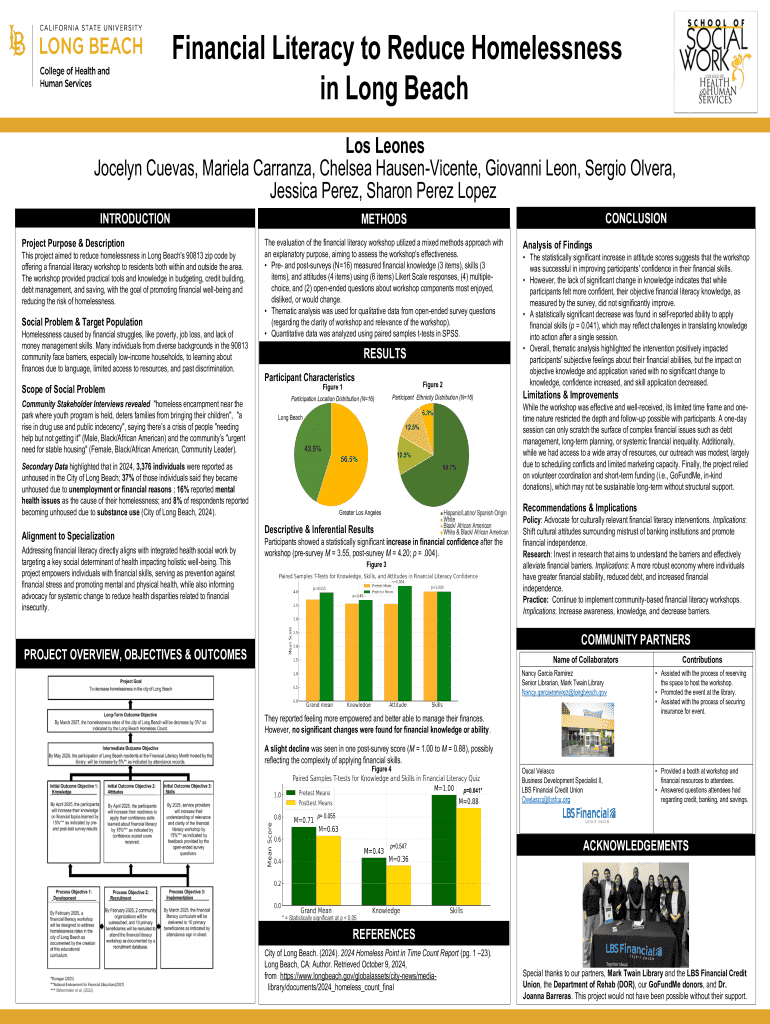

Get the free Financial Literacy to Reduce Homelessness in Long Beach

Get, Create, Make and Sign financial literacy to reduce

How to edit financial literacy to reduce online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial literacy to reduce

How to fill out financial literacy to reduce

Who needs financial literacy to reduce?

Financial literacy to reduce form issues

Understanding financial literacy

Financial literacy refers to the ability to understand and effectively use various financial skills, including personal finance management, budgeting, and investing. It is a crucial skill set that empowers individuals to make informed and effective decisions regarding their financial resources. The importance of financial literacy extends beyond personal finance; it has significant implications for managing essential documents, particularly forms associated with financial transactions.

The ability to navigate financial forms with confidence can greatly influence personal and organizational success. Poor financial literacy can lead individuals to mishandle documents, resulting in financial mismanagement, delays, and even legal challenges. It’s essential to recognize that literacy is not just about numbers; it incorporates understanding the language and format of forms, which fosters greater financial wellbeing.

Common forms in financial transactions

Common financial forms are essential for various transactions and include expense reports, tax forms, and loan applications, among others. Understanding these documents is critical to making accurate submissions and avoiding mistakes that can lead to financial loss or inefficiency. Each type of form features unique sections that require careful scrutiny.

Key sections to focus on include income declarations, expense descriptions, and personal identification details. A common mistake individuals make is omitting vital information or failing to validate the accuracy of their entries. For instance, overlooking line items on tax forms can result in misreporting one’s income or missing out on possible deductions.

