Get the free Infrastructure Bank - General Program (DCIB-G)

Get, Create, Make and Sign infrastructure bank - general

Editing infrastructure bank - general online

Uncompromising security for your PDF editing and eSignature needs

How to fill out infrastructure bank - general

How to fill out infrastructure bank - general

Who needs infrastructure bank - general?

Infrastructure Bank - General Program How-to Guide

Understanding the infrastructure bank

An infrastructure bank is a specialized financial institution designed to support the development and maintenance of public infrastructure projects. Unlike traditional banks, infrastructure banks often focus on funding large-scale initiatives that drive community and economic development. These entities leverage financial resources to fill funding gaps for vital projects, ensuring that essential infrastructure can be achieved, from roads and bridges to renewable energy initiatives.

The role of an infrastructure bank in economic development is crucial as it helps facilitate investments in public assets, thereby improving overall quality of life. Infrastructure banks provide critical funding sources often unavailable through private means, enabling timely project completion and fostering regional growth.

The characteristics that distinguish infrastructure banks from traditional banks include their mission focus on public welfare, project-specific financing, and flexibility in structuring financial solutions. While traditional banks may emphasize profitability over social impact, infrastructure banks prioritize sustainable development, creating long-lasting benefits for communities.

Benefits of using an infrastructure bank

Utilizing an infrastructure bank comes with numerous advantages for entities involved in infrastructure projects. One of the primary benefits is access to tailored financial solutions that accommodate the unique needs of each project. This ensures that the financing structure matches the specific developmental objectives and operational challenges faced by different kinds of infrastructure initiatives.

Infrastructure banks also encourage public-private partnerships, crucial for sharing risks and maximizing resources. By fostering collaboration between governmental agencies and private entities, these banks enhance investment opportunities and increase the pool of available funding, thus expanding the potential for successful project outcomes.

Additionally, with a keen focus on long-term investments, infrastructure banks are less likely to be swayed by market volatility. They often prioritize strategic projects that yield sustainable economic growth, job creation, and community development. This dedication to impactful investments can significantly influence local economies, especially in underserved areas.

Moreover, infrastructure banks account for environmental and social considerations, ensuring that funded projects contribute to a greener and more equitable society. By supporting initiatives that promote sustainability, these banks help mitigate the challenges associated with climate change and resource depletion.

Eligibility criteria for infrastructure bank programs

Understanding eligibility criteria is essential for those looking to apply for funding through an infrastructure bank. Generally, various entities may qualify, including local and state governments, non-profit organizations, and private sector companies. Each of these applicants plays a distinct role in advancing infrastructure projects that benefit communities.

The types of projects that infrastructure banks typically fund are diverse, encompassing key areas essential to urban and rural development. Common project categories include:

Furthermore, successful applications often require the submission of comprehensive financial documentation to demonstrate project viability and sustainability. A thorough understanding of these financial requirements can significantly streamline the application process.

