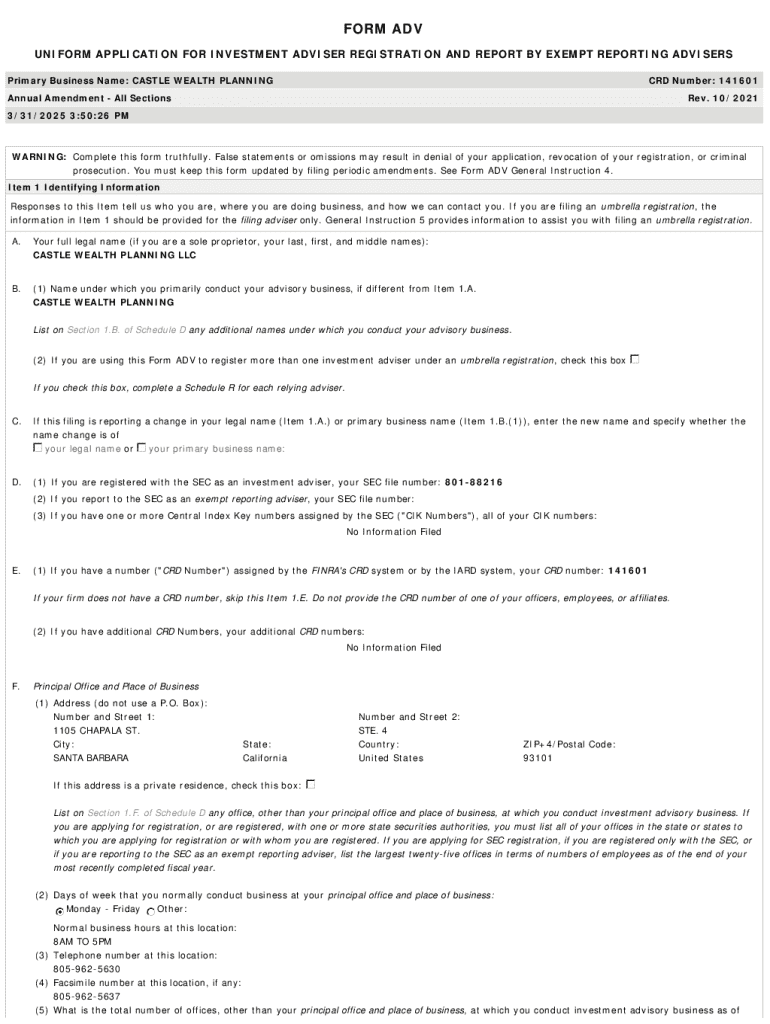

Get the free CASTLE WEALTH PLANNING - Investment Adviser Firm

Get, Create, Make and Sign castle wealth planning

How to edit castle wealth planning online

Uncompromising security for your PDF editing and eSignature needs

How to fill out castle wealth planning

How to fill out castle wealth planning

Who needs castle wealth planning?

Unlocking Your Financial Future with the Castle Wealth Planning Form

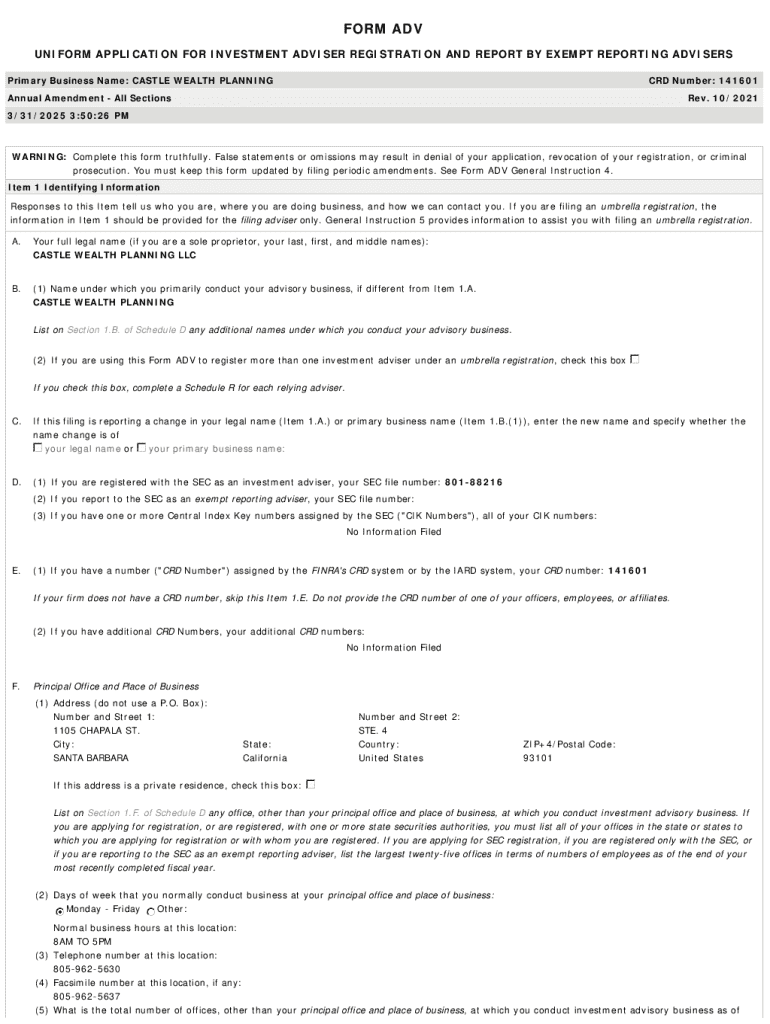

Overview of Castle Wealth Planning

Castle Wealth Planning encapsulates a strategic approach to managing and nurturing your financial resources, ensuring they can grow effectively while safeguarding your legacy. For individuals and teams, this planning is crucial; it defines a pathway through the complexities of wealth management, tailored specifically to one’s goals and aspirations. The Castle Wealth Planning Form is a central tool designed to facilitate this process, incorporating essential components to aid in crafting a comprehensive financial strategy.

