Get the free Nebraska Property Tax Credit 2024

Get, Create, Make and Sign nebraska property tax credit

How to edit nebraska property tax credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska property tax credit

How to fill out nebraska property tax credit

Who needs nebraska property tax credit?

Nebraska Property Tax Credit Form: How-to Guide Long-Read

Overview of Nebraska property tax credit

The Nebraska property tax credit is a vital financial relief initiative aimed at reducing the property tax burden on homeowners and renters. By providing credits directly to taxpayers, this program helps to offset the costs associated with property ownership or rental expenses, allowing individuals more financial flexibility. In Nebraska, where property taxes can significantly impact household budgets, these credits become a lifeline for many individuals and families, alleviating some of the pressure from increasing assessments.

Eligibility for the Nebraska property tax credit is determined by several factors, including income level, ownership status of the property, and residency. Homeowners who occupy their properties, as well as renters, can qualify under certain conditions. It is essential for applicants to understand these criteria and apply accordingly to take full advantage of this tax relief.

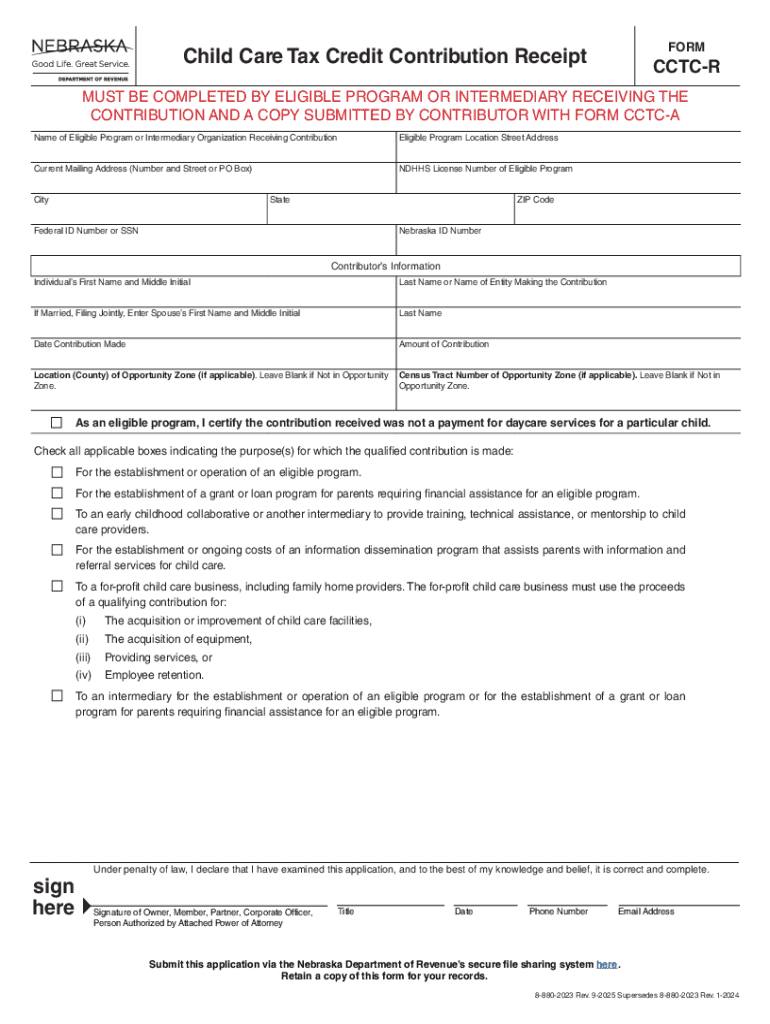

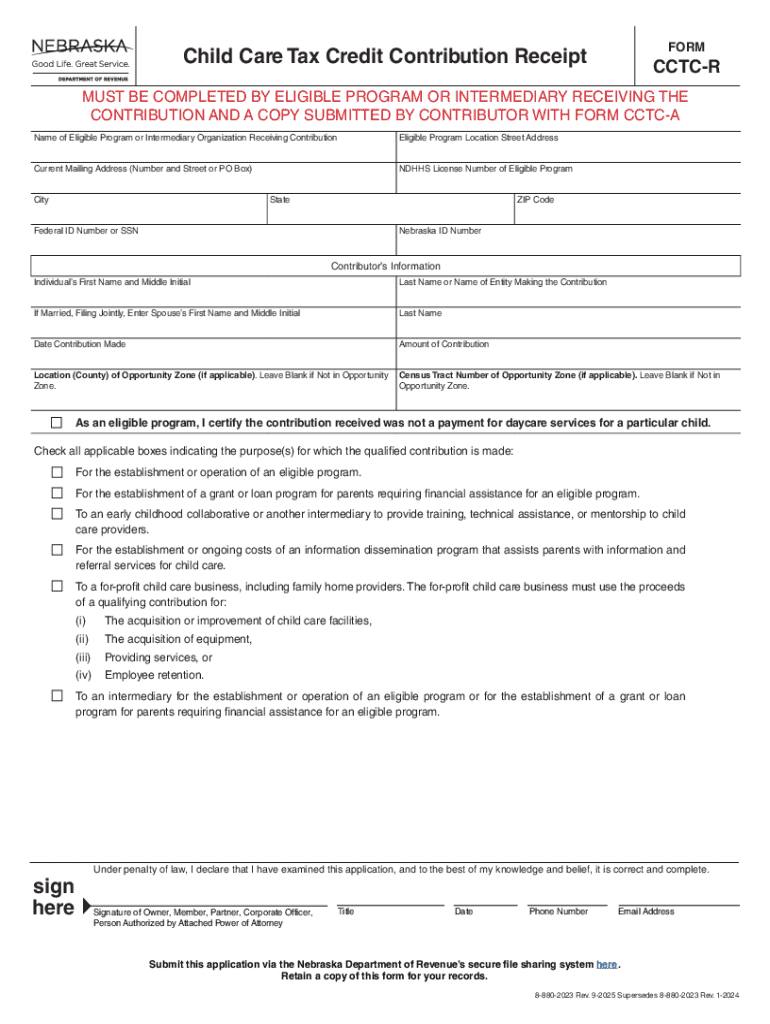

Understanding the Nebraska property tax credit form

The Nebraska property tax credit form is the primary document required for applying for the property tax credit. This form serves the purpose of gathering necessary details about the applicant and the property involved to calculate the potential credits accurately. Completing this form ensures that taxpayers can receive the financial aid they are entitled to, thereby contributing to improved economic stability.

Key information required on this form includes personal data such as name, address, and Social Security number, alongside specifics about the property, including its type and valuation. Familiarizing yourself with common terminology and definitions associated with the form is crucial, as this knowledge can ensure accurate completion and improve understanding of the overall process.

Detailed instructions for filling out the form

Completing the Nebraska property tax credit form can seem daunting, but following a structured approach can make it manageable. Here's a step-by-step breakdown:

Editing and managing your Nebraska property tax credit form

Utilizing pdfFiller to edit and fill out the Nebraska property tax credit form streamlines the entire process. pdfFiller’s platform offers a user-friendly interface where you can easily input necessary information, ensuring that your application is both accurate and complete.

Once filled, saving and securing your document in the cloud is a breeze. pdfFiller provides robust features, such as eSigning capabilities, allowing you to sign your form digitally. It also includes collaboration tools for teams, making it easy to gather input from others involved in the process.

Common issues and resolution tips

Navigating the Nebraska property tax credit form can lead to several questions and potential issues. Below are some frequently asked questions along with common troubleshooting steps:

Interactive tools and resources

Accessibility to related resources can significantly enhance your experience in applying for the Nebraska property tax credit. Various online tools, such as property tax calculators, help estimate potential credits based on your circumstances. Links to downloadable versions of the Nebraska property tax credit form are also widely available on the Department of Revenue website.

