Get the free county Tax Collector's office

Get, Create, Make and Sign county tax collector039s office

How to edit county tax collector039s office online

Uncompromising security for your PDF editing and eSignature needs

How to fill out county tax collector039s office

How to fill out county tax collector039s office

Who needs county tax collector039s office?

Understanding the County Tax Collector's Office Form: A Comprehensive Guide

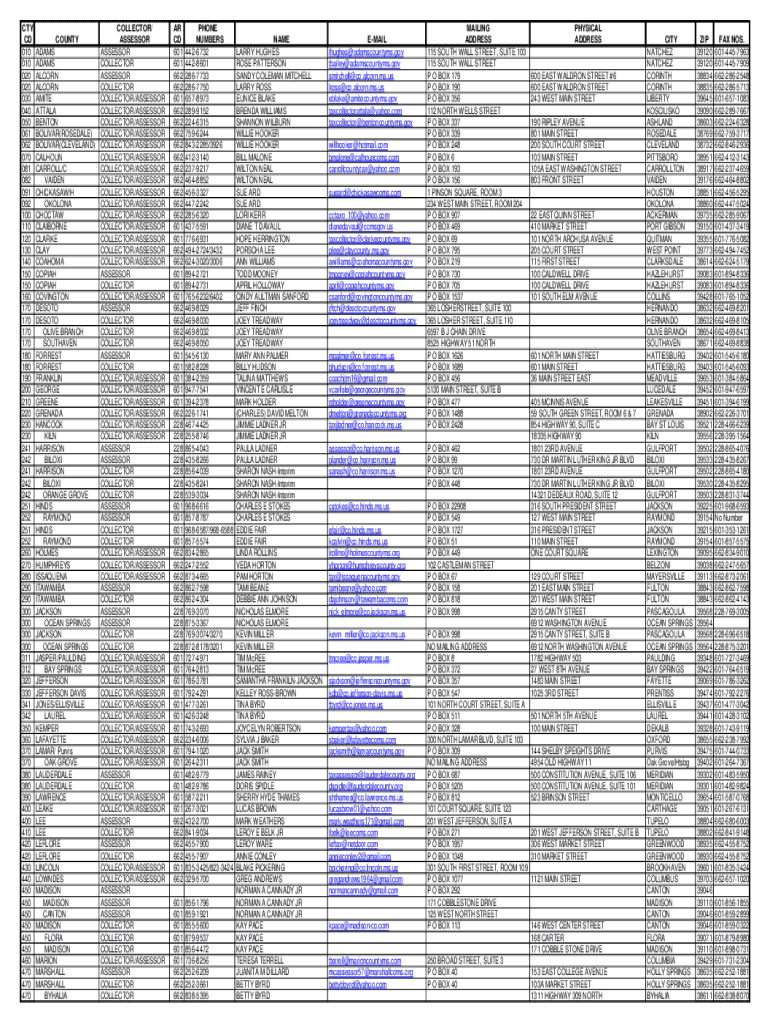

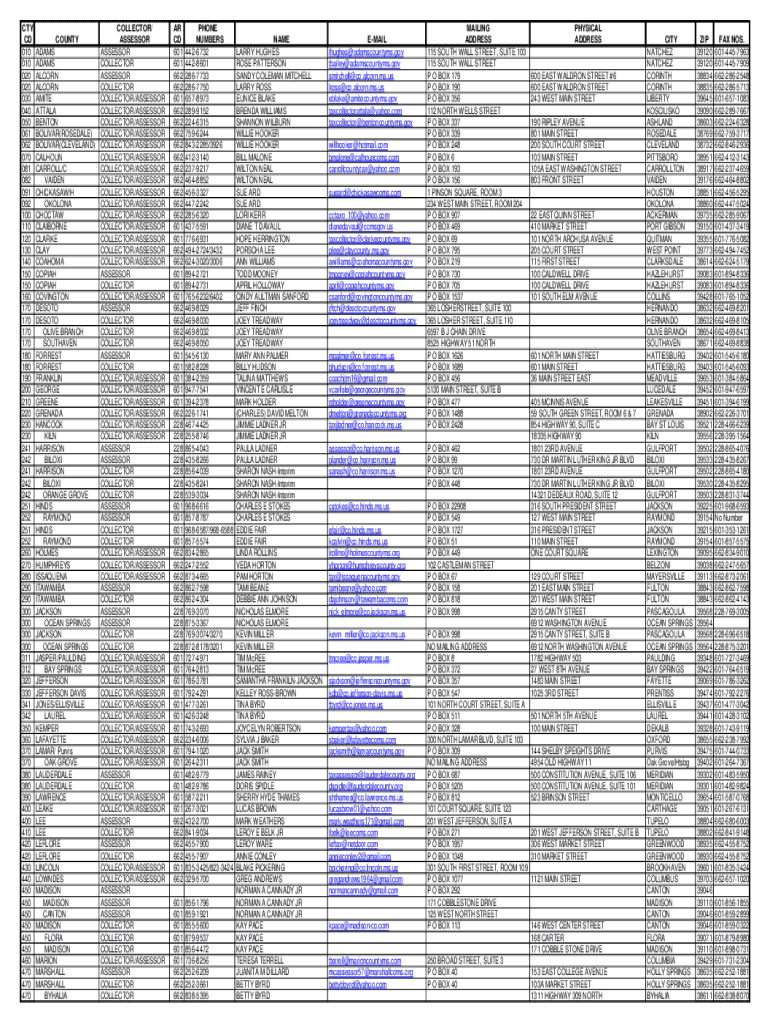

Overview of the County Tax Collector’s Office Form

The County Tax Collector’s Office Form is a crucial document utilized by individuals and businesses to manage their property taxes effectively. This form serves as a formal request for various services, including tax assessments, payment processing, and updates regarding property ownership. By submitting this form accurately and timely, taxpayers ensure compliance with local regulations while avoiding potential penalties associated with late or inaccurate submissions.

Accurate submission is paramount; it directly influences tax calculations, property assessments, and eligibility for potential exemptions. Common uses of the County Tax Collector's Office Form include reporting changes in property ownership, applying for property tax exemptions, and initiating queries about tax due dates.

Interactive features of the form

Leveraging technology, pdfFiller provides users with interactive tools to enhance the usability of the County Tax Collector’s Office Form. These interactive features allow users to fill out, edit, and sign the form digitally, streamlining the entire process. Users can easily navigate through various sections, add comments, and incorporate attachments.

To utilize these features effectively, users should follow step-by-step instructions provided within the pdfFiller platform. This includes accessing the form, entering information, utilizing available tools like auto-fill, and securing electronic signatures. The benefits of these interactive elements extend to time savings, reduced errors, and improved collaboration among teams handling tax-related documentation.

