Get the free Income Eligibility Scales for School Year 202526 - doe louisiana

Get, Create, Make and Sign income eligibility scales for

Editing income eligibility scales for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out income eligibility scales for

How to fill out income eligibility scales for

Who needs income eligibility scales for?

Understanding Income Eligibility Scales for Form: A Comprehensive Guide

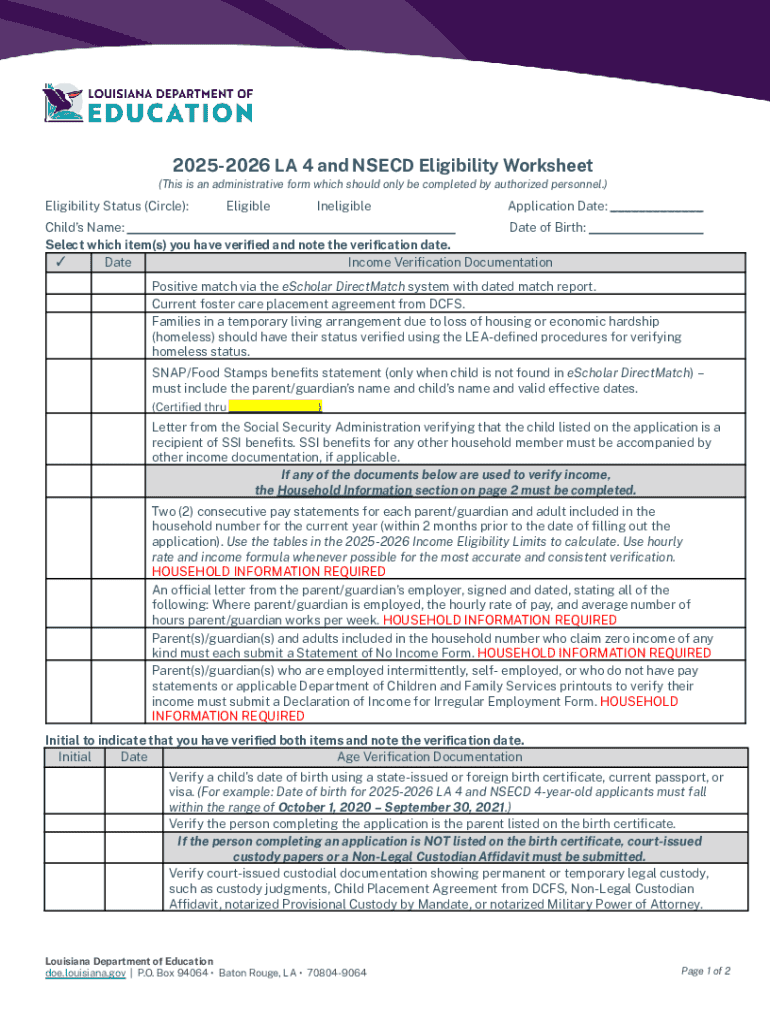

Understanding income eligibility scales

Income eligibility scales are systematic guidelines indicating income limits for individuals and households to qualify for various government assistance programs. These scales are crucial as they determine whom these programs can assist, ensuring resources are allocated to those who genuinely need them. Without these scales, there would be ambiguity and potential misuse of funds intended for vulnerable populations.

The significance of income eligibility in government programs cannot be understated. By basing eligibility on well-structured scales, programs like Supplemental Nutrition Assistance (SNAP) or Medicaid ensure they serve their intended populations effectively and efficiently.

Determining your eligibility

Eligibility for assistance programs is influenced by several key factors. Primarily, your household size and the total income from various sources play significant roles. For example, a household with five members will have different income limits compared to a single-person household. This differentiation ensures that assistance is tailored to the needs of the household.

Moreover, the types of income are also critical in determining eligibility. Earned income, like wages from employment, generally impacts eligibility differently than unearned income, such as pensions or benefits. Additionally, geographical variability means that the income eligibility scales might differ based on the state or even the local area, reflecting different living costs.

