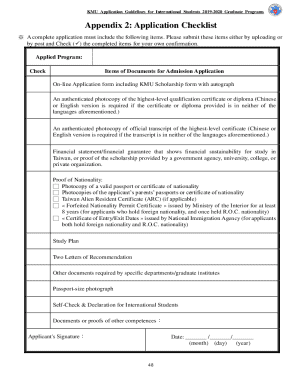

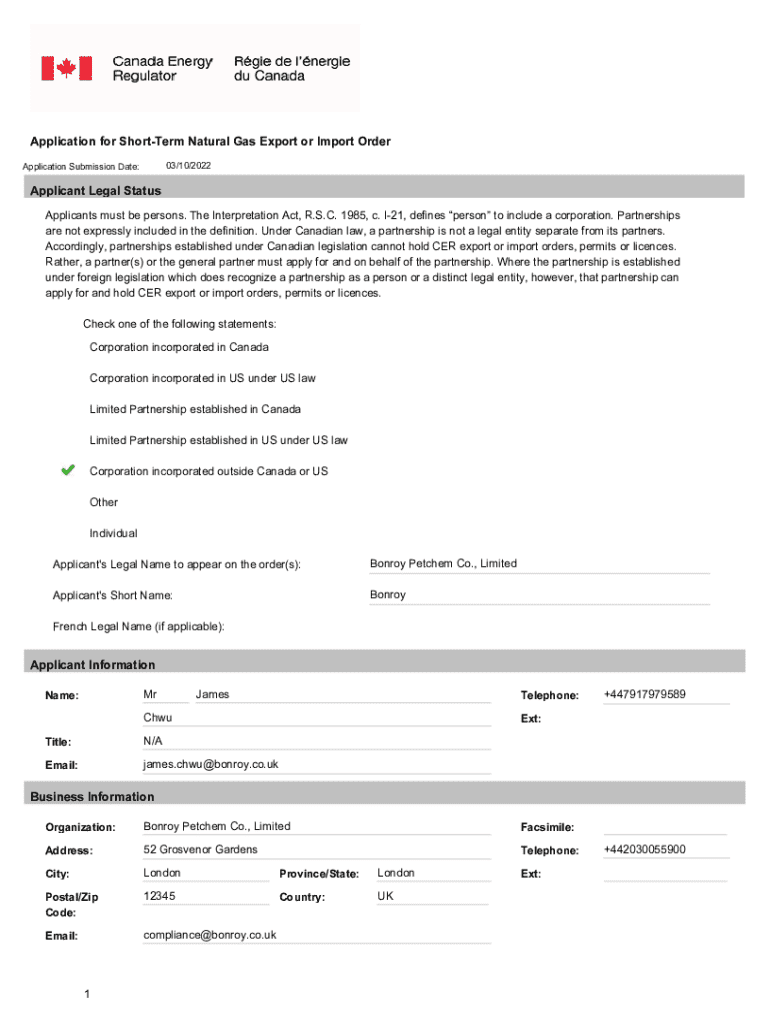

Get the free Accordingly, partnerships established under Canadian legislation cannot hold CER exp...

Get, Create, Make and Sign accordingly partnerships established under

Editing accordingly partnerships established under online

Uncompromising security for your PDF editing and eSignature needs

How to fill out accordingly partnerships established under

How to fill out accordingly partnerships established under

Who needs accordingly partnerships established under?

Partnerships Established Under Form: A Comprehensive Guide

Understanding partnerships: Definition and types

Partnerships manifest as a collaborative business form where two or more individuals share ownership and operational responsibilities. Each partner contributes to the business, whether through capital, labor, or expertise, correlating with their stakes. This business structure presents a blend of shared decision-making with profound implications for liability, profit, and governance.

Engaging in partnerships presents distinct advantages and disadvantages. One appealing aspect is the pooling of resources and skills, which can stimulate business growth. However, conflicts in decision-making and liability exposures require careful consideration.

The legal framework for establishing partnerships

Navigating the legal landscape is essential when forming a partnership. Compliance with specific legal requirements ensures both operational legitimacy and protection for partners. Each partnership is bound by a partnership agreement, outlining key terms of operation and delineating the scope of authority among partners.

Additionally, partnerships can either adopt formal business structures or maintain informal arrangements. While informal partnerships may operate without extensive documentation, having a written agreement is advisable to clarify responsibilities and expectations.

Key components of a partnership agreement

A robust partnership agreement is vital; it serves as the foundation for a successful partnership. Clarity in defining the roles and responsibilities of partners fosters accountability and aligns the team's efforts toward common objectives.

Incorporating these elements into the partnership agreement not only protects the interests of each partner but also streamlines operations, paving the way for a collaborative environment.

Establishing partnerships: Step-by-step guide

Laying the groundwork for a partnership demands thorough planning and open communication. Initiating initial discussions sets the stage for a shared vision between partners. Begin by identifying potential partners who complement your business goals, ensuring alignment in your objectives.

After drafting your partnership agreement, it’s crucial to formalize the partnership through proper registration and obtaining any required permits, localized to the jurisdiction where your business will operate.

Managing and sustaining partnerships

Effective management plays a pivotal role in sustaining partnerships. Establishing open communication channels is imperative; partners should feel free to express ideas and concerns. Regular review meetings not only nurture team dynamics but also encourage collaborative decision-making.

Employing technology enhances collaboration, making document sharing, editing, and signing streamlined and efficient, which is essential for partners operating from different locations.

Special considerations

Operating a partnership involves various special considerations, particularly regarding tax implications. Partnerships benefit from pass-through taxation, meaning profits and losses pass through to the partners' personal tax returns, effectively avoiding corporate taxation and simplifying the tax process.

Being aware of how personal relationships and business dynamics interplay can also significantly affect decision-making and overall partnership health.

Case studies and examples

Analyzing case studies of successful and challenging partnerships can reveal invaluable insights. Successful partnerships often thrive due to clearly defined roles, balanced contributions, and open communication. For example, a tech startup's partnership changed the game by leveraging complementary skills, while a struggling restaurant partnership faced downfall due to ambiguous decision-making roles.

Ultimately, the study of diverse partnership pathways offers a wealth of knowledge that can inform future decisions and strategies.

Interactive tools and resources for partnership formation

With advancements in technology, numerous interactive tools can streamline partnership formation. Utilizing platforms like pdfFiller provides seamless access to pre-designed templates, customizable forms, and document signing solutions. These tools simplify every step, from drafting agreements to collaborating on edits.

The cloud-based access that pdfFiller provides ensures that partners can manage their documents efficiently regardless of their physical location, fostering a productive partnership environment.

Future trends in partnership structures

The landscape of partnerships is evolving rapidly. The advent of technology integrates innovative solutions that streamline operations, communication, and management frameworks. Remote partnership models and digital collaborations are becoming increasingly viable, allowing businesses to tap into a global pool of talent and resources.

Recognizing these trends allows prospective partners to stay ahead of the curve and leverage technology to enhance operational efficiency and adaptability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify accordingly partnerships established under without leaving Google Drive?

How can I send accordingly partnerships established under to be eSigned by others?

How do I fill out the accordingly partnerships established under form on my smartphone?

What is accordingly partnerships established under?

Who is required to file accordingly partnerships established under?

How to fill out accordingly partnerships established under?

What is the purpose of accordingly partnerships established under?

What information must be reported on accordingly partnerships established under?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.