Get the free Credit Report- Structured - New York State Attorney General

Get, Create, Make and Sign credit report- structured

How to edit credit report- structured online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit report- structured

How to fill out credit report- structured

Who needs credit report- structured?

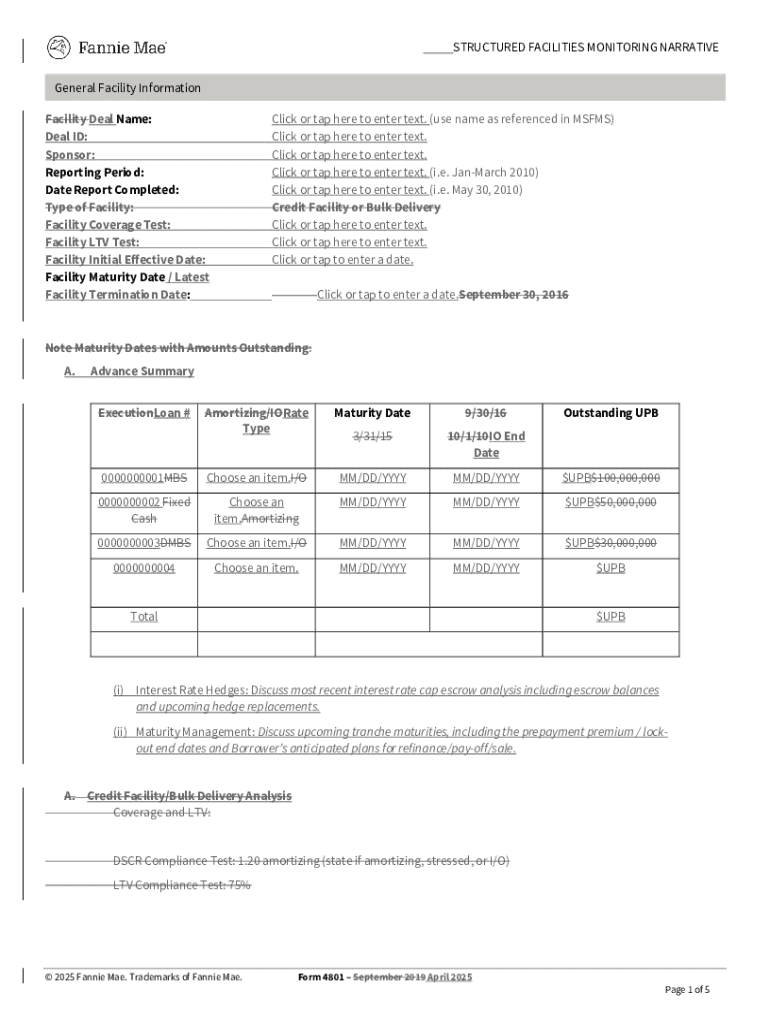

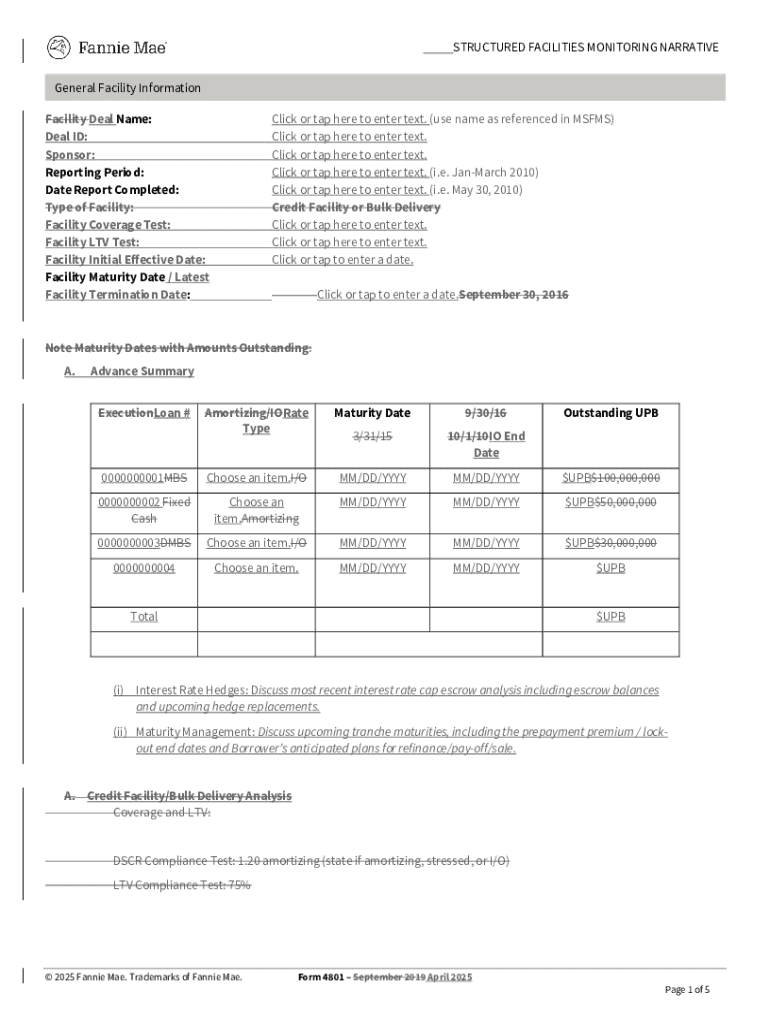

Understanding Credit Reports: A Detailed Guide to Your Structured Form

Understanding credit reports

A credit report is a detailed document that outlines an individual's credit history, including information on loans, credit cards, payment history, and outstanding debts. It serves the purpose of providing lenders and other financial entities with a comprehensive overview of a consumer's creditworthiness. The major components of a credit report include various credit accounts, a history of payments made on those accounts, and records of any inquiries into a person's credit.

