Get the free Form 13F Report of Institutional Investment Managers ...

Get, Create, Make and Sign form 13f report of

Editing form 13f report of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 13f report of

How to fill out form 13f report of

Who needs form 13f report of?

Form 13F Report of Form: A Comprehensive Guide

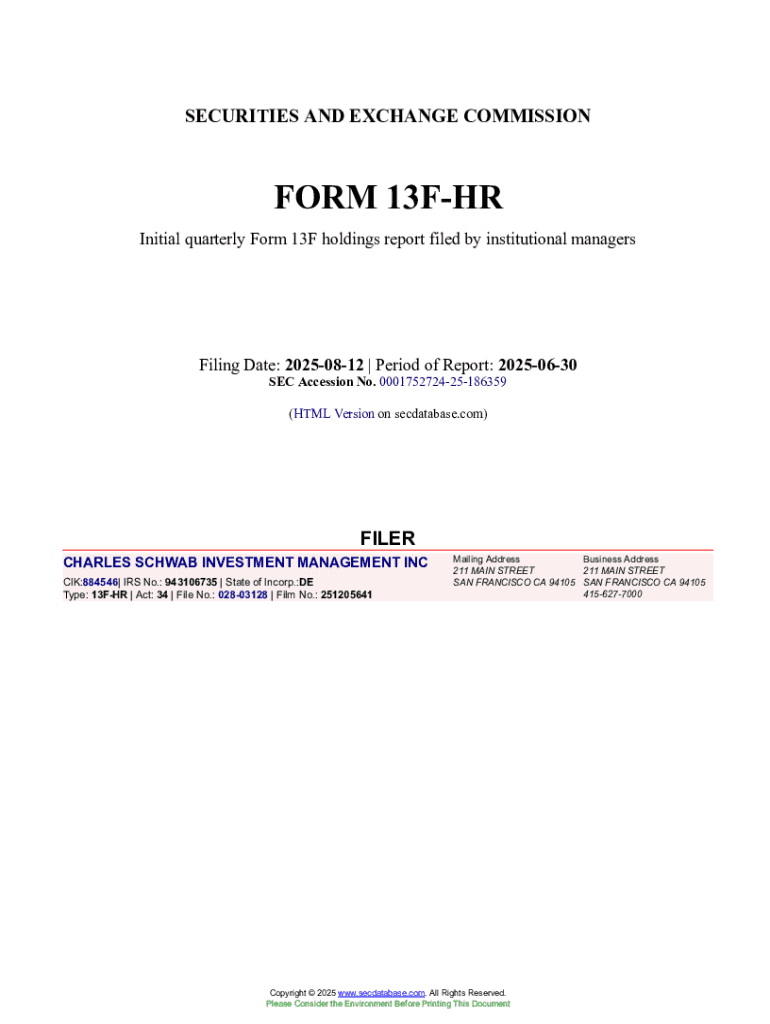

Understanding Form 13F: An overview

Form 13F is a necessary financial reporting document in the United States, designed for institutional investment managers that manage over $100 million in securities. This form is a critical tool required by the Securities and Exchange Commission (SEC) to ensure transparency in the investment sector. Through Form 13F, these managers disclose their equity holdings, enabling regulatory agencies and the public to gain insights into investment trends and institutional behaviors.

The significance of Form 13F lies in its ability to provide a peek into the investment strategies of large institutional investors, which can have a profound effect on market dynamics. By compiling and analyzing this data, market participants can make more informed investment decisions, understand prevailing trends, and conduct competitive analysis.

Legal framework surrounding Form 13F

The regulatory landscape governing Form 13F is grounded in SEC regulations and guidelines. Since its inception in the 1970s, the SEC has mandated its use to monitor the movements of large institutional investors more effectively. The form serves to uphold the integrity of the financial markets by ensuring that institutional managers disclose their holdings, thereby addressing potential conflicts of interest and risk management.

Each Form 13F submitted must include an OMB (Office of Management and Budget) Control Number. This number signifies that the form has been approved for use by federal agencies, confirming compliance with established reporting standards. The existence of this control number emphasizes the importance of structured and standardized reporting in helping the government organization audit these disclosures.

Purpose and objectives of the Form 13F

The primary objective of Form 13F is to compile a comprehensive record of the investment portfolios managed by institutional investors. This reporting initiative helps bolster transparency within financial markets, which is vital for fostering trust among investors and the public. Additionally, it aims to provide insight into the valuation and movement of investments concentrated in certain sectors, enabling stakeholders to better gauge economic health.

Furthermore, the impact of Form 13F on investors and market participants cannot be overstated. By revealing the holdings of institutional managers, it allows smaller investors and analysts to identify potential trends and strategies employed by larger entities. As such, this transparency can lead to more informed investment decisions and greater market efficiency.

Who must file Form 13F?

Form 13F is mandatory for institutional investment managers, which include entities like mutual funds, pension funds, hedge funds, and other entities that manage large amounts of securities. These entities must meet a threshold of having at least $100 million in assets under management, as stipulated by the SEC. This threshold ensures that only the largest, potentially most impactful investors are subjected to this reporting requirement.

Exceptions exist, however, such as for small investment firms or personal trusts that do not meet this asset threshold. The intent behind these regulations is to focus regulatory resources on larger entities that have a more significant impact on market dynamics and investor confidence in the financial system.

