Get the free Home Equity Line of Credit Application - Reliance Bank

Get, Create, Make and Sign home equity line of

Editing home equity line of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out home equity line of

How to fill out home equity line of

Who needs home equity line of?

Home equity line of form: A comprehensive how-to guide

Understanding home equity lines of credit (HELOCs)

A home equity line of credit (HELOC) is a revolving credit option that allows homeowners to borrow against the equity in their property. As a flexible financing solution, it operates similarly to a credit card, where you draw funds as needed up to a predetermined credit limit. Unlike traditional personal loans or fixed home equity loans that offer a lump sum, a HELOC allows you to withdraw funds during the draw period, which typically lasts 5 to 10 years.

Home equity refers to the market value of your home minus any outstanding mortgage balances. By leveraging this equity, borrowers can access cash for various purposes, such as home renovations, debt consolidation, or unexpected expenses. HELOCs generally have lower interest rates compared to unsecured loans, making them appealing for many homeowners.

Key terms and concepts

To navigate a home equity line of form successfully, it is crucial to understand key terms related to HELOCs. The credit limit is the maximum amount a lender approves for borrowing against your equity. The draw period is the time frame during which you can access funds, and the repayment period follows, during which you must pay back the borrowed amount. HELOCs typically offer variable interest rates, which can change over time based on market conditions, although some lenders might offer fixed-rate options.

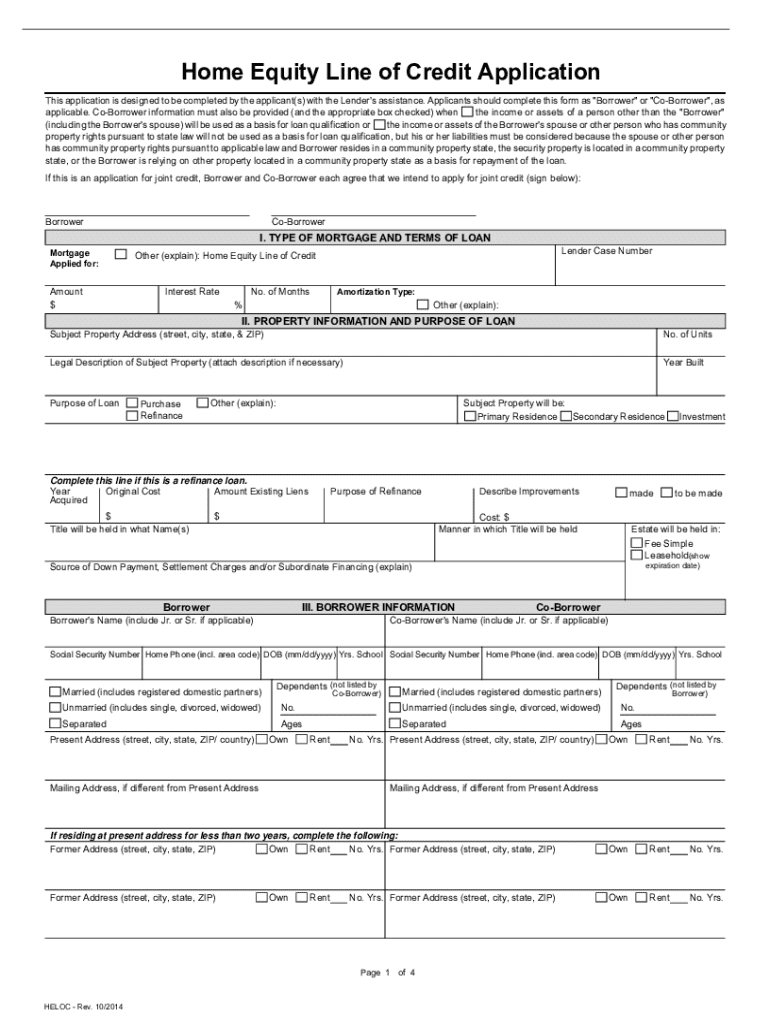

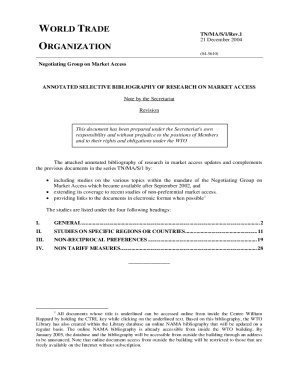

The home equity line of form

The home equity line of form is an essential document for anyone looking to apply for a HELOC. This form serves as your official application to the lender, providing all the necessary details they require to evaluate your financial health and equity position. Completing this form accurately can expedite the approval process and improve your chances of securing a favorable line of credit.