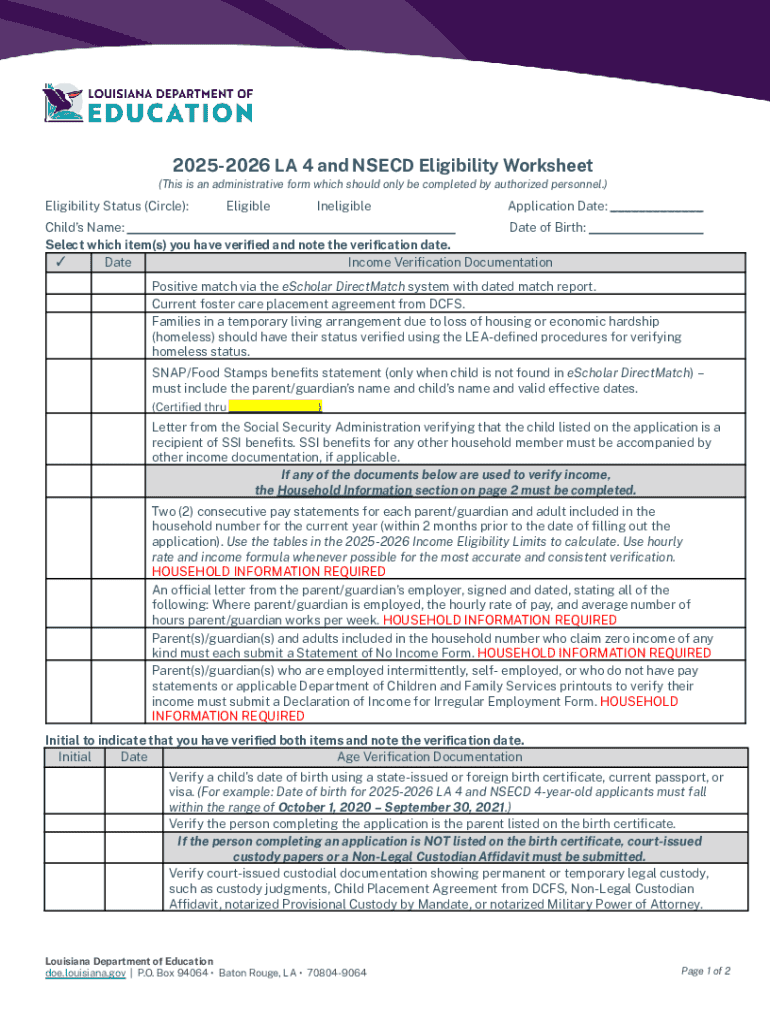

To accurately assess your eligibility, collection of necessary financial information is vital. This includes gathering documents such as pay stubs, tax returns, and proof of any other forms of income. Best practices for record-keeping can greatly simplify this process.

Filling out the income eligibility form

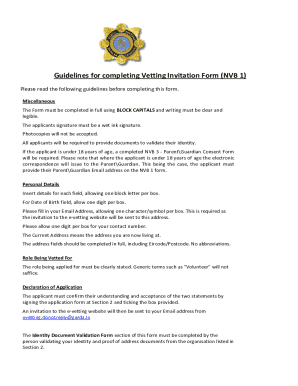

Completing the income eligibility form can be daunting if you’re unfamiliar with the process. Start by accessing the form through pdfFiller, which makes it straightforward and accessible. The website provides a user-friendly interface, allowing you to complete forms online, which can save time and reduce errors.

When filling out the form, focus on specific fields related to income. Ensure that you accurately represent all forms of income—both earned and unearned. It’s essential to include any adjustments you might qualify for, which could affect your overall eligibility.

Remember to double-check entries for clarity and accuracy. Mistakes in financial disclosure could result in delays or denial of your application.