The role of pdfFiller in enhancing financial literacy

pdfFiller serves as a powerful tool to enhance financial literacy through its robust features. Users can easily edit PDFs, making necessary alterations to financial documents without needing specialized software. This capability is crucial when ensuring forms are error-free and up to date, facilitating smoother financial transactions.

Additionally, eSigning features enable users to sign documents digitally, ensuring that they are legally binding and secure without the hassle of printing and scanning. Collaboration tools available on pdfFiller allow multiple stakeholders to participate in document completion, promoting a comprehensive understanding of financial forms and stimulating learning.

The platform’s cloud-based solutions foster a more profound understanding of forms, as users can access their documents anytime, anywhere, making it easier to familiarize themselves with financial terminology and concepts.

Step-by-step guide to filling out common financial forms

Filling out financial forms accurately is essential, and following a structured approach can simplify the process. Here’s a step-by-step guide for users to follow:

Interactive tools offered by pdfFiller

pdfFiller enhances the user experience with interactive tools designed to improve financial understanding. Features such as financial calculators and planners help users visualize their monetary situations and make informed decisions. For instance, users can calculate their potential tax refunds with a reliable tool rather than guesswork, improving overall financial literacy.

Moreover, utilizing templates simplifies the form completion process. Templates serve as a guide that helps users avoid common mistakes frequently made in document preparation. Feedback tools allow for easy document review by multiple parties, giving an extra layer of assurance before submission.

Advanced tips for managing financial documents

Managing financial documents effectively requires organization and strategic planning. Begin by developing a systematic approach to storing documents—consider cloud storage solutions for easy access, which aligns well with the capabilities of pdfFiller. Organizing documents into categorized folders such as income, expenses, tax forms, and loan documents can enhance your ability to retrieve information promptly.

Security is paramount when dealing with sensitive financial documents. Encryption and secure password protection are critical practices to safeguard personal information. Regular maintenance and review of these documents play a vital role in sustaining financial literacy over time. Engage in ongoing education and awareness about financial tools, policies, and lending rates to remain abreast of changes.

Case studies: Success stories from pdfFiller users

Numerous users of pdfFiller have reported significant improvements in financial literacy and effective document management. From individuals seeking to maximize their tax refunds to businesses reducing the time spent on expense reports, the user testimonials are overwhelmingly positive. One user, Jessica, was able to navigate her credit report with newfound confidence, subsequently improving her credit score by resolving previous discrepancies that she would have overlooked without pdfFiller.

Another remarkable case involves a team at a small startup that streamlined their loan application process. By utilizing pdfFiller's collaborative features, they efficiently gathered necessary documentation, submitting their application ahead of schedule. Such success stories illustrate the tangible benefits of improved financial literacy facilitated by effective document management systems.

Conclusion: Empowering financial literacy through effective document management

The relationship between financial literacy and proficient document management is clear. Empowering individuals and teams with the knowledge and tools to handle financial forms proficiently results in reduced errors and increased efficiency. pdfFiller serves as a pivotal resource by providing a user-friendly platform that fosters understanding through practical application.

By prioritizing financial literacy, users can approach their financial forms with confidence, maximizing their potential for accurate submissions and informed decision-making. Harnessing the features of pdfFiller not only clarifies document management but also enhances overall financial competency, paving the way for better financial health.

Next steps: Engaging with pdfFiller

Getting started with pdfFiller is straightforward and user-friendly. Users can sign up for various subscription options based on their needs, whether individual or team-based. With full access to templates, editing tools, and interactive features, individuals can significantly boost their financial literacy while managing financial documents more effectively.

The seamless integration of these tools will not only enhance users' ability to navigate financial forms but also instill confidence in dealing with their financial futures. Embracing a proactive approach to financial literacy opens doors to better money management, understanding credits, and leveraging one’s financial potential.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my financial literacy to reduce directly from Gmail?

How do I make changes in financial literacy to reduce?

How do I edit financial literacy to reduce in Chrome?

What is financial literacy to reduce?

Who is required to file financial literacy to reduce?

How to fill out financial literacy to reduce?

What is the purpose of financial literacy to reduce?

What information must be reported on financial literacy to reduce?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.