Key components of the form often include personal information, current mortgage details, and financial credentials. This will include specifics like your income, existing debts, and the purpose for which you'll use the line of credit. Before filling out the home equity line of form, gather all relevant documents and information to streamline the process and minimize errors.

Where to find the home equity line of form

Accessing the home equity line of form is simple. You can easily download or access this form through online platforms like pdfFiller. It’s essential to ensure you’re using official sources to prevent potential fraud or errors. Look for authorized lenders or financial institutions that provide necessary documentation on their websites.

Step-by-step guide to filling out the home equity line of form

When preparing to fill out the home equity line of form, it's beneficial to approach it in a structured manner. Here’s a breakdown of the key sections:

Filling out this form requires attention to detail and honesty. Ensure all information is accurate to prevent delays. Common pitfalls include omitting relevant information or providing inaccurate data, so double-check everything before submission. You can utilize tools on pdfFiller for auto-fill features and digital signatures to enhance efficiency.

Managing your home equity line of credit

Once your HELOC has been approved, managing it wisely is critical. You gain the flexibility to draw against your line of credit as needed, but it's vital to monitor the variable interest rates closely, as they can fluctuate based on the market. Managing your withdrawals with a clear strategy can help you avoid overextending your financial obligations.

Responsible use of your HELOC is crucial. It is essential to establish a budget and avoid treating it as a long-term solution to financial difficulties. Use it for planned projects or solid financial opportunities; this will help maintain your financial health. Watch for key indicators like your ability to manage repayments, your credit utilization, and overall financial stability.

Repayment strategies

Planning how to repay your HELOC should begin as soon as you draw funds. Many borrowers opt for the interest-only payment during the draw period but must prepare for the transition into full repayment later. Consider paying back more than the minimum whenever possible, as this reduces interest costs over time.

Reassessing your position regularly can provide options for refinancing or even paying off your HELOC early if financial situations change. Keep tabs on current interest rates and evaluate if it’s more beneficial to consolidate or refinance for lower payments.

Benefits of utilizing pdfFiller for your home equity line of form

pdfFiller stands out as an invaluable resource when it comes to managing your home equity line of form. The user-friendly interface equips individuals and teams with interactive tools and templates designed for seamless document management. With cloud access, users can edit, sign, and collaborate on their forms anytime, anywhere.

Collaboration features allow you to work with financial advisors or team members effectively. Real-time updates and document-sharing capabilities mean you can receive feedback swiftly and stay organized throughout the application process. This ensures that the information submitted is accurate and up-to-date, enhancing your overall financial strategy.

Comprehensive document management

Additionally, pdfFiller offers secure storage and retrieval options for all your completed forms. The ability to utilize digital backups ensures you won’t lose vital documents, especially when managing multiple loans or credits. Ongoing access to your documents makes tracking your financial health and commitments through your HELOC straightforward.

Additional insights and resources

Navigating the nuances of a home equity line of credit can raise questions. Some common FAQs include understanding how interest rates are determined or whether HELOC interest may be tax-deductible. Addressing these queries can lead to informed financial decision-making.

Further, there are numerous articles and guides available on pdfFiller about related topics such as home equity management, credit utilization, and financial planning strategies. Utilizing these resources can deepen your understanding of your financial options and help you make informed decisions concerning your home equity line of credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in home equity line of?

How do I edit home equity line of in Chrome?

How do I fill out the home equity line of form on my smartphone?

What is home equity line of?

Who is required to file home equity line of?

How to fill out home equity line of?

What is the purpose of home equity line of?

What information must be reported on home equity line of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.