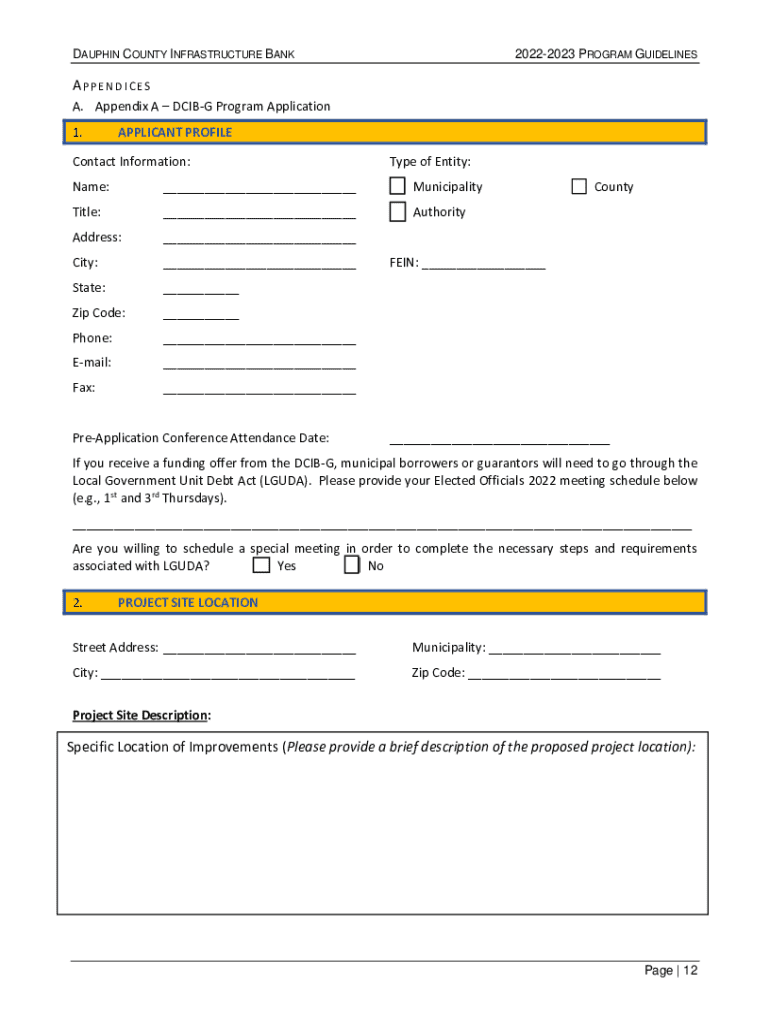

Step-by-step guide to applying for infrastructure bank funding

Navigating the application process for infrastructure bank funding can seem daunting, but a structured approach can simplify it considerably. This step-by-step guide outlines the essential actions to take:

By following these steps meticulously, applicants can enhance their chances of securing the much-needed funding for crucial infrastructure projects.

Managing your infrastructure bank loan

Once funding from an infrastructure bank is secured, effective management of the project and associated financial obligations becomes paramount. This involves regularly monitoring project progress and providing timely financial reporting. Keeping transparent records helps maintain credibility with funding entities.

Additionally, adhering to best practices for compliance and accountability is essential for meeting the infrastructure bank's requirements. Regular updates and being proactive about engaging bank representatives can mitigate potential issues and foster a more cooperative relationship.

Handling changes and adjustments in project plans is also an aspect of managing infrastructure bank loans. As projects evolve, it’s crucial to communicate any significant changes to ensure alignment with the funding terms.

Maximizing the value of your infrastructure bank engagement

To fully leverage the benefits of your relationship with an infrastructure bank, collaboration with experts in your field is essential. Forming strategic partnerships can lead to innovative solutions and enhance the potential for project success. Embracing collaboration ensures diverse perspectives contribute to planning and execution.

Furthermore, utilizing tools like pdfFiller can facilitate the creation, editing, and management of essential documents throughout the project lifecycle. Its seamless document collaboration and eSigning features allow teams to work collectively and keep workflows efficient. Cloud-based accessibility ensures that crucial project documentation is manageable from various locations and devices.

Additionally, building strong relationships with stakeholders—ranging from community members to governmental bodies—plays a vital role for future projects. Engaging stakeholders early and often can create a supportive environment that fosters successful outcomes.

Case studies of successful infrastructure bank projects

Examining successful projects funded by infrastructure banks provides valuable insights for prospective applicants. These case studies demonstrate how infrastructure banks have positively impacted their communities through innovative project funding. For instance, transportation initiatives have enhanced mobility and decreased congestion in urban areas.

Similarly, energy projects funded by these banks aim at reducing carbon emissions while fostering economic growth. Community revitalization efforts, backed by infrastructure bank funding, have rejuvenated neighborhoods and improved the quality of life for residents. Each of these projects highlights vital lessons learned, such as the importance of stakeholder engagement and the need for comprehensive planning.

