Get the free ma cpf m 102 form - fill online, printable, fillable, blank ...

Get, Create, Make and Sign ma cpf m 102

Editing ma cpf m 102 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ma cpf m 102

How to fill out ma cpf m 102

Who needs ma cpf m 102?

Understanding the MA CPF 102 Form: A Complete Guide

Understanding the MA CPF 102 Form

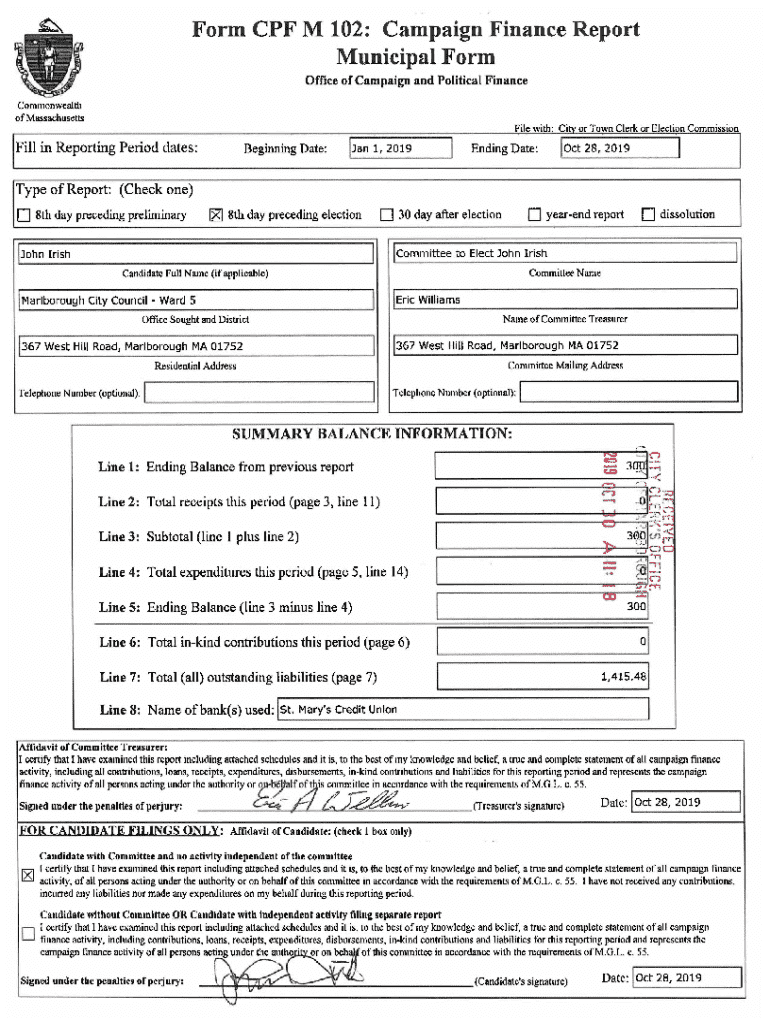

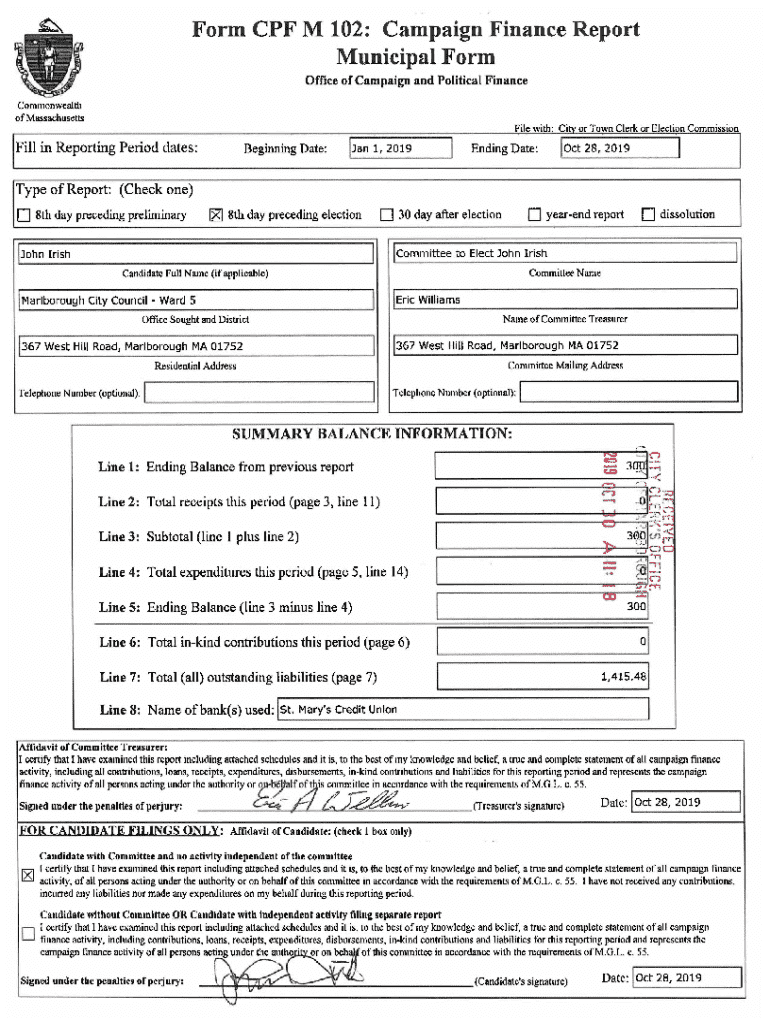

The MA CPF M 102 form is a specific document used in the realm of campaign finance in Massachusetts. Its primary purpose is to provide transparency and accountability regarding the funding and expenditures of political campaigns. The form is essential for candidates, committees, and organizations seeking to comply with state laws governing campaign finance. Proper handling of this document supports a fair election process and helps maintain integrity in political activities.

