Get the free Tax Exempt Information - Purchasing Office

Get, Create, Make and Sign tax exempt information

How to edit tax exempt information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax exempt information

How to fill out tax exempt information

Who needs tax exempt information?

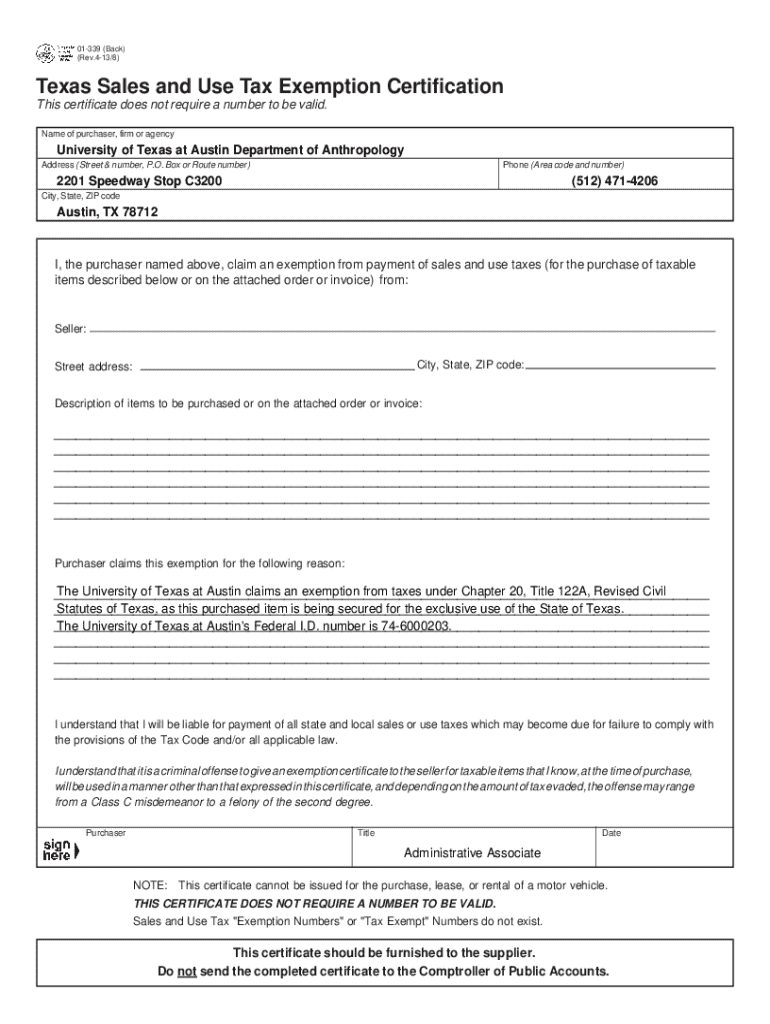

Tax Exempt Information Form – A Comprehensive How-to Guide

Understanding tax exemption

Tax exemption refers to the monetary relief granted by the government to certain individuals, entities, or organizations, allowing them to avoid paying certain taxes. This status is particularly significant as it provides financial advantages, enabling funds to be allocated toward a mission or service rather than tax obligations. For organizations, especially non-profits, this status is crucial as it can enhance credibility, attract donors, and facilitate the growth of community service initiatives.

Types of tax exemptions

Various categories of tax exemptions exist, tailored to different organizations and purposes. It's essential to understand these categories to determine eligibility, as each has unique qualifications and documentation requirements. The primary categories are charitable organizations, religious entities, educational institutions, and governmental organizations. Each serves a specific societal role and has criteria that must be met for tax-exempt status.

Eligibility for these categories requires submitting thorough documentation. For example, charitable organizations need to provide proof of their charitable purpose, while educational institutions must demonstrate formal accreditation and operational compliance with educational standards.

What is a tax exempt information form?

The tax exempt information form is a crucial document used to apply for and maintain tax-exempt status. This form gathers necessary information about the organization or individual seeking the exemption, showcasing eligibility based on established criteria. By effectively completing this form, applicants relay essential information to the government, illustrating how their organization aligns with tax-exempt goals.

Step-by-step guide to completing the tax exempt information form

Before filling out the tax exempt information form, proper preparation is necessary. This includes gathering all relevant documents and ensuring you understand the terminology used throughout the form. Being familiar with terms such as ‘public benefit’ and ‘non-profit’ can help you navigate the form more efficiently. Take time to review IRS guidelines and determine which section aligns with your organization's mission.

Avoid common mistakes, such as providing incorrect personal information or omitting necessary financial details. Incomplete submissions or missing supporting documents can lead to delays in approval or outright denial, thus it’s imperative to double-check every detail before submission.

Submitting your tax exempt information form

Once you've completed the tax exempt information form, the next step is submission. There are generally two methods for sending your application: online and physical mailing. Online submission via e-filing is often encouraged as it speeds up the processing time. However, if you choose to mail in your application, ensure that you send it to the correct government organization address and use a reliable postal service.

After submission, your form will enter a review process where officials assess your application. Timelines vary, but generally, applicants can expect a few weeks to months for approval or denial notifications based on the complexity and volume of applications received.

Managing your tax exempt status

Maintaining tax-exempt status necessitates ongoing compliance with both IRS regulations and any relevant local laws. Organizations must be aware of annual filing requirements, such as Form 990, while also keeping the IRS informed of any significant changes in their structure or operations. This vigilance ensures that the organization remains eligible for the tax benefits provided.

Handling the revocation of tax-exempt status involves understanding common reasons, such as failure to operate within permitted activities or issues with governance. If your status is revoked, you may appeal the decision through formal channels or take corrective measures to reinstate your status with the necessary adjustments.

Tools and resources for managing tax exempt information forms

pdfFiller emerges as an efficient solution for managing tax-exempt information forms. With its cloud-based platform, users can easily edit, sign, and share forms with colleagues, removing the need for cumbersome paper processes. This streamline enables teams to collaborate in real-time, ensuring that every necessary document is in place without delay.

Frequently asked questions (FAQs)

Commonly asked questions include inquiries about how to successfully maintain tax exemption status and troubleshoot issues with the tax exempt information form. Many applicants often wonder about challenges faced during the submission process or ways to simplify the documentation requirements. Resources such as government websites, including the IRS and local organizations, offer extensive guidance to help individuals navigate the complexities of tax exemption and forms.

Success stories: Real-world examples of effective tax exemption applications

Many organizations have experienced success in applying for tax-exempt status by conducting thorough research and preparation. Case studies highlight the triumphs of various entities, from small non-profits to significant educational institutions achieving exemption through determination and attention to regulatory detail. These stories illuminate the best practices and lessons learned, showcasing that perseverance and understanding criteria laid out by government organizations such as the IRS can lead to fruitful applications.

These examples serve as a reminder that understanding the submission process and maintaining a clear adherence to the regulations can amplify an organization's chances of success in gaining and retaining tax-exempt status.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find tax exempt information?

How do I edit tax exempt information on an iOS device?

How do I fill out tax exempt information on an Android device?

What is tax exempt information?

Who is required to file tax exempt information?

How to fill out tax exempt information?

What is the purpose of tax exempt information?

What information must be reported on tax exempt information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.