Get the free Declaration under section 197A(1C) of the Income-tax Act ...

Show details

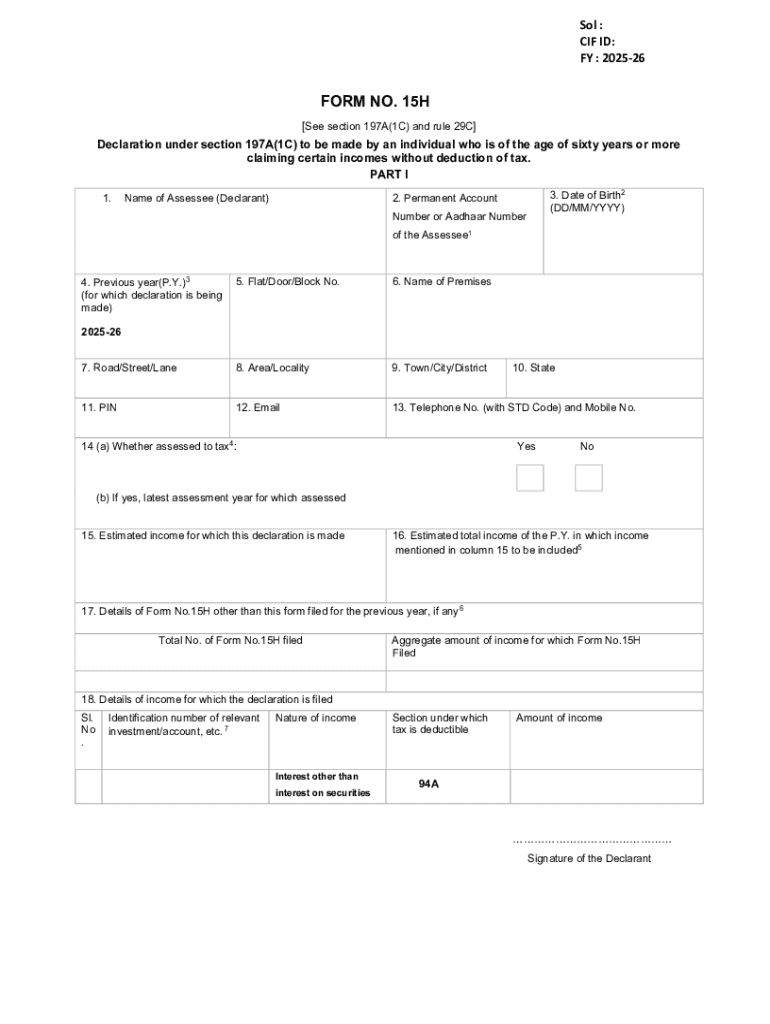

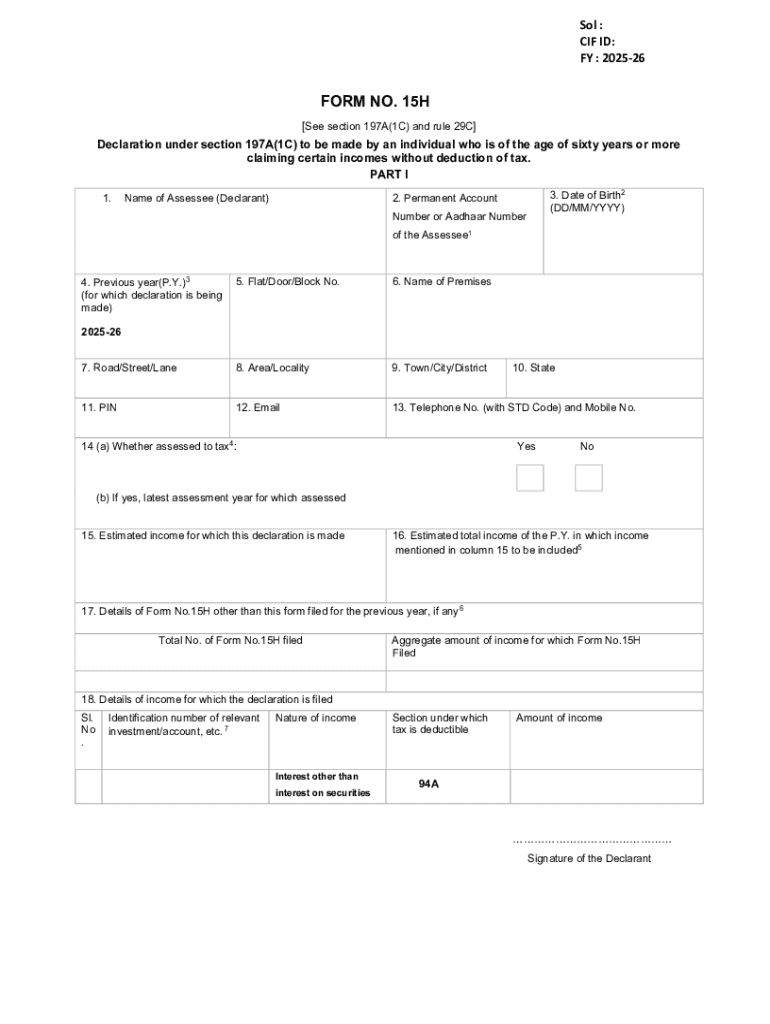

Sol : CIF ID: FY : 202526FORM NO. 15H [See section 197A(1C) and rule 29C]Declaration under section 197A(1C) to be made by an individual who is of the age of sixty years or more claiming certain incomes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign declaration under section 197a1c

Edit your declaration under section 197a1c form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your declaration under section 197a1c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit declaration under section 197a1c online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit declaration under section 197a1c. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out declaration under section 197a1c

How to fill out declaration under section 197a1c

01

Gather all necessary documents, including proof of income and tax identification.

02

Obtain the declaration form specifically for section 197a1c.

03

Fill in your personal details, including name, address, and tax identification number.

04

Provide information regarding your income and any applicable tax deductions.

05

Sign the declaration, ensuring all information is accurate and complete.

06

Submit the declaration form to the relevant tax authority or organization as instructed.

Who needs declaration under section 197a1c?

01

Individuals receiving certain types of income that may qualify for tax exemption under section 197a1c.

02

Taxpayers seeking to apply for reduced withholding tax rates on specific income sources.

03

Anyone who has been advised by a tax consultant or advisor to complete this declaration for compliance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get declaration under section 197a1c?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the declaration under section 197a1c. Open it immediately and start altering it with sophisticated capabilities.

