Get the free Claims Beneficiary Requirements

Get, Create, Make and Sign claims beneficiary requirements

How to edit claims beneficiary requirements online

Uncompromising security for your PDF editing and eSignature needs

How to fill out claims beneficiary requirements

How to fill out claims beneficiary requirements

Who needs claims beneficiary requirements?

Understanding the Claims Beneficiary Requirements Form

Understanding the claims beneficiary requirements form

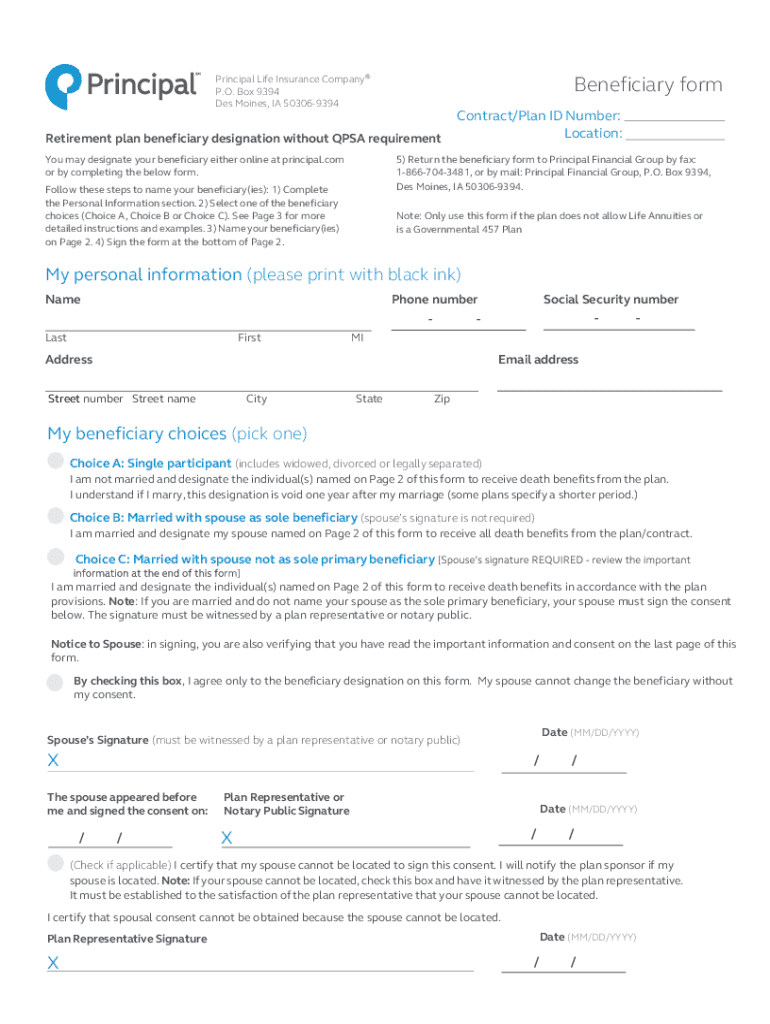

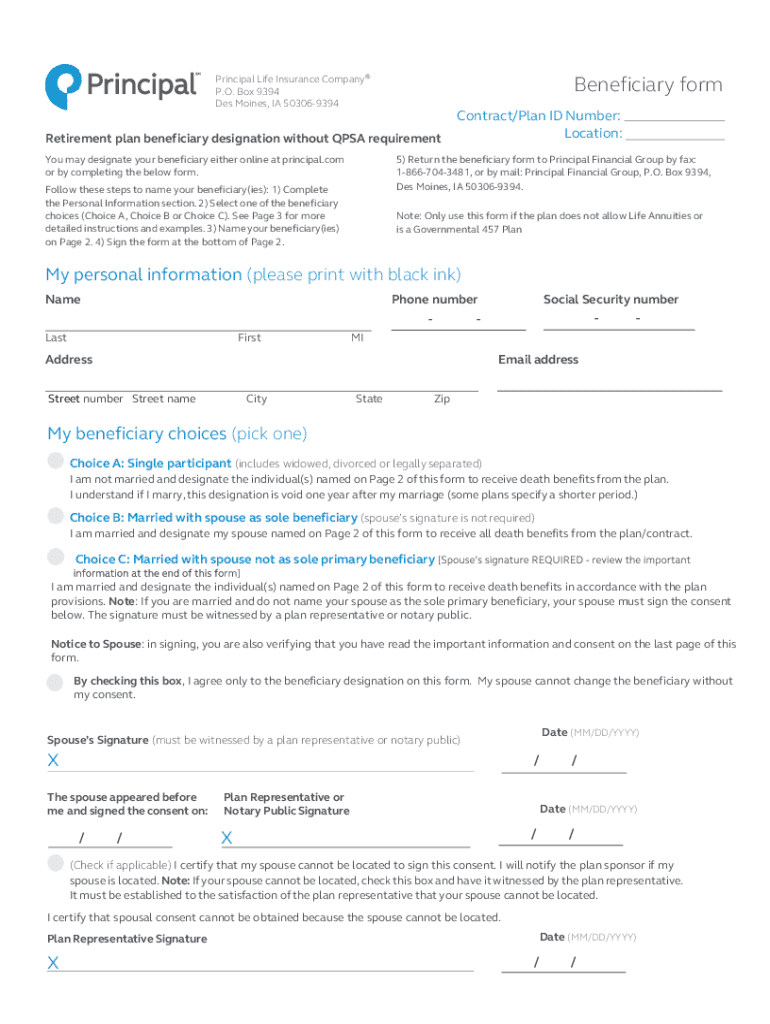

The claims beneficiary requirements form serves as a crucial document in the insurance industry, specifically designed to facilitate the processing of claims made by beneficiaries of insurance policies. This form not only evidences the relationship between the claimant and the insured but also provides essential information required to initiate claim proceedings. By submitting this form, beneficiaries can authorize the insurance company to release benefits following the death of the insured, policy changes, or other significant events.

