Get the free Phelps County Collector of RevenueRolla MO

Get, Create, Make and Sign phelps county collector of

Editing phelps county collector of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out phelps county collector of

How to fill out phelps county collector of

Who needs phelps county collector of?

A Comprehensive Guide to the Phelps County Collector of Form

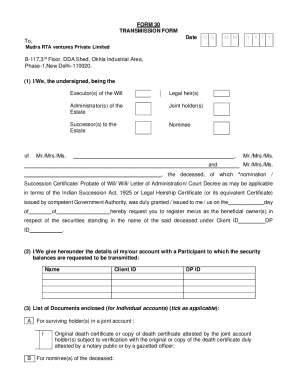

Understanding the Phelps County Collector of Form

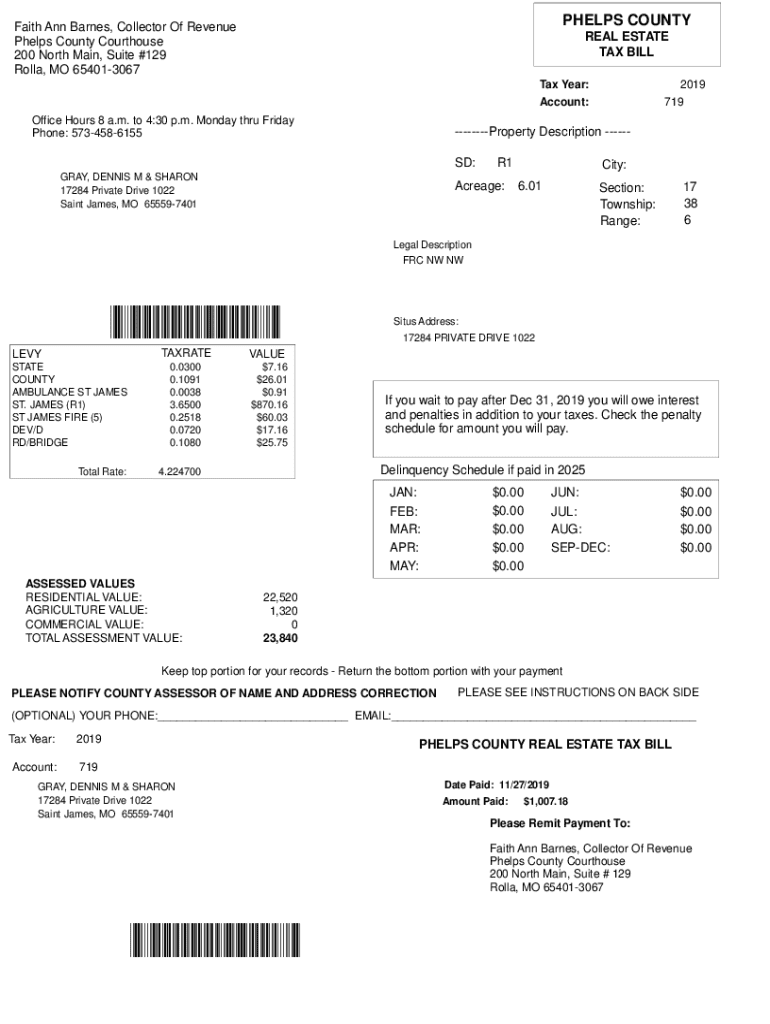

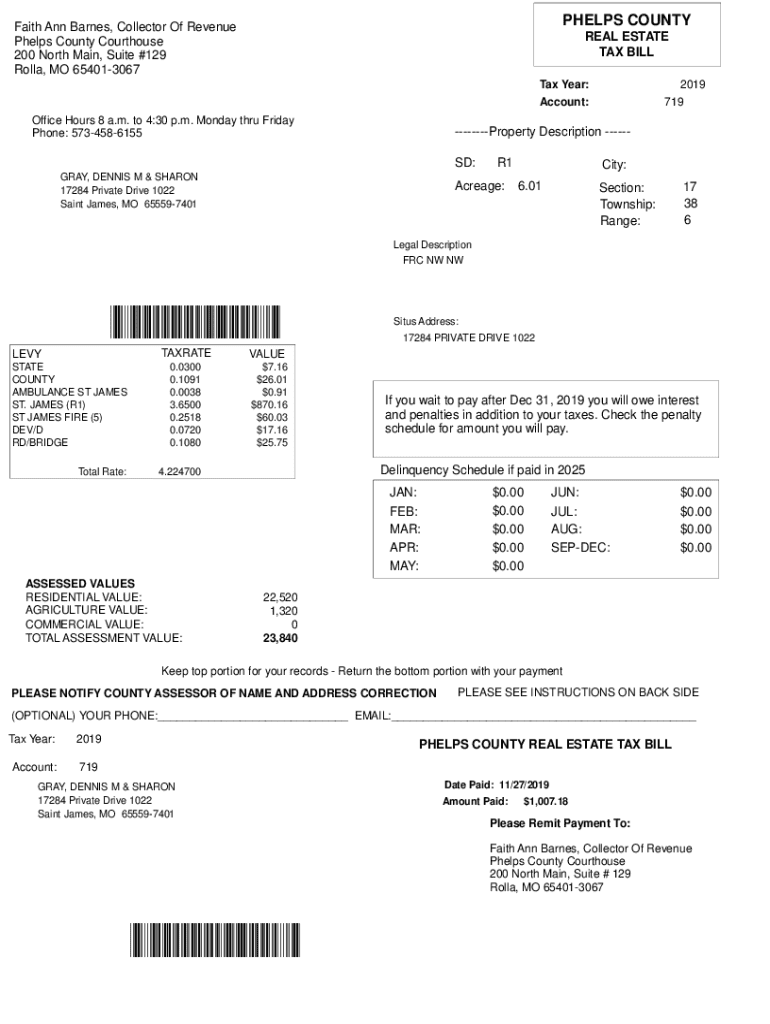

Phelps County, located in the heart of Missouri, has a robust organizational structure aimed at managing a variety of public services, including the efficient handling of forms related to taxation and public assistance. The Phelps County Collector’s office is primarily responsible for the collection of property taxes and related services. Understanding the functions of the Collector of Form is essential for residents and businesses alike, as it plays a crucial role in local governance and community resource allocation.

Residents must navigate numerous forms pertaining to property taxes and exemptions, making it critical to comprehend how these forms operate. For businesses, proper form management ensures compliance with local tax laws, avoiding penalties and fostering a positive relationship with the county. The Phelps County Collector of Form serves as a gateway to understanding these processes.

Types of forms managed by the Phelps County Collector

The Phelps County Collector deals with a variety of forms catered to different needs. These forms are essential for both individuals and businesses to ensure compliance with applicable tax regulations. The following categories encapsulate the primary varieties of forms you will encounter:

How to access Phelps County Collector forms

Accessing the required forms from the Phelps County Collector is a step-by-step process that ensures residents can quickly locate and submit their documents. Here’s a straightforward guide to find the necessary forms:

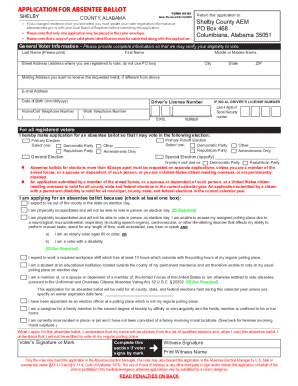

Detailed instructions for filling out forms

Completing forms accurately is vital to avoid delays in processing. When filling out forms for the Phelps County Collector, you’ll commonly need to provide several pieces of information. Here’s what to keep in mind:

To enhance the accuracy of your submissions, consider these tips: double-check all fields before submission, avoid common mistakes like transposed numbers, and ensure that all necessary documentation is attached to your completed forms. Accuracy is crucial for a smooth processing experience.

Editing and managing your forms

Once forms are downloaded, there may be a need for edits or revisions. Utilizing pdfFiller allows for seamless editing of these PDF forms, making the management process much simpler. With pdfFiller, users can easily upload completed forms and use interactive tools to make necessary amendments.

