Get the free idr documentation requirements

Get, Create, Make and Sign idr documentation requirements form

Editing idr documentation requirements form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out idr documentation requirements form

How to fill out student loan idr plan

Who needs student loan idr plan?

Complete Guide to the Student Loan IDR Plan Form

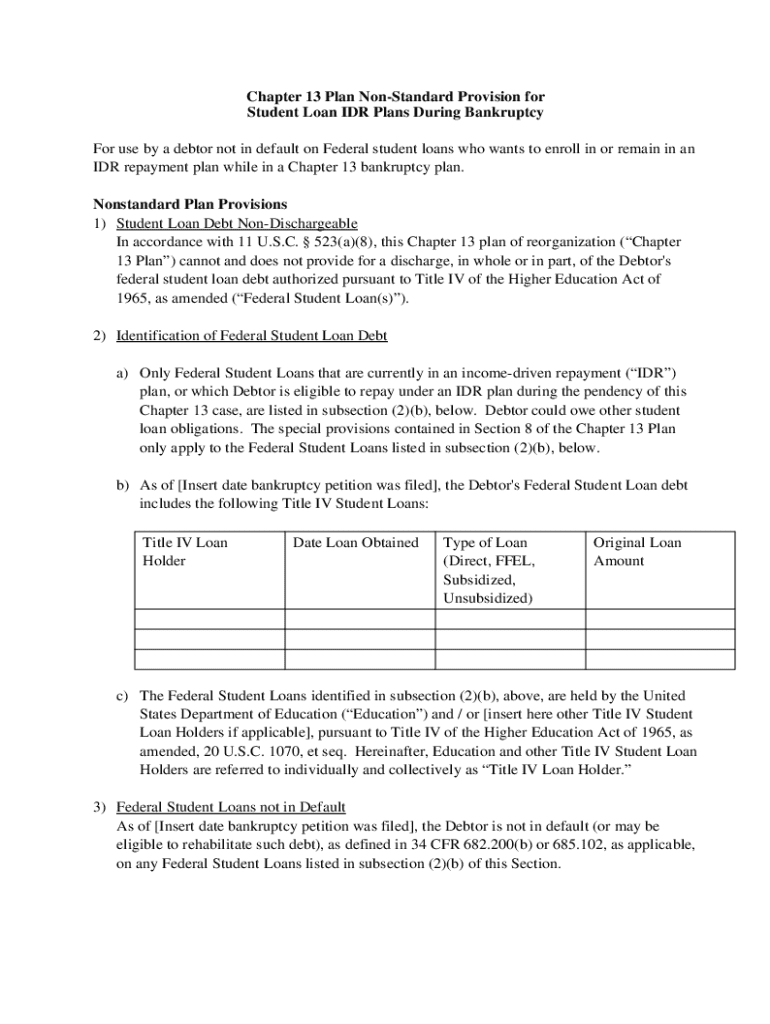

Understanding the income-driven repayment (IDR) plan

An Income-Driven Repayment (IDR) Plan is designed to make student loan repayment more manageable for borrowers by basing monthly payments on income and family size. This approach allows borrowers who are facing financial challenges to reduce their monthly obligations significantly. IDR Plans not only provide immediate financial relief but also offer the potential for loan forgiveness after a set number of years, depending on the plan.

The benefits of enrolling in an IDR Plan are numerous. Borrowers can enjoy lower monthly payments tailored to their specific financial situation. Additionally, IDR Plans typically include options for loan forgiveness. After making payments for 20-25 years, the remaining balance might be forgiven under specific IDR programs. Furthermore, these plans allow for payment recalibration whenever there's a significant change in income, ensuring that borrowers can maintain affordability over time.

Eligibility requirements for the IDR plan

To enroll in an IDR Plan, borrowers need to meet specific eligibility requirements. First, the type of student loans is crucial. Generally, federal student loans are eligible for IDR Plans, including Direct Subsidized and Unsubsidized Loans, PLUS Loans for graduate or professional students, and Consolidation Loans. Private loans do not qualify for IDR.

Income consideration plays a significant role in determining eligibility. Borrowers must provide documentation reflecting their income level, which can include recent tax returns, pay stubs, or other income verification forms. Family size also impacts eligibility; as the number of dependents increases, so does eligibility for lower payments, as the calculations take into account the borrower's ability to support dependents financially.