Utilizing income eligibility scales

Understanding the structure of income eligibility scales is vital for assessing your position within these guidelines. Typically, scales are broken down into tiers or levels that denote eligibility limits based on household size and income. For example, a family of four may have a different income ceiling compared to a family of two or six, reflecting diverse financial needs.

Charts and visuals can greatly aid in understanding these scales. For instance, a simple graph may illustrate income ranges, helping applicants identify their standing. It’s critical to interpret your position accurately, as it directly affects which program(s) you can apply for and what benefits you may receive.

Interactive tools for assessing eligibility

Interactive tools, such as the eligibility calculators available on pdfFiller, can significantly enhance your understanding of income eligibility scales. These calculators allow users to input their financial information and receive real-time feedback regarding potential eligibility across various programs.

Using online tools not only makes the assessment process quicker but also reduces errors associated with manual calculations. It equips applicants with immediate insights into their potential eligibility status and what steps they should take next.

Common mistakes to avoid

Navigating income eligibility forms can lead to potential pitfalls. One critical mistake is misreporting income and assets. Ensure you provide accurate figures as discrepancies can lead to denial of benefits. Additionally, failing to consider adjustments for household members can skew your eligibility.

Regularly updating your information is also crucial. Changes in income, household size, or new family members all necessitate a review and update of your eligibility status to avoid lapses in benefits.

Frequently asked questions (FAQs)

One of the most common queries is what happens if your income changes. It's essential to report changes immediately to maintain compliance and continue receiving benefits. Similarly, many wonder how often income eligibility scales are updated; typically, these scales are reviewed annually or bi-annually, reflecting changes in the federal poverty level.

Special considerations may apply to students or disabled individuals. Understanding these nuances is vital, as they may have distinct eligibility criteria compared to the general population.

Managing your eligibility status

Managing your eligibility requires ongoing diligence. Regularly verifying and updating your status will help ensure you remain in compliance with the requirements of programs. Utilize resources available through local assistance offices or online platforms to gain clarity on your current standing.

Should discrepancies arise, or if you believe you have been wrongfully denied assistance, be proactive in seeking help. Many organizations offer support for appeals, guiding applicants through the necessary steps to contest decisions effectively.

Collaborating on forms with pdfFiller

pdfFiller enhances the document management process significantly. Its team features allow multiple users to collaborate seamlessly on group applications, making the filling process efficient. This collaborative approach can be particularly beneficial for organizations or families applying for assistance together.

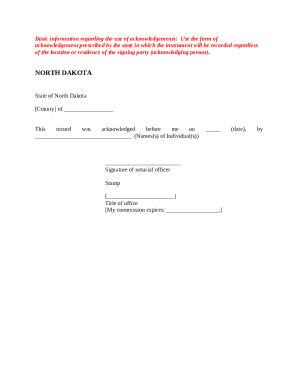

Additionally, saving and sharing options within pdfFiller add a layer of convenience. You can easily manage documents, securely store important records, and ensure proper electronic signature protocols for submission. This assures you’re complying with submission guidelines, paving the way for smoother processing.

Conclusion: Stay informed and agile with your financial eligibility

Regularly reviewing your income eligibility options is pivotal in navigating various assistance programs. Economic circumstances fluctuate, and being proactive in understanding your eligibility keeps you informed and prepared to take advantage of available resources.

Utilizing pdfFiller as a comprehensive solution for document management not only simplifies form completion but also empowers users with the tools necessary for effective collaboration and accuracy. Transform your application experience today with pdfFiller's user-friendly platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit income eligibility scales for in Chrome?

Can I create an eSignature for the income eligibility scales for in Gmail?

How do I edit income eligibility scales for straight from my smartphone?

What is income eligibility scales for?

Who is required to file income eligibility scales for?

How to fill out income eligibility scales for?

What is the purpose of income eligibility scales for?

What information must be reported on income eligibility scales for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.