Get the free Massachusetts Sales Tax Resale Certificate Form ST-4

Get, Create, Make and Sign massachusetts sales tax resale

How to edit massachusetts sales tax resale online

Uncompromising security for your PDF editing and eSignature needs

How to fill out massachusetts sales tax resale

How to fill out massachusetts sales tax resale

Who needs massachusetts sales tax resale?

Massachusetts Sales Tax Resale Form: A Comprehensive Guide

Understanding the Massachusetts Sales Tax Resale Form

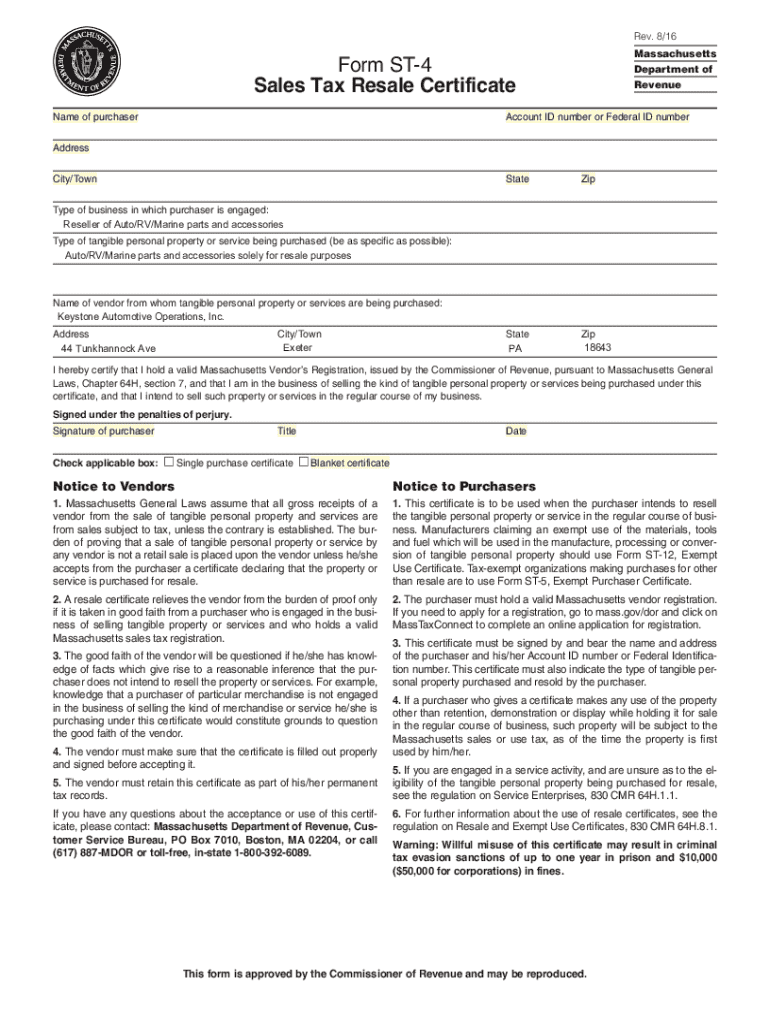

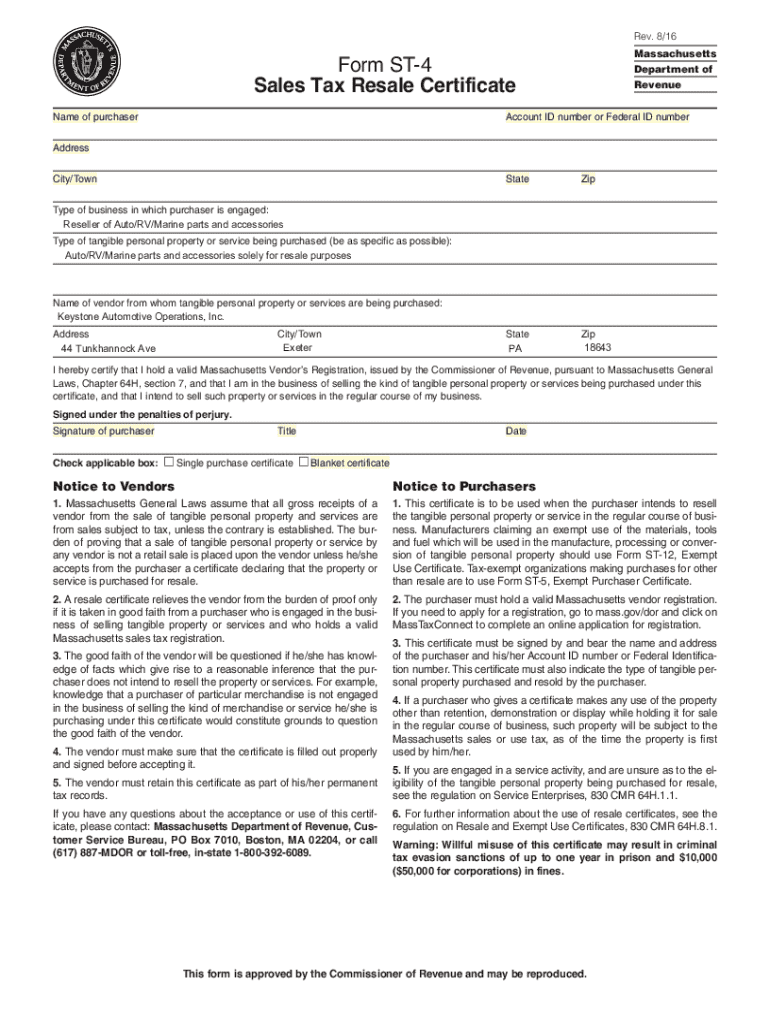

The Massachusetts Sales Tax Resale Form is a crucial document for businesses involved in reselling goods. This form, also known as the Massachusetts resale certificate, enables buyers to purchase items without paying sales tax, provided those items are intended for resale rather than personal use. As a legal document, it facilitates a smooth transaction process between wholesalers and retailers by clearly indicating that the transaction is tax-exempt.

The purpose of the resale form is to support businesses in compliance with Massachusetts sales tax laws. It ensures that tax is only paid on the final sale to the end consumer, thus preventing double taxation. Understanding who needs the resale form is vital; typically, any business purchasing goods for resale must fill out this form to avoid unnecessary tax payments.

Key information on the Massachusetts resale certificate

The Massachusetts resale certificate includes several key pieces of information that are essential for both buyers and sellers. Each certificate must provide the buyer's name, address, and the seller's name and address, alongside the nature of the business. Furthermore, the certificate must cite the seller's Massachusetts Sales Tax Registration number and clearly describe the goods being purchased for resale.