Detailed sections of the County Tax Collector’s Office Form

Section 1: Personal information

In the personal information section, users must provide details such as name, address, and contact information. Accuracy in this section is crucial; inaccurate information can delay processing and lead to misinformation regarding tax notices. It’s advisable to double-check all entries to ensure correct spelling and address formats.

Section 2: Property information

This section includes the types of properties covered, ranging from residential homes to commercial establishments. Required documentation can include property deeds, previous tax bills, or any relevant proof of ownership. These documents validate the details provided and are essential for the assessment process.

Section 3: Tax information

Understanding tax implications is vital. This section often requires details about the tax year, assessed value, and any exemptions or deductions that apply. Common mistakes include missing out on available exemptions or miscalculating figures, both of which can lead to incorrect tax liabilities.

Section 4: Payment options

The payment options section outlines accepted methods such as credit card, check, or electronic transfers. For those opting for electronic payments via pdfFiller, users must follow specific instructions to ensure secure and timely transactions. Knowing the available payment methods helps in planning to meet tax deadlines efficiently.

Step-by-step guide for filling out the form

Step 1: Accessing the form on pdfFiller

To begin the process, access the County Tax Collector's Office Form by navigating to the pdfFiller website. Users can search for specific county forms using the intuitive search function. It's crucial to select the right form corresponding to one’s county to avoid complications.

Step 2: Editing the form

Once the form is accessed, pdfFiller allows users to edit directly within the platform. Utilize editing features to adjust field entries, add text comments, or highlight sections as necessary. Best practices for editing PDFs include keeping track of changes and ensuring clarity in all entries.

