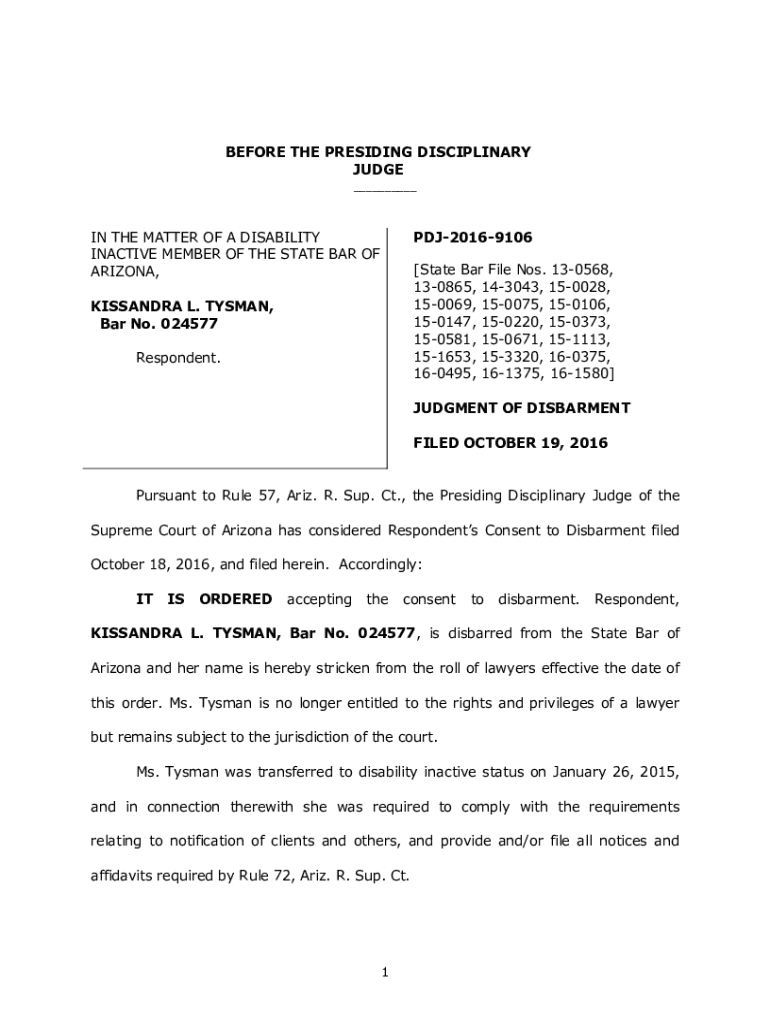

Get the free Rule 63. Transfer to Disability Inactive Status

Get, Create, Make and Sign rule 63 transfer to

Editing rule 63 transfer to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out rule 63 transfer to

How to fill out rule 63 transfer to

Who needs rule 63 transfer to?

Rule 63 transfer to form: A comprehensive guide

Understanding rule 63 in the context of document transfers

Rule 63 plays a crucial role in legal and administrative processes, serving as a framework for transferring certain rights or responsibilities from one entity to another. It is primarily focused on ensuring that those involved in the transfer have met specific legal criteria. When discussing Rule 63 transfers, it's vital to comprehend its implications for both individuals and organizations.

Common scenarios where Rule 63 may apply include the transfer of assets following the death of an individual, the reassignment of responsibilities in a business context, or the transition of medical-related benefits due to eligibility changes. Each of these situations requires meticulous attention to detail, as inaccuracies can lead to significant delays or complications.

The importance of accurate documentation and compliance cannot be overstated—failure to comply may result in rejected claims or legal disputes. Knowing the ins and outs of the Rule 63 transfer process is essential for a smooth experience.

Key components of the rule 63 transfer process

Eligibility for initiating a Rule 63 transfer varies depending on the nature of the transfer being requested. Typically, individuals directly impacted by the transfer—such as beneficiaries, business owners, or authorized representatives—can initiate the process. Understanding the qualifications and conditions necessary for a successful application is crucial.