In addition to the credit form, pdfFiller offers various templates for related paperwork, making document management more efficient. Engaging with these tools can simplify the entire claims process and ensure you maintain compliance with all tax requirements.

Beyond the Nebraska property tax credit

Apart from the Nebraska property tax credit, numerous other property tax credits exist within the state, each with unique eligibility and benefits. Comparing these programs allows clients to explore all available options. For example, the Homestead Exemption is another popular program designed to assist senior citizens and other eligible individuals, providing additional financial relief in managing property taxes.

Understanding the nuances between these programs can empower taxpayers to make informed decisions regarding their property assessments and taxation. Additionally, resources for further exploration are available through the state’s revenue resources, which can enhance knowledge of related credits and their implications.

Additional insights for homeowners and renters

Property taxes can significantly impact overall budgeting, particularly for homeowners managing mortgage payments alongside tax obligations. It is advisable for residents to strategize effectively to maximize available tax credits, thereby enhancing their financial situation.

Regularly reviewing property tax evaluations is crucial. Homeowners should remain alert to changes in property assessments, ensuring they advocate for fair valuations that accurately reflect their property’s worth. This proactive approach can lead to more cost-effective tax management and optimization of refunds or credits.

Regional variations in property tax law

Property tax laws are not uniform across Nebraska, as variations exist among the different counties. Each county may implement unique regulations concerning assessments and credits, impacting how taxes are calculated and applied. Understanding these regional differences is vital for effective tax management.

By accessing county-specific resources, taxpayers can navigate inquiries more effectively and gain precise information tailored to their local context. This localized approach enables better planning and application of available tax benefits.

Conclusion/Next steps in form submission

Completing the Nebraska property tax credit form is an essential step for qualifying for much-needed financial relief. By understanding each section and gathering necessary documentation, applicants can accurately fill out the form and submit it on time. Proactive management of property-related documents through the pdfFiller platform can further streamline the submission process, making it an invaluable tool for all taxpayers.

Ultimately, staying informed about property tax changes, available credits, and the intricacies of form submissions can empower homeowners and renters alike to optimize their financial resources effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the nebraska property tax credit electronically in Chrome?

How do I complete nebraska property tax credit on an iOS device?

How do I fill out nebraska property tax credit on an Android device?

What is nebraska property tax credit?

Who is required to file nebraska property tax credit?

How to fill out nebraska property tax credit?

What is the purpose of nebraska property tax credit?

What information must be reported on nebraska property tax credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.