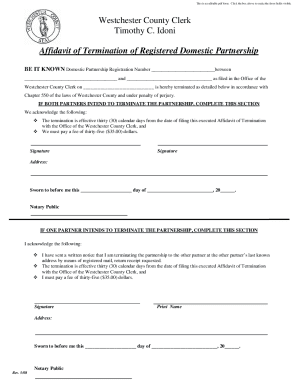

Step 3: Signing the form

The eSignature process on pdfFiller is user-friendly. After filling out the form, users can sign electronically using a stylus, mouse, or by uploading an existing signature image. Understanding the legal validity of eSignatures is key; they are recognized as binding in most jurisdictions, making electronic submission a viable option.

Step 4: Submitting the completed form

Submission guidelines may vary based on the county. After completing your form, ensure to follow your county's specific instructions for submission, whether electronically through pdfFiller or via postal mail. Tracking your submission may be possible through confirmation emails or tracking numbers provided by your local tax office.

Collaborating on the County Tax Collector’s Office Form

Collaboration is another significant advantage of using pdfFiller. Teams can work together more effectively by sharing the County Tax Collector’s Office Form for input and revisions. This collaborative approach minimizes errors and ensures that all necessary information is thoroughly vetted before submission.

To share the form, simply utilize the sharing features on pdfFiller. Users can invite others via email or share direct links to the document. Additionally, it's possible to monitor changes and comments made by collaborators, allowing for transparent communication and efficient workflow management throughout the process.

Troubleshooting common issues

Filling out the County Tax Collector's Office Form can sometimes lead to common errors, including incomplete information, miscalculations, or incorrect form selections. Paying close attention to instructions and required fields is critical to minimizing these risks. If users encounter technical issues with pdfFiller, troubleshooting can often be resolved through the platform's FAQ section or user guides.

In the case of unresolved issues, contacting support directly provides access to further assistance. pdfFiller's customer support team is equipped to handle queries around common errors or technical difficulties, ensuring that users can continue with their form management without prolonged interruptions.

FAQs about the County Tax Collector’s Office Form

Potential FAQs often revolve around submission deadlines and correction processes. Many users question what happens if they submit the form late; typically, penalties may be incurred. It's recommended to submit forms as early as possible to avoid complications.

Additionally, users frequently ask how to make corrections after submission. Most counties allow a secondary process for amendments, but clarity on this should be confirmed through local tax office guidelines. For further information, users can always refer back to the pdfFiller resources or connect with county guidance for additional support and clarity.

Related forms and templates

Several other forms are crucial for property owners, including various exemption applications and appeals for property assessments. Understanding the relationship between these forms and the County Tax Collector's Office Form is significant for effective compliance. Each county may have specific documents related to property evaluations and tax reductions, often available for download on pdfFiller.

Quick links to forms pertinent to specific counties using pdfFiller can help users locate necessary documentation quickly. It's essential to recognize key differences among these related forms, particularly with respect to deadlines and required information, aiding in efficient tax management.

Maximizing the features of pdfFiller for form management

Using a cloud-based platform like pdfFiller offers numerous advantages for form management, particularly for the County Tax Collector's Office Form. The accessibility allows users to work from any location, which is especially beneficial for busy professionals managing multiple properties or businesses. Cloud storage also enhances document security, safeguarding sensitive information efficiently.

Leveraging templates for future form needs can streamline the process even further. Users can create standardized forms for regular submissions, minimizing repetitive data entry. Furthermore, keeping abreast of emerging trends in document management ensures users are utilizing tools to their full potential, like automation features and advanced collaboration capabilities within pdfFiller.

Additional considerations for tax collectors

Tax collectors should prioritize keeping track of deadlines both for filing and payment to maintain smooth operations. Efficient systems in place help avoid penalties and ensure compliance with local regulations. Furthermore, maintaining document security is essential; adopting best practices for safeguarding sensitive taxpayer information can foster trust and streamline tax collection processes.

Regular updates on forms and guidelines are crucial for both tax collectors and taxpayers. Since regulations can change frequently, staying informed helps mitigate misinformation, ensuring that the tax collection process remains clear and efficient for all stakeholders involved.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the county tax collector039s office form on my smartphone?

How do I edit county tax collector039s office on an iOS device?

How can I fill out county tax collector039s office on an iOS device?

What is county tax collector's office?

Who is required to file county tax collector's office?

How to fill out county tax collector's office?

What is the purpose of county tax collector's office?

What information must be reported on county tax collector's office?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.