One significant aspect to keep in mind is the validity period of the certificate. While there is no specific expiration date, businesses should routinely check and update their certificates, especially if any information changes or upon the introduction of new products for resale. Staying mindful of the certificate's validity helps ensure ongoing compliance with state regulations.

How to obtain the Massachusetts Sales Tax Resale Form

Obtaining the Massachusetts Sales Tax Resale Form is a straightforward process. Step 1 involves downloading the form from the official Massachusetts Department of Revenue website. The document is readily available in PDF format and can be printed out for completion.

Required documentation generally includes your business's tax identification number and proof of operating status, like a certificate of organization or business license. Alternatively, individuals may acquire the form by making an in-person request at local government offices, where assistance is often readily available. For further guidance, contacting the State Taxation Office can provide essential insights into the form acquisition process.

Filling out the Massachusetts Sales Tax Resale Form

Filling out the Massachusetts Sales Tax Resale Form accurately is crucial for avoiding delays or issues during transactions. The form typically includes sections for personal and business information, detailing the buyer's contact details, business type, and tax identification number. Buyers must also provide a specific description of the goods being purchased for resale, ensuring clarity for both parties involved in the transaction.

It is essential to pay attention to the signatory requirements; the form must be signed by an authorized representative of the purchasing business. Common mistakes that can occur while filling this form include omitting critical information, providing incorrect tax identification numbers, or failing to sign the document. To ensure accuracy, double-check all entries and update the form whenever business details change.

