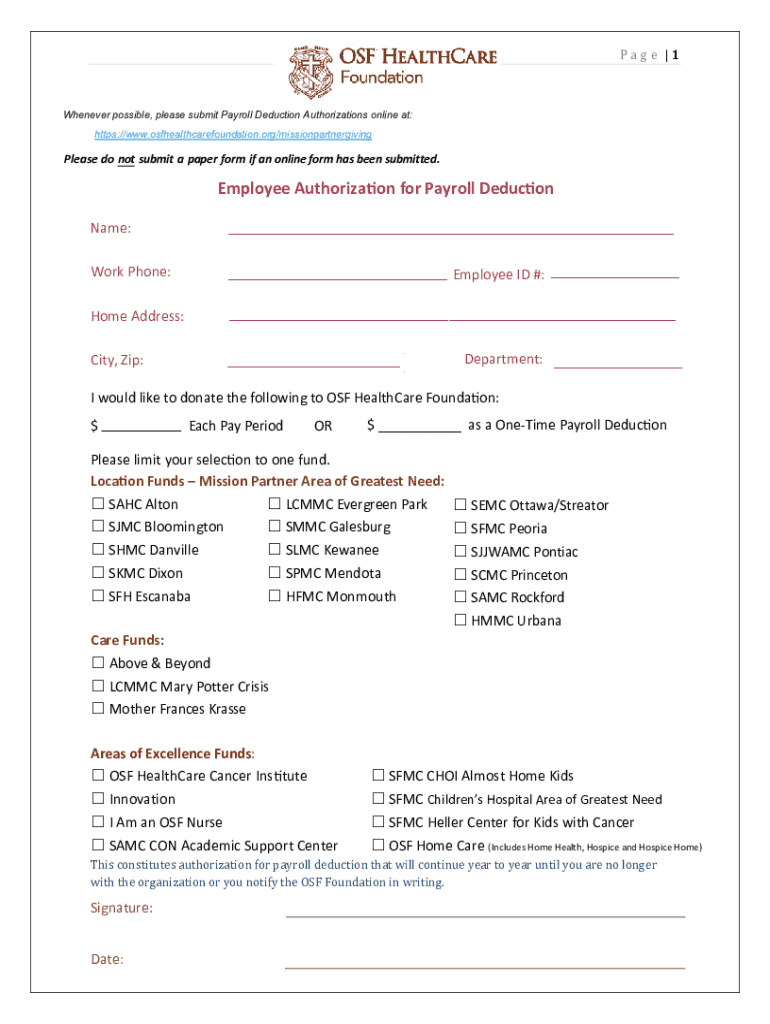

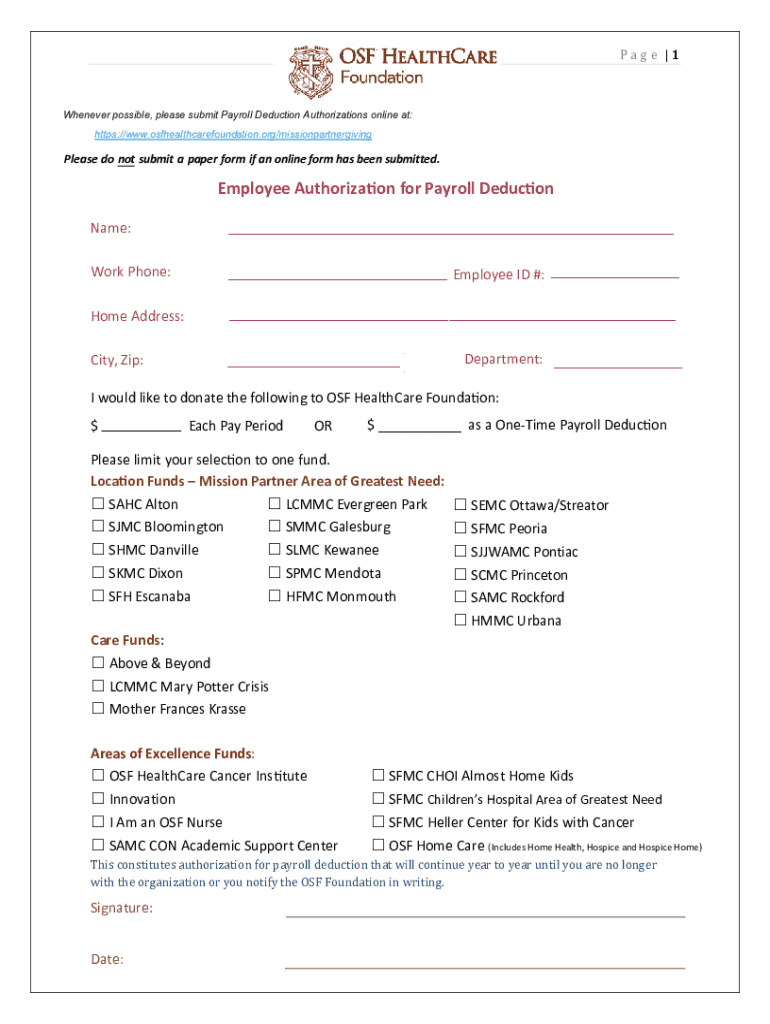

Get the free Employee Authoriza on for Payroll Deduc on

Get, Create, Make and Sign employee authoriza on for

How to edit employee authoriza on for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employee authoriza on for

How to fill out employee authoriza on for

Who needs employee authoriza on for?