Collecting necessary documentation

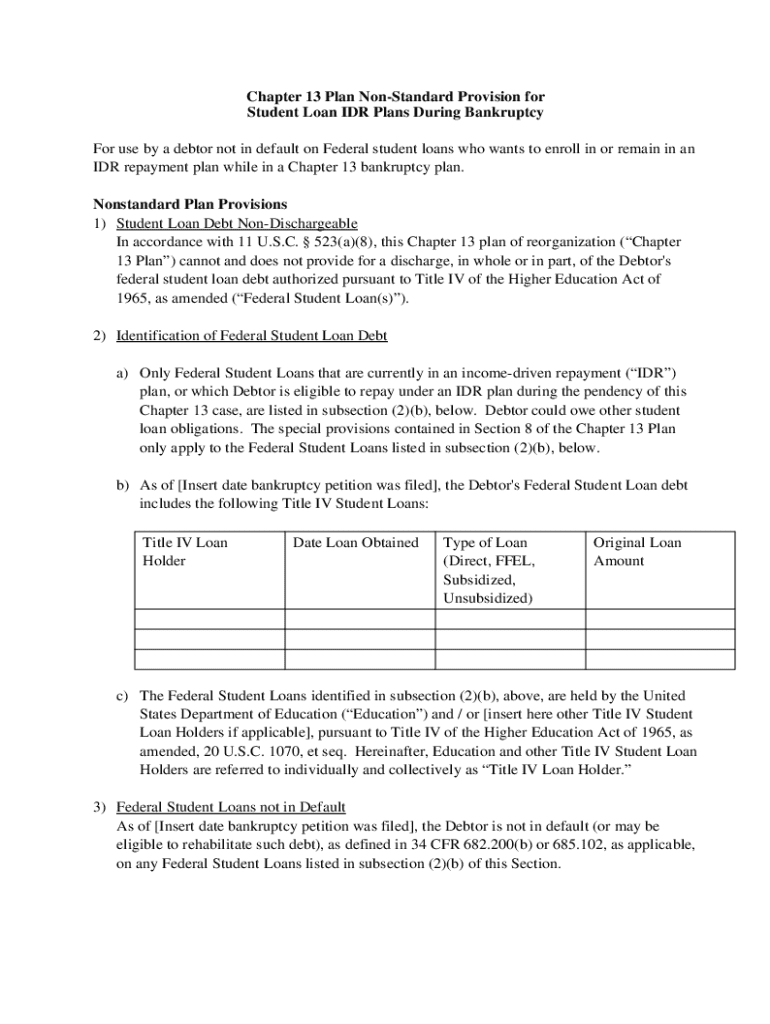

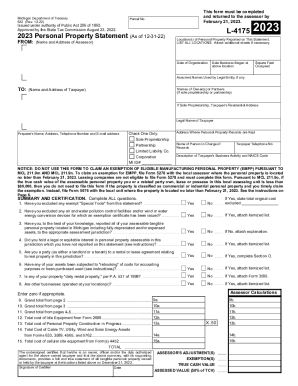

Filling out the student loan IDR plan form requires specific documentation to verify eligibility and ensure accurate payment calculations. The most recent tax return is often the primary document needed as it provides proof of income. This could be either a 1040 form or a transcript from the IRS if available. It's vital to ensure that this document reflects all applicable income accurately.

Beyond the tax return, borrowers should prepare pay stubs or other relevant income documentation for their current employment. For those with additional sources of income, such as rental income or investments, including documentation for these is advisable. Finally, if there are dependents, any additional documentation—like birth certificates or legal guardianship papers—may be required to substantiate the information provided.

How to fill out the student loan IDR plan form

Completing the student loan IDR plan form can seem daunting, but breaking it down into manageable sections can ease the process. Start with your personal information, including your name, contact information, and Social Security number. Ensure that all information is accurate, as discrepancies can lead to processing delays.

Next, you will need to provide details about your student loans. List all eligible federal student loans and include details like the type, balance, and loan servicer. Following that, focus on the income section. Here, you will report your household income, which may involve using your most recent tax return and current pay stubs. It's essential to double-check these numbers for accuracy.

