Get the free Form 110 - NET

Get, Create, Make and Sign form 110 - net

Editing form 110 - net online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 110 - net

How to fill out form 110 - net

Who needs form 110 - net?

Form 110 - Net Form: A Comprehensive How-to Guide

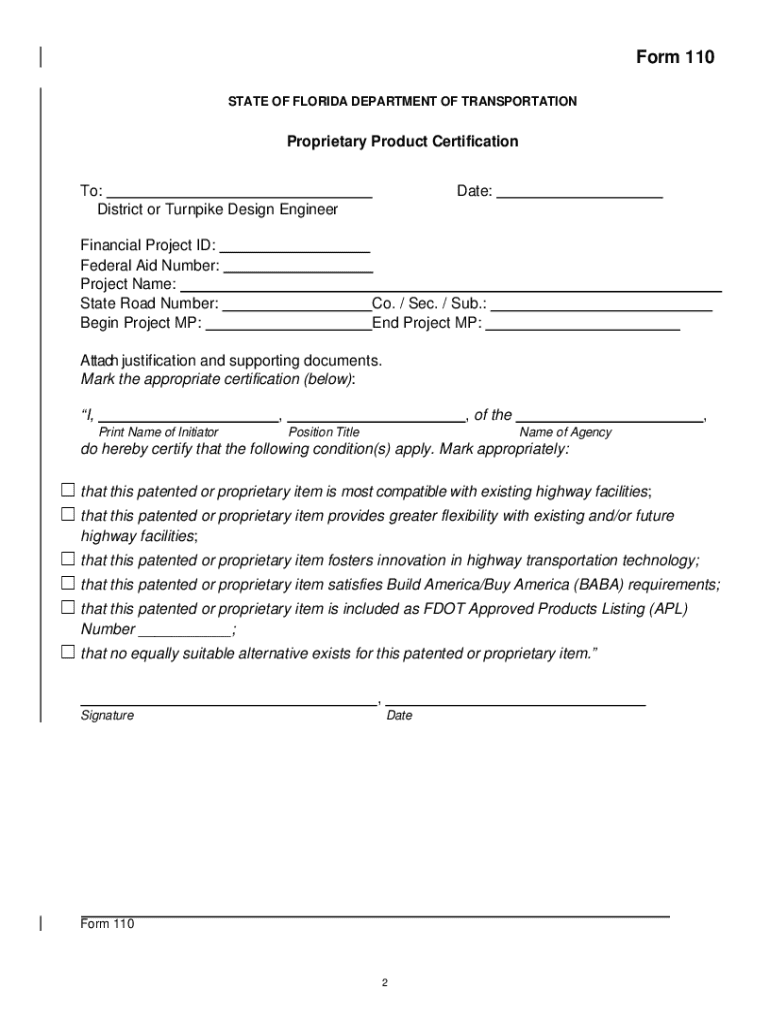

Overview of Form 110 - Net Form

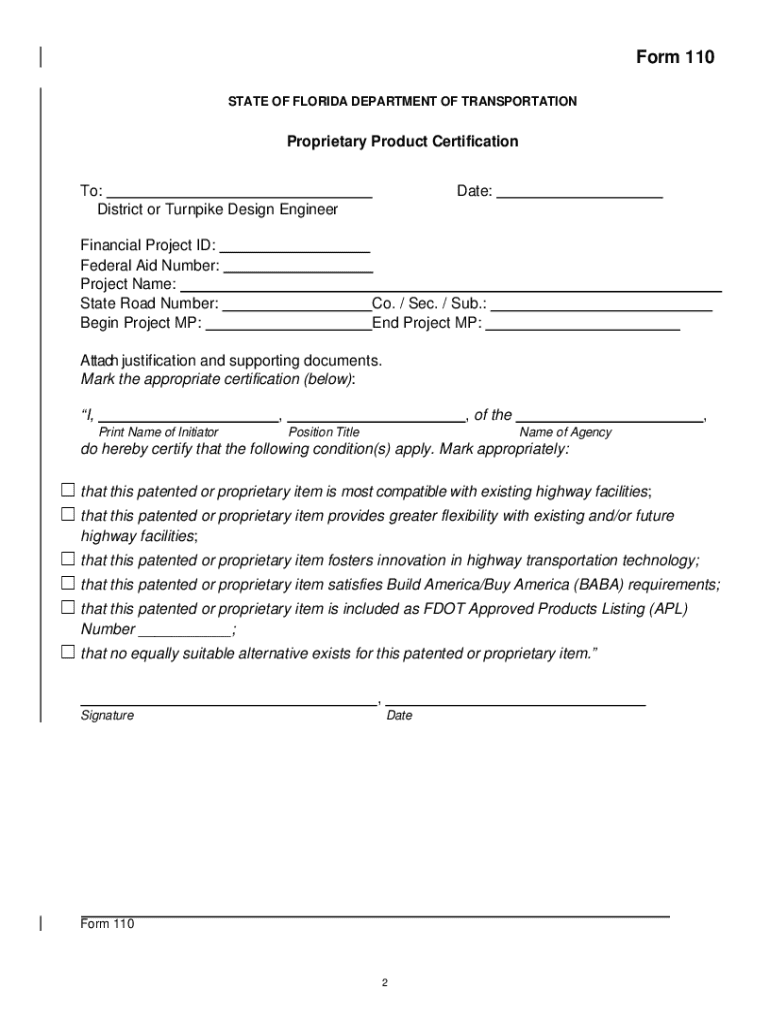

Form 110, also referred to as the Net Form, is a critical document primarily utilized in various professional and business contexts. Its main purpose is to detail financial data necessary for accurate reporting and compliance, especially during tax season. This form holds immense importance as it impacts how businesses operate in terms of financial forecasting, tax obligations, and financial accountability. Understanding Form 110 is essential for both individuals and teams involved in financial documentation and ensures that all parties are adhering to legal obligations.

