Get the free Why Should I Complete A Professional Judgment?

Get, Create, Make and Sign why should i complete

Editing why should i complete online

Uncompromising security for your PDF editing and eSignature needs

How to fill out why should i complete

How to fill out why should i complete

Who needs why should i complete?

Why Should Complete a Form?

Understanding the purpose of completing forms

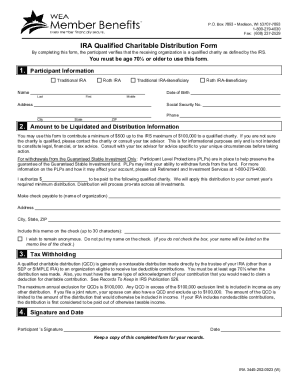

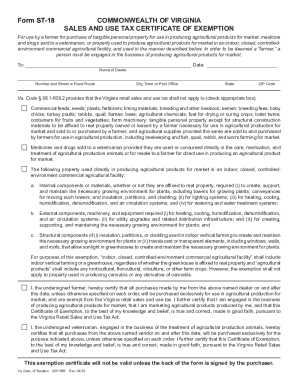

A form is a structured document that collects information in a systematic way. Forms can be numerous and varied, from job applications to tax forms, each serving unique functions. Completing forms accurately is essential across various sectors, including government, finance, healthcare, and employment. You might be filling out a W-2 for tax preparation, an application for a job, or health insurance paperwork — the purpose is often to gather relevant information to facilitate a process or decision-making.

The significance of completing forms cannot be overstated. Legally and administratively, they serve a critical role, ensuring compliance with regulations. When you fill out a form, you're not only providing necessary data but also creating a record that may be used for audits or evaluations, proving claims, and documenting your eligibility for services. Complete and accurate submissions ensure ease and efficiency in processing your requests.

Benefits of completing forms

Completing forms offers many benefits that enhance both personal and professional interactions. One of the primary advantages is the streamlined processes; by using forms, organizations can collect structured data efficiently, which mitigates errors. When everyone adheres to a set format, it allows for quicker reviews and submissions, saving time for both the individual filling out the form and the organization receiving it.

Additionally, many services require the completion of forms for eligibility. Job applications, government aid, medical services, and loans often necessitate well-completed forms. If you haven’t fully filled out your job application or tax return, you may find yourself missing out on opportunities or face unnecessary hurdles.

Completing forms also helps in organization; it provides a structured way to document important information regarding your personal and professional life. For example, keeping tax records organized is crucial for accurate filing, and digital forms can enhance accessibility to essential documents.

The risks of not completing forms

Neglecting to complete forms can lead to significant missed opportunities. Many individuals have faced hurdles in job applications or missed tax refunds simply because they didn’t fill out forms fully or correctly. Missing just one essential piece of information, like tax filing status or withholding details, can result in complications, audits, or even denial of application. Common consequences underscore the importance of diligence.

Moreover, not adhering to legal requirements by leaving forms incomplete can have actual legal implications. Failing to complete a necessary form, such as those pertaining to taxation or employment, may expose an individual or organization to fines, penalties, or even litigation. Compliance is not just best practice; it’s essential for avoiding issues down the line.

How to complete a form effectively

Filling out a form needs to be a systematic process to ensure accuracy and completeness. The first step is to read the instructions carefully. Each form comes with specific guidelines that highlight what information is required, and overlooking these can cause hiccups in the submission process.

Gathering necessary information beforehand is also crucial. For example, if you're applying for a job, having your employment history and references ready can streamline the process. Throughout the filling-out process, using tools for clarity, such as pdfFiller, can significantly enhance your work. Its features allow you to edit, sign, and manage documents efficiently, making form completion less daunting.

Common pitfalls include leaving fields blank or misreading questions. Always take the time to proofread before submission. A minor error could lead to major complications, such as those experienced when tax forms contain mistaken withholding amounts affecting your tax return.

Interactive tools for form completion

In today's digital age, leveraging technology for form completion is crucial. pdfFiller provides an array of interactive tools designed to streamline the form-filling process. Its features allow you to fill, edit, eSign, and collaborate on documents remotely, which is especially valuable for teams. These capabilities improve organizational efficiency and reduce the likelihood of errors.

Real-time collaboration on forms is another advantage of using digital tools. For instances like team projects or shared applications, pdfFiller allows multiple users to access and edit the same document simultaneously. This collaborative aspect helps keep everyone on the same page and ensures version control, preventing miscommunication and errors that could arise from outdated documents.

