Get the free Information concerning the financial services offered by RESCAD SA

Get, Create, Make and Sign information concerning form financial

Editing information concerning form financial online

Uncompromising security for your PDF editing and eSignature needs

How to fill out information concerning form financial

How to fill out information concerning form financial

Who needs information concerning form financial?

Information Concerning Financial Forms: A Comprehensive Guide

Understanding financial forms

Financial forms serve as the backbone of a myriad of financial activities, documenting essential transactions, applications, and reports. Defined as standardized documents, they collect and communicate financial information necessary for a range of purposes, including taxes and loans. Each financial form plays a crucial role in ensuring transparency and accountability in the financial process.

Accurate financial reporting is paramount, as it affects everything from personal budgets to corporate financial health. People and organizations rely on these forms to accurately represent their fiscal status. Failure to complete these documents correctly can lead to significant repercussions, including legal and financial penalties.

Key components of financial forms

Financial forms typically require essential information to ensure appropriate processing and compliance with relevant regulations. Personal identifiable details of the individual completing the form, such as name, address, and Social Security Number, are necessary to authenticate identity and trace financial history.

In addition to personal details, financial forms demand accurate financial data, including income sources, assets, and liabilities. This financial information provides a snapshot of an individual's or organization's economic standing, crucial for lenders, tax authorities, and other stakeholders. Lastly, signatures and dates are vital components that validate the authenticity of the information provided.

Moreover, understanding common terminology used in financial forms is essential. Key terms like assets, liabilities, and equity are frequently encountered. An asset is anything of value owned, liabilities are obligations or debts, and equity represents the owner's interest in the financial entity.

Step-by-step guide to completing financial forms

Completing financial forms can seem intimidating, but following a structured approach simplifies the process. Begin by gathering all necessary documents. This may include pay stubs, bank statements, tax return documents, and proof of identity. Organizing these documents beforehand ensures that you have all the critical information at your fingertips.

Next, as you fill out the financial forms, precise entry of data is crucial. Take advantage of digital solutions like pdfFiller that allow you to interactively fill forms online. A common best practice is to double-check the data after entry; minor errors can lead to delays or rejection of your submission.

Finally, once your forms are completed, establish a thorough review process. Verify that all information is accurate and complete. It might help to have someone else check the form for mistakes or omissions. After confirming accuracy, submit the forms promptly, keeping in mind that the method of submission can affect processing times.

Editing and managing financial forms

One key advantage of using pdfFiller is the capability to efficiently edit financial documents post-completion. Users can easily upload documents to the platform, ensuring they can make necessary adjustments without hassle. Editing can involve adjusting text, images, or adding signatures swiftly, which enhances user experience.

Moreover, collaboration on financial forms has become increasingly accessible. pdfFiller encourages sharing documents with team members, allowing for collective input and insights. New features enable comments and the tracking of changes, facilitating a smooth collaborative environment that enhances the overall efficiency of managing financial documents.

eSigning financial forms

Electronic signing, or eSigning, has transformed how individuals and organizations manage financial forms. This method is not only expedient but adds an extra layer of security as well. By setting up an eSignature on platforms like pdfFiller, users can ensure that their documents remain secure and encrypted during the signing process, which is crucial for sensitive financial data.

The process for eSigning within pdfFiller is streamlined: set up your eSignature, apply it to the required document, and send it for necessary approvals. This method reduces turnaround time significantly while maintaining document integrity, providing convenience for busy individuals and organizations alike.

Common issues and FAQs related to financial forms

It's common for users to encounter issues while working with financial forms. Frequently asked questions often revolve around what actions to take if a mistake is made. It is advisable to contact the relevant authority or lender promptly and follow their guidance on amendments, particularly as regulations can vary depending on local laws and practices.

Additionally, users may wonder how to handle rejections of submissions. Understanding the exact reason for rejection, whether it’s missing information or incorrect calculations, is critical. Resolving these issues swiftly ensures that your financial needs are met without unnecessary delays.

Conclusion and next steps

Staying organized with financial documents is essential for both individual and business success. Using digital tools like pdfFiller can vastly enhance efficiency in managing financial forms, facilitating editing, collaboration, and security. By leveraging the platform’s comprehensive features, users can optimize their financial documentation processes, reduce stress, and maintain accuracy.

Embracing the digital transformation in document management empowers users with the flexibility and speed necessary for efficient operations. This journey into financial documentation not only drives productivity but ensures detailed attention to the accuracy of the financial forms that are so crucial in today’s economy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

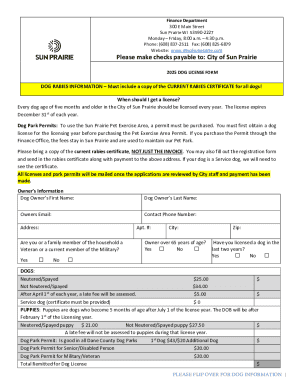

How do I complete information concerning form financial online?

Can I create an eSignature for the information concerning form financial in Gmail?

How can I fill out information concerning form financial on an iOS device?

What is information concerning form financial?

Who is required to file information concerning form financial?

How to fill out information concerning form financial?

What is the purpose of information concerning form financial?

What information must be reported on information concerning form financial?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.