Get the free Filings for 49779 - PUC Interchange

Get, Create, Make and Sign filings for 49779

Editing filings for 49779 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out filings for 49779

How to fill out filings for 49779

Who needs filings for 49779?

Filings for 49779 Form: A Comprehensive Guide

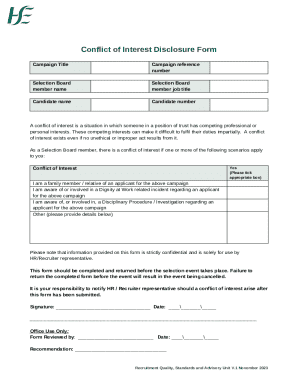

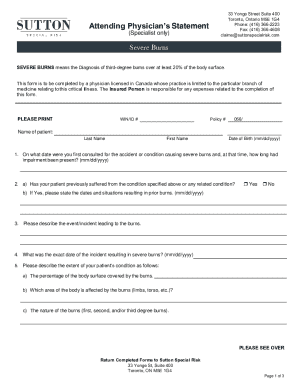

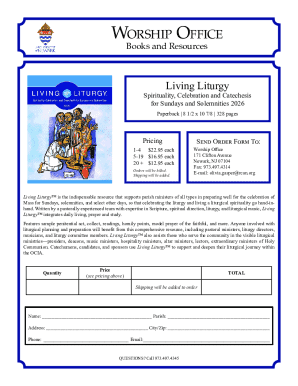

Understanding the 49779 form

The 49779 Form is a crucial document within the realm of securities regulation. Primarily used by entities involved in the financial marketplace, this form aids in disclosing specific financial and operational information to regulatory bodies. Its purpose extends beyond mere compliance; it's a tool for transparency, ensuring that all stakeholders are accurately informed of a company's activities, which is paramount in maintaining trust in the financial markets.

Filing this form is vital for maintaining proper records and ensuring regulatory adherence, ultimately contributing to market stability. As such, individuals and teams who engage in trading, investment, or any financial transactions related to securities must familiarize themselves with the ins and outs of the 49779 Form.

Who needs to use the 49779 form?

Eligibility to file the 49779 Form typically hinges on one's role within the financial ecosystem. This includes public and private companies, financial institutions, and investment managers who need to disclose significant holdings, transactions, and other pertinent information about securities.

Key features of the 49779 form

The 49779 Form comprises several critical sections, each designed to elicit specific information necessary for regulatory compliance. Understanding each component's significance is essential, as it directly influences how the form is interpreted by regulators.

The sections include disclosures on specific shareholdings, transaction types, and other data that highlight an entity's market activities. Accurate representation in these sections not only facilitates smoother processing but also minimizes the likelihood of inquiries or audits by regulatory bodies.

Common mistakes to avoid

One of the most prevalent mistakes in filing the 49779 Form is failing to disclose all relevant transactions. This omission can lead to significant compliance issues. Other common errors include miscalculations of share values, incorrect categorization of securities, and not adhering to the latest filing guidelines.

Step-by-step guide to filling out the 49779 form

Preparing to fill out the form

Before diving into the 49779 Form, adequate preparation is key. Gather all necessary data, including financial statements, past transaction records, and details about your holdings. Having this information readily available will streamline the filling process and help avoid mistakes.

Consider creating a checklist of documents you may need, as follows:

Detailed instructions for each section

Now, let’s delve into how to fill out the various sections of the 49779 Form:

Step 1: Basic Information

In this initial section, you’ll provide general information about the filing entity, such as the name, address, and type of security being reported. Accuracy is crucial here, as incorrect information could delay processing.

Step 2: Stock Transactions

This section requires a detailed account of all stock transactions. Here, entities must summarize the number and types of shares involved. Key considerations include noting high and low transaction prices and ensuring that volumes accurately reflect actual transactions.

Step 3: Reporting Thresholds

This part is critical in ensuring compliance with regulatory thresholds. Entities must report any holdings above defined limits—failing to do so can lead to substantial penalties. It's essential to stay updated on reporting thresholds that may change by the year.

Editing the 49779 form with pdfFiller

Utilizing pdfFiller for editing the 49779 Form enhances ease of use significantly. With its user-friendly interface and access to a suite of editing tools, users can quickly navigate and make changes as necessary. Additionally, the cloud-based platform allows users to work on documents from anywhere, ensuring flexibility.

To edit your 49779 Form effectively, you’ll follow several straightforward steps:

eSigning the 49779 form

The importance of digital signatures cannot be overstated. They facilitate smoother interactions with regulatory authorities, enabling faster processing of the 49779 Form. By adopting eSigning, users can ensure compliance while enhancing security, as eSigned documents often have built-in features to verify the signer's identity.

When using pdfFiller, the eSigning process is seamless. Following these steps ensures your document is securely signed:

Collaborating on the 49779 form

Collaboration on the 49779 Form is straightforward with pdfFiller's features, allowing teams to work on the form in real-time. This capability is invaluable in ensuring that multiple stakeholders, such as accountants and analytics teams, can provide input without delay.

Effective collaboration also means tracking edits and feedback efficiently. pdfFiller enables users to manage changes and comments, simplifying the review process.

Submitting the 49779 form

When it comes to submitting the 49779 Form, several methods are available, giving users flexibility depending on their preferences and needs. Depending on regulatory requirements and specific circumstances, users can choose among electronic submission, mail, or fax.

For those opting for electronic filings, ensure you familiarize yourself with the chosen submission portal's requirements, as these can vary significantly.

Troubleshooting common issues

Several common issues arise when filing the 49779 Form. Problems can range from missing information to technical difficulties during electronic submissions. Identifying these issues early can save significant time and frustration in the filing process.

For effective resolution, consider these strategies:

Finalizing your filing process

After submitting the 49779 Form, it’s crucial to verify that the filing was completed correctly. Having a checklist can help ensure that all steps were followed—failure to do this may lead to unexpected repercussions.

Additionally, maintaining a copy of your filled 49779 Form is essential for record-keeping purposes. Here’s how you can ensure proper documentation:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my filings for 49779 in Gmail?

Can I edit filings for 49779 on an iOS device?

How do I edit filings for 49779 on an Android device?

What is filings for 49779?

Who is required to file filings for 49779?

How to fill out filings for 49779?

What is the purpose of filings for 49779?

What information must be reported on filings for 49779?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.