Understanding the structure of Form 110

Form 110 is composed of several key sections, each bearing specific instructions on what information needs to be provided. Familiarity with these sections is critical for anyone filling out the form. Understanding these individual components can help prevent errors that may arise from unfinished or incorrect entries. Sections typically include general information about the entity, financial reporting details, and tax-related data.

Common terminology used within Form 110 includes terms like ‘taxable income’, ‘deductions’, and ‘credits’. Understanding these terms is crucial as it facilitates an accurate completion of the form and prevents costly misunderstandings.

Step-by-step guide to completing Form 110

To ensure a seamless experience when filling out Form 110, start by gathering all the required information. This includes past tax returns, financial statements, and any other documents that possess relevant data. Organizing these documents before sitting down to fill out the form is key to avoiding stress and inefficiency.

Once you've gathered your documents, begin filling out Section 1 of the form by entering the entity information. Proceed to the financial overview next, meticulously ensuring that all numbers reflect the accurate figures from your documents. Throughout this process, watch out for common pitfalls such as data entry errors and missed fields that could lead to processing delays.

After completing the form, review it thoroughly. Use a checklist to cross-reference your data and ensure completeness. Double-check figures for accuracy, especially in the financial overview, as even minor discrepancies can lead to significant consequences.

Editing and modifying Form 110

When it comes to editing Form 110, pdfFiller proves to be an invaluable tool. Using pdfFiller’s editing features allows users to easily modify PDFs without the hassles associated with paper forms. To begin editing electronically, simply upload your form to the pdfFiller platform, and utilize its robust tools for adjustments.

One of the significant advantages of editing electronically is the ability to efficiently make last-minute updates. Moreover, adding signatures within pdfFiller is straightforward; simply choose the eSignature option and complete the process in a legally binding manner. Understanding the legality of eSignatures ensures that your forms are secure and reliable.

Collaborating on Form 110 with teams

When working in teams, collaboration on Form 110 can significantly enhance efficiency. pdfFiller offers features designed for document sharing and team-based input. Utilize these features to ensure all team members can access the necessary documents without managing multiple versions manually.

Tracking changes and comments via pdfFiller can further streamline this collaboration. Familiarize yourself with the version history to recognize modifications made by each team member, fostering accountability. Establishing a system for providing comments and feedback can ensure a constructive review process.

Submitting Form 110

Once you've completed Form 110, it's time to submit it. Depending on the requirements, submission can occur through various methods—such as online submission via pdfFiller or mailing the printed form. Be mindful of important deadlines when submitting the form to avoid late fees or legal complications.

After submission, track the status of your form. Staying proactive can help in resolving any issues that may arise, ensuring that your submission is processed accurately and efficiently.

Managing your Form 110

Managing Form 110 post-completion is essential for referencing and future needs. pdfFiller not only allows you to store forms securely online but also facilitates easy retrieval. The benefits of digital storage enhance organization, allowing you to categorize your forms logically based on client, date, or project.

Furthermore, keeping your Form 110 updated ensures that your information remains relevant for future entries. A best practice includes reviewing your records on a set schedule, ensuring you capture any changes that could impact your financial status.

Frequently asked questions (FAQs)

Frequently asked questions regarding Form 110 often revolve around its filling processes and common issues. Common concerns might include understanding specific fields, knowing what documents are needed, or how to correct mistakes post-filing. Addressing these frequently asked questions can help alleviate anxieties related to documentation.

Troubleshooting these matters is simpler with a reliable document management system like pdfFiller, which can provide resources for guidance and support.

Security and privacy considerations

When handling Form 110, prioritizing data protection is paramount. pdfFiller incorporates robust security features designed to safeguard your sensitive information. These include encrypted data transmission and compliance with privacy regulations, ensuring that your documents remain safe and secure.

Understanding the importance of privacy in document management is crucial, especially in the financial realm. Using pdfFiller offers peace of mind that your documents are managed according to the highest security standards.

Resources for further assistance

If you find yourself needing additional help with Form 110, resources abound. pdfFiller offers extensive support, ranging from user guides to live chat assistance. Utilizing community forums can also provide peer-supported solutions or tips to navigate common challenges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 110 - net?

How do I fill out form 110 - net using my mobile device?

How do I edit form 110 - net on an iOS device?

What is form 110 - net?

Who is required to file form 110 - net?

How to fill out form 110 - net?

What is the purpose of form 110 - net?

What information must be reported on form 110 - net?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.