Managing completed forms

Once you’ve completed a form, managing it is the next step in ensuring your information is easily accessible and organized. Best practices for digital storage include categorizing documents in folders based on their purpose, such as job applications, taxes, or medical forms. This organization allows for easy retrieval without having to sift through numerous files.

Following up on submissions is just as crucial. After completing and submitting a form, know the next steps. This may involve tracking your application status, checking for any feedback, or ensuring that the documents were received correctly. Being proactive in managing your submissions can save you time and ensure nothing slips through the cracks.

Frequently asked questions about form completion

Completing forms can often lead to questions, and it’s essential to address these to enhance understanding. For instance, one common inquiry is whether all sections of a form must be completed. Generally, it is advisable to fill out all sections to avoid delays or rejections, but some forms may allow optional fields. Always check the form's guidelines for specifics.

Another frequent concern is how to handle mistakes on submitted forms. It's important to correct errors as soon as they are discovered. Contacting the issuing organization promptly can help clarify next steps. Lastly, deadlines for form submissions can vary substantially. Being aware of such timelines, especially for tax documents or job applications, ensures that you won’t miss critical opportunities.

The future of form completion

With the rapid evolution of technology, forms are increasingly becoming digital and more user-friendly. Trends indicate that paper forms may soon be a thing of the past, replaced by interactive digital solutions that facilitate ease of use. Predictions suggest that voice and AI-driven interfaces will drive form completion in the future, allowing users to fill out forms using simple voice commands or guided prompts.

pdfFiller is already at the forefront of these trends, providing tools that integrate advanced technology into form completion. As more people embrace digital solutions, services like pdfFiller continue to innovate, ensuring document management is as seamless as possible for individuals and teams alike.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send why should i complete to be eSigned by others?

How do I execute why should i complete online?

Can I create an eSignature for the why should i complete in Gmail?

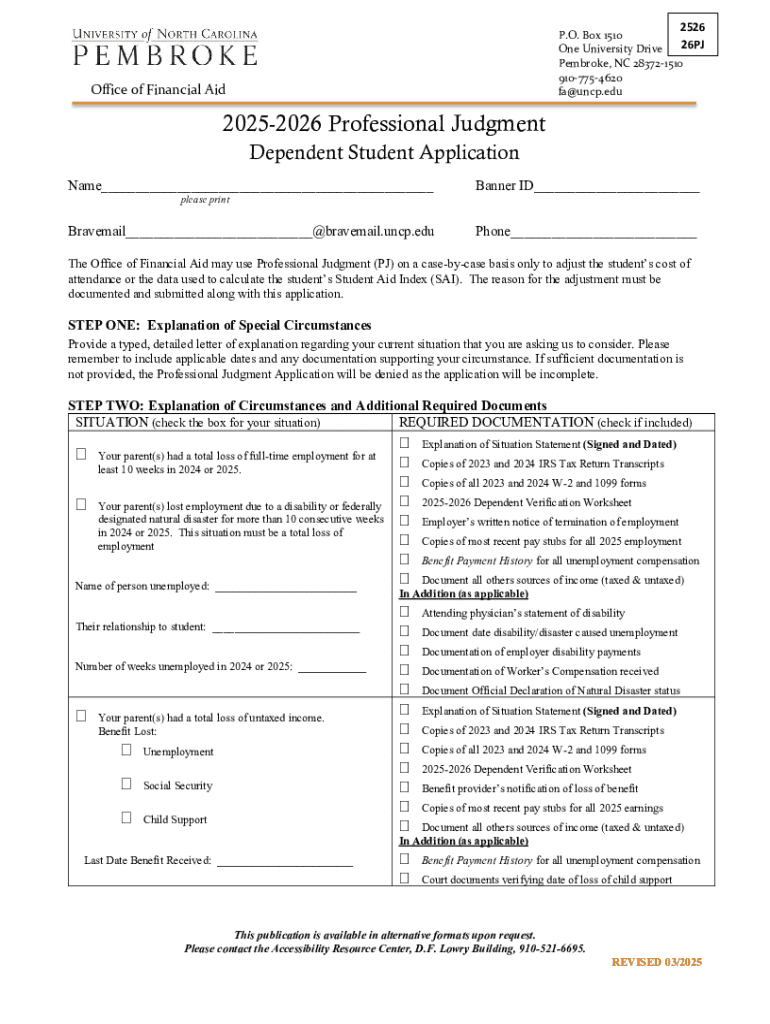

What is why should i complete?

Who is required to file why should i complete?

How to fill out why should i complete?

What is the purpose of why should i complete?

What information must be reported on why should i complete?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.