Get the free Your Property Casualty Claims Rights - commerce.Alaska.gov

Get, Create, Make and Sign your property casualty claims

How to edit your property casualty claims online

Uncompromising security for your PDF editing and eSignature needs

How to fill out your property casualty claims

How to fill out your property casualty claims

Who needs your property casualty claims?

Your Property Casualty Claims Form: A Comprehensive Guide

Understanding your property casualty claims form

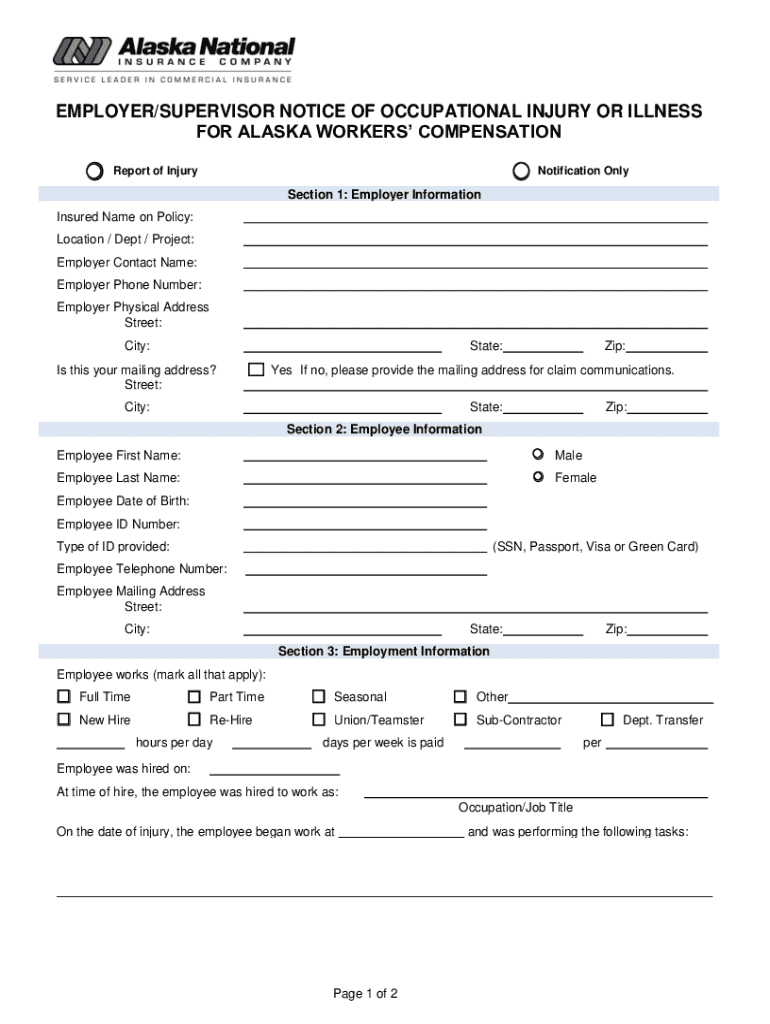

A property casualty claims form is a vital document used to report losses or damages that occur to property due to unforeseen events. This form is essential in initiating the claims process with your insurance provider, allowing you to claim compensation for losses incurred.

Filing a claim accurately is crucial, as any discrepancies can delay or even deny your claim. Insurers require precise details about the incident and the loss to assess and process your claim effectively. Accurate and thorough reporting helps ensure that you receive the benefits entitled under your policy.

Common scenarios that necessitate filing a property casualty claim include but are not limited to incidents such as fire, theft, vandalism, natural disasters, and liability claims against you. Each of these scenarios brings its own specifics that need to be carefully documented in your property casualty claims form.

Preparing to fill out your claims form

Preparation is critical when filling out your property casualty claims form. The first step is to gather all required documents, as this will facilitate a smoother claims process. Accuracy in the details you provide cannot be overstated.

