Get the free RI-1040H Rhode Island Property Tax Relief Claim - tax ri

Get, Create, Make and Sign ri-1040h rhode island property

Editing ri-1040h rhode island property online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ri-1040h rhode island property

How to fill out ri-1040h rhode island property

Who needs ri-1040h rhode island property?

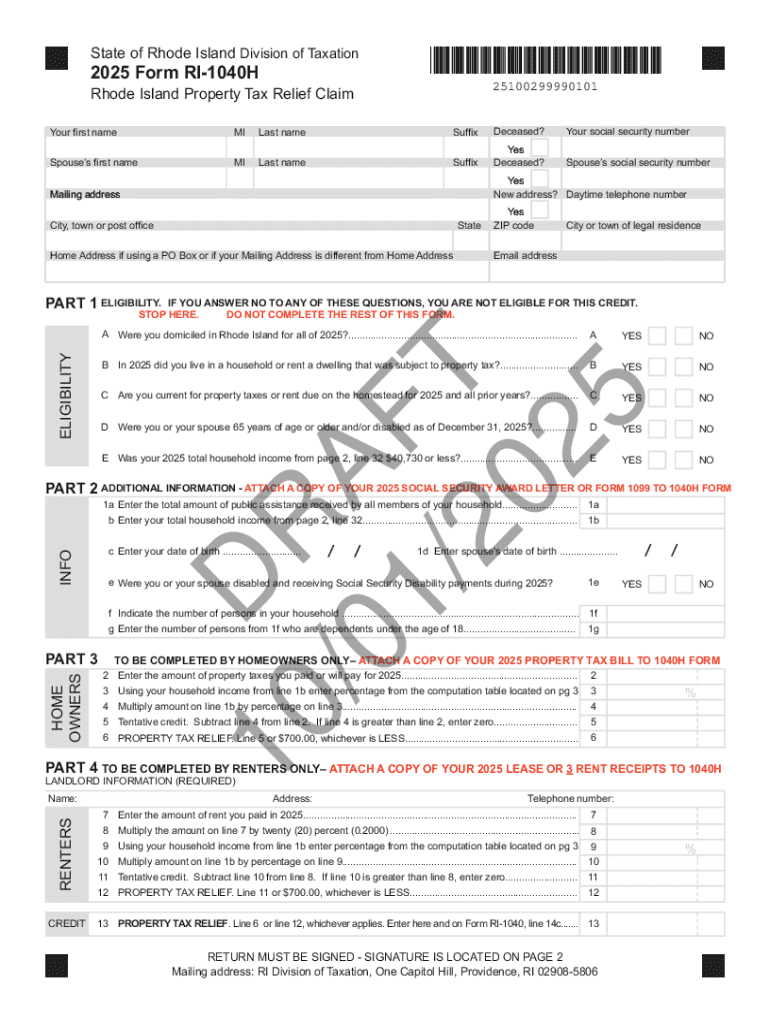

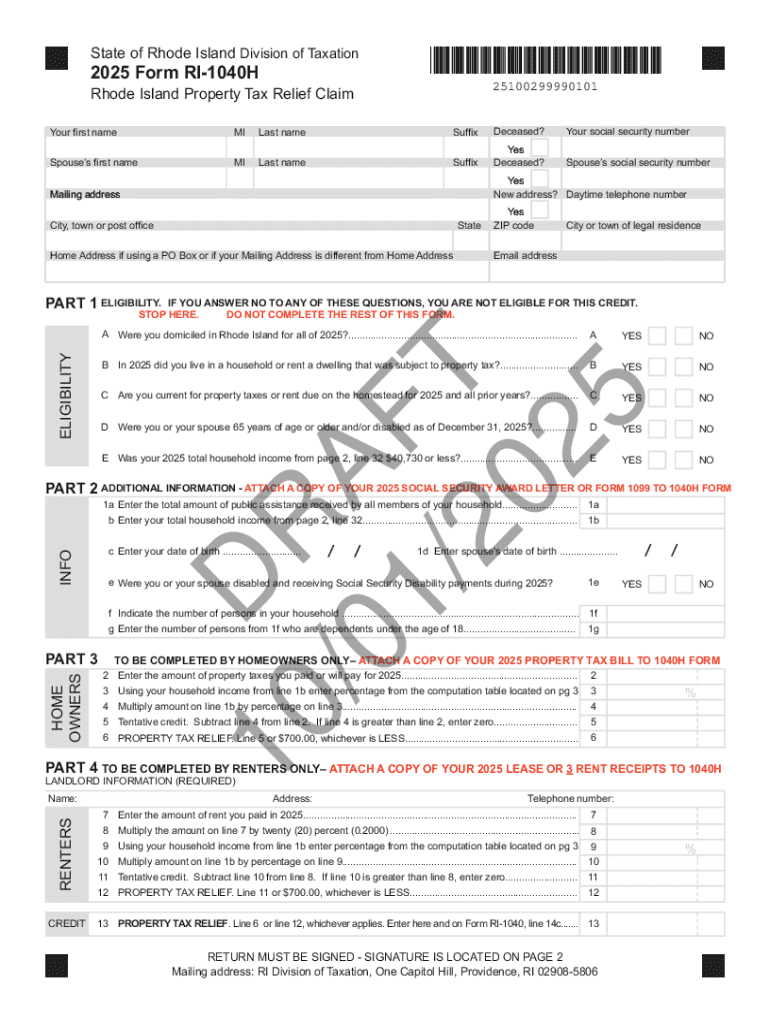

The RI-1040H Rhode Island Property Form: A Comprehensive Guide

Understanding the RI-1040H form: Overview and purpose

The RI-1040H form is a crucial document for property tax relief in Rhode Island. This form is designed for residents aiming to benefit from certain tax exemptions based on their income and housing situation. The significance of this form goes beyond mere compliance; it represents a structured approach to easing the financial burden of property taxes for eligible individuals.

