Get the free Income Driven Repayment Plan Request for the William D. ...

Get, Create, Make and Sign income driven repayment plan

Editing income driven repayment plan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out income driven repayment plan

How to fill out income driven repayment plan

Who needs income driven repayment plan?

Income driven repayment plan form: A comprehensive how-to guide

Understanding income driven repayment plans

Income Driven Repayment Plans (IDR) are tailored to assist borrowers manage their federal student loan payments based on income levels and family size. They adjust monthly payment amounts, ensuring that payments are affordable and manageable for individuals in varying financial circumstances. By aligning payments with income, these plans aim to prevent borrowers from defaulting on loans, ultimately easing the burden of debt repayment.

Choosing the right repayment plan is crucial. Not only can it provide immediate financial relief, but it can also influence long-term financial health by preventing accumulating interest and default consequences. IDR plans are ultimately designed to offer a sustainable path to debt repayment, accommodating fluctuations in income that many individuals face.

Eligibility for IDR plans varies. Generally, borrowers must demonstrate a partial financial hardship, meaning their monthly payment under a standard repayment plan would be higher than what they would pay under an IDR. Specific documentation, such as proof of income or family size, is essential when applying for these plans.

Navigating the income driven repayment plan form

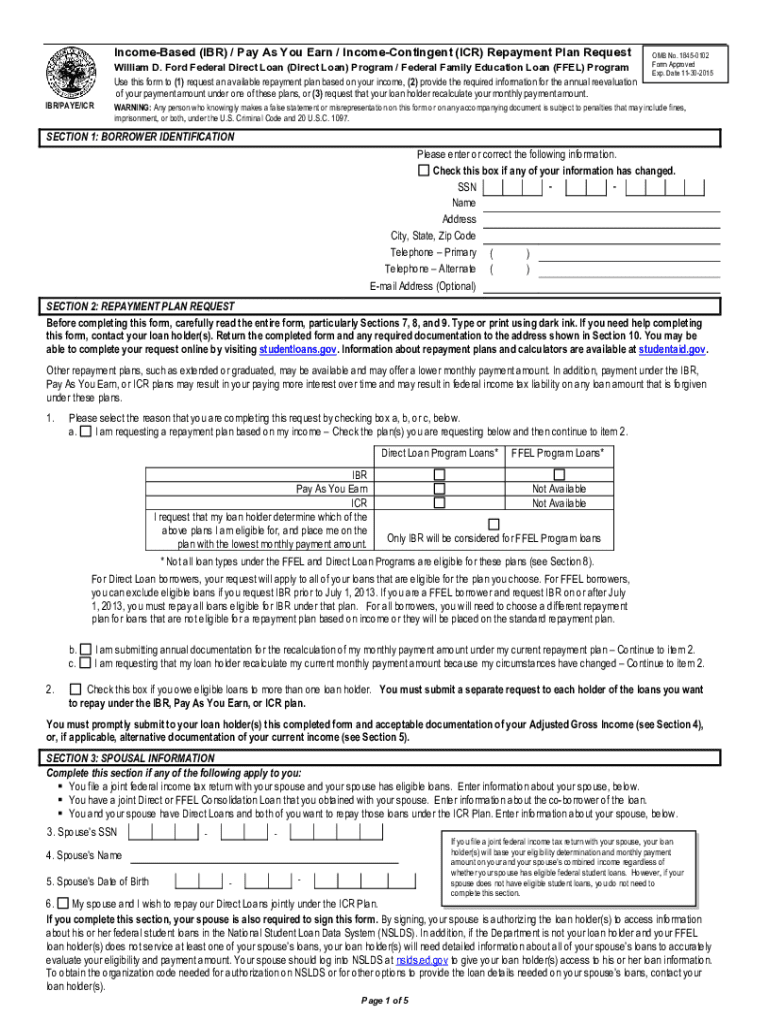

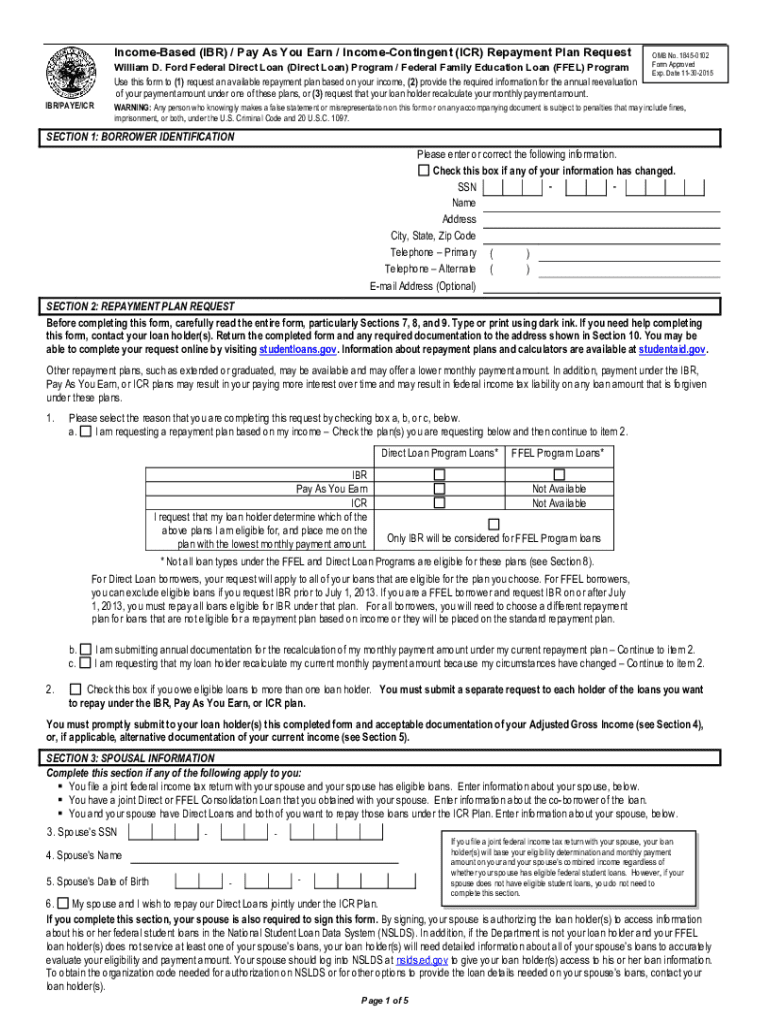

The Income Driven Repayment Plan Form is a critical document that allows borrowers to apply for, and manage, their repayment plans effectively. This form collects essential data regarding your financial situation, household size, and other relevant details that determine your eligibility and repayment obligations.

Accessing the form is straightforward. Most borrowers can obtain it through the Federal Student Aid website or directly from their loan servicer. Additionally, it's available on platforms like pdfFiller, which streamlines the process of filling out such documents.

Filling out the income driven repayment plan form: Step-by-step guide

To ensure your Income Driven Repayment Plan Form is completed accurately, begin by gathering necessary financial documents. This documentation is key to substantiating your income and household information.

Next, you will input your personal information. Accuracy is vital here; provide your full name, address, and contact information, ensuring it matches the details your loan servicer has on record. Inaccuracies can lead to processing delays.

When reporting your income, include all sources. This includes salary, bonuses, and any side income. If you are self-employed, calculate your average monthly income by reviewing your business earnings over the past year, factoring in expenses. This ensures a fair representation of your actual earnings.

Your household size plays a pivotal role in determining your monthly payment amount. Be sure to reflect anyone living in your household who relies on your financial support. Accurate representation can lower repayment amounts significantly, helping to align payments with your financial reality.

Additionally, the form may have optional sections. While they are not mandatory, they can provide the loan servicer with important context about your situation. Filling out these areas may enhance your application and offer a more comprehensive understanding of your financial standing.

Reviewing and submitting your form