Can I sign the declaration under section 197a1c electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your declaration under section 197a1c in seconds.

Can I create an electronic signature for signing my declaration under section 197a1c in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your declaration under section 197a1c right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is declaration under section 197a1c?

Declaration under section 197A(1)(c) is a declaration made by a taxpayer requesting for non-deduction of tax at source on specified income, based on the provision of the Income Tax Act in India.

Who is required to file declaration under section 197a1c?

Individuals or entities receiving income that is subject to tax deduction at source, who believe they are eligible for exemption or lower rate of TDS under section 197A(1)(c), are required to file this declaration.

How to fill out declaration under section 197a1c?

To fill out the declaration, individuals need to provide their personal details, PAN number, and specify the income on which they are requesting non-deduction or reduced tax, along with the relevant provisions under the Income Tax Act.

What is the purpose of declaration under section 197a1c?

The purpose of this declaration is to enable taxpayers to avoid or reduce tax deduction at source for income that may not be liable to TDS or to which a lower rate applies, thereby improving cash flow.

What information must be reported on declaration under section 197a1c?

The declaration must report the taxpayer's name, PAN, address, details of income, section under which non-deduction or lower rate is claimed, and any other supporting information related to the claim.

Fill out your declaration under section 197a1c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Declaration Under Section 197A1C is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.