Eligibility for filing the RI-1040H primarily centers around income levels, residency status, and specific demographic factors such as age and disability. Generally, individuals must be homeowners or those renting a property within the state to qualify for claimed relief. Filing deadlines for the RI-1040H are critical to note, often aligning with the state tax return deadlines, which means timely submission can play a vital role in financial planning.

Who should file the RI-1040H?

Determining who should file the RI-1040H involves differentiating between homeowners and renters. Homeowners benefit primarily from the property tax relief provided via this form, while certain renters may also qualify under specific conditions. Typically, these benefits are structured around income thresholds which lower the tax burden. For instance, low-income households or individuals above a certain age may enjoy exemptions or credits that help mitigate property tax expenses.

Further, special exemptions are tailored for seniors and disabled individuals, recognizing the unique financial challenges faced by these groups. To claim property relief, individuals should be aware of their income levels, as exceeding specific thresholds could disqualify them from receiving welfare benefits associated with the RI-1040H.

What you need before filling out the RI-1040H

Before diving into filling out the RI-1040H form, gathering the necessary documentation is essential. The primary documents required include property tax bills that outline the amount due and proof of income such as W-2s and 1099s, which validate income claims. If an individual has filed taxes in the previous year, that return may also be beneficial for reference, ensuring one doesn’t miss any relevant deductions.

An understanding of Rhode Island’s property tax regulations is imperative as these rules dictate the eligibility and extent of relief. Knowing the specific regulations can help ensure that homeowners and renters capitalize on available exemptions, reducing their overall tax burden efficiently.

Step-by-step guide to completing the RI-1040H form

Filing the RI-1040H may seem daunting, but breaking it into manageable sections can simplify the process. Here’s a detailed step-by-step guide:

Interactive tools for managing your RI-1040H form

pdfFiller provides a suite of tools tailored for RI-1040H management. Editing and signing this essential document is straightforward with their interactive platform. Users can collaborate in real time, making it ideal for teams or families managing tax submissions collectively.

Being cloud-based further enhances the appeal, allowing access to your documents from anywhere at any time. This accessibility leads to an organized and streamlined filing process, alleviating the stress often associated with tax season.

Common challenges in filing RI-1040H and solutions

Filing the RI-1040H can present various challenges, ranging from missing documentation to misunderstanding tax regulations. A frequent issue includes misreporting income, which could slow down processing times or result in rejection. Being proactively informed is key to overcoming these errors; thus, consulting available resources prior to filing can be beneficial.

Additionally, understanding notices from the Rhode Island tax authority is crucial. If they request clarification or additional information, it’s essential to respond promptly with accurate data. For those who need further assistance, numerous resources exist, such as local tax offices or online platforms where experienced professionals can provide guidance.

Frequently asked questions about the RI-1040H form

Navigating the nuances of the RI-1040H can prompt numerous questions. A common concern revolves around what to do if you missed the filing deadline: it’s advisable to file as soon as possible, even if late, to access potential benefits for which you may still qualify.

Another issue pertains to amending submitted forms: individuals can indeed amend an RI-1040H form if they discover errors post-submission. Furthermore, understanding how changes in income affect relief applications is vital, ensuring you remain eligible according to the updated income thresholds.

Leveraging pdfFiller for smooth document management

Utilizing pdfFiller for managing your RI-1040H offers several advantages, including its eSignature functionality. This feature significantly speeds up the process for obtaining signatures, crucial for refunds and potential appeals, especially as deadlines approach.

Users have reported smoother experiences when filing their forms through pdfFiller, citing its user-friendly interface. Testimonials reflect enhanced efficiency when leveraging this platform, allowing users to seamlessly manage and submit their documents without friction.

Keeping track of future updates to the RI-1040H

As the property tax landscape in Rhode Island evolves, being prepared for future updates to the RI-1040H is vital. Changes could arise from shifts in regulations that might affect property owners directly. Staying attuned to tax-related news via official state channels or local news outlets can help homeowners react promptly to such updates.

Implementing best practices involves maintaining an organized filing system for documents and utilizing platforms like pdfFiller to keep your forms updated. This practice not only supports compliance but allows for quick adjustments when tax laws change.

Why choose pdfFiller for your RI-1040H needs?

pdfFiller stands out for its unique features tailored specifically for the RI-1040H form. The platform's emphasis on efficient editing and easy document management makes it an invaluable resource during tax season. Compared to traditional filing methods, pdfFiller provides streamlined solutions that emphasize user experience.

Moreover, its commitment to enhancing document management further solidifies pdfFiller as a go-to platform. Users can expect not just a tool, but a comprehensive ecosystem supporting their success in navigating the complexities of tax filing.

Final tips for successful RI-1040H submission

To wrap up, adopting a checklist approach before submitting the RI-1040H can ensure accuracy and preparedness. Key items to verify include ensuring all documents are complete, double-checking entries for accuracy, and confirming submission methods while retaining copies of your application for future reference.

Additionally, staying proactive by tracking any responses or follow-ups from tax authorities allows for an organized approach toward potential queries or issues that may arise post-filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ri-1040h rhode island property in Gmail?

How do I make edits in ri-1040h rhode island property without leaving Chrome?

How do I fill out the ri-1040h rhode island property form on my smartphone?

What is ri-1040h rhode island property?

Who is required to file ri-1040h rhode island property?

How to fill out ri-1040h rhode island property?

What is the purpose of ri-1040h rhode island property?

What information must be reported on ri-1040h rhode island property?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.