Get the free Disclosure-No.-1293-2025-Annual-Report-SEC-Form-17-A.pdf

Get, Create, Make and Sign disclosure-no-1293-2025-annual-report-sec-form-17-apdf

How to edit disclosure-no-1293-2025-annual-report-sec-form-17-apdf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out disclosure-no-1293-2025-annual-report-sec-form-17-apdf

How to fill out disclosure-no-1293-2025-annual-report-sec-form-17-apdf

Who needs disclosure-no-1293-2025-annual-report-sec-form-17-apdf?

Comprehensive Guide to Disclosure No. 1293: 2025 Annual Report SEC Form 17-A PDF

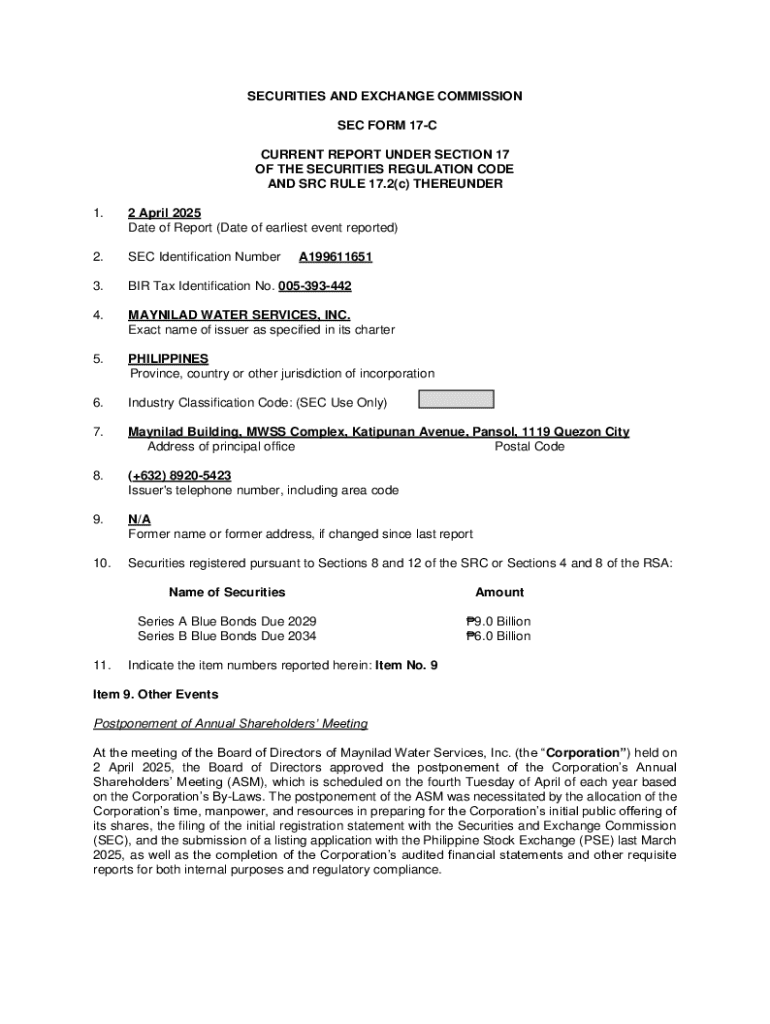

Understanding SEC Form 17-A

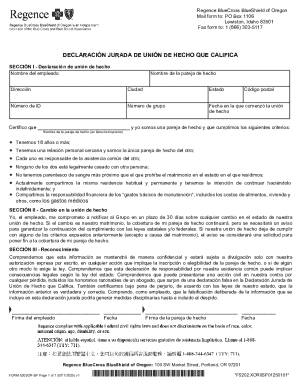

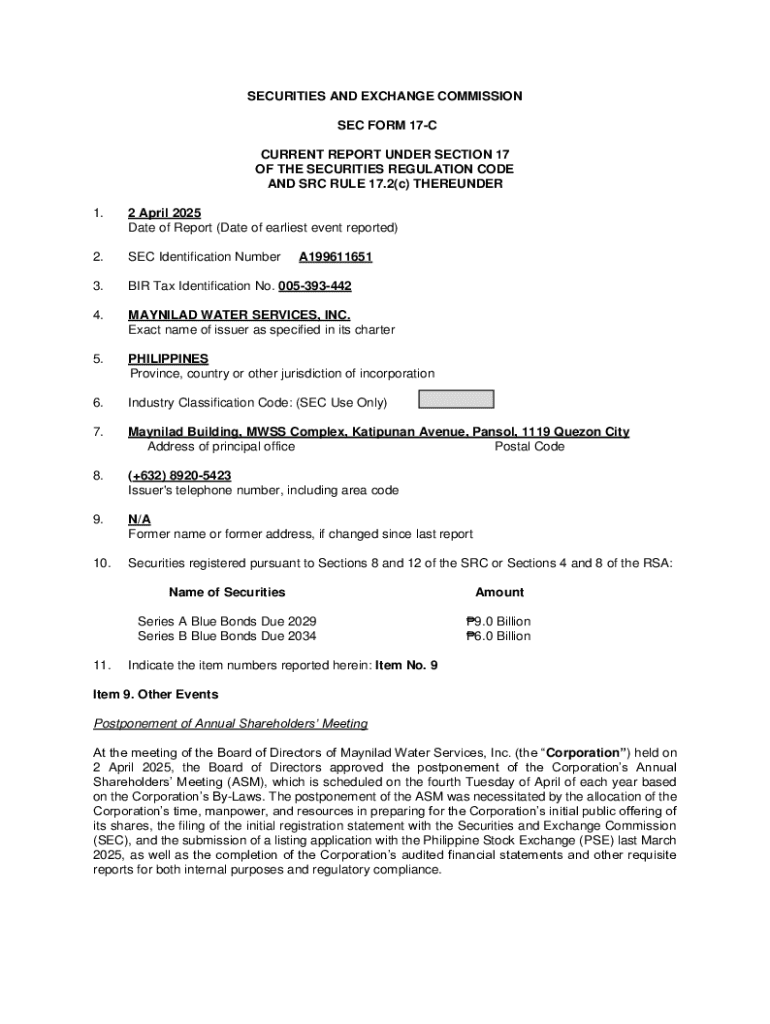

SEC Form 17-A is a pivotal regulatory document designed for public companies in the Philippines. Its primary purpose is to provide investors and regulators with essential information about the company’s financial health and its business operations for the previous fiscal year. This annual report must reflect the accuracy and completeness of the company’s financial standings, along with any relevant disclosures that may influence financial decisions.

Filing deadlines are critical when dealing with SEC Form 17-A. Companies typically must submit their annual report within 120 days from the end of their fiscal year. For example, if a company’s fiscal year ends on December 31, the annual report is due by April 30 of the following year. Compliance with these deadlines ensures that the company maintains good standing and avoids potential penalties.

The importance of compliance cannot be overstated. Non-compliance with SEC reporting requirements may lead to hefty penalties, restrictions on business operations, or other legal complications. Hence, understanding the significance of the SEC Form 17-A is essential for any company operating publicly.

Overview of Disclosure No. 1293

