Get the free pay statement request for duplicateemacs

Get, Create, Make and Sign pay statement request for

How to edit pay statement request for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pay statement request for

How to fill out pay statement request for

Who needs pay statement request for?

Pay statement request for form: A comprehensive guide

Understanding your pay statement request

A pay statement is a crucial document generated by an employer detailing the wages earned during a specific pay period and any deductions made. It provides employees with a transparent view of their earnings, including hours worked, pay rates, tax withholding, and other payroll deductions for benefits or retirement contributions. Requesting your pay statement is essential for maintaining accurate financial records, verifying income for loans, and resolving payroll discrepancies.

Common reasons for requesting a pay statement include verifying earnings for tax preparation, applying for loans or mortgages, clarifying discrepancies in pay, and managing personal budgets. Understanding why and when to request a pay statement can empower employees to take charge of their financial health and ensure all records are up to date.

Who can request a pay statement

Typically, any current employee has the right to request their pay statements as part of their benefits. This ensures that employees can regularly check their pay details and keep financial oversight at the forefront of their responsibilities. Furthermore, former employees maintain their rights to access their pay statements for a specified period, which can vary by state and company policy.

Legal guardians or authorized representatives may also submit requests on behalf of employees, particularly in cases where the employee is unable to do so due to health or personal reasons. It's essential to understand these guidelines to avoid complications when requesting pay statements.

The process of requesting a pay statement

Gather required information

Before submitting a pay statement request, it's crucial to gather all relevant information to expedite the process. This includes your employee ID, personal details such as name and address, and specifics about your employment duration and payroll details. Ensuring this information is accurate will not only make it easier for your employer to locate your records but also reduce the likelihood of delays.

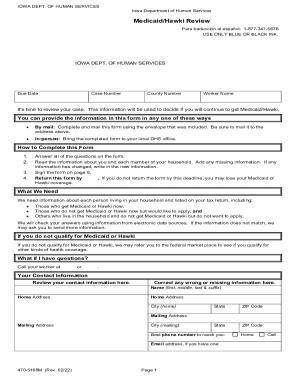

Identify the correct form

Most organizations have a standard pay statement request form available on their employee self-service portal or human resources website. These forms can come in various formats, including PDF, online access, or paper copies. Ensuring you utilize the correct form is vital for a smooth request process, so consult your HR department if you're uncertain about which form to use.

How to fill out the pay statement request form

Step-by-step guide

1. Begin with the contact information section, where you'll provide your name, employee ID, and contact details. Ensure every detail is accurate to avoid any correspondence issues.

2. In the specific request section, clearly indicate the dates regarding which the pay statement is being requested, and any specific types of statements needed (e.g., monthly, quarterly).

3. Lastly, complete the form with your signature to authenticate the request. Without your signature, the form may be considered incomplete.

Tips for accurate completion

Pay attention to common pitfalls such as mismatching dates or providing incorrect employee IDs. Double-check all entries before submitting your request. Also, ensure that any necessary supervisors or departmental approvals are obtained before submitting the form.

Submission methods for the pay statement request form

Online submission

Using platforms like pdfFiller allows for seamless online submission. You can complete the form digitally and e-sign it, making the process faster and more efficient. Benefits of online submission include immediate confirmation and the ability to keep electronic records for future reference.

Mail submission

If you choose to mail your request, be sure to address the form correctly to the designated payroll department. Recommended mailing practices include using certified mail to ensure delivery and maintaining a copy of your request for your records.

In-person requests

For those who prefer a personal touch, you can submit your request in person. Check with your HR department on where to submit the form and what to bring for confirmation, such as identification and any necessary supporting documents.

What to expect after submitting your request

After submitting a pay statement request, expect typical processing times to range from a few days to a couple of weeks, depending on the company's payroll schedule and resources. Many organizations allow you to track your request status, often through an online portal.

If there are delays or issues with the request, it's advisable to contact the payroll department directly for clarification. Having your request details handy will facilitate a smoother follow-up.

Frequently asked questions about pay statement requests

Common queries revolve around what to do if your request is denied. In such cases, reviewing company policies or directly communicating with HR can often provide clarity and potentially rectify misunderstandings.

For employees needing multiple statements, it’s crucial to state this clearly in your request to ensure efficiency. Additionally, being aware of state-specific regulations regarding pay statement access can save time and effort.

Managing your pay statements post-request

After receiving your pay statements, it's vital to store them securely, whether digitally or physically. Consider using pdfFiller's platform for organized cloud storage, allowing easy access to previous records while ensuring they are safeguarded from unauthorized access.

Moreover, creating a systematic approach to tracking and organizing financial documentation can assist in both auditing your pay and preparing for tax season. Regularly check for any duplicates or errors in your records to maintain accuracy.

Additional resources

To facilitate a smooth payroll experience, familiarize yourself with other common forms like W-2 or 1099 for tax purposes. Keeping up-to-date contact information for your payroll department can also assist in resolving any future issues efficiently.

Utilizing online tools for document management can greatly enhance your capability to maintain organized payroll records, so consider exploring additional features offered by pdfFiller.

Benefits of using pdfFiller for pay statement requests

pdfFiller provides a plethora of resources aimed at simplifying your pay statement request process. Its editing features allow for seamless modifications to forms, ensuring that all information is correct before submission.

Moreover, the platform's digital signing capabilities eliminate the hassle of printing and signing documents physically, streamlining the process further. Access to a cloud-based platform means that you can manage your documents from anywhere, making it an optimal choice for individuals and teams alike.

Lastly, the collaborative features of pdfFiller allow multiple users to manage payroll information effectively, making it a powerful resource for organizations striving for efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get pay statement request for?

How do I make changes in pay statement request for?

How do I make edits in pay statement request for without leaving Chrome?

What is pay statement request for?

Who is required to file pay statement request for?

How to fill out pay statement request for?

What is the purpose of pay statement request for?

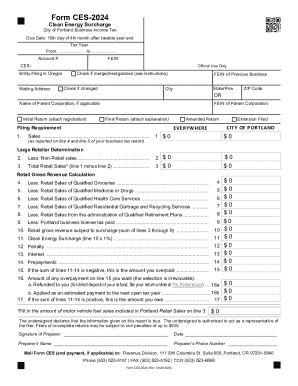

What information must be reported on pay statement request for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.