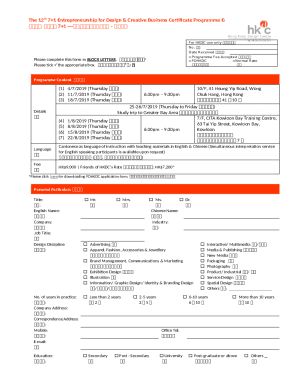

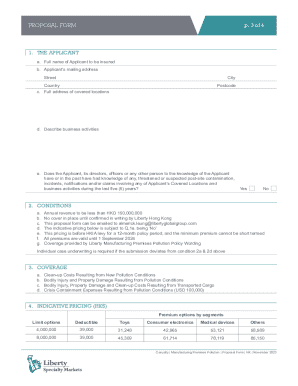

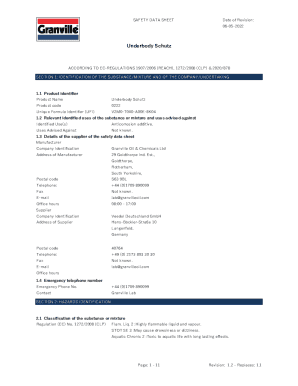

Documentation requirements for filing a Rule 63 transfer are stringent. Submitting appropriate documents is vital for the processing of your application. Commonly required documents might include:

Accurate and complete submissions not only expedite processing but also minimize the risk of errors that could jeopardize your application.

Step-by-step guide to completing the rule 63 transfer form

The process of completing a Rule 63 transfer form starts with gathering necessary information. Begin by collecting identification details, including personal information of both the current and new status holders. It's also essential to prepare additional documentation that might be required.

Once information is gathered, proceed to fill out the application form accurately. Each section of the transfer form must be completed with attention to detail. Common areas to focus on include:

After filling out the form, the next step is reviewing your submission. It’s crucial to double-check for accuracy and ensure all necessary attachments are included before proceeding to submit the form.

When it comes to submission, you'll have several options, including online submission through designated portals, mailing it to the appropriate offices, or delivering it in person. Be mindful of any associated fees and payment processing requirements applicable to your transfer process.

Understanding the review process

The review process following the submission of your Rule 63 transfer form can vary significantly based on the specific context and jurisdiction. Typically, the relevant authorities will review your application, ensuring that all requirements are met and that there are no discrepancies.

Timeline expectations for processing Rule 63 transfers depend heavily on the complexity of the case. On average, you can anticipate processing to take anywhere from a few weeks to several months. It’s beneficial to stay proactive; check back periodically to track the status of your application.

Common issues and solutions related to rule 63 transfers

Delays in processing Rule 63 transfers can be frustrating. Common reasons for these delays may include incomplete documentation, high application volumes, or the need for additional information from the submitter. If you find that your application has not progressed in a timely manner, reaching out to the relevant authorities can often help clarify the situation.

In cases of rejections or denials, it’s essential to understand the common causes, which might include inaccuracies in the information provided or failure to meet eligibility criteria. If your application is denied, follow the specific instructions provided in the denial notice to understand how to appeal or amend your application.

If you need to modify the application post-submission, familiarize yourself with the process for amending your transfer request. Depending on the authority, there may be specific forms or protocols to follow to ensure your requested changes are recognized.

Resources for further assistance

Navigating the complexities of Rule 63 transfers can be daunting, but several resources can provide clarity. Contacting the relevant authorities directly helps resolve specific inquiries you may have concerning your transfer application. They can provide personalized assistance based on your situation.

Additionally, several online tools can aid in tracking application statuses. Platforms like pdfFiller feature interactive resources that assist users in managing their document submissions, making it easier to keep track of your transfer processes.

Leveraging pdfFiller for rule 63 transfers

pdfFiller is an innovative platform that simplifies the Rule 63 transfer process. Its features enhance the user experience significantly. For instance, the e-signature capabilities allow for quick approvals, eliminating the hassle of printing and scanning documents.

Moreover, pdfFiller's document editing tools ensure precision when filling out the Rule 63 transfer form. Users can make changes easily and accurately, minimizing the risk of errors. Collaboration features also come in handy, especially for teams managing multiple applications.

Numerous case studies highlight how users have benefited from employing pdfFiller to manage their Rule 63 transfers efficiently. Many have reported time savings and reduced stress when using this comprehensive document management solution.

Frequently asked questions about rule 63 transfers

Several common queries arise concerning Rule 63 transfers. For instance, individuals may wonder about the required documentation or the expected timelines for processing. Addressing these inquiries requires in-depth knowledge of local regulations and the specifics of the case.

For smooth transitions, effective communication with administrative bodies plays a vital role. Keeping lines of communication open and ensuring all requested documentation is submitted promptly can significantly enhance outcomes. Familiarizing yourself with the protocol for these forms can lead to a more streamlined experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send rule 63 transfer to for eSignature?

How do I make edits in rule 63 transfer to without leaving Chrome?

Can I create an electronic signature for the rule 63 transfer to in Chrome?

What is rule 63 transfer to?

Who is required to file rule 63 transfer to?

How to fill out rule 63 transfer to?

What is the purpose of rule 63 transfer to?

What information must be reported on rule 63 transfer to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.