Disclosure No. 1293 pertains specifically to the 2025 Annual Report format for SEC Form 17-A. It outlines specific filing requirements and changes that public companies must adhere to for this reporting period. Among these requirements are updates on financial disclosures and corporate governance, reflecting the evolving regulatory landscape to enhance transparency.

All companies listed in the Philippine Stock Exchange (PSE) must file SEC Form 17-A, making them eligible to do so based on their public company status. Additionally, new companies that went public in the preceding fiscal year are also mandated to comply. Non-compliance can have severe repercussions, such as civil penalties, criminal charges against executives, or the revocation of the company's licenses.

Preparing for the Form: Gathering Required Information

Preparation for SEC Form 17-A involves meticulous gathering of essential documents and data. This includes detailed financial statements for the last fiscal year, which encompass the balance sheet, income statement, and statement of cash flows. These documents serve as the backbone of the annual report and must reflect true and fair financial performance.

Additionally, a comprehensive overview of the company’s business operations and structure is required. This includes describing the core products and services offered, primary markets served, and any operational changes over the reporting year. Accurate shareholder information must also be compiled, outlining the percentage of shares held by insiders, institutional investors, and the public.

Best practices for data compilation include ensuring that all financial data is backed by credible sources and verified for accuracy. Engaging financial consultants or legal advisors can also prove beneficial in navigating complex reporting regulations.

Step-by-step guide to filling out SEC Form 17-A

Completing the SEC Form 17-A involves multiple sections that systematically gather necessary information. Section 1 requires general company details such as legal name and registered address, which helps identify the entity for regulatory purposes. Accurate representation of the company's nature of operations provides context for stakeholders.