Using or accepting a Massachusetts resale certificate

Retailers accepting a Massachusetts resale certificate hold specific legal responsibilities. They must verify the authenticity of each resale certificate presented and maintain proper records to demonstrate compliance with tax laws. This includes keeping on file the resale certificates for all tax-exempt purchases, ensuring that they are accurately filled out and up to date.

For buyers, it’s crucial to understand the appropriate scenarios for using the resale certificate. Misuse, such as utilizing it for personal purchases or non-resale items, can lead to severe consequences, including penalties and back taxes owed. Clear communication with suppliers is necessary to avoid any compliance issues.

Resale certificate vs. Massachusetts sales tax permit

There is a distinct difference between a Massachusetts resale certificate and a sales tax permit. The resale certificate is specifically used for tax-exempt purchases of items intended for resale, while the sales tax permit grants permission for a business to collect sales tax on retail sales. Businesses must be aware of when to use each document to comply with Massachusetts tax laws effectively.

Understanding this difference is pivotal for maintaining compliance and avoiding costly mistakes. A failure to collect appropriate sales tax from customers can lead to back tax liability, making it all the more important for businesses to prioritize correct documentation for every transaction.

Out-of-state resale certificates: what you need to know

Many businesses often wonder whether Massachusetts accepts resale certificates from other states. The answer is, yes, Massachusetts does recognize certain out-of-state resale certificates; however, there are limitations and considerations to keep in mind. Businesses utilizing out-of-state certificates must ensure that the goods purchased are intended for resale and the certificate conforms to Massachusetts standards.

It's important to verify that the form from another state includes the required information, such as the buyer’s tax identification number and a clear description of the purchase. Additionally, businesses should be cautious, as improperly used out-of-state resale certificates might lead to complications during audits.

Additional licensing requirements

In addition to the Massachusetts Sales Tax Resale Form, businesses may also be required to obtain a resale license. This application is often necessary for businesses intending to sell goods at retail, and the process typically involves submitting specific documentation to the Massachusetts Department of Revenue. Key aspects of the application include proof of business formation and periodic reporting to the state.

Costs associated with applying for a resale license may vary, but businesses must factor in any applicable fees during the application process. Frequent inquiries regarding this licensing often revolve around the time it takes to obtain the license and any prerequisite documents necessary to initiate the application.

Interactive tools and resources

For businesses seeking to optimize their management of the Massachusetts Sales Tax Resale Form, pdfFiller's interactive form tool offers a streamlined solution. This platform enables users to easily edit PDF documents, eSign forms, and collaborate with teams seamlessly from a single cloud-based interface. Such tools are invaluable for ensuring all documents remain compliant with the latest tax regulations.

Additionally, digital signature compliance through such platforms can expedite the process, thereby allowing businesses to manage documentation more efficiently. By collaborating effectively, teams can keep proper records and ensure that all forms, including the sales tax resale certificate, are accurate and readily accessible.

Frequently asked questions

When it comes to the Massachusetts Sales Tax Resale Form, several questions arise commonly among users. A frequent concern is what to do if a mistake is made on the resale certificate. In such instances, it is recommended to correct the error promptly and, if necessary, reissue a new certificate to the supplier, indicating the corrected information.

Another common question is whether the resale certificate can be used for personal purchases. The short answer is no; the resale certificate is intended strictly for items purchased for resale. Misuse not only jeopardizes the transactional integrity but can have tax implications. Lastly, many individuals inquire about the processing time for their application; generally, it may take several weeks, depending on the volume of requests handled by the state department.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit massachusetts sales tax resale from Google Drive?

How do I edit massachusetts sales tax resale in Chrome?

How can I fill out massachusetts sales tax resale on an iOS device?

What is massachusetts sales tax resale?

Who is required to file massachusetts sales tax resale?

How to fill out massachusetts sales tax resale?

What is the purpose of massachusetts sales tax resale?

What information must be reported on massachusetts sales tax resale?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.