Credit reports play a crucial role in an individual's financial health. They are primary determinants in the approval processes for loans and mortgages, influencing the interest rates that lenders may offer. A good credit report can lead to lower interest rates, while a poor one can result in rejections or higher rates. Moreover, credit reports are essential for identity verification in various situations, including employment screening, renting property, and even securing insurance.

The structure of a credit report

A credit report is structured into several main sections, each providing critical information. The first section typically includes personal information such as name, address, and Social Security number. Next is the credit accounts section, which lists all current and past credit accounts, their balances, payment history, and whether any accounts are past due. Public records come next, detailing any bankruptcies, liens, or judgments. The final section contains inquiries, indicating when lenders have checked your credit.

To effectively read your credit report, it’s vital to understand the significance of the credit score associated with it. Scores generally range from 300 to 850, indicating your credit risk level. Higher scores correlate with lower risk, while lower scores suggest higher risk. Identifying accounts and their statuses helps you understand your financial standing better. Knowing what constitutes positive or negative information enables individuals to take steps toward improving their credit history.

How to obtain your credit report

Under the Fair Credit Reporting Act (FCRA), consumers have the legal right to access their credit report annually from each of the three major credit reporting agencies: Equifax, Experian, and TransUnion. Knowing that you can obtain these reports for free once per year is essential for maintaining your credit health. Requesting your credit report can be done easily, either online or via mail.

To request your report online, visit the official website AnnualCreditReport.com, where you can securely access your reports. Alternatively, if you prefer to request it through the mail, download a request form from this website, fill it out with required personal details, and send it to the credit bureaus. Tools like pdfFiller can simplify this process by allowing you to fill out forms online, making it easier to obtain the necessary documentation.

Reviewing your credit report

Once you have your credit report, a thorough review is vital. Start by checking for accuracy—make sure that all personal information is correct, account details match your records, and there are no unusual accounts listed. It's also wise to cross-reference your report against bank statements to determine if all reported transactions are legitimate and reflect your current financial situation.

Common errors in credit reports include misreported late payments, incorrect account balances, and even accounts that do not belong to you. Statistics reveal that a significant percentage of credit reports contain errors, which can impact your credit score. Being diligent in reviewing your report can save you from potential financial troubles and disputes later on.

Correcting errors on your credit report

Disputing errors on your credit report is a process that requires attention to detail. If you find inaccuracies, you can initiate a dispute with the reporting agency. First, gather all necessary documentation, including copies of your original documentation and a detailed explanation of the error. Then, submit a dispute letter to the credit bureau in question. This is where tools such as pdfFiller can be particularly useful, as they offer templates and features for writing and submitting dispute letters quickly and effectively.

When creating a dispute letter, it’s crucial to include the specific inaccuracies, any supporting evidence, and a request for correction. Different bureaus may have their own processes, but generally, you can expect a response within 30 days. Including necessary attachments can strengthen your case and expedite the review process.

Understanding credit report impacts

The implications of having a good versus a bad credit report can be profound. Positive credit reports facilitate loan applications, often resulting in better interest rates and terms from lenders. Conversely, a negative credit report can limit your access to financial products, lead to higher premium costs for insurance, and even hinder job opportunities in industries that require credit checks. Understanding these impacts can motivate individuals to prioritize their credit health.

Rebuilding your credit report after setbacks is possible, but it typically takes time. Strategies for improvement include paying bills on time, reducing debt, and avoiding opening multiple new accounts in a short period. Gradual improvements in your credit report can be observed if these strategies are consistently applied over several months.

Interactive tools for managing your credit

pdfFiller offers various features that empower users to manage their credit-related documents effectively. Users can edit, sign, and share their credit reports through an intuitive online platform, allowing for seamless document handling. Utilizing interactive tools effectively can also enhance your understanding of your credit report, making it easier to identify areas that need attention.

Integration with other financial tools is another advantage. For instance, linking your credit report with budgeting apps can give you a holistic view of your financial situation, ensuring your credit management strategies align with your overall financial goals. This synergy of tools can lead to more informed financial decisions.

Best practices for monitoring your credit

Regularly scheduling credit report checks is essential for maintaining financial health. Experts recommend checking your credit report at least once a year, ensuring that you are aware of any sudden changes. Look for discrepancies, unusual activity, or new accounts that you do not recognize. Prompt action upon discovering issues is essential.

Setting alerts for changes in your credit report can be an effective preventative measure. Many credit monitoring services provide alerts for significant changes, such as new inquiries or changes in account status. This proactive approach can protect you from identity theft and keep your credit score stable.

Advanced tips for navigating credit reports

Understanding credit scoring models is crucial for comprehending how your credit report affects your overall credit standing. The two primary models are FICO and VantageScore, each employing different criteria and weightings. Knowing the distinctions can help you target areas for improvement effectively.

Utilizing credit monitoring services can also provide insights into your credit report. While there are pros and cons to third-party services, the right choice can help you stay informed about changes and trends in your credit history. Furthermore, financial institutions and businesses must adhere to FCRA regulations when reporting consumer credit data, reinforcing the importance of accurate reporting and protecting consumer rights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get credit report- structured?

Can I create an electronic signature for signing my credit report- structured in Gmail?

How can I fill out credit report- structured on an iOS device?

What is credit report?

Who is required to file credit report?

How to fill out credit report?

What is the purpose of credit report?

What information must be reported on credit report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.