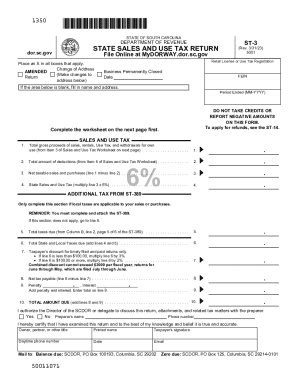

Submitting your IDR plan application

Once the student loan IDR plan form is complete, the next step is to submit it. Many borrowers prefer online submission for convenience and speed. Most loan servicers offer a secure portal where applications can be submitted electronically. This method often provides immediate confirmation of receipt, which is beneficial.

Alternatively, if you prefer a more traditional approach, mailing your application is also an option. Ensure that you send it via a traceable method, such as certified mail, to confirm delivery. Regardless of the submission method, keeping a copy of your completed form and documentation for your records is crucial.

What happens after submission?

After you submit your student loan IDR plan application, processing begins. Typically, loan servicers may take anywhere from a few weeks to a couple of months to review your application. During this time, keep an eye on your email or the servicer's portal for any communications regarding your application status.

Once your application is reviewed, you will receive confirmation of your IDR Plan enrollment. This notice will outline your new monthly payment amount and any relevant terms associated with your plan. Be prepared as there may also be follow-up communications if additional information is required to finalize your application.

Managing changes post-application

Financial situations often change, and it's important to manage your IDR Plan accordingly. If you experience a change in income, such as a significant raise or loss of employment, it’s crucial to report this to your loan servicer immediately. This allows your payment to be recalibrated based on your new financial circumstances.

Additionally, if your circumstances have worsened, you may need to reapply for an IDR Plan altogether. Ensure you have all necessary documentation ready and be mindful of deadlines to avoid any lapse in your repayment plan. Proper management of your IDR Plan helps maintain financial stability.

Resources and tools for seamless management

Managing your IDR Plan effectively is made easier with the right tools. pdfFiller is an excellent resource for document management, allowing users to fill out, edit, and sign forms from anywhere. With its cloud-based platform, users can access their documents at any time for modifications or reviews—ideal for students and borrowers managing their IDR Plan paperwork.

pdfFiller also offers collaboration tools that enable users to work together on documents, making it valuable for teams. Interactive tools available can help calculate potential repayment amounts under various IDR Plans, guiding borrowers to choose the best option. These features not only streamline document handling but also enhance accessibility and organization, ensuring all necessary forms are at your fingertips.

Frequently asked questions (FAQs)

When it comes to IDR Plans, many borrowers have common questions. One frequently asked question is how often you can apply or reapply for an IDR Plan. The answer is that borrowers can request a new IDR Plan anytime their financial situation changes, and they are encouraged to do so at least once a year to keep their terms aligned with their income and family size.

Another common concern is what to do if your application is denied. In this case, you should review the reasons for denial provided by your servicer and address any missing documentation or discrepancies. Additionally, it's important to understand the possibility of switching from one IDR Plan to another; this is allowed and often recommended if a different plan would provide more favorable payment terms.

Customer support and assistance

Finding reliable customer support for student loans can be immensely helpful. To reach your loan servicer for assistance, look for their contact information on official communications or their website. Loan servicers are equipped to answer questions regarding your IDR Plan, address concerns about payments, and offer guidance on what to do if issues arise.

Additionally, pdfFiller provides support resources within their platform, including live chat options for immediate assistance. Whether it's navigating their document management system or having inquiries about filling out the student loan IDR plan form, pdfFiller’s comprehensive support ensures users can effectively manage their documents with confidence.

Next steps after enrollment

Once enrolled in an IDR Plan, it's essential to understand your repayment schedule and stay on track with payments. Reviewing the terms and conditions outlined in your confirmation notice will help you anticipate your monthly obligations. This proactive approach allows you to plan your finances accordingly and avoid any potential late payments.

Additionally, borrowers should keep track of their payments and loan balances, ensuring they stay informed about their debt and any changes. An important aspect of IDR Plans is the annual recertification process. You must submit updated income documentation each year to continue in your IDR Plan, so staying organized with all necessary forms will ease this process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get idr documentation requirements form?

Can I sign the idr documentation requirements form electronically in Chrome?

How can I edit idr documentation requirements form on a smartphone?

What is student loan idr plan?

Who is required to file student loan idr plan?

How to fill out student loan idr plan?

What is the purpose of student loan idr plan?

What information must be reported on student loan idr plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.