Employee Authorization for Form: A Comprehensive Guide

Understanding employee authorization

Employee authorization is a critical process that ensures individuals have the proper permissions to undertake specific roles or access certain resources within an organization. This process not only safeguards the company’s interests but also protects workers by defining their roles clearly. In essence, employee authorizations help maintain a structured workplace where everyone understands their rights and responsibilities.

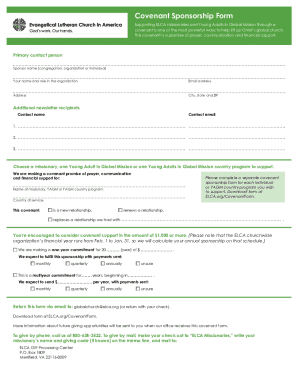

Overview of forms related to employee authorization

Various forms play an integral role in the employee authorization process. These forms ensure compliance with laws and regulations while streamlining internal processes. It's essential for employers and employees to be aware of these documents as they navigate the authorization landscape.

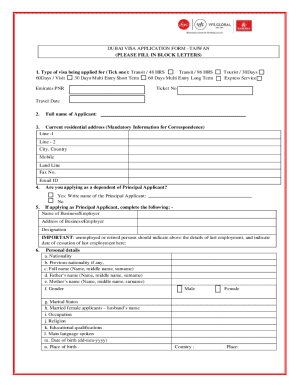

Detailed insights into the Form -9

Form I-9 is vital for confirming an employee's eligibility to work in the United States. Employers must complete the I-9 form for every new hire, ensuring that they possess valid identification and work authorization documents. This not only protects the employer from penalties but also ensures that employees work in compliance with federal laws.

Completion of the Form I-9 is mandatory for every person who gets hired post-November 6, 1986. The form requires specific identity verification, including a combination of documents that prove both identity and legal work status. Employers are responsible for ensuring the form is completed accurately within specific deadlines, making this a crucial administrative duty.

Step-by-step guide to completing the Form -9

Completing the Form I-9 accurately is essential to ensure compliance with federal regulations. Here’s a concise guide to help both employees and employers through the process.

Step 1: Gathering necessary documentation

Before filling out the Form I-9, it’s crucial to gather the necessary documentation. Employees must present valid documents that verify their identity and employment authorization. Acceptable documents include:

Step 2: Filling out Section 1

In Section 1 of Form I-9, the employee must provide their personal information, including name, address, date of birth, and attest to their work authorization status. It’s essential to avoid common errors like typos or using nicknames. This section must be completed before the start of employment.

Step 3: Employer's responsibilities in completing Section 2

In Section 2, employers are responsible for reviewing the provided documentation and verifying the employee’s identity and work eligibility. This involves recording the document details on the form and signing to confirm the verification took place. Employers must adhere to an important three-day deadline to complete this section, or they can face penalties.

Managing and retaining the Form -9

Proper management and retention of Form I-9 are crucial for compliance with U.S. immigration laws. Employers must retain completed forms for a designated period, typically three years after the date of hire or one year after termination, whichever is longer. Proper storage methods and regular audits are necessary to ensure adherence to these requirements.

Utilizing pdfFiller for employee authorization forms

pdfFiller simplifies the employee authorization form process, including Form I-9. Users can easily create and edit forms from anywhere, ensuring they are always up-to-date with the latest information and compliance requirements. Utilizing pdfFiller not only streamlines the form-filling process but enhances collaboration among team members.

Common challenges and solutions in employee authorization

Navigating the complexities of employee authorization can present various challenges. Ensuring compliance with ever-evolving regulations and securing sensitive information are common issues facing employers. To tackle these, proactive strategies and reliable tools like pdfFiller can greatly enhance the process.

Interactive tools and resources

pdfFiller offers interactive tools to assist users in navigating employee authorizations. Document templates can streamline the creation of various authorization forms, while checklists ensure no steps are overlooked during completion.

Case studies and success stories

Real-world applications illustrate how effective employee authorization management can enhance organizational efficiency. Teams that have implemented pdfFiller report significant improvements in their document handling and authorization processes. Testimonials highlight the rapid turnaround times and improved accuracy resulting from using this digital solution.

Next steps in employee authorization management

To effectively navigate employee authorization, establishing a routine for verifications is essential. Organizations should create a calendar to track deadlines for documentation, ensuring compliance at all stages. Staying updated on legal changes is also key to maintaining an effective and compliant employee authorization process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get employee authoriza on for?

How do I edit employee authoriza on for online?

How can I edit employee authoriza on for on a smartphone?

What is employee authorization for?

Who is required to file employee authorization for?

How to fill out employee authorization for?

What is the purpose of employee authorization for?

What information must be reported on employee authorization for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.