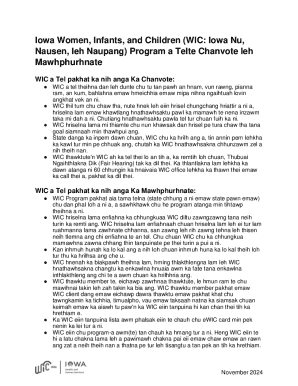

Get the free Pronouncements under the Insolvency and Bankruptcy ...

Get, Create, Make and Sign pronouncements under form insolvency

Editing pronouncements under form insolvency online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pronouncements under form insolvency

How to fill out pronouncements under form insolvency

Who needs pronouncements under form insolvency?

Pronouncements under form insolvency form: A Comprehensive Guide

Understanding pronouncements and their importance in insolvency

Pronouncements in the context of insolvency refer to the formal declarations, judgments, or decisions made by courts or relevant authorities regarding the status and proceedings of insolvency cases. These pronouncements serve as crucial touchpoints that clarify the legal standing of a debtor, offer guidance on debt recovery, and set precedence for future filings.

The importance of these pronouncements cannot be overstated. They enhance transparency in the insolvency process, ensuring that all stakeholders, including creditors and debtors, understand their rights and obligations. By establishing clear legal frameworks, pronouncements contribute to more effective insolvency resolution, ultimately aiming to aid in debt recovery and financial rehabilitation.

Overview of the insolvency process

The insolvency process consists of several stages, each designed to navigate the financial turmoil faced by individuals or businesses. Initially, it involves planning and preparation, where debtors assess their financial situation and explore possible solutions. Following this, the formal filing for insolvency occurs in a court, marking the official start of the process.

Next are the court proceedings, where a judge reviews the case and makes determinations based on the presented evidence. Finally, the process culminates in debt resolution and recovery, where either the remaining assets are sold off to pay creditors or a repayment plan is established. Throughout this journey, various roles come into play.

Types of insolvency pronouncements

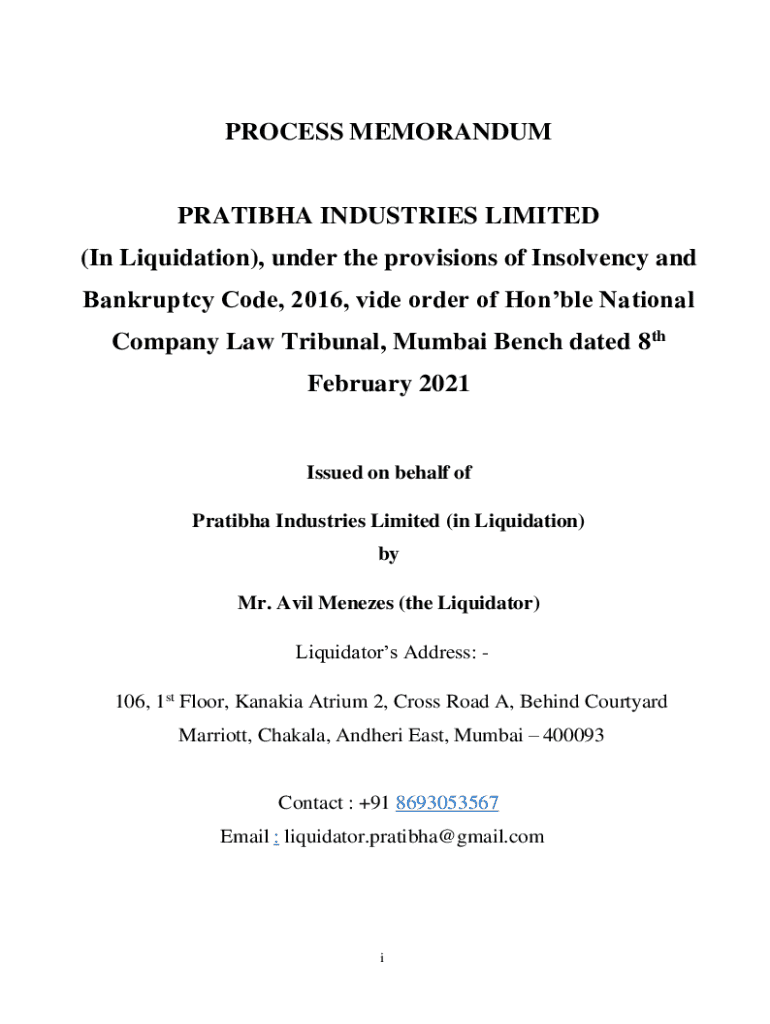

Insolvency pronouncements can be categorized into three main types: court-ordered pronouncements, administrative pronouncements, and statutory pronouncements. Court-ordered pronouncements arise from a judge’s decision during insolvency proceedings, offering critical rulings that guide the rest of the process.