Moving on to Section 2, companies need to prepare detailed financial information. This involves submitting financial statements that comply with the Philippine Financial Reporting Standards (PFRS). Include key metrics such as revenue, net profit, and EBITDA, ensuring all data aligns with standard accounting practices.

Section 3 focuses on shareholder information, detailing the equity distribution and the percentage held by insiders versus public ownership. In Section 4, details about the company's directors and executives, including their backgrounds and tenure, should be provided to establish governance integrity.

Finally, Section 5 contains additional disclosures relevant to Disclosure No. 1293. Here, companies are encouraged to address any significant changes during the reporting period, including mergers, acquisitions, or significant operational shifts. These enhancements in transparency help foster investor trust.

Editing and reviewing your submission

Once you have drafted SEC Form 17-A, thorough editing and reviewing is crucial. Utilizing pdfFiller's editing features can enhance the collaboration process among team members. Tools available through pdfFiller allow for real-time feedback and annotation, making it easier to pinpoint areas needing clarification or adjustment.

Using software features to add digital signatures is vital for validation. Ensuring every executive involved checks the report before submission can prevent oversights and enhance accountability. Tools for annotating and commenting help streamline the review process, maintaining integrity from draft to final submission.

E-signing the document

Preparing your document for e-signature involves finalizing all edits, ensuring that all information is complete and accurate before signing. E-signatures are legally recognized for SEC filings, providing a secure method to authenticate documents without the need for physical signatures.

Best practices for e-signing include verifying all signers' identities and ensuring that all parties involved have fully reviewed the document. Implementing secure e-signature practices not only streamlines the process but also minimizes the risk of identity fraud in financial reporting.

Managing your submission

Submitting SEC Form 17-A can be done electronically via the SEC's online portal, which provides a more efficient method than physical submission. Once submitted, tracking the status of the filing is crucial. This can usually be done through the SEC’s filing system, ensuring that you are aware of any issues or needed amendments.

Record-keeping becomes equally important post-submission. Maintaining copies of the submitted forms and any correspondence from the SEC aids in preserving an audit trail. Best practices include storing these records electronically and ensuring they are backed up securely to prevent data loss.

Common mistakes to avoid

Common errors in SEC Form 17-A filings often stem from inaccurate financial reporting or omitted disclosures. It's vital to review all sections for outstanding queries or incomplete data. Errors can lead not only to penalties but also to reputational damage, making a thorough review essential before submission.

Tips for ensuring compliance include familiarizing yourself with the specific requirements of Disclosure No. 1293 and cross-checking all reported figures against reliable financial documents. If errors are identified post-filing, companies have the option to submit an amended filing, clearly indicating the corrections made to ensure transparency.

Frequently asked questions (FAQs)

One common concern regarding SEC Form 17-A is what to do if the filing deadline is missed. Companies are advised to file as soon as possible and prepare a formal explanation for any delays to mitigate compliance issues. The SEC may impose penalties, but transparent communication can help in addressing the oversight.

Another frequent question pertains to the review process by the SEC. Post-submission, the SEC will conduct a review for completeness and compliance. If any issues are identified, the company may receive comments or requests for additional information. Responding promptly and thoroughly is essential to maintain compliance and public confidence.

Support and resources

For various queries related to SEC Form 17-A, accessing pdfFiller’s support resources can prove invaluable. Whether you have questions about specific filing requirements or the editing process, pdfFiller offers insights and detailed guidance to assist users.

pdfFiller also provides additional tools that enhance the user experience, such as templates, form storage, and collaboration features. By leveraging these tools, companies can navigate the complexities of SEC reporting with ease, ensuring a seamless filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit disclosure-no-1293-2025-annual-report-sec-form-17-apdf in Chrome?

How can I edit disclosure-no-1293-2025-annual-report-sec-form-17-apdf on a smartphone?

Can I edit disclosure-no-1293-2025-annual-report-sec-form-17-apdf on an iOS device?

What is disclosure-no-1293-annual-report-sec-form-17-apdf?

Who is required to file disclosure-no-1293-annual-report-sec-form-17-apdf?

How to fill out disclosure-no-1293-annual-report-sec-form-17-apdf?

What is the purpose of disclosure-no-1293-annual-report-sec-form-17-apdf?

What information must be reported on disclosure-no-1293-annual-report-sec-form-17-apdf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.