In addition to documents, having key information at your fingertips will streamline the form-filling process. Ensure you have your personal details ready, including your name, address, and contact information. You should also prepare a concise description of the loss, detailing what occurred, and include contact information for any potential witnesses to the incident.

Step-by-step instructions for completing the property casualty claims form

Completing the property casualty claims form can seem daunting, but breaking it down into sections simplifies the process. Begin by filling out claimant information, ensuring you accurately list your details and those of any dependents covered by the policy.

When describing your claim, use clear and concise language, avoiding jargon that may confuse claims adjusters. A common pitfall is providing vague descriptions; aim for specificity. For example, instead of stating 'the furniture was damaged', clarify 'the kitchen table was broken into two pieces due to the fallen tree branch from the storm'.

Certain types of claims require special considerations. For instance, theft claims often require a police report, while natural disaster claims might need documentation of the event itself, such as news articles or weather reports. Liability claims need an added layer of caution, ensuring that all parties involved are properly documented to avoid disputes.

Editing and signing your property casualty claims form

Once your claims form is filled out, it’s essential to review and edit it for accuracy. Utilizing digital editing tools available on pdfFiller can be incredibly beneficial during this step. These tools allow you to make necessary adjustments seamlessly without hassle.

Adding your electronic signatures is the next critical step. With pdfFiller, adding an eSignature can be done in a few clicks. This method not only expedites the submission process but also maintains the legal validity of your claims form, as eSignatures hold the same legal weight as handwritten ones in many jurisdictions.

In collaborative work settings, pdfFiller provides features that allow sharing the form with teammates or family members who may need to provide input or approval. This collaborative aspect ensures that all necessary details are discussed and confirmed before submission, reducing the likelihood of errors.

Submitting your property casualty claims form

The submission process for your property casualty claims form can be done through various methods, providing flexibility based on your preferences. You can submit your claim online, which is the fastest method as it often includes instant confirmation of receipt.

After submission, receiving confirmation is critical. Most insurance companies will send an acknowledgment of your claim submission via email or post. Tracking your claim status is also important; many insurers provide online portals where you can follow the progress of your claim as it moves through processing.

It's essential to understand what to expect after you submit your claim. Claims processing times can vary significantly depending on the type and complexity of the claim, so remain patient while your insurer reviews your documentation.

Managing your claims process

Monitoring the progress of your claim involves several tools and resources. pdfFiller can keep you updated by allowing you to check for changes or requests from your insurer. Regular communication with your insurer is also important; your claims adjuster will be your primary point of contact for any questions you may have during the process.

Common issues may arise during the claims process, including delays in processing or incomplete documentation. Understanding how to navigate these situations can save you considerable stress. Should your claim be denied, familiarize yourself with your insurance provider's appeals process, and make sure to gather any additional information or clarification needed to support your appeal.

Frequently asked questions (FAQs) about property casualty claims

Leveraging pdfFiller for complete document management

Using a cloud-based document platform like pdfFiller offers considerable advantages in managing your claims forms and all related documents. For one, it enables access to your files from any mobile device or computer, facilitating widespread accessibility when you need to make changes or track your claims.

Enhancing collaboration and efficiency, pdfFiller allows multiple users to make edits and input directly into the claims form. This feature is particularly beneficial for teams, ensuring that everyone involved can contribute to the accuracy and thoroughness of documentation.

Streamlining future claims processes can be achieved by keeping templates of your property casualty claims form on pdfFiller. This way, every time you need to file a claim, you can quickly fill out the pre-existing form, benefiting from saved information and previous insights to minimize repetitive work.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the your property casualty claims electronically in Chrome?

How do I fill out your property casualty claims using my mobile device?

Can I edit your property casualty claims on an iOS device?

What is your property casualty claims?

Who is required to file your property casualty claims?

How to fill out your property casualty claims?

What is the purpose of your property casualty claims?

What information must be reported on your property casualty claims?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.