Interactive tools and resources

For individuals and organizations pursuing funding through an infrastructure bank, a variety of tools and resources can assist in project planning and execution. Effective project planning tools help outline key milestones, budget constraints, and resource allocations required for successful project completion.

Financial projections and budgeting worksheets are also critical in establishing realistic funding models and long-term financial sustainability. Using templates for application and documentation can streamline the submission process, ensuring that all necessary information is always included, ultimately improving the chances of securing funding.

Conclusion

The importance of infrastructure banks in facilitating sustainable development cannot be overstated. Through targeted funding and support structures, these institutions empower communities to address their unique infrastructure needs effectively. For those considering applications, being informed and well-prepared is paramount to navigating the complexities of the infrastructure bank process.

By following the outlined steps and employing the right tools, applicants can position themselves to not just secure funding, but also maximize the overall impact of their projects on development.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify infrastructure bank - general without leaving Google Drive?

How do I make changes in infrastructure bank - general?

Can I sign the infrastructure bank - general electronically in Chrome?

What is infrastructure bank - general?

Who is required to file infrastructure bank - general?

How to fill out infrastructure bank - general?

What is the purpose of infrastructure bank - general?

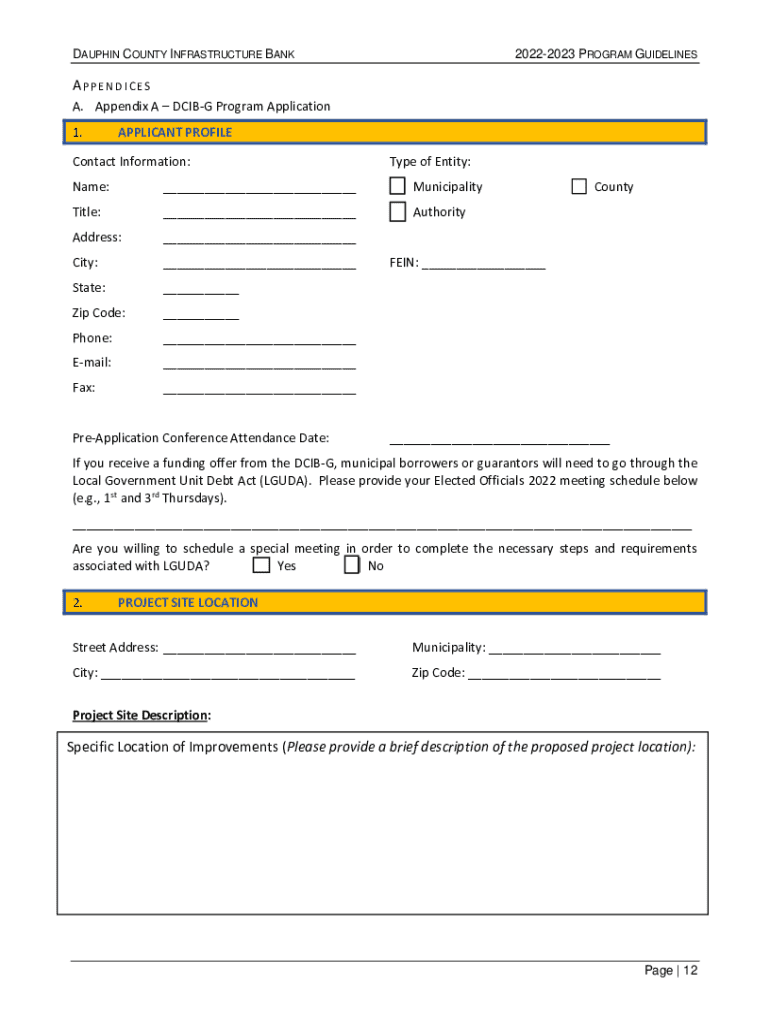

What information must be reported on infrastructure bank - general?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.