear communication regarding investment risks and fee structures is vital for trust.

Moreover, effectively delivering the ADV Part 2A to clients ensures they are informed about their investments. Regular client meetings present an opportunity to discuss the key points within the ADV and address any questions, fostering an engaged and informed client base.

Accessing further resources and tools

Navigating the intricacies of Form ADV and related documents is essential for any advisor committed to compliance. Resources from regulatory bodies, such as the SEC, provide ongoing updates regarding requirements and best practices. Additionally, engaging with pdfFiller's expanding library of document templates can streamline the advisory process significantly.

Investors and advisors alike benefit from utilizing available resources to remain compliant and informed. Regular participation in training programs and professional groups will contribute positively to overall business practices and client confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form adv part 2a?

How do I edit form adv part 2a straight from my smartphone?

How do I fill out form adv part 2a on an Android device?

What is form adv part 2a?

Who is required to file form adv part 2a?

How to fill out form adv part 2a?

What is the purpose of form adv part 2a?

What information must be reported on form adv part 2a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.