In the context of document management, the MA CPF M 102 form serves as a critical tool to track financial contributions and expenditures. Mismanagement or failure to file this form can result in legal penalties and tarnish a candidate’s reputation. Therefore, understanding its importance cannot be overstated.

Who Needs the MA CPF 102 Form?

The MA CPF M 102 form is designed for candidates running for public office, political committees, and organizations that participate in political activities in Massachusetts. Individuals involved in campaign finance, such as treasurers or campaign managers, are also required to utilize this form. As the keeper of town records, the Sudbury town clerk and team members must ensure that these forms are filed accurately and promptly to maintain compliance with state laws.

Common scenarios where the MA CPF M 102 form is needed include when a candidate is launching a campaign, during election cycles, or when political entities engage in fundraising activities. Whether you’re a candidate, part of a campaign team, or involved in local elections, familiarity with this form is vital.

Key features of the MA CPF 102 form

The MA CPF M 102 form consists of several detailed components that facilitate accurate reporting of contributions and expenditures. Key sections typically include contributor information, expenditure categories, total amounts contributed or spent, and a signature section for verification. Unique to this form are features that cater specifically to Massachusetts state laws on campaign financing, making it essential for those engaging in local elections.

One notable benefit of using the MA CPF M 102 form is its streamlined approach to documentation. With pdfFiller, users can efficiently fill out, edit, and sign the form digitally, which not only saves time but also enhances collaboration among team members who may need to review financial details. The transition to a cloud-based solution offers additional benefits in terms of accessibility and security.

Step-by-step guide to filling out the MA CPF 102 form

Preparation is crucial when filling out the MA CPF M 102 form. Begin by gathering all necessary information, including details of contributions received and expenditures made. Familiarize yourself with state regulations to ensure compliance, as missing information can lead to delays or complications in submission.

The form consists of various sections, each requiring specific information. Start by inputting your name, contact information, and other relevant personal details. Document all contributions with precise amounts and sources. Use the expenditure section to delineate all spending categorized by purpose. Ensuring accuracy here is crucial to prevent legal issues.

After completing the form, you can edit and customize it through pdfFiller’s features, which allow you to add notes or custom signatures. This capability not only enhances functionality but also ensures multi-user access for collaborative efforts.

Signing and submitting the MA CPF 102 form

Signing and submitting the MA CPF M 102 form has been simplified through pdfFiller’s electronic signing capabilities. You can request signatures from multiple parties seamlessly, ensuring that all necessary stakeholders provide their consent efficiently. This feature maintains both security and compliance with Massachusetts laws surrounding electronic documents.

Various submission options are available for your completed MA CPF M 102 form. You can submit it physically, via mail to your local election office, or electronically if permitted. Always verify the submission method to ensure it aligns with current state regulations. Successful submissions can typically be verified through confirmation emails or notifications from the office handling your documents.

Managing your MA CPF 102 form post-submission

Post-submission management of the MA CPF M 102 form is another essential aspect of campaign finance compliance. Utilizing pdfFiller’s document management tools, users can track the status of their submitted forms and maintain organized records for future reference. This organization is especially critical during election periods when timely reporting can make or break a campaign.

By leveraging cloud storage options, all team members can securely access forms, share them for review, and ensure that documentation remains accessible from anywhere. This functionality is particularly valuable for collaborative teams who must keep everyone updated on contributions and expenditures throughout the campaign process.

FAQs related to the MA CPF 102 form

Users often have questions regarding the MA CPF M 102 form. Common inquiries include its filing deadlines, how to amend submitted forms, and what to do if discrepancies arise. Understanding these aspects is key to ensuring smooth compliance with Massachusetts laws governing campaign finance. Addressing these concerns proactively not only enhances the clarity of the process but also informs users of their responsibilities.

Some misunderstandings arise about the form's requirements and the process itself. For instance, citizens may not realize that all contributions, regardless of amount, must be reported. Another frequent concern involves the necessity of signatures; users might assume that electronic signatures are not permitted, which is incorrect. Utilizing resources available through pdfFiller can dispel these misconceptions and provide clear guidelines.

Additional tips for success

Efficiency in document management is critical for any campaign's success. Best practices include regularly reviewing and organizing documents, maintaining up-to-date knowledge about campaign finance requirements, and utilizing collaborative tools like pdfFiller. This proactive approach can prevent potential issues before they arise, enabling smoother operations.

Apart from document organization, leveraging pdfFiller for its wide range of features—such as accessibility from anywhere and customizable templates—can significantly enhance the overall user experience. Staying informed about features such as real-time collaboration options can empower teams to manage their documents and campaign finances more effectively.

Real-world examples

Many candidates and political teams have successfully navigated the complexities of campaign finance using the MA CPF M 102 form effectively. For instance, a local candidate in Sudbury utilized pdfFiller to streamline their submission process and ensure that all donations were accounted for meticulously. By maintaining accurate records and utilizing digital tools, they successfully maintained compliance throughout the election cycle, ultimately leading to a successful campaign.

Another notable example is a campaign committee that faced challenges with timely submissions due to manual paperwork. They adopted the MA CPF M 102 form through pdfFiller, allowing them to manage expenditures and contributions more efficiently. The result was not only compliance but reduced stress during the election process and strategic advantages in their campaign operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ma cpf m 102 directly from Gmail?

Where do I find ma cpf m 102?

How do I edit ma cpf m 102 on an iOS device?

What is ma cpf m 102?

Who is required to file ma cpf m 102?

How to fill out ma cpf m 102?

What is the purpose of ma cpf m 102?

What information must be reported on ma cpf m 102?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.