Before hitting submit, double-check your information. Key areas to verify include your financial details, personal information, and household size. A minor error could postpone the processing of your application or lead to an inaccurate assessment of your repayment obligations.

Submitting your form through pdfFiller allows for a digital solution that simplifies the process. To submit via pdfFiller, ensure you complete all fields and follow on-screen prompts to electronically send your document. After submission, tracking your submission status can provide peace of mind and confirm that your loan servicer is processing your application.

Editing and managing your form with pdfFiller

After submission, you may find the need to edit your Income Driven Repayment Form, especially if circumstances change or if you realize an error. pdfFiller offers simple editing capabilities that allow users to make modifications easily. This is particularly useful for maintaining accuracy across your documents.

Moreover, pdfFiller includes collaborative tools so you can share your form with advisors or family members who might provide insight or assistance. The platform’s eSignature options enhance efficiency, allowing for quick approvals and confirmations needed for timely submissions.

Common mistakes to avoid when filling out the form

Completing the Income Driven Repayment Plan Form can be straightforward, but common errors can lead to delays or rejection. One frequent mistake is underestimating income — ensure all sources are included to avoid inaccurate reporting. Another common issue is not clearly defining household size; any discrepancies here may result in a higher repayment amount.

To ensure accuracy, consider reviewing your form with someone knowledgeable about financial aid or student loans. Their insights can help catch any mistakes you may have missed.

What happens after submission?

Once you submit your Income Driven Repayment Form, processing times can vary. Generally, expect a confirmation from your loan servicer within a few weeks. During this time, they may reach out to request additional documentation or clarification regarding your financial details.

Understanding how communication will flow from your loan servicer is essential. They will notify you regarding the status of your application and inform you of any approved adjustments or additional information needed. Based on your approval status, you may receive revised payment amounts or updates regarding your repayment plan options.

Additional support and resources

Navigating the Income Driven Repayment Plans and their associated forms can provoke questions. Here are some FAQs that often arise: What happens if my income changes? Can I switch plans? Will my loan servicer provide guidance in filling out the form? Addressing these inquiries is vital for ensuring that you fully understand your options and obligations.

For ongoing documentation needs, resources like pdfFiller can streamline further forms required throughout the repayment process. Whether you need to update your income records or fill out additional documents, leveraging such platforms ensures you remain organized and prepared.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit income driven repayment plan online?

Can I create an eSignature for the income driven repayment plan in Gmail?

How do I edit income driven repayment plan straight from my smartphone?

What is income driven repayment plan?

Who is required to file income driven repayment plan?

How to fill out income driven repayment plan?

What is the purpose of income driven repayment plan?

What information must be reported on income driven repayment plan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.