For example, a judge may approve a scheme of arrangement or declare a liquidator’s appointment. Administrative pronouncements, on the other hand, are decisions made by regulatory bodies or agencies overseeing the insolvency framework, often addressing compliance issues. Statutory pronouncements refer to the laws and regulations that shape insolvency practices, potentially affecting everything from filing procedures to creditor rights.

How to prepare for a form insolvency filing

Preparing for a form insolvency filing requires careful organization and awareness of legal obligations. Firstly, it is essential to gather the required documents, such as financial statements, tax returns, and a list of debts and assets. Ensuring that these documents are accurate and up-to-date is paramount for a smooth filing process.

Moreover, understanding legal obligations before proceeding is crucial. This includes being aware of any mandatory disclosures, potential penalties for inaccurate filings, and the rights afforded to creditors and debtors during the insolvency process. Finally, consulting with legal and financial professionals is advisable to navigate the complexities of insolvency laws effectively.

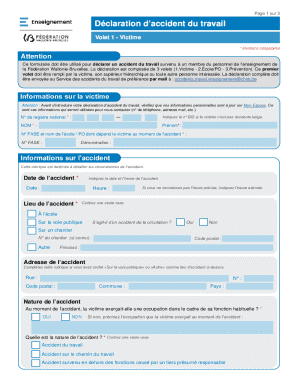

Filling out the insolvency form

Filling out the insolvency form is a pivotal step in initiating the insolvency process. Start by reviewing the form thoroughly to understand each section’s requirements. Typically, the form will ask for personal information, details about your debts, income sources, and asset values. Providing accurate data is critical, as inaccuracies can lead to delays or complications in the process.

Some common pitfalls to avoid include submitting incomplete forms, misreporting income or debts, and failing to list all creditors. Utilizing interactive tools such as pdfFiller can significantly assist with this process, allowing users to fill out forms digitally, verify information efficiently, and save or submit completed forms securely.

Editing and managing your insolvency documents

Managing your insolvency documents effectively is key during this process. One great option is pdfFiller, which offers features for editing PDF forms, enabling users to make necessary adjustments as financial situations change. This interface simplifies the editing process, allowing for easy updates and corrections before submitting any forms.

Furthermore, collaborating with stakeholders becomes seamless as you can securely share documents with creditors or legal advisors via the pdfFiller platform. Once the form is finalized, users can also benefit from electronic signing options that comply with legal standards, facilitating a smoother acceptance process.

Case studies and real-life applications of insolvency pronouncements

Examining notable cases of insolvency pronouncements provides valuable lessons for individuals and organizations. For instance, the case of XYZ Corporation demonstrated how a court-ordered pronouncement led to an expedited liquidation process, offering insights into the effectiveness of judicial interventions in complex financial scenarios.

Another example can be drawn from administrative pronouncements that clarified the rights of creditors under specific circumstances, showcasing the essential role of transparency in the insolvency landscape. Such case studies reveal the importance of informed legal strategies when navigating insolvency proceedings.

Implications of pronouncements on future insolvency filings

The effects of earlier pronouncements can significantly influence future insolvency filings. Legal precedents established by prominent cases guide judges and practitioners in their decision-making processes. This cumulative body of law creates a safety net, helping stakeholders predict outcomes and strategize effectively during insolvency situations.

Additionally, recent changes in regulations often arise from past rulings, adjusting how insolvency cases are handled. Staying updated with these legislative changes is critical for anyone involved in insolvency, ensuring that all processes comply with contemporary legal standards.

Resources and tools for managing insolvency forms

Access to adequate legal and financial resources is vital for anyone navigating the insolvency process. Online platforms, such as pdfFiller, offer a wealth of resources—from templates and guidelines to tools for efficient document management. Utilizing these tools can streamline the form completion process, alleviating stress during an already challenging time.

Interactive tools provided by platforms like pdfFiller allow users to fill, edit, and sign documents from any device, ensuring that stakeholders can operate effectively regardless of their location. Leveraging these resources ensures compliance with legal standards while fostering a more organized approach to managing insolvency filings.

Frequently asked questions (FAQs)

Navigating the complexities of insolvency forms can lead to numerous questions. Common queries include how to determine the best time to file for insolvency, what happens if a form is filled out incorrectly, and the potential outcomes post-filing. Addressing these questions is crucial for individuals seeking clarity during a confusing time.

Additionally, misconceptions around insolvency procedures often lead to unnecessary anxiety. It's important to clarify that filing for insolvency does not inherently equate to bankruptcy; instead, it serves as a legal remedy designed to assist in recovering financially.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pronouncements under form insolvency in Gmail?

How do I execute pronouncements under form insolvency online?

Can I create an electronic signature for the pronouncements under form insolvency in Chrome?

What is pronouncements under form insolvency?

Who is required to file pronouncements under form insolvency?

How to fill out pronouncements under form insolvency?

What is the purpose of pronouncements under form insolvency?

What information must be reported on pronouncements under form insolvency?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.