The importance of the form lies in its ability to streamline the claims process. Insurance providers use this document to verify claimant identity, confirm policy status, and ensure all required information is complete before proceeding with the claim. Properly filling out the claims beneficiary requirements form can significantly reduce delays and promote a more efficient claims resolution.

Who needs to fill out the claims beneficiary requirements form?

Primarily, the claims beneficiary requirements form must be filled out by beneficiaries designated in life insurance policies. These individuals have a legal right to the benefits specified in the policy, which typically outlines who is to receive financial compensation upon the policyholder's death. Moreover, other relevant claimants, such as trust beneficiaries or estate representatives, may also need to complete this form in specific scenarios.

Common situations requiring the submission of this form include the death of the insured, where beneficiaries must present their claims to initiate payout. Additionally, scenarios involving policy transfers or updates may also necessitate filling out the claims beneficiary requirements form to reflect any changes in beneficiary designations, ensuring that policy proceeds go to the correct parties.

Key components of the claims beneficiary requirements form

The claims beneficiary requirements form contains several critical components designed to gather comprehensive information necessary for claim processing. The required information section typically includes beneficiary identification details, such as full name, date of birth, and Social Security number, as well as the primary policy information like policy number and the name of the deceased.

Additionally, supporting evidence is crucial for validating claims. Types of documents that may need to accompany the claims beneficiary requirements form include the insured’s death certificate, policy documents, and sometimes even medical records depending on the situation. Collecting accurate and complete documentation will help expedite the claims process.

Beyond identification and policy specifics, the form often requires additional personal details from the claimant, such as current contact information and their relationship to the deceased. This information allows the insurance company to reach out for clarifications or further processes while ensuring all parties involved are properly notified.

Step-by-step process for completing the claims beneficiary requirements form

Completing the claims beneficiary requirements form can be simplified by following a structured approach:

Taking these steps carefully will help mitigate common claims processing issues and streamline the overall experience.

Common mistakes to avoid when filling out the claims beneficiary requirements form

Filling out the claims beneficiary requirements form can sometimes lead to errors that may delay the claims process. To avoid these issues, recipients should be aware of a few common mistakes:

Awareness of these pitfalls can significantly enhance the chances of a smoother claims experience.

Managing your claims beneficiary requirements form after submission

After submitting the claims beneficiary requirements form, proactive communication with the insurance company becomes vital. First, confirm receipt of your submission to ensure that your claim is in the pipeline for processing. Each insurance company may have different methods to confirm receipt, such as customer portals or direct customer service channels.

Tracking the status of your claim is another step to take post-submission. Many insurance companies provide claim tracking options through their websites, offering up-to-date information. Expect response times to vary; while most companies aim for expedient processing, unforeseen circumstances can lead to delays. If a claim is denied, understand your options for appeal; carefully review the provided reasons for denial and consult with customer support for clarifications.

Utilizing pdfFiller for your claims beneficiary requirements form

pdfFiller offers valuable features that can simplify the process of completing the claims beneficiary requirements form. Its user-friendly interface allows users to easily fill out and edit the form, ensuring that all required information is accurately inputted. The platform also supports collaboration; users can invite others to review or contribute to the form, minimizing mistakes.

One of the standout features of pdfFiller is its eSigning capabilities, allowing users to securely sign and submit the claims beneficiary requirements form online. This eliminates the hassle of printing physical copies. Moreover, with cloud storage solutions, individuals can access their forms and related documents from anywhere, providing convenience and organization for the entire claims process.

FAQs about the claims beneficiary requirements form

Addressing common concerns regarding the claims beneficiary requirements form can empower users:

Troubleshooting common issues

Navigating through potential obstacles during the claims process is essential for a successful claim outcome. Addressing delays in claim processing often begins with reaching out to the insurance company to inquire about any complications or missing documentation that might be causing a hold-up. Likewise, resolving issues related to documentation should involve double-checking that all necessary documents were submitted as required.

In cases involving multiple beneficiaries, understanding how to navigate complex situations becomes even more crucial. Clear communication with the insurance company can help clarify payout distributions and ensure every beneficiary is informed about their rights and responsibilities concerning the claims beneficiary requirements form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the claims beneficiary requirements in Gmail?

How do I edit claims beneficiary requirements straight from my smartphone?

How do I fill out the claims beneficiary requirements form on my smartphone?

What is claims beneficiary requirements?

Who is required to file claims beneficiary requirements?

How to fill out claims beneficiary requirements?

What is the purpose of claims beneficiary requirements?

What information must be reported on claims beneficiary requirements?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.