The benefits of digital management via pdfFiller extend beyond editing. Users can access documents from anywhere, enabling on-the-go flexibility. The collaboration features make it easy for teams to work together on shared forms, promoting efficiency and accuracy.

eSigning your forms efficiently

With modern technology paving the way for digital convenience, utilizing eSignatures through pdfFiller is both practical and legally sound in Phelps County. Understanding the eSigning process is straightforward and provides users the ability to expedite submissions without the need for physical signatures.

Digital signatures are recognized under Missouri law, granting them the same weight and validity as traditional signatures. This not only speeds up the processing time but also enhances security, ensuring that documents remain tamper-proof.

Submission process for collector of forms

Submitting your completed forms to the Phelps County Collector can be accomplished through various methods. Understanding the submission process is key to ensuring your forms are accepted and processed promptly. Here’s how you can submit your forms:

To track your submission status, the Collector’s office provides resources on their website. Keeping an eye on your submission can prevent unforeseen issues and allow for timely follow-ups if needed.

Frequently asked questions (FAQs)

Many individuals have questions about the Phelps County Collector of Form, especially when it comes to managing taxation-related paperwork. Here are some common queries that arise:

Additional support and resources

Residents seeking further support can easily reach out to the Phelps County Collector’s office. Their contact information is readily available online, ensuring quick communication for any inquiries. Additionally, pdfFiller offers robust support for users who experience difficulties with forms, providing step-by-step guidance for troubleshooting.

Moreover, resources for related forms and additional government information can often be found on the official Phelps County website, equipping users with the tools they need to efficiently manage their paperwork.

Conclusion on efficient form management with pdfFiller

In conclusion, the Phelps County Collector of Form plays an essential role in managing local taxation and related services. By utilizing pdfFiller, users can navigate the complexities of form management with ease, enhancing productivity through efficient editing, signing, and document tracking. Encouraging the use of digital tools not only simplifies workflows but also ensures that residents and businesses remain compliant with county regulations, which is paramount in fostering a healthy community and local economy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get phelps county collector of?

How do I edit phelps county collector of in Chrome?

Can I sign the phelps county collector of electronically in Chrome?

What is Phelps County Collector of?

Who is required to file Phelps County Collector of?

How to fill out Phelps County Collector of?

What is the purpose of Phelps County Collector of?

What information must be reported on Phelps County Collector of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.