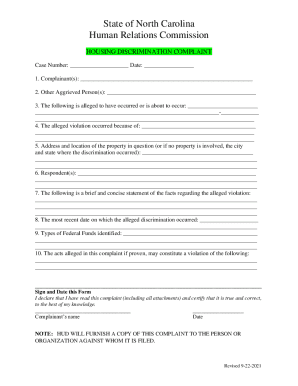

Components of the Form 13F

A well-completed Form 13F includes several critical components, each designed to provide regulatory agencies and the public with a clear snapshot of a manager's investment activities. One of the most vital sections lists all the securities held in the manager’s portfolio, detailing the names, values and number of shares owned.

Additionally, the form requires information about the value of these securities at the reporting date, which provides context for the size and significance of each holding. Another essential element is the disclosure of voting authority and investment discretion for the reported securities, outlining who has the authority to vote on key company decisions regarding the securities held.

The filing process for Form 13F

Completing and filing Form 13F efficiently entails several steps to ensure compliance and accuracy. First, gathering required information related to all securities held is crucial. This includes comprehensive details about each investment, such as the names, values, and quantities of shares. Managers must ensure that their reported data accurately reflects their portfolio as of the end of each quarter.

After gathering the necessary data, the next step involves carefully completing the form. Managers should maintain transparency and accuracy while following the prescribed format, which must then be filed electronically through the SEC's EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system by the applicable deadlines. Common pitfalls involve miscalculating valuations or failing to include all securities, leading to potential penalties and compliance issues.

Frequency of filing

Form 13F must be filed quarterly, aligning with the close of every fiscal quarter. This means that institutional investment managers need to adhere to a structured timeline, ensuring their reports are submitted within 45 days after the end of each quarter. Such regularity is essential for maintaining consistent transparency within financial markets.

Understanding these obligations not only helps managers keep their compliance on track but also offers the market regular updates, fostering informed decision-making among investors and analysts alike. With quarterly reporting, the burden of remaining aware of shifting investment strategies is alleviated, as up-to-date information becomes readily available.

Public release of Form 13F data

Once filed, Form 13F reports are made publicly available via the SEC's EDGAR system. This opens a wealth of information to the public, financial analysts, and market participants, providing valuable insights into the activities of institutional investors. Investors can analyze these filings to track which sectors are gaining interest and which companies are receiving increased attention from major funds.

The accessibility of Form 13F data not only supports market analysis but also promotes a fairer regulatory environment where all investors, regardless of size, can access crucial information. By having this data readily available, all market participants can respond more intelligently to investment trends reported by larger institutions and enhance their decision-making processes.

The role of pdfFiller in managing Form 13F

pdfFiller plays a pivotal role in simplifying the process of managing Form 13F. With its user-friendly interface, institutional managers can easily edit and fill out their forms in a streamlined manner. This adaptability not only reduces the risk of errors during data entry but also vastly accelerates the filing process, allowing for quicker compliance.

Moreover, pdfFiller offers cloud-based solutions, enabling users to store, edit, and manage their Form 13F documents from anywhere, ensuring that vital information is safe and accessible. Features such as eSigning and secure sharing tools enhance collaboration among teams, making it easier for various parties involved in the filing process to work together efficiently on compliance matters.

Managing and organizing filed Form 13F documents

For compliance and audit preparation, it’s crucial for institutional investment managers to maintain organized records of all filed Form 13F documents. Proper archiving ensures that firms can quickly retrieve necessary forms when required for audits or regulatory requests. Establishing a structured file management system can save time when compiling reviews or responding to inquiries.

Best practices for archiving Form 13F reports include regularly updating records, ensuring that filing versions are clearly labeled, and maintaining a digital backup in secure locations. Utilizing databases or document management tools can further enhance order, making it easy for teams to navigate through past reports, especially as more filings accumulate quarterly.

FAQs about Form 13F

Questions commonly arise concerning Form 13F, largely surrounding its filing status and requirements. Some might inquire about what constitutes an institutional investment manager or seek clarity on the $100 million reporting threshold. It's essential for managers to fully understand the criteria and implications of their reporting responsibilities to maintain compliance effectively.

Other frequently asked questions include how the data influences broader market analysis and whether any sanctions arise from failure to comply. Addressing these queries supports a clearer understanding of the responsibilities that come with filing Form 13F, fostering an empowered and knowledgeable investment community.

Navigating challenges with Form 13F

Despite its necessity, the reporting process of Form 13F can pose challenges to institutional investors. Common hurdles may include gathering accurate data, ensuring on-time submissions, and correctly interpreting regulatory guidelines. Navigating these complexities requires diligence, particularly as the financial landscape continuously evolves.

Seeking assistance from compliance experts or legal advisors familiar with SEC regulations is vital for managers facing difficulties with reporting. Consulting resources that provide clarity on requirements can mitigate potential errors, penalties, or even the risk of being flagged by authorities for compliance discrepancies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 13f report of to be eSigned by others?

How do I make changes in form 13f report of?

How do I edit form 13f report of straight from my smartphone?

What is form 13f report of?

Who is required to file form 13f report of?

How to fill out form 13f report of?

What is the purpose of form 13f report of?

What information must be reported on form 13f report of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.