Understanding the Castle Wealth Planning Form

The Castle Wealth Planning Form serves a crucial purpose in streamlining your approach to wealth management. By utilizing this form, individuals can clarify their financial situation, set realistic goals, and track their progress towards achieving them. The benefits of using this form extend to families and teams seeking collective understanding and collaboration on their financial strategy. Aligning the use of this form with one's financial goals can transform how wealth is perceived and managed, providing both clarity and direction amidst financial uncertainty.

With the Castle Wealth Planning Form, families can assess the intricacies of their financial dynamics; professionals can outline their wealth-building initiatives, all while ensuring that the planning process accommodates both immediate needs and long-term aspirations. This form isn't just about numbers; it's about framing a coherent narrative that connects your financial legacy with your personal life and future.

Interactive tools for wealth management

Leveraging interactive features within the Castle Wealth Planning Form enhances the user experience significantly. pdfFiller’s platform offers an array of tools that streamline the creation and organization of your financial documents. Fillable fields allow you to input specific data effortlessly, while checkboxes and radio buttons facilitate quick selections for numerous options, enhancing clarity in your financial documentation.

One of the standout features is the integration of digital signatures, enabling users to finalize documents securely. This feature not only accelerates the signing process but ensures compliance with legal standards. By creating a personalized wealth profile using these interactive tools, users can tailor their plans more effectively, ensuring every decision aligns with their unique financial narrative and objectives.

Step-by-step instructions for completing the Castle Wealth Planning Form

To maximize the utility of the Castle Wealth Planning Form, follow these detailed steps to ensure a thorough completion. Each step is vital in constructing a comprehensive wealth management strategy.

Collaborating with others on your wealth plan

Collaboration is paramount in successful wealth planning. Engaging with other stakeholders in your financial journey can lead to more informed decisions and shared accountability. The Castle Wealth Planning Form allows for easy sharing with family members or financial advisors, making the collaborative effort even more seamless.

By setting permissions and defining roles for each collaborator within the document, you effectively streamline the planning process. This ensures that all voices are heard and that the collective insights contribute to building a robust wealth strategy tailored to your family or team’s needs. Active collaboration also fosters transparency and mutual understanding of each party’s financial capabilities and limitations.

eSigning the Castle Wealth Planning Form

The eSigning process in pdfFiller introduces a layer of convenience and security. With just a few clicks, you can sign the Castle Wealth Planning Form electronically, eliminating the need for printed documents and cumbersome mailing processes. This not only enhances efficiency but also contributes to a more environmentally friendly approach to document handling.

Utilizing electronic signatures provides various benefits, such as ensuring compliance with legal standards and safeguarding the integrity of your signature. Security features incorporated into pdfFiller protect your documents throughout the signing process, ensuring that your wealth planning information is handled with the utmost care and discretion, maintaining your financial privacy.

Managing and storing your wealth planning documents

Once your Castle Wealth Planning Form is complete, efficient management and secure storage of your documents become critical. pdfFiller offers cloud-based storage solutions, allowing you to save your forms securely online. This means you can access your documents from anywhere, enabling flexibility as your financial needs evolve.

Implementing version control is essential for keeping track of updates and changes to your wealth planning strategy. Tips for effective document retrieval include categorizing files, naming them clearly, and utilizing searchable tags. Regular updates to your wealth plan are advisable as life circumstances change—this ensures your strategies remain relevant and aligned with your current financial objectives.

Common questions and troubleshooting

As users engage with the Castle Wealth Planning Form, questions often arise. Understanding how to navigate common issues can make the process smoother. What should you do if errors appear in the form? It’s crucial to use the edit function available in pdfFiller to correct any inaccuracies before finalizing the document.

Another common concern might be forgetting login details for pdfFiller. Users can easily reset their passwords using the 'Forgot Password' option on the login page. For further assistance, pdfFiller offers customer support, where you can get dedicated help for any challenges faced in using the Castle Wealth Planning Form.

Real-life case studies

Examining success stories surrounding the Castle Wealth Planning Form reveals the potential impact of effective wealth planning on financial well-being. For instance, a family might utilize this form to collaboratively decide on investment strategies for their children's education, ensuring alignment of their financial resources with their family legacy.

Another example includes a team of professionals using the form to outline their retirement planning strategy, combining their financial resources and growth objectives. These case studies underscore the importance of thorough planning and documentation in achieving dreams and securing financial futures, highlighting how proactive wealth management leads to greater satisfaction and success.

Exploring additional wealth planning tools

Beyond the Castle Wealth Planning Form, pdfFiller offers a suite of additional templates and forms designed to support ongoing wealth management efforts. Exploring these resources can provide further insights and tools to enhance financial planning. Leveraging multiple forms can help in addressing different aspects of wealth management, from estate planning to investment analysis.

Engaging with experts can also add depth to your wealth strategy, providing personalized advice tailored to your specific situation. Whether you're preparing for retirement or looking to navigate the complexities of inheritance, additional resources can equip individuals and teams with the knowledge to make informed financial decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get castle wealth planning?

How do I edit castle wealth planning in Chrome?

Can I create an electronic signature for the castle wealth planning in Chrome?

What is castle wealth planning?

Who is required to file castle wealth planning?

How to fill out castle wealth planning?

What is the purpose of castle wealth planning?

What information must be reported on castle wealth planning?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.