Get the free Applying for Financial Aid When You Don't Live With Your ...

Get, Create, Make and Sign applying for financial aid

How to edit applying for financial aid online

Uncompromising security for your PDF editing and eSignature needs

How to fill out applying for financial aid

How to fill out applying for financial aid

Who needs applying for financial aid?

Applying for Financial Aid Form: A Comprehensive How-To Guide

Understanding Financial Aid

Financial aid is designed to assist students in covering the costs associated with their education, making higher learning more accessible. It comes in several forms, each serving a distinct purpose based on the financial circumstances of the applicant.

Understanding the different types of aid available is crucial in addressing educational expenses effectively.

Financial aid is critical for students, particularly those from low to moderate-income families. It helps bridge the gap between personal funds and the total cost of education, enabling more individuals to pursue their academic goals.

Getting started with the financial aid form

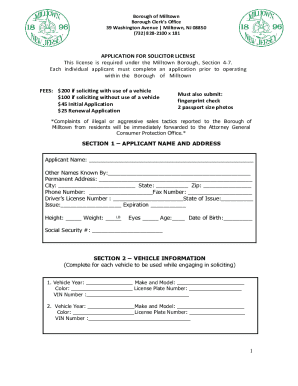

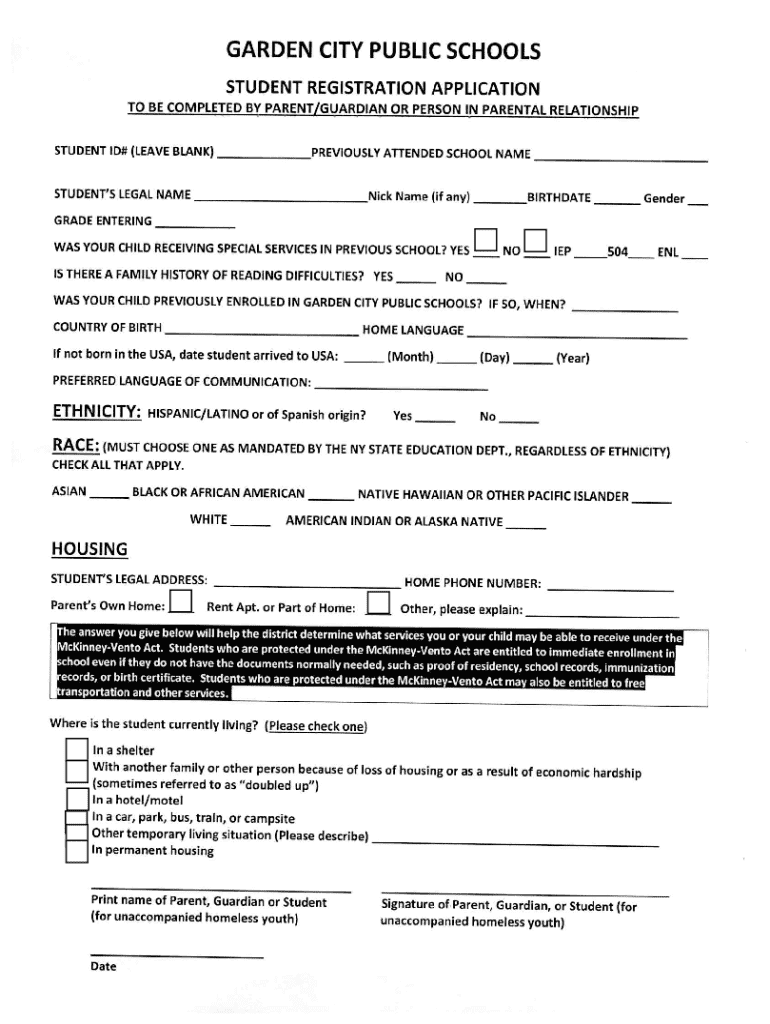

To initiate the financial aid process, it’s essential to understand how the system works and what qualifies you for assistance. This journey begins by determining eligibility.

Eligibility typically hinges on several factors. Most applicants must meet specific criteria to qualify for various funding types.

Preparing to apply

Before embarking on your application, preparation is vital. The better prepared you are, the smoother the application process will be.

Gathering necessary documents is a critical first step. Collecting the right paperwork will not only facilitate your application but also aid in accurately reporting your financial status.

In addition to these documents, researching financial aid options can provide insight into what is available to you.

Detailed steps for completing the financial aid form

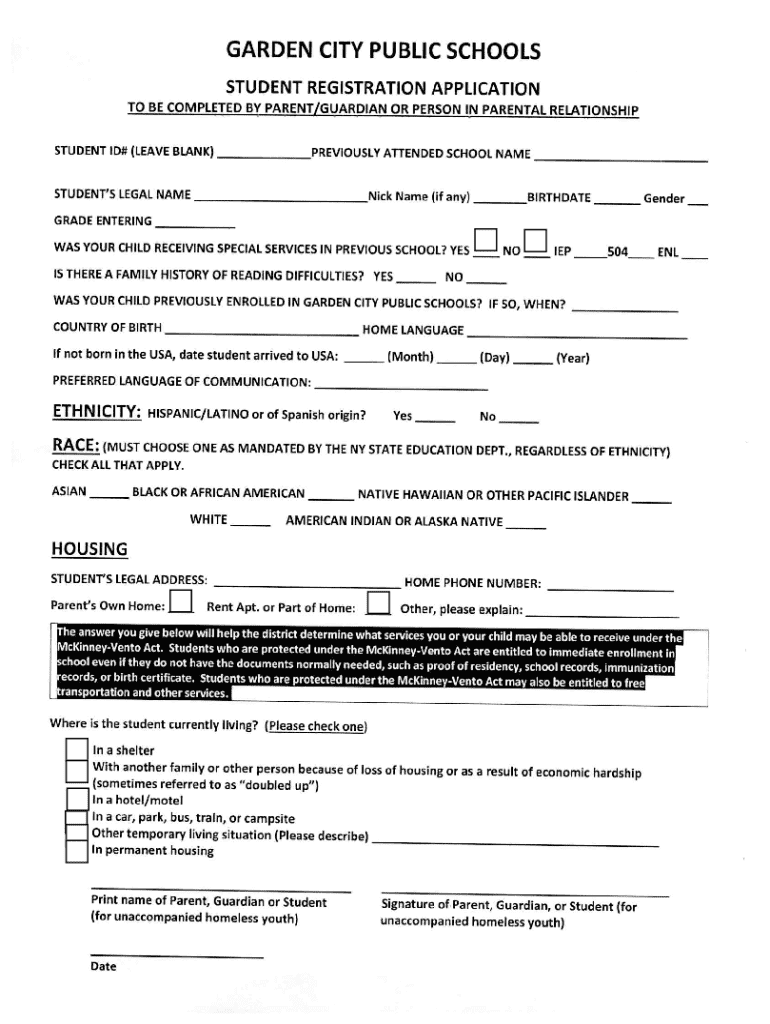

Accessing the financial aid form is your first concrete step towards securing assistance for your educational costs. In most instances, the Free Application for Federal Student Aid (FAFSA) is the required form.

This form is available online, ensuring easy access for applicants nationwide. Once you access the form, it's critical to fill in your personal information correctly.

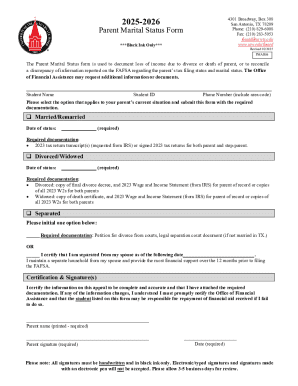

After entering your personal information, the next step is reporting financial details, which is one of the most critical parts of your application.

You’ll also need to indicate household information, such as the number of family members and how many are currently enrolled in college. This information allows the financial aid office to assess your family’s financial planning.

Additionally, some applicants may need to provide information regarding special circumstances or dependency status, particularly if there are unique elements affecting their situation.

Common pitfalls to avoid

Navigating the financial aid application can be complex, and several common pitfalls can derail your efforts. Being aware of these potential issues is essential for a successful application.

Submitting the financial aid form

After carefully completing your application, the submission process is crucial. Take the time to review all details thoroughly before submitting.

Be sure to confirm submission details, including the option you selected for communicating with the financial aid office (email updates, etc.).

Tracking your application status is vital after submission. This allows you to follow up on any issues that may arise during processing.

Understanding response times is equally important—these can vary significantly from one institution to another, but generally, it may take several weeks to process applications.

What happens after submission?

Once your application is submitted, it enters a processing period during which the financial aid office reviews it based on the information provided.

The next step in this journey is receiving a financial aid offer, which should outline the types and amounts of aid you qualify for.

Finally, you will have the option to accept or decline the aid offered, and you must be aware of any stipulations attached to these funds.

Tips for maximizing financial aid opportunities

To enhance your chances of securing financial aid, proactive measures are essential. Being thorough in your research can yield excellent results.

Start by exploring additional scholarships and grants that may not be directly tied to your application. This can widen your financing net significantly.

Frequently asked questions (FAQs)

As you navigate the financial aid application process, questions are likely to arise. Here are some common inquiries along with their answers.

Final considerations

Maintaining eligibility for financial aid is just as crucial as applying for it initially. Keep documentation organized and be mindful of your academic performance and overall compliance.

Additionally, connecting with financial aid resources can be incredibly beneficial. Utilize available tools and platforms to manage documents and seek assistance when needed.

Utilizing pdfFiller can significantly streamline your financial aid application process. The platform allows you to edit forms online, facilitate electronic signatures, and collaborate with your family or advisors closely.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute applying for financial aid online?

How do I fill out the applying for financial aid form on my smartphone?

How do I complete applying for financial aid on an Android device?

What is applying for financial aid?

Who is required to file applying for financial aid?

How to fill out applying for financial aid?

What is the purpose of applying for financial